Sensient Technologies Q2 2023: Finding Shades Of Opportunity

Summary

- Despite a 7% decrease in EBITDA and operating income, Sensient Technologies Corporation shows promising sales performance and growth prospects, leading to a "hold" recommendation for the stock.

- The company faces challenges such as global destocking trends, declining volumes, and rising costs, which could impact its short-term performance.

- Sensient's strong sales execution, consistent dividend growth, and potential undervaluation suggest long-term potential, making it advisable to hold the shares until the company navigates current challenges.

GoodLifeStudio/E+ via Getty Images

Thesis

This article provides an analysis of Sensient Technologies Corporation (NYSE:SXT), a diversified global entity with a legacy in supplying natural and synthetic color systems and unique ingredients for various industries. Despite a challenging Q2 2023 marked by a 7% decrease in adjusted local currency EBITDA and operating income, the company continues to demonstrate promising sales performance and a robust growth perspective. Nevertheless, structural issues such as global destocking trends, declining volumes, and escalating costs pose significant challenges. Balancing these strengths and hurdles, my evaluation concludes with a "hold" recommendation for the stock.

Company Overview

Tracing back their roots, Sensient Technologies Corporation was created in 1882 and is currently headquartered in Milwaukee, Wisconsin. The company, with its myriad of subsidiaries, has their hands in a variety of pies by specializing in supplying natural and synthetic color systems to a vast array of industries, from food and beverages to pharmaceuticals and nutraceuticals. Beyond colors, they provide unique ingredients for personal care products, technical colors for industrial applications, and even pharmaceutical and nutraceutical excipients. These products come under several trade names including Sensient Food Colors, Sensient Pharmaceutical Coating Systems, Sensient Cosmetic Technologies, and Sensient Specialty Markets.

Sensient Technologies Q2 2023 Earnings Highlights

Sensient's Q2 2023 revenue stood at $374.3 million, a notch up from $371.7 million in Q2 2022, with operating income of $51.6 million in comparison to $55.2 million in the same period of the previous year. Though the quarter witnessed a slip of around 7% in adjusted local currency (more on this in "Risks & Headwinds" below) EBITDA and operating income, attributed to global destocking and a contraction in various consumer product categories, Sensient was not bereft of silver linings. There were signs of order patterns ameliorating in parts of their operations, accompanied by a surge in promotional undertakings for certain North American food product classes.

One area where Sensient's prowess was evident was its successful sales executions, demonstrated through a strong win rate, adept pricing strategies and sustaining a low attrition rate. The firm showed competence in clinching new sales across its broad product spectrum and across the majority of its geographical footprints. According to management, this sales vigor is at a peak not seen before in the company's history, signaling a promising prospect when the destocking period abates.

For Q2, Sensient's Color Group logged a 2% uplift in local currency revenue and, despite an about 8% descent in local currency operating profit, the group's revenue growth enjoyed a boost from a high single-digit price uptick. Management noted that the Color Group, the Flavors and Extracts Group, and the Asia Pacific Group are all projected to persevere on the path of growth over the long haul.

Lastly, despite the downward pressure from destocking leading to volume decreases and the subsequent dent in operating profit, Sensient retains a sanguine view on the long-term trajectory for each of these groups. Moreover, the company has noted some alleviation in supply chain and raw material expenses in certain areas, even as costs related to energy, cultivation, and commodities in specific regions endure at elevated levels.

Expectations

Sensient Technologies is covered by two Wall Street analysts who have an average "Buy" rating on the company that culminate into an ambitious +24.64% upside price target for its shares.

Seeking Alpha

Performance

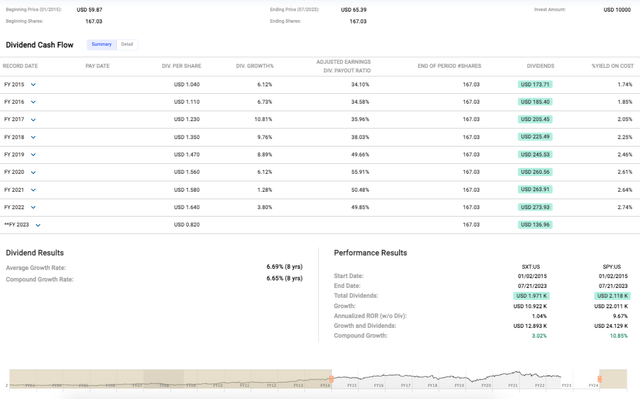

Let's rewind the clock and look into the company's performance in the medium-term, tracing its journey from the start of 2015 up until the present moment. Back then, the stock was valued at a $59.87, and while it has experienced some growth over the span of eight years (see data below), reaching $65.39, you can't ignore the overall sluggishness in its share price appreciation. With no alteration in the number of shares, the ascent has been absolutely lackluster. The annualized Rate of Return (ROR) without factoring in dividends stands at a mere 1.04% during this period, leaving much to be desired in SXT's capital growth. A stark contrast arises when we look at the S&P 500 Index that has achieved an impressive annualized ROR of 9.67% without dividends over the same duration, clearly indicating SXT's underperformance.

