Toyota Motor: Dividend Is At Risk As Company Struggles For A Turnaround

Summary

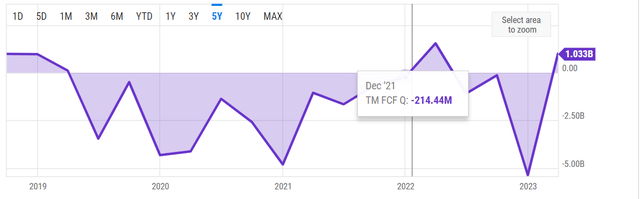

- Toyota Motor Corporation's dividend is at risk, with only two quarters of positive free cash flow in the last 10.

- Toyota's struggles with EVs are real and well-documented.

- Can the company surprise us by actually bypassing EV progress to create the next big thing?

- Deep rootedness may hamper the ability to change.

JHVEPhoto

Analyzing dividend stocks can be tricky with the various metrics available. A lot of times, these metrics contradict each other, with one indicating a super strong dividend while something else indicates a shaky dividend. Things get trickier with American Depository Receipts (ADRs) as they frequently have irregular (at least not quarterly) dividend payments, which also tend to be impacted by currency fluctuations.

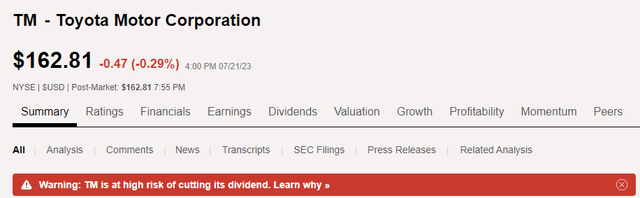

Hence, when I saw this warning on Seeking Alpha about Toyota Motor Corporation's (NYSE:TM) dividend being at risk, I wanted to get deeper and find out if I agree with this assessment. My analysis has almost always agreed with Seeking Alpha's except one very recently. Will Toyota Motor Corporation turn out to be number two? Let's find out.

TM Dividend Warning (seekingalpha.com)

Free Cash Flow Analysis

- Total outstanding shares were 1.35 billion at the end of the most recent quarter.

- As mentioned above about ADRs, Toyota Motor Corporation's dividend has fluctuated over the years. I am using 2022's annual dividend payment of $4 as my basis for this calculation.

- Based on that, the company is committing $5.40 billion to its dividend. That is, 1.35 billion outstanding shares times $4 per share in annual dividend.

- Toyota Motor Corporation has reported just two quarters with positive FCF in the last 10. In addition, the average quarterly FCF over the last five years has been -$1.40 billion.

- The five-year chart shown below conveys the woes, with only 5 or 6 quarters showing positive FCF out of the last 20.

- In short, this is one of the worst FCFs I've seen, and I did my best to find out if any publicly available information could shed some light on the reasons. For example, there could be a long-term project that went way over budget and there could be hope that things would return to normal once that one-off event settles down. Or being a car company, bad debt through loan financing could be another banana peel. I did not find any such reasons to show up. I'd be curious to see if readers have some thoughts to share on this below.

- To end the section on a positive note, based on forward EPS of $18.10, the dividend appears extremely safe with a payout ratio of 21%. But as I've stated in many of my articles, I prefer FCF strength over EPS strength any day. In this case, the difference in the story conveyed by the two payout ratios is staggering.

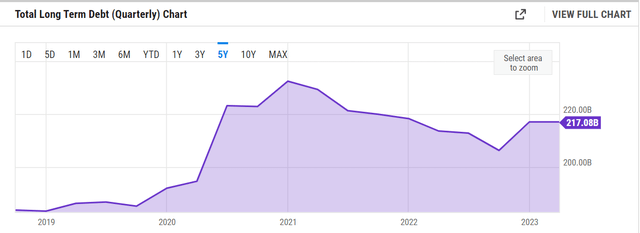

Debt and Cash Situation

Toyota Motor Corporation's debt level is almost the same as its current market cap, which is raising another red flag in my opinion. In addition, the fact that debt has crept up by almost 20% in the last five years, while FCF has been on a declining roller coaster ride, is like a double-whammy.

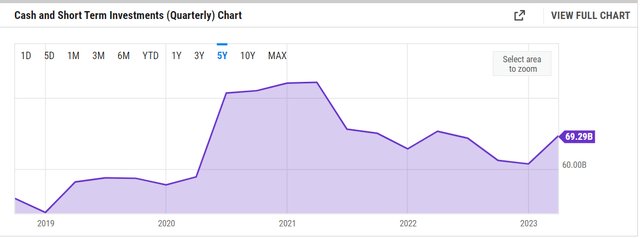

The debt situation does not appear that bad when you look at the company's cash and short-term investments pile of nearly $70 billion. This has gone up by about 35% in the last five years.

Finally, the debt-to-equity ratio of 0.58 is nothing to be alarmed about and indicates no liquidity issues.

So, What About Seeking Alpha's Warning?

