How Well Do U.S. Treasury Yields Forecast Inflation? An Update Through June 30, 2023

Summary

- The ability of bond market participants to anticipate potential inflation is a critical element of an investor's decision to buy long-maturity or short-maturity bonds.

- There has been surprisingly little reporting on actual realized returns of a "go long" versus "go short" strategy.

- We show below that realized returns on investing in 10, 20, and 30-year Treasury bonds have always exceeded a comparable amount invested in six-month Treasury bills.

- Given the recent spike in interest rates, pending interim excess returns are 100% negative on 1-year and 2-year bonds versus six-month Treasury bills.

- Looking for a portfolio of ideas like this one? Members of Corporate Bond Investor get exclusive access to our subscriber-only portfolios. Learn More »

Torsten Asmus

Abstract

The size of the term premium embedded in the current U.S. Treasury yield curve has been a major focus of research by monetary policy makers and market participants. Researchers have employed both closed form solutions and no-arbitrage simulations using multi-factor models with stochastic volatility. This paper, prepared with individual investors in mind, asks a question that should be answered first in order to estimate the current term premium: looking back over the history of the U.S. Treasury curve, what premium has been earned by investors who buy fixed rate Treasury bonds instead of rolling over 6-month Treasury bills?

The surprising answer is that this premium has never been negative for any trade date for maturities of 10 years and over. Looking at “in progress” premiums for holding periods not yet completed, the answer is that “in progress” term premiums through June 30, 2023 are positive on average for maturities of 7 years and longer, but negative on average for maturities of 5 years and under. For maturities of 1 and 2 years, not a single observation has positive excess returns. The recent spike in short-term rates engineering by the Federal Reserve is the reason for “in progress” results that are much less positive than results from our December 31, 2022, update.

How Well Do U.S. Treasury Yields Forecast Inflation? An Update Through June 30, 2023

With inflation at the highest levels in roughly four decades, any rational investor should be asking “How well do U.S. Treasury yields forecast inflation?” Why? If Treasury yields are poor indicators of future inflation, then no one should buy bonds. On the other hand, if Treasury yields are reasonably accurate in predicting actual inflation, there is no reason not to buy bonds as part of a balanced equity and fixed income portfolio.

A related question is one often addressed by economists: how big is the “term premium” in the U.S. Treasury bond market? There are many forward-looking articles on that topic. It is surprising that there are very few reviews of the historical results comparing rolling over short-term investments versus buying a fixed-rate bond. That calculation answers both the inflation question and the term premium question. If U.S. Treasury yields inaccurately reflect future inflation, then there should be many historical periods where the realized results from rolling over short-term Treasury bills exceed the return that an investor holding the matched-maturity long-term bonds would have received.

In this note we update our December 31, 2022, December 31, 2021, June 30, 2021, January 7, 2021, and October 4, 2017, analysis of realized and “in progress” term premiums in the U.S. Treasury market through June 30, 2023. On every single trading day since 1982, we compare the actual results from rolling over 6-month Treasury bills compared to buying Treasury bonds with maturities of 1, 2, 3, 5, 7, 10, 20, and 30 years. Because interest rates were declining for much of this period but rising sharply in recent months, we also report results for investments that are “in progress” and whose final outcome is still uncertain.

The magnitude of a “term premium” or risk premium in long term U.S. Treasury yields is a major focus of research by both academics and economists in the Federal Reserve System. A recent paper by Canlin Li, Andrew Meldrum, and Marius Rodriguez summarizes two important papers on this topic and reviews their methodologies. Adrian, Crump, Mills and Moench (2014) summarize their term premium findings as follows:

“The evolution of term premia has been of particular interest since the Federal Reserve began large-scale asset purchases. Over this time, short-term interest rates have been close to zero, and our estimates show that the term premium has been compressed and has at times even been negative.”

Estimates of the term premium are a function of the data used, the modeling approach taken, and market expectations.

