RH: Reiterate Hold Rating As Underlying Demand Likely To Remain Weak

Summary

- I maintain a hold rating for RH due to ongoing weak demand and potential margin deterioration, with concerns about the company's promotional growth strategy.

- My key concerns lie in the inventory markdown strategy and increased marketing expenses, which is likely to negatively affect gross margins and overall profitability.

- The current valuation of RH appears high compared to historical trends and industry peers.

onurdongel

Summary

This is an update to my previous coverage for RH (NYSE:RH). Previously, I recommended a hold rating because of the new concerns I had after the update provided in early February this year. For this update, I reiterate a hold rating for RH as the industry and business continue to experience demand headwinds. Particularly for RH, there is a risk of further margin deterioration as well as pursuing a promotional strategy to drive growth.

Thesis updates

The general macro climate and home-related industries have contributed to RH's 1Q23 sales reduction of 23% to $739 million. Unexpectedly, however, management has upgraded its 2023 revenue forecast, raising the midpoint to a range of $3-3.1 billion from $2.9-3.1 billion on the strength of increased promotions that should boost sales and new product. Consequently, management reduced its adj. operating margin estimate to a range of 14.5-15.5% from 15-17% before, with the negative impact of global expansion ramp up accounting for 150 bps of the reduction.

While management remains optimistic—hence the revised revenue forecast—I remain wary and negative on the luxury housing market and the economy as a whole, both of which I anticipate will face difficulties for the rest of FY23 and into next year.

Therefore, I am restating my hold recommendation on RH. Earnings could still be at danger as the company deals with the aftermath of the epidemic and a difficult macro housing market, especially for luxury goods. Although RH's 2023 growth objectives include new store openings in international and small-market locations as well as the introduction of innovative new products, I believe the weak macro environment will ultimately outweigh these opportunities. Additional strategic price cuts and margin pressure are also worth mentioning, as RH is increasing markdowns in the face of weakening demand trends.

Growth outlook

In addition to revising their FY23 forecast, management also provided new projections for 2Q23: $767–775 million in revenue, with operating margins of 14%–15%. Management stated that the launch of RH England and the publication of the RH Interiors and RH Contemporary source books will result in an additional advertising spend of about $18 million in 2Q23, equating to approximately 230bps of operating margin deleverage. I think it's important to point out that the 2H23 guide implies a rise in sequential sales trends as comps get easier, promotions ramp up, and new products are introduced.

Even if management is optimistic about the near future, I am not because I do not believe the underlying demand driver (consumer confidence, discretionary income, etc.) is reflecting the optimism that management is expressing. My bearish view is that RH has exaggerated the strength of underlying demand and have already committed huge S&M investments to pursue in the future quarters. It's possible that the EBIT margin may continue to fall as a result of low demand (revenue) and rising costs.

Inventory markdown issues

Another issue with RH is inventory markdown, which means lower gross margin. But I agree with this since RH must find a method to get rid of old stock to create room for new items. The difficulty is that management has indicated that, even though the company is speeding up clearance, it is not marketing the full-price business; this bodes ill for future gross margin. Let's say RH is able to sell off all of its stock, but customer demand ends up being lower than anticipated. EBIT margin may fall further as a result of the combination of a shrinking gross margin and rising operating expenses.

Valuation

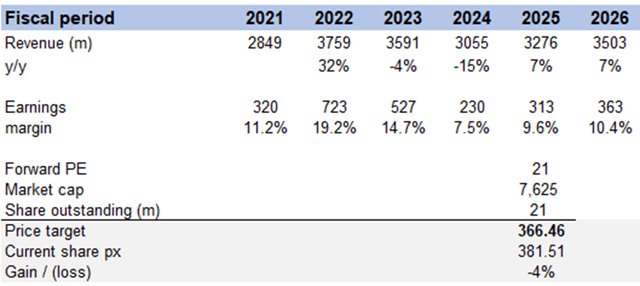

I expect RH to see a weak FY24 as the weak demand environment continues to persist. Net margin should decline as well, given the lower gross margin and increase in OPEX from more marketing. Holding a positive view on the economy in CY24 onwards, I expect RH to benefit from the recovery and grow topline as per historical rates while net margin recovers to a normalized level as well. I believe RH's valuation is not cheap at 31x forward PE based on historical trends. Historically, the stock trades at a 21x forward PE and a standard deviation range of 13x to 28x. I expect valuation to revert back to an average of 21x in FY25 once the business starts growing as per normal. If we compare RH's valuation to other US home furniture businesses like Container Store Group, Bassett Furniture Industry, etc., they tend to trade in the high single digits to low teens of forward PE with similar growth rates. As such, I don’t think the premium that RH is experiencing today will hold.

Risk

As mentioned above, the key risk here is a mismatch between actual demand and management optimism on demand in 2H23. If demand remains weaker than expected, profit on both a margin and an absolute dollar basis will be significantly hurt.

Conclusion

In conclusion, I reiterate a hold rating for RH due to ongoing weak underlying demand and potential margin deterioration. The company's reliance on a promotional strategy for growth raises concerns, and the challenging luxury housing market and economic conditions may continue to impact earnings. Additionally, the inventory markdown issue and increased marketing expenses may further affect gross margins and overall profitability. The current valuation appears high compared to historical trends and industry peers, warranting caution. The key risk lies in the potential mismatch between management's optimism and actual demand in the second half of 2023, which could significantly impact profitability.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.