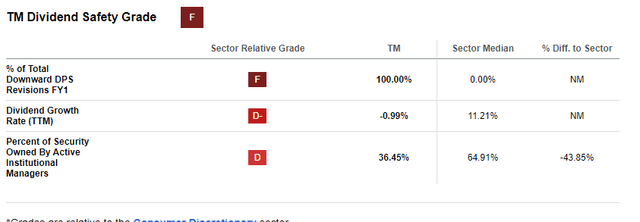

As I mentioned at the beginning of the article, there are many ways to measure a dividend's safety. I don't necessarily agree with SA's top 3 reasons shown below. For example, not every dividend stock "must" be a dividend growth stock. A "D-" there does not concern me as much as say a "C" on Free Cash Flow coverage. Similarly, the inference that not many institutional managers seem to be holding the stock has no bearing on the company's ability to sustain its dividends.

That said, I do believe Toyota's dividend is a risk here due to its FCF woes and high-debt situation. In addition, a turnaround does not appear imminent as covered below.

TM Dividend Warning (seekingalpha.com)

Outlook and Conclusion

- Outlook: That Toyota is the largest automotive manufacturer in the world is undeniable. But the future may not be so bright, especially if it fails to crack the EV puzzle. It is hard for me to actually believe Toyota has not been able to solve this yet. The optimist in me would like to believe that the company is on track with the next big thing, such as the Hydrogen combustion engine, which has been touted to have the potential to make EVs obsolete. Honda and Suzuki have already followed Toyota in this push, and it will be interesting to follow this trajectory. In addition, in my view, the company's plans to produce 900-mile batteries at scale in a short period of time seem like a quick way to appease investors and environmentalists instead of an actual target.

But for now, the company's start-stop struggles with EV are real, as highlighted below:

- EVs make up a miniscule percentage of its total production.

- Investors, I mean large investors and not you and me, are calling for top heads to be ousted over the company's failures with EVs so far.

- The company has frequently changed its approach to EVs.

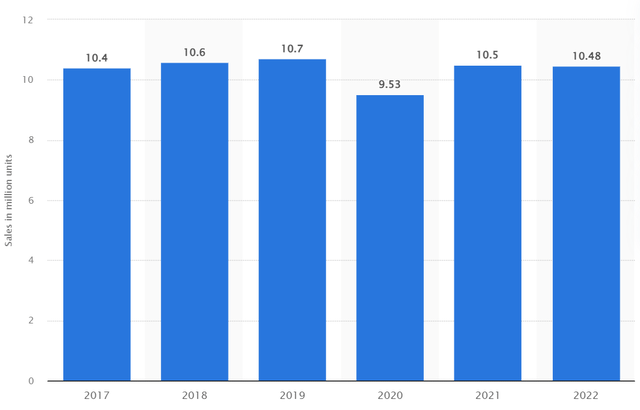

Outside of EVs, the company also has two major problems to address: Flat sales (chart below) and a flattening (or slowly decreasing) profit margin, which last breached 20% in 2016.

TM Retail Sales (statista.com)

- Stock Valuation: At a forward multiple of 9, the stock is trading at a Price-Earnings/Growth ("PEG") ratio 0.53, which is rare these days even for a "car company". This is based on the company's expected 5-year growth rate of 16.80%/yr. However, one can argue that there is a reason or two for the undervaluation, such as the cyclical nature of the demand, competition, and slow or lack of progress on the EV space covered above.

- Risks:

- Even the best manufacturing companies are not immune to production issues and supply-chain delays.

- As stated above, the company's more or less flat sales over the last 5+ years is a concern and is clearly the result of a combination of supply, demand, and competitive risks.

- I expect far more countries to add more pressure on Internal Combustion Engines (ICE) sales, and there is no company at a greater risk than Toyota if this scenario pans out.

- With flat sales on existing business and huge question marks over the future, I find it hard to recommend buying a stock trading nearly its 52-week highs under such conditions.

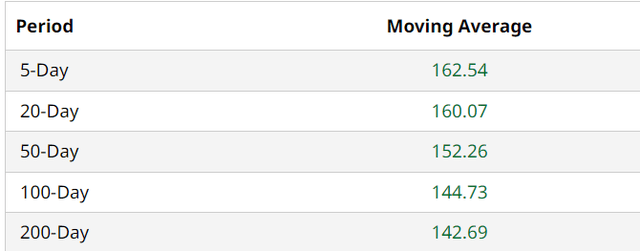

- Technicals: TM stock has now moved past all the commonly used moving averages. More importantly, the stock is almost 15% up from its 200-Day moving average, suggesting long-term accumulation. In addition, the stock's Relative Strength Index ("RSI") is in my preferred sweet spot of 60, which gives the stock a strong footing while leaving enough room to the upside.

TM Moving Avgs (Barchart.com) TM RSI (aiolux.com)

Conclusion:

To state the obvious, Toyota is a great company. And has been for nearly 100 years. But a great company does not make a great stock, especially when starting at a long-expected turnaround when your industry is being disrupted by competitors and politicians alike. I rarely slap "Sell" ratings on a stock, but unfortunately, Toyota is getting one here as I believe the dividend is at risk and the turnaround looks like a painful road ahead.

Finally, I don't mean to be judgmental here, but from my experience, if there is one thing that the rest of the world could do well to learn from Japanese companies (and people), it is their respect for culture and tradition. Those are wonderful traits to have but also come in with a heavy dose of reluctance, if not inability, to change. I have a hard time seeing Toyota making a quick turnaround, given how deep-rooted the company is. I am not betting against it happening ever. Just not when the stock is at $162.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)