The focus of this note is a simple one: the calculation of historical realized term premiums and “in progress” term premiums. From the perspective of prudential regulation of financial institutions, Ramaswamy and Turner [2018] argue that interest rate risk may well be the trigger for the next financial crisis, and the demise of Silicon Valley Bank on March 10, 2023 confirms the accuracy of that forecast. The magnitude of the term premium, both current and future, is an important element in assessing the interest rate risk of financial institutions.

A historical perspective on actual realized term premiums is also a potentially important contributor to market expectations, subject to the caveat stated by Robert A. Jarrow, “History is just one draw from a Monte Carlo simulation.” 1

We seek to answer this question:

“Which investment has provided the best total dollar return to investors, a U.S. Treasury bond maturing in X years or a money market fund that invests only in Treasury bills?”

We address the answer to that question with respect to U.S. Treasury fixed rate bonds with maturities of 1, 2, 3, 5, 7, 10, 20 and 30 years. We remind readers that what follows is an analysis of history, not a forecast for the future.

Methodology

We use the time series of U.S. Treasury yields maintained by the U.S. Department of the Treasury and distributed by the Board of Governors of the Federal Reserve. 2

We assume that on each day for which data is available, an investor invests $1000 in the U.S. Treasury bond and $1000 in 6-month Treasury bills (US6M). Every six months, the investor will receive a coupon on the bond. We assume that cash from the coupon payment is invested in 6-month Treasury bills and that this investment is rolled over in new 6-month Treasury bills until the underlying bond matures. The investment in the “money fund” starts with an investment in 6-month Treasury bills, and all cash thrown off is reinvested in new 6-month Treasury bills until the underlying investment in the fixed rate bond matures. Interest on the six-month bills is calculated on an actual/365-day basis because the U.S. Treasury data series for short term rates is on an “investment” basis.

The payment dates, 6-month bill rates, and the value of the “money fund” are given in a spreadsheet available upon request from the author.

The total dollar returns on 1, 2, 3, 5, 7, 10, 20, and 30-year Treasury bonds (US30Y), both realized and “in progress,” are given in a second spreadsheet that is also available upon request from the author.

Summary Results

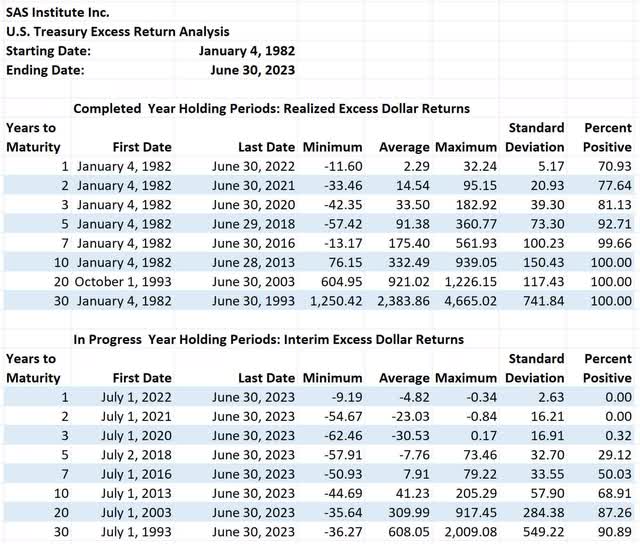

The results of the term premium analysis are summarized in the following table:

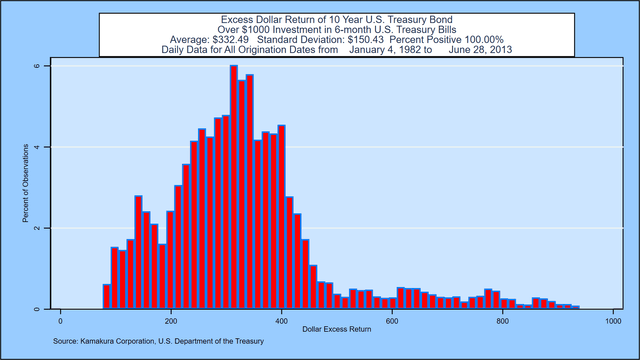

The results show that realized total dollar excess returns have never been negative for maturities of 10, 20, and 30 years. This conclusion is unchanged since the prior update through December 31, 2022. “Excess dollar return” is the ending dollar amount of the “bond strategy” less the ending dollar amount of the “T-bill strategy.” For example, on average, investors buying a $1000 1-year fixed rate bond earned $2.29 more than investors rolling over six-month Treasury bills, down $0.14 since the December 31, 2022, study. The maximum advantage was $32.24, and the worst outcome was a loss: $-11.60.

