GHY: Global, But Wait For It

Summary

- PGIM Global High Yield Fund, Inc. is a closed-end fund that aims to offer a high level of current income primarily by investing in below investment-grade fixed income.

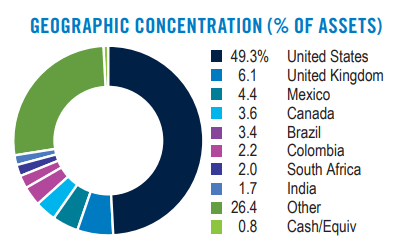

- The fund's investment portfolio is diversified across different geographies and industries, with the United States accounting for the largest single country exposure.

- While the annualized results might appear modest, it's important to remember that bond investing can certainly see sizable declines.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Learn More »

designer491

Prophesy is a good line of business, but it is full of risks. - Mark Twain.

The PGIM Global High Yield Fund, Inc. (NYSE:GHY) is a closed-end fund, or CEF, that aims to offer a high level of current income primarily by investing in below investment-grade fixed income instruments worldwide. The mix of securities is interesting, and I think this could be one to watch after a credit event occurs.

The fund's investment portfolio is diversified across different geographies and industries, with the United States accounting for the largest single-country exposure. The portfolio also includes assets in the United Kingdom, Mexico, Canada, Brazil, Colombia, South Africa, India, among others. I tend to favor emerging markets long term, but timing, as always, is everything.

PGIM.com

Performance

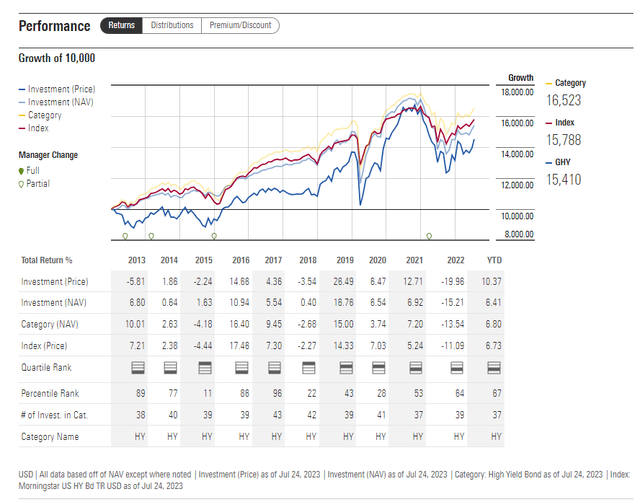

Being globally diversified has been a drag for most funds for some time given US dominance in terms of both equity and bond market momentum. Despite the fund's global focus, the total NAV returns have only slightly lagged behind its category, which is important should the cycle begin to favor bond markets outside the U.S.

While the annualized results might appear modest, it's important to remember that bond investing can certainly see sizable declines. This is evident in last year's performance of many fixed-income funds, including GHY. However, the fund remains an interesting choice for investors looking to gain global bond exposure.

Credit Quality and Geographic Breakdown

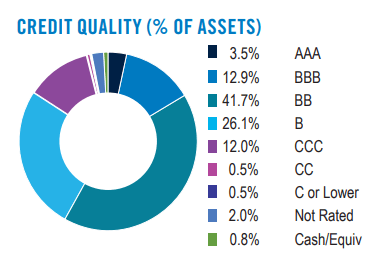

The credit quality of GHY's portfolio primarily falls into the BB and B-rated categories. However, the fund does have a significant allocation in the CCC-rated and below category.

PGIM.com

Industry Exposure

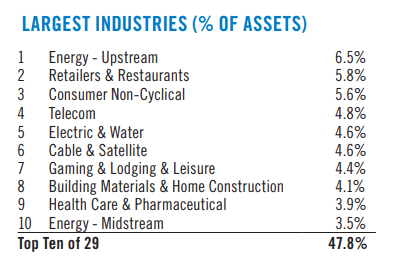

GHY's portfolio is well-diversified across various industries, with no single industry accounting for more than 7% of the total assets. The top ten industries in the portfolio include Energy - Upstream, Retailers & Restaurants, Consumer Non-Cyclical, Telecom, Electric & Water, Cable & Satellite, Gaming & Lodging & Leisure, Building Materials & Home Construction, Health Care & Pharmaceutical, and Energy - Midstream.

PGIM.com

Risks Associated with Investing in GHY

Investing in GHY involves several risks, including market risks, credit risks, and liquidity risks. The fund primarily invests in high yield ("junk") bonds, which are subject to greater credit and market risks, including a higher risk of default. The fund also invests in derivative securities, foreign securities, and emerging markets securities, all of which carry their unique risks.

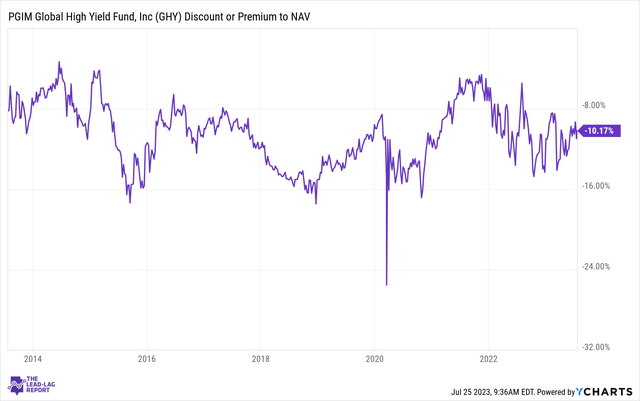

It's also worth noting that as is the case with CEFs, it does trade at a 10% discount currently.

Conclusion

PGIM Global High Yield Fund, Inc. offers an opportunity for investors looking for high current income through investments in below investment-grade fixed income instruments worldwide. Despite the various risks associated with investing in GHY, the fund's extensive diversification, focus on high-yield investments, and global exposure make it an interesting investment choice. I just don't think the time is right just now. Risks are elevated on a delayed effect by the bond market to Fed policy in terms of credit spreads. Default risk can suddenly kick in and create a dislocation in anything and everything that is high yield. I suspect there will be a great opportunity to allocate to GHY, but we need to see more stress in my view to make it worthwhile.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.