FAST Graphs

However, the company has demonstrated a consistent dividend growth rate of approximately 6.69% over the course of those eight years, reflecting a positive indication of steady cash flow, a factor that merits consideration in the broader assessment.

Valuation

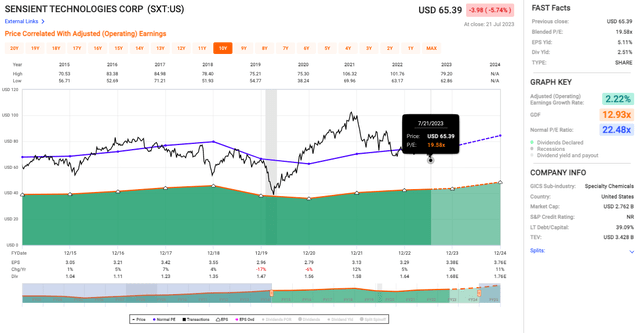

The blended P/E of 19.58x (see chart below) suggests that the market has been pricing the company a little below the historical average. The normal P/E ratio for Sensient Technologies stands at 22.48x, indicating a possible undervaluation.

FAST Graphs

Looking at the growth rate of adjusted (operating) earnings of 2.22%, the expansion is rather moderate, which might be factored into the currently discounted P/E ratio. The Graham Dodd Formula (GDF) at 12.93x further points towards a general variance in earnings growth, implying a higher level of unpredictability in the company's earnings.

The EPS yield of 5.11% does provide some cushion, signaling reasonable profitability. Nevertheless, we can't ignore the fact that earnings yields need to be high enough to justify the risk associated with equity investment. In Sensient's case, I would prefer to see a higher EPS yield given the apparent risk factors.

Risks & Headwinds

As mentioned earlier, the company's adjusted local currency EBITDA and operating income have shown a troubling slide of around 7%. This is no minor hiccup; it underscores deeper structural issues, primarily propelled by a global destocking trend and a palpable decline in volumes across many consumer product categories.

The destocking issue is not a fleeting predicament. Rather, it is evolving into a more pervasive and, frankly, concerning trend, exceeding Sensient's own estimations. Based on management's feedback, customers across the board seem to be tightening their inventory stances, which is expected to persist throughout the year. While in isolation, this activity could be perceived as a transitory phase, the real worry lies in its continued presence, casting a shadow of uncertainty over Sensient's near-term performance.

Now, let's delve into the volume trends. The data coming out of the retail sector for a large portion of Sensient's clientele presents a somewhat gloomy picture. We're witnessing negative volume trends persisting for a staggering 24-month period. Softening demand is an alarm bell that can't be ignored and can trigger a cascade of issues – from excess inventory and supply chain disruptions to revenue shortfalls.

The conversation around costs is equally critical. Sensient is grappling with heightened energy expenses, growing costs, and increased commodity prices in certain geographic areas. This confluence of escalating costs is akin to a proverbial tightening vice that could squeeze their margins in the near term.

Finally, let's touch upon Sensient's downgraded guidance for 2023 which added fuel to the flames of their post-earnings -5.74% decline. The company's forecast suggests a somewhat turbulent year ahead. As noted, with adjusted local currency EBITDA projected to be down mid-single digits and local currency EPS forecasted to decline high-single digits, there are certainly headwinds to confront. The air of cautious pessimism is tangible. This downgraded guidance doesn't exactly inspire confidence, and as an investor, it leaves me with a lot to think about.

Final Takeaway

Based on the provided data, I would rate Sensient Technologies Corporation as a "hold". The company is facing headwinds like declining EBITDA, destocking issues, and weakened demand, which create uncertainty for its short-term performance. However, Sensient's solid sales execution, consistent dividend growth, and future growth projections across all groups, paired with potential undervaluation, suggest long-term potential. Overall, I'd advise to hold the shares until the company navigates through these current challenges.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.