Pending “in progress” excess returns reflect the sharpness of the recent rate rise At the shorter maturities, results are dramatically different from the “in progress” results of a year ago. For 1 and 2-year horizons, 0% and 0% of realized dollar excess returns have been positive. At three years, the results are 81.13% (realized) and 0.32% (pending). At five years, the results are 92.71% (realized) and 29.12% (pending). It isn’t until the 7-year maturity that the majority of pending excess returns are positive: 50.03%. The statistics for other maturities are shown in the chart.

Graphical Analysis Available Upon Request from the Author

Appendix A shows the evolution of total dollar return (in red) versus the 6-month T-bill money fund total dollar return (in blue) for completed 1, 2, 3, 5, 7, 10, 20 and 30-year terms beginning January 4, 1982. For most holding periods, interest rates have declined substantially over the investment periods that have been completed. The graphs in Appendix A also include the evolution of the initial six-month Treasury bill yields (in light blue) and the relevant fixed rate Treasury bond yields (in pink) on the origination dates.

Appendix B shows the histogram of realized dollar excess returns for each of the 8 fixed rate maturities. Appendix C reports on the histograms of “in progress” pending dollar excess returns for each maturity. For these incomplete periods, we define the “pending excess return” as the known dollar advantage of the fixed-rate Treasury bond over the 6-month T-bill investment as of the observation date. For example, on August 26, 2022, the amount of interest that will be paid on a 6-month Treasury bill equivalent that matures in 6 months (not necessarily 182 days) on February 26, 2023 is known with certainty. We tally all of the pending dollar term premiums, all of which have a differing time to maturity, in the histograms in Appendix C.

One of the reasons for the positive long-term premium results is the large size of the “interest on interest” earned on the fixed coupon payments, which are assumed to be invested in 6-month Treasury bills. The highest total realized dollar returns for all of the completed fixed-rate periods are shown in Appendix D. The lowest total realized dollar returns for each of the fixed-rate holding periods are shown in Appendix E.

Conclusions

The total dollar returns for the 10, 20 and 30-year Treasury bond have exceeded the total dollar returns for the 6-month T-bill money fund on every completed holding period for which data is available. This is due in part because “interest on interest” earned on coupon payments rises when rates rise over the holding period, and, at least so far, this has been enough to generate strictly positive excess returns for 30-year bonds. The recent spike in short-term interest rates, however, shows that the risk of “going long” is not zero, especially for maturities of 5 years and under. The next update of this analysis will be filled with more drama.

With respect to the historical ability of Treasury yields to anticipate inflation, we conclude that the market’s forecast of future inflation has generally been quite accurate for very long-term holding periods.

With respect to the historical excess returns versus the T-bill strategy, the rewards for buying long term bonds have always been positive for maturities of 10 years and over. For shorter maturities, the average premium is positive at all maturities for completed holding periods. For holding periods in process, the average excess return is negative for maturities of five years and under and positive for maturities of 7 years and longer.

It goes without saying that there is no guarantee that the future will be like the past. At the same time, expectations for the future should be set with the past in mind.

The Appendices are available in a supplemental PDF file upon request to the author.

References

Adrian, T., R. K. Crump, B. Mills and E. Moench (2014), 'Treasury Term Premia: 1961-Present', Liberty Street Economics, available at:

http://libertystreeteconomics.newyorkfed.org/2014/05/treasury-term-premia-1961-present.html.

Adrian, T., R. K. Crump and E. Moench (2013), 'Pricing the Term Structure with Linear Regressions', Journal of Financial Economics 110(1), pp. 110-138.

