PDF Solutions: Farfetched Valuation Should Worry Investors

Summary

- PDF Solutions' share price has risen by nearly 60% in 2023, but the forward P/E ratio of over 60x is considered too high for the company to justify.

- The company, which provides software and physical intellectual property products for electrical measurement hardware tools, has benefited from the growing importance of data and analytics in the semiconductor industry.

- Despite robust growth and a solid outlook for data analytics, PDFS is rated a hold due to the high valuation and inherent risks in the volatile semiconductor industry.

SweetBunFactory

Investment Rundown

So far in 2023 PDF Solutions, Inc. (NASDAQ:PDFS) has had a fantastic start with the share price up nearly 60%. The runup has however caused the valuation to skyrocket and the FWD p/e sits at over 60x. It is very rare for a company to ever be able to justify such a high multiple, and in my opinion, PDFS doesn't do a good enough job doing just that. Estimates are optimistic about the bottom-line growth, but I still find that the downside risks are plenty more than the potentials right now.

PDFS is a company that provides software and physical intellectual property products aimed at electrical measurement hardware tools. The market is international and some of the key drivers behind this recent growth is the importance that data and analytics are having for the market. This optimistic outlook has like I’ve mentioned made the valuation skyrocket and I think for investors looking at a value play, PDFS is nothing of the sort. The price needs to come down drastically for a buy case to be possible. Until then I find PDFS to be a hold.

Company Segments

PDF Solutions was founded back in 1991 and has grown into a state as of now with a market cap of $1.6 billion. The company focuses on providing customers with comprehensive data solutions aimed at empowering organizations across the globe in the semiconductor ecosystem. The semiconductor industry has experienced a lot of hype in recent months, with NVIDIA Corporation (NVDA) taking the lead. PDFS seems to have been caught up with that momentum seeing as they serve the industry.

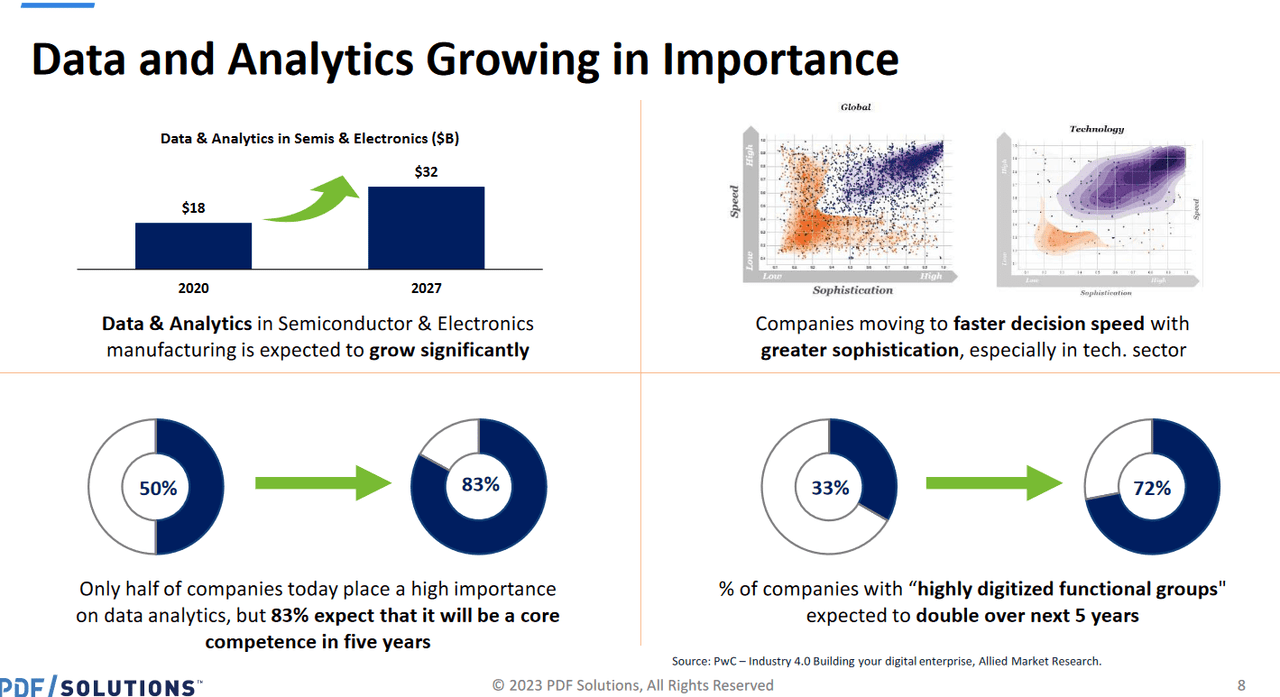

Market Growth (Earnings Presentation)

The growing importance of data and analytics is creating a large market for PDFS to tap into. By 2027 the market for Data & Analytics in Semis & Electronics is set to be valued at $32 billion, up significantly from the $18 billion valuation it had in 2020. Capturing this growth will come down to an efficient market position from the side of PDFS. The trends are also highlighting the fact that more and more companies are expecting to start prioritizing data and analytics even further in the coming years. This could provide PDFS with more markets to tap into, and seemingly this potential has been what results in the quite absurd valuation it currently has.

