Allstate: ALL Is Not Lost

Summary

- Allstate has had a terrible relative and absolute performance lately.

- Problems stem from poor pricing of auto insurance policies relative to their underwriting costs.

- The company is fixing that and we might be approaching a secular buy point.

- Looking for option income ideas that focus on capital preservation? I offer this and much more at my exclusive investing ideas service, Conservative Income Portfolio. Learn More »

Vivien Killilea/Getty Images Entertainment

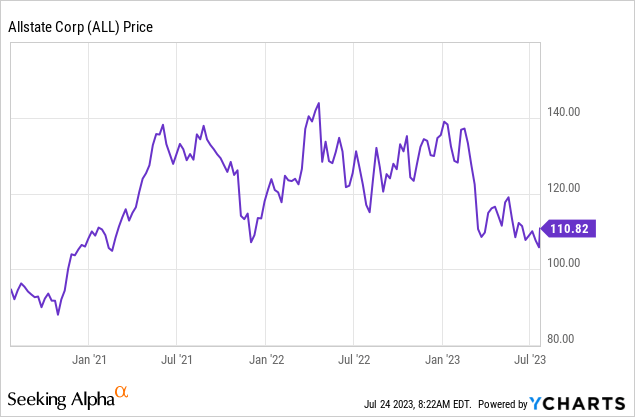

They say no one rings a bell at the top. Certainly if you looked at the first two times that The Allstate Corporation (NYSE:ALL) visited just above the $140 level in the last 2 years, you would have not heard any warning bells.

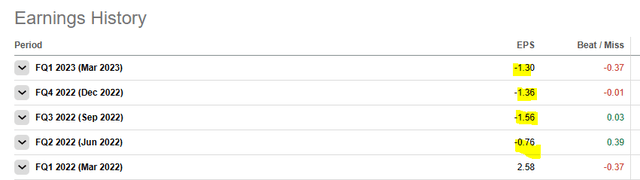

In fact, the news looked great. On the first occasion, quarterly earnings were at $3.79 or close to $15.00 on an annualized basis. On the second run, we were at $2.75 or about $13.00 per share on a yearly run-rate. But by the third, you could clearly tell something was wrong. ALL was reported losses after losses.

The move to almost $100 was inevitable and markets sometimes take their sweet time figuring this out. But it does ultimately happen that fundamentals win out.

The Thesis Today

We have covered what ALL does in our earlier articles. Our previous work was focused on the secondary income securities issued by ALL. Today, we look at why the common shares could be entering an attractive zone and why you should still not be in a rush to buy. We will go over how we played it and why even the secondary securities could be picked up down the line for better prices.

Why ALL Looks Lost

The COVID-19 boost was powered by less driving and hence less accidents. The results were not even linear as accidents would tend to decline more than the decline in miles travelled, thanks to fewer cars on the road. The company's results were fantastic, despite big rebates offered to customers during this timeframe. But then came the blowback. While miles travelled quickly caught up, the bigger issue was cost inflation in autos. The second hand auto market was a particularly strong victim of the inflationary boost and new car inventories falling to all-time lows did not help either.

If you adjust this number for population growth or existing cars on the road, it becomes even more ridiculous. ALL faced extreme pain as it paid for repairs and replacements and its auto division was at a constant underwriting loss.

This is not just ALL. The entire auto insurance sector is struggling with this. But there is a light at the end of the tunnel. Pricing has now improved modestly and the industry is working hard to get back to a sub 100% underwriting number.

The Valuation That Tells You We Are There

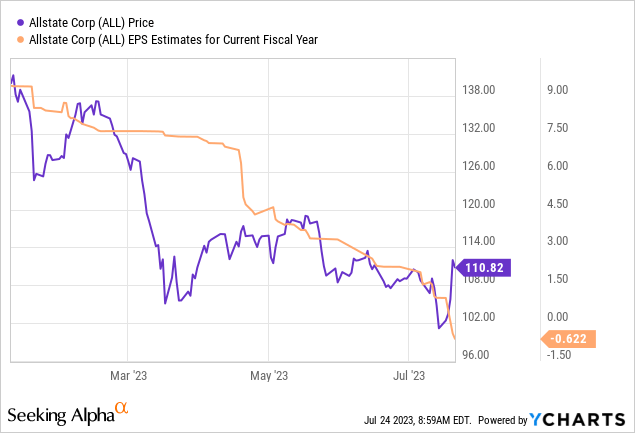

If you look at expected earnings this year, you will definitely not like what you see. Those started off near $9.25 a share and we are now down to a loss of 62 cents.