Li, Canlin, Andrew Meldrum, and Marius Rodriguez (2017). "Robustness of long-maturity term premium estimates," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, April 3, 2017, https://doi.org/10.17016/2380-7172.1927.

Heath, David, Robert A. Jarrow and Andrew Morton (1992),” Bond Pricing and the Term Structure of Interest Rates: A New Methodology for Contingent Claim Valuation,” Econometrica, 60(1), pp. 77-105.

Kim, D. H. and J. H. Wright (2005), 'An Arbitrage-Free Three-Factor Term Structure Model and the Recent Behavior of Long-Term Yields and Distant-Horizon Forward Rates', Federal Reserve Board Finance and Economics Discussion Series 2005-33.

Ramaswamy, Srichander and Philip Turner, “A dangerous unknown: interest rate risk in the financial system,” Central Banking, February 7, 2018.

Footnotes:

- Conversation with the author, 2015.

- This is a different data series than was used by the papers reviewed by Li, Meldrum, and Rodriguez. The selection of the U.S. Department of the Treasury series was intentional, because of interest rate smoothing quality advantages that we discuss in a separate note.

- The “use of proceeds” of cash thrown off from coupon payments was chosen for two important reasons. First, the typical academic assumption that cash generated is reinvested in the same security is an investment strategy that is difficult, if not impossible, to execute in the U.S. Treasury market due to lack of liquidity in “off the run” issues. Second, such an approach preserves the valuation of the Treasury bond when using the risk neutral discounting methodology of Heath, Jarrow and Morton [1992].

For a daily ranking of the best risk-adjusted value of corporate bonds traded in the U.S. market, please check out a free trial of The Corporate Bond Investor. Subscribers are actively arbitraging 161-year-old legacy credit ratings using modern big data default probabilities from Kamakura Corporation. Remember, the Pony Express and credit ratings were both invented in 1860. Are you still using the Pony Express?

Subscribers to the Corporate Bond Investor learn how to

1. Calculate a forward looking assessment of the investor's cash needs

2. Rank bonds from best to worst by the reward-to-risk ratio

This article was written by

Donald R. van Deventer is a Managing Director in the Center for Applied Quantitative Finance at SAS Institute, Inc. Prior to the acquisition of Kamakura Corporation by SAS on June 24, 2022, Dr. van Deventer was the Chairman and Chief Executive Officer of Kamakura Corporation. He founded the Kamakura Corporation in April, 1990. The second edition of his book, Advanced Financial Risk Management (with Kenji Imai and Mark Mesler) was published in 2013. Dr. van Deventer was senior vice president in the investment banking department of Lehman Brothers (then Shearson Lehman Hutton) from 1987 to 1990. During that time, he was responsible for 27 major client relationships including Sony, Canon, Fujitsu, NTT, Tokyo Electric Power Co., and most of Japan's leading banks. From 1982 to 1987, Dr. van Deventer was the treasurer for First Interstate Bancorp in Los Angeles. In this capacity he was responsible for all bond financing requirements, the company’s commercial paper program, and a multi-billion dollar derivatives hedging program for the company. Dr. van Deventer was a Vice President in the risk management department of Security Pacific National Bank from 1977 to 1982. Dr. van Deventer holds a Ph.D. in Business Economics, a joint degree of the Harvard University Department of Economics and the Harvard Graduate School of Business Administration. He was appointed to the Harvard University Graduate School Alumni Association Council in 1999 and served through 2021. Dr. van Deventer was Chairman of the Council for four years from 2012 to 2016. From 2005 through 2009, he served as one of two appointed directors of the Harvard Alumni Association representing the Graduate School of Arts and Sciences. Dr. van Deventer also holds a degree in mathematics and economics from Occidental College, where he graduated second in his class, summa cum laude, and Phi Beta Kappa. Dr. van Deventer speaks Japanese and English.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

Also, I don’t see where the article answers the question in the title of whether treasury rates forecast inflation. It seems to me they are at best a lagging indicator. Rates were high in 1982 AFTER we went through a period of high inflation. That was a poor prediction of what would happen over the next 40 years.