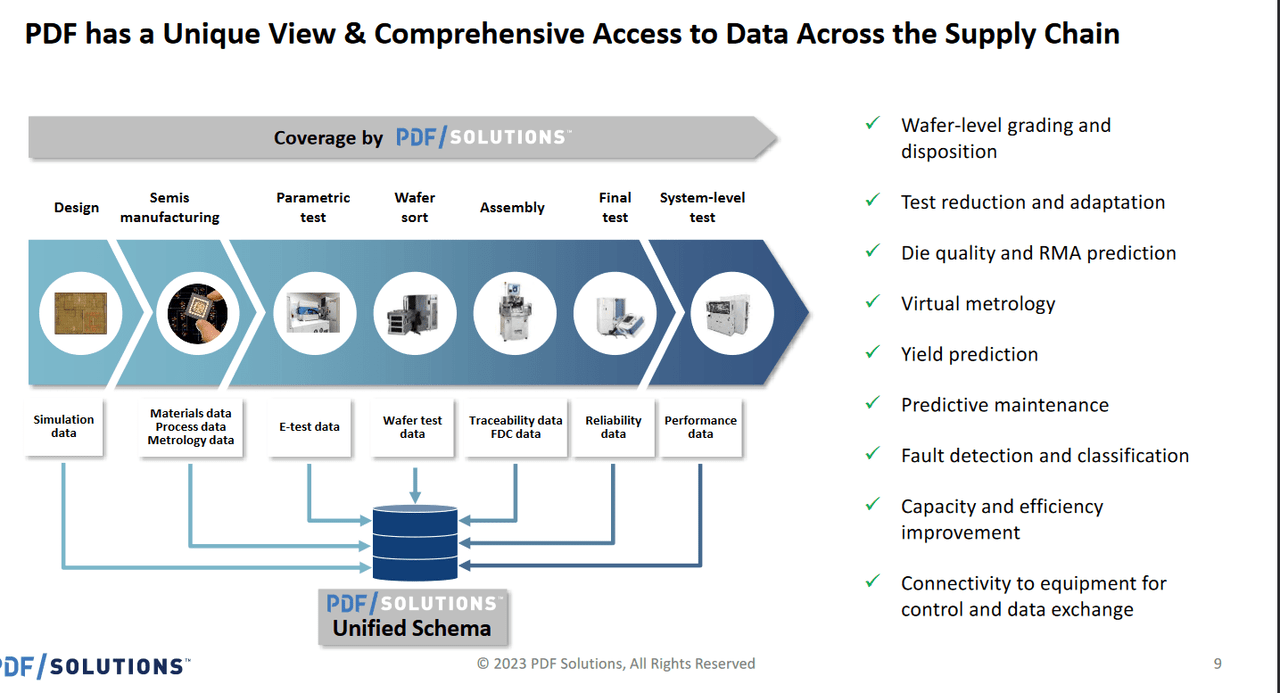

Company Overview (Earnings Presentation)

Where PDFS has been able to set itself apart has come down to its unique set of offerings across several service areas. The broad coverage that PDFS has lends it to be able to service a large and diversified customer base that is growing too. What PDFS offers comes down to helping bridge the gap between supply chain stacks and enabling a smarter manufacturing line, resulting in better margins for clients of PDFS.

Markets They Are In

Seeing as PDFS servers and works with the semiconductors industry I think coming earnings reports will show a lot of volatility. The industry has 1.5 more volatility compared to the S&P 500. This comes as demand and loss of demand can be short-lived. Companies see an influx of capital as orders amount, but after building up inventory levels, the demand shifts and the priority lies in depleting inventories rather than maintaining them.

