General Electric Q2 Earnings: Aerospace Shines

Summary

- General Electric Company has reported Q2 earnings results with a roughly 5% increase in the stock price, beating both top and bottom lines and raising its FY EPS guidance.

- Keep an eye on restructuring expenses as the company moves towards the last two spinoffs.

- I expect Aerospace to be the growth spinoff, while the energy division could become the slow, dividend-paying company.

jetcityimage

I don't know about you, but the very mention of General Electric Company (NYSE:GE) brings back memories of Jack Welch. Mr. Welch advocated and implemented "pruning" the workforce to keep an organization nimble and ready for growth even during slow economic conditions. I am not sure I'd associate the word "nimble" with the General Electric of the last two decades, though.

I lost interest in the company towards the end of Jeff Immelt's tenure. My last coverage of this company was in 2016, where I was cautiously optimistic but overall a skeptic, too. The stock has since lost 30% (including dividends) while the market has returned 135%, with the most important business update in the meantime being the plan to split into three different companies, which we will cover at the end of the article.

Back to the present. GE has just reported its Q2 earnings results, as Seeking Alpha has reported here. While pre-market actions do not follow through always, the stock is up nearly 5% as of this writing. Does that mean Mr. Market sees a turnaround for GE? Let's find out in this edition of Good, Bad, and Ugly.

Good

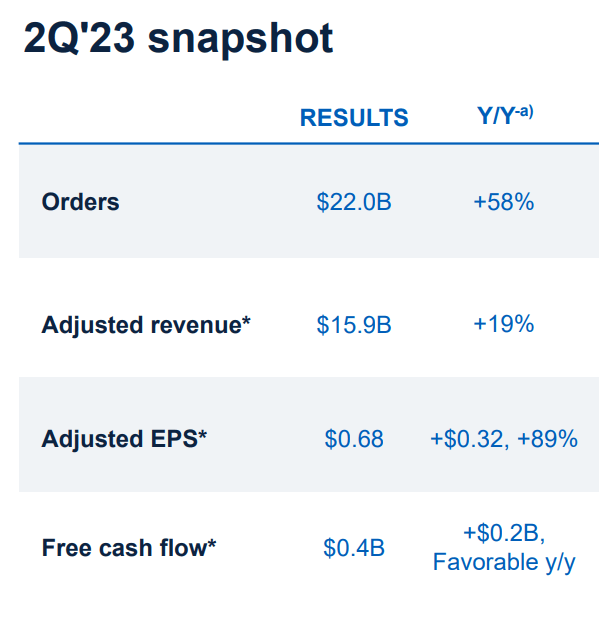

- Classic Beat, Raise, and Rise: GE has surprised investors with the classic beat, raise, and rise as the company beat on both top and bottom lines, raised guidance, and the stock has responded positively. Non-GAAP EPS of 68 cents beat by nearly 50% while revenue of $16.7 billion beat by 10.20%. The company has also raised its FY EPS guidance to a range between $2.10 and $2.30, where even the low end is higher than the previous range's high end of $2.

- Organic orders grew an impressive 58%, handily beating 26% in Q1 2023 and 4% in the same quarter last year (Q2 2022).

- Free Cash Flow (FCF) guidance was also increased to a range between $4.1 billion to $4.6 billion, up from the $3.6 billion to $4.2 billion guidance earlier. As I've stressed in many of my articles before, I pay more attention to FCF when it comes to a company's ability to cover and increase dividends. Based on total shares outstanding of 1.089 billion, the company is committing just $348 million/yr towards its dividend. That means the company is committing less than 10% of its FCF guidance towards dividends.

- Aerospace is inspiring a lot of excitement and confidence from the company as it delivered double-digit growth in both top and bottom lines as well as volume.

Q2 Snapshot (GE.com)

Bad and Ugly

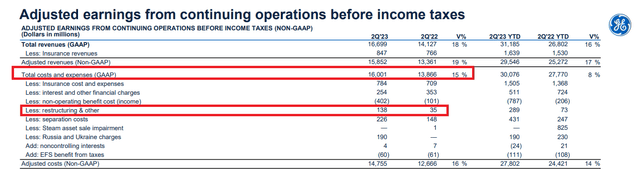

- Q2's total cost and expenses went up 15% YoY, despite a $100 million reduction in interest and other financial charges. I suggest paying closer attention to the restructuring charges from here on, as this section almost quadrupled YoY from $35 million to $138 million, with the 2024 spinoffs getting closer.

- Even the revised guidance of $2.10 to $2.30 per share gives GE stock a forward multiple of 50 at least, which looks expensive even if you believe the company will actually grow earnings, and 26%/yr over the next five years. But bear in mind, a lot of these estimates are dicey when you factor in the spinoffs.

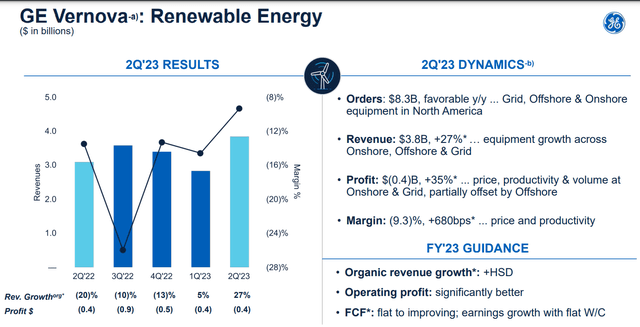

- Vernova showed little to no improvement in its FCF and earnings and is losing money. There is no doubt in my mind that post-spinoff, the Aerospace division will be glad that it is not being dragged down by the energy segment.

Conclusion

General Electric's numbers in Q2 are moving in the right direction. Perhaps, in hindsight, the company got too large by trying to be a jack of all trades (no put intended at Jack Welch). The spinoff seems to have invigorated the healthcare company, GE HealthCare Technologies Inc. (GEHC), already.

Speaking of the spinoffs, the elephant in the room remains the company's upcoming split into three different units/companies:

- GE HealthCare (this split is already in effect)

- GE Vernova, which will be the company's current energy business

- GE Aerospace, which will retain the company's current ticker "GE" and the jet engines + components

I am particularly looking forward to the growth in GE Aerospace with deals like the one with the Indian Air Force, which may also include joint production of F414 engines. Thanks (sadly) to the current global situation, I expect more and more countries to expand their defense footprint. In addition, GE is also likely to benefit from expanding existing partnerships. A quick EBITDA-based calculation shows that the aerospace stock is likely worth $96 given its slight (deserved) premium compared to its peers, while the Vernova stock is likely worth about $10. The combined GE is now trading at nearly $115.

However, I find it hard to recommend buying General Electric Company stock here at 52-week highs, especially when you consider that many parts of the company business are still highly cyclical in nature. Add to that the rich forward multiple of 50. I do recommend holding on to your GE shares here if you are already long, primarily with an eye on the spinoffs and potential synergy down the road. I expect aerospace to remain the cyclical growth company, while the energy business may become the slow-growing, dividend company.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)