This is also not written in stone as hurricane season still lies ahead and some higher loss estimates are for a loss of $2.75 per share this year. There is another valuable lesson here before we move on to why valuation is compelling. That is that analysts take their sweet time getting acquainted with reality. Everyone saw the losses in Q2-2022 to Q4-2022, and yet, there was a miracle expected with over $9.00 in earnings per share. Wall Street always goes down the slope of hope and it takes time to price things out. That said, we think we can make a case here. That case is that ALL is trading at a price to sales multiple that has historically marked a bottom in the stock.

If you assume that over the long run ALL and other auto insurers will price at a level that is compatible with their required rate of returns, then one can ignore shorter term headwinds of profitability and focus on price to sales ratios. We are seeing those increases currently.

During the month of June, the Allstate brand implemented auto rate increases of 11.6% across 12 locations, resulting in total brand premium impact of 2.6%.

“Allstate continued to implement significant auto and homeowners insurance rate actions as part of our comprehensive plan to improve profitability. Beginning with this month’s release, we are expanding reporting transparency by disclosing implemented homeowners insurance rates monthly. Since the beginning of the year, rate increases for Allstate brand auto insurance have resulted in a premium impact of 7.5%, which are expected to raise annualized written premiums by approximately $1.95 billion and rate increases for Allstate brand homeowners insurance have resulted in a premium impact of 7.4%, which are expected to raise annualized written premiums by approximately $754 million,”

Source: Allstate

We will note that we saw bottoming action in 2009 and 2012 bear these valuations, even when interest rates were far lower. Higher rates actually help the investment income side for ALL and they have that tailwind today.

How We Played It

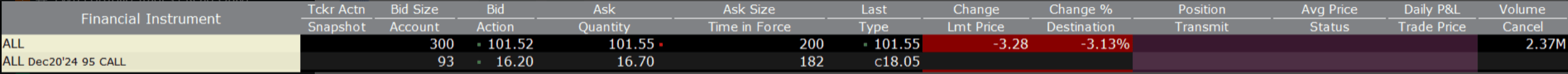

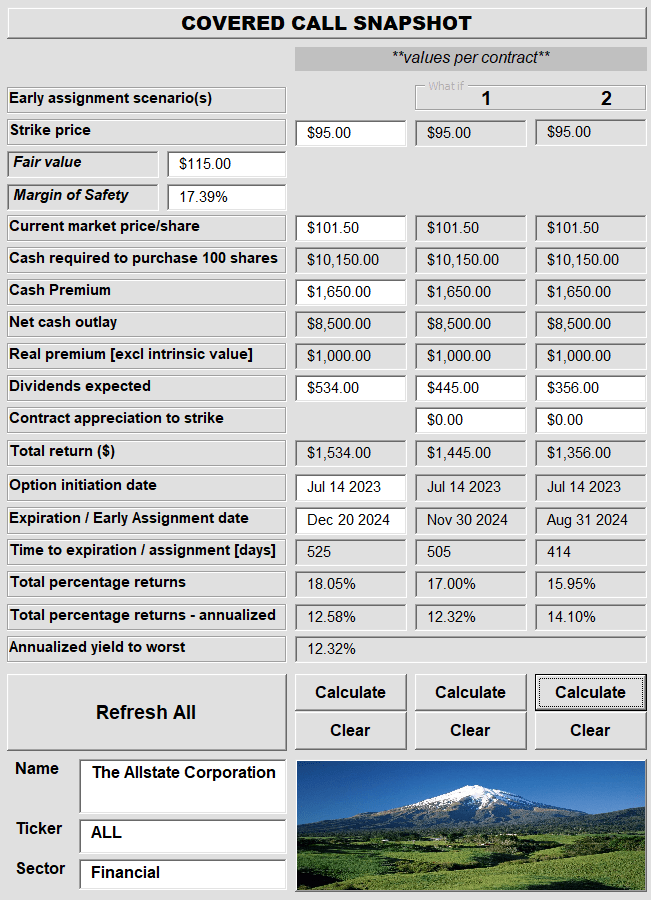

We think that exact market timing is impossible, but you can make educated bets when you are in the right postal code. Our educated bet here is that $90-$95 probably represents an extremely good entry point. Hence we sold covered calls on July 14, at the $95 strike level.

Interactive Brokers July 14, 2023

The return profile is of course modest but creates a good buffer and the net adjusted entry point is just $85.00

Author's App

Early exercise is possible but that would not impact annualized returns much. This is a good starter position and we might add to it in the months ahead.