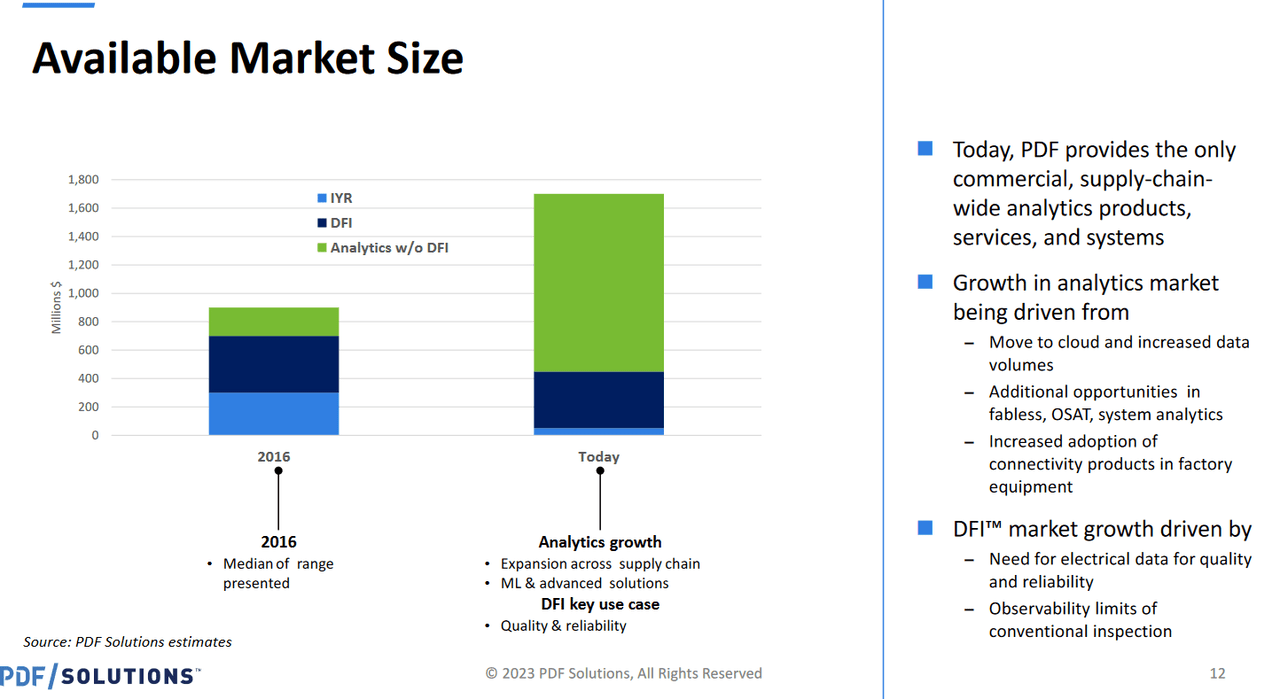

TAM Size (Earnings Presentation)

However, the market size for PDFS is steadily growing and this is offsetting some of the otherwise volatility of the industry and demand. A steady trend upward seems to be the case going forward, fueled by an increased move towards cloud-based solutions and more adoption of connectivity products primarily in factory equipment.

Earnings Highlights

Back in May, we got the Q1 report from the company and in a few weeks, we are set to get the Q2 results from PDFS, on August 8.

Ever since the first report of 2023, the share price has been on a steady trajectory upwards it seems with no sign of slowing down. The revenues grew by 22% YoY which is impressive but honestly not fast enough to make a p/s of 9.7 make any sense. It is still far too high of a premium to pay, even if PDFS comes off as a growth company right now.

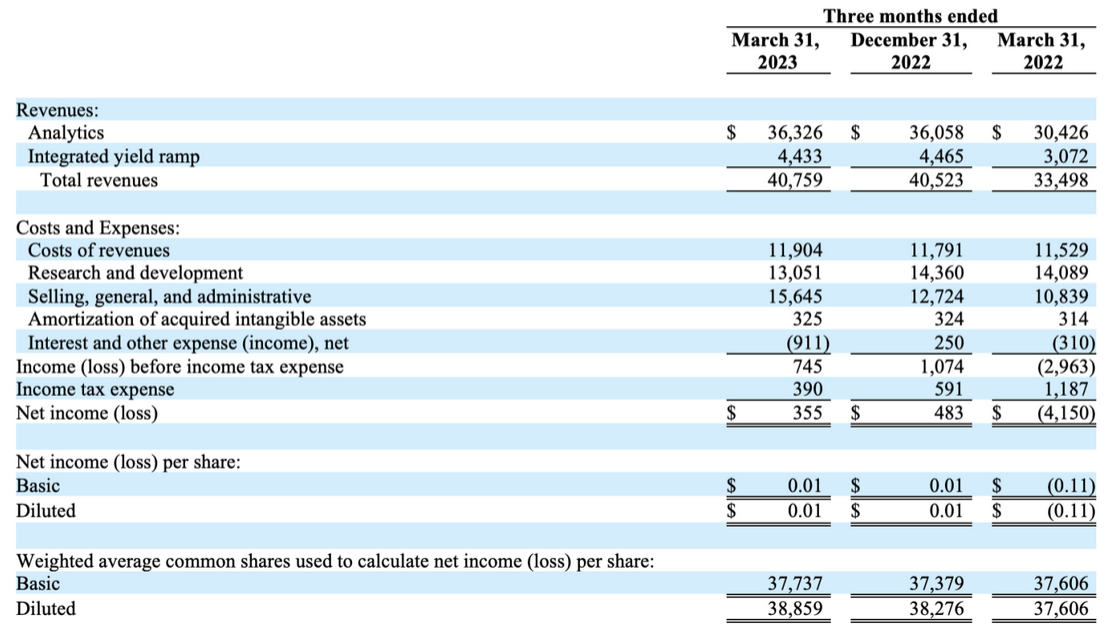

Revenue Statement (Earnings Report)

Diving deeper into the earnings we see that the largest portion of revues comes from the analytics segment. QoQ growth was quite disappointing, basically flat and the smallest segment, Integrated Yield Ramp saw a decline in revenues compared to Q4 2022. The lower R&D expense though for Q1 seems to have significantly helped the bottom line, decreasing about $1 million YoY. What has had investors optimistic is the fact that PDFS has been able to scale very well in just 12 months and the cost of revenues remains larger than the same, but revenues of course much higher.

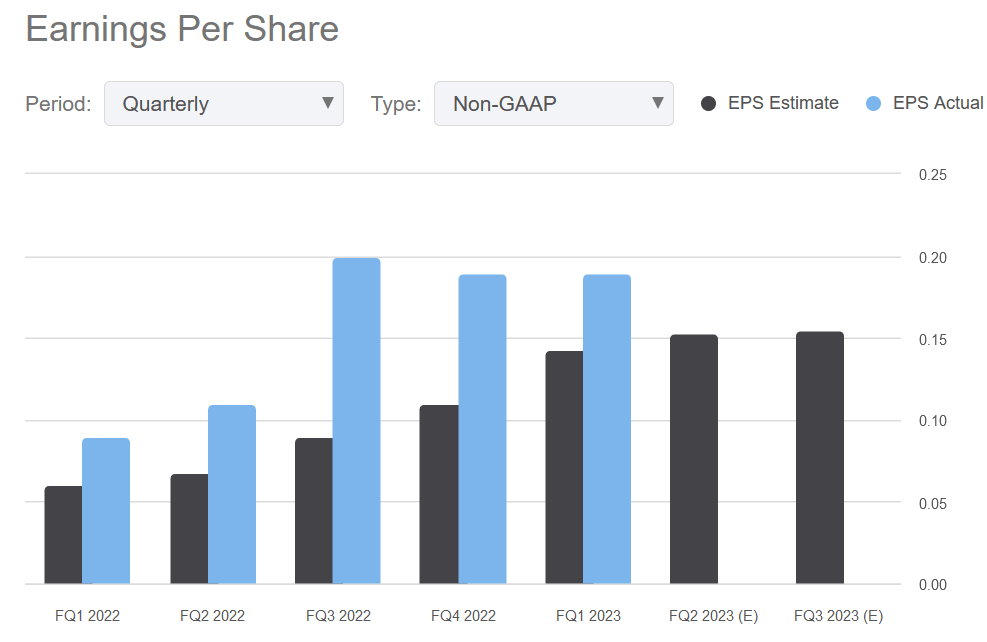

EPS History (Seeking Alpha)

For Q2 the predictions are that PDFS is going to produce an EPS of $0.15 per share. Historically they have had a fantastic reputation for beating out on earnings. A beat on the Q2 EPS might justify the current valuation for the market. But I am still not comfortable buying at these prices as I have made it clear. A p/e around 30x seems more reasonable given the growth and being able to get in at a great price point. That would be a target price of $19.8 per share, over 50% less than the current price. I find it unlikely we reach that point which makes me have a hold rating for the company.

Risks

Analyzing the momentum of PDF Solutions' stock reveals its robust growth, which has been fueled in part by the excitement surrounding the AI hype in the market. However, as the company's valuation has already factored in high expectations, there might be challenges ahead in sustaining this growth trajectory.

The semiconductor industry, in which PDF Solutions operates, is known for its inherent risks and uncertainties. While the application of AI and advanced technologies bring promising opportunities, it also introduces potential pitfalls that PDFS and other semiconductor companies should be mindful of.

Furthermore, the semiconductor industry is highly competitive, with companies vying for market share and technological leadership. Rapid advancements in technology and innovation can quickly render existing products obsolete, leading to a loss of market relevance and decreased profitability.

Final Words

PDFS has been very active in growing its customer base and the revenues have grown increasingly over the last 12 months. For investors seeking an undervalued play, PDFS is not there right now. The FWD p/e is over 60 and being in a volatile market there is always the risk of a slowdown in revenues I think. That shouldn't translate to such a high multiple. But as the overall outlook for data analytics looks solid, a hold rating will be my verdict for PDFS.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.