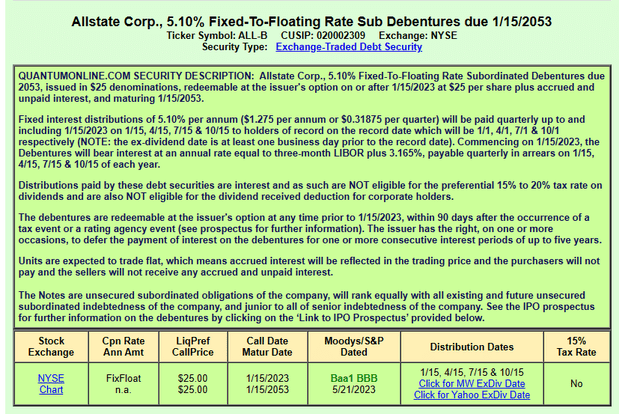

The Allstate Corporation SUB DEB 53 (NYSE:ALL.PB)

Since the focus of our work is income generation while emphasizing capital preservation, it would not make sense to ignore the secondary securities for ALL. ALL, PB, the exchange traded debentures now yield more than 8.5%. This is made up of a spread of 3.165% plus the 3 month LIBOR rate of 5.6%.

The bonds do trade slightly over par but still land up yielding over 8.5% currently. Keep in mind though that your returns can be lower if they land up being called by the next interest date.

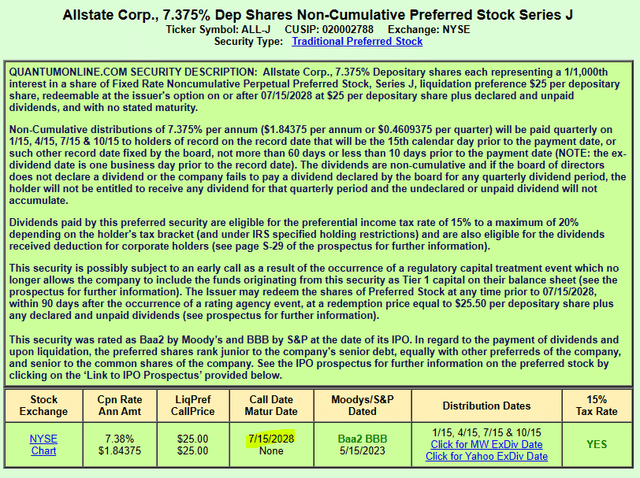

The Allstate Corporation 7.375% DEP PFD J (NYSE:ALL.PJ)

These preferred shares offered by ALL trade at a premium to par value and offer a modest yield to call date.

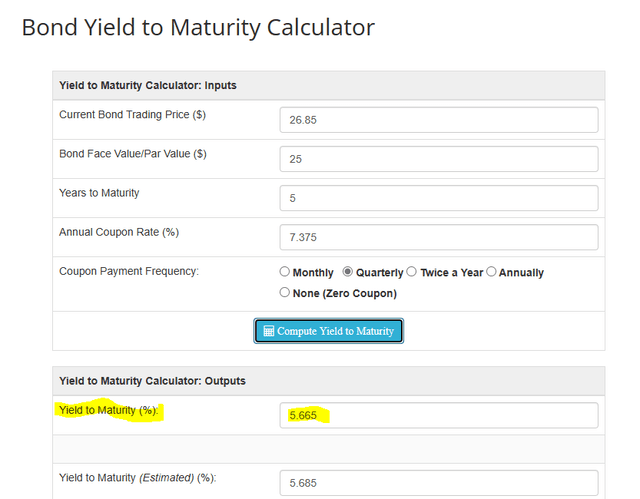

At the current price your yield to call is just 5.665%.

While you can make the argument that this cannot be called, the yield here is just too low to hold this.

The Allstate Corporation 4.75% DP SH PF I (NYSE:ALL.PI)

This preferred offering is trading at a big discount to par and yields about 6% currently. On the surface this would make sense for those expecting a heavy dose of interest rate cuts. While that may be true, there are far better securities trading at a better yield and similar credit metrics. One example we can share is for Brookfield Infrastructure Partners L.P. 5.125 CL A PFD13 (BIP.PA). While these are rated one notch lower (BBB minus, versus BBB for ALL.PI), they yield 7.33% versus 6% for ALL.PI. They have a stronger upside in case of interest rate cuts and their dividends are cumulative versus non-cumulative for ALL.PI. We did not cover The Allstate Corporation 5.1% DP SH PFD H (NYSE:ALL.PH), but everything said about ALL.PI pretty much applies to ALL.PH.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ALL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.