AMC Stock Soars Big - What's Next?

Summary

- AMC Entertainment Holdings is up +50% over the weekend. What's going on? Read on.

- Speculatively, I'd consider buying AMC stock because my further research shows that moves like the one we are seeing now in after-hours trading don't end with a one-day pump.

- But in the end, each pump leads to a bursting of the formed bubble, when fundamentals again take over from market sentiment and apes' excitement.

- I urge all speculators not to forget the stop-losses when buying AMC and wish all long-term investors good luck in selecting other companies for their portfolios.

- Looking for a helping hand in the market? Members of Beyond the Wall Investing get exclusive ideas and guidance to navigate any climate. Learn More »

Tom Cooper

Introduction

As I write this, the capitalization of AMC Entertainment Holdings, Inc. (NYSE:AMC) is changing somewhat chaotically in after-hours trading. Still, the upside is not going lower than +50% [at one point there was even a doubling]. Why is this happening? A Delaware court rejected a settlement that paved the way for a share conversion, Seeking Alpha News reported on Thursday last week:

The rejected settlement was meant to help AMC raise more money, but the court said it could not be approved as is. This news excited some retail investors (the "Ape Army") who believed in the company and its potential - their enthusiasm prompted the crowd to buy AMC stock and short-sellers to cover, which drove up the share price so significantly.

But does it make sense now to follow the crowd and buy AMC stock to take advantage of the abnormal uptrend? Let's figure it out.

AMC Stock Is A Double-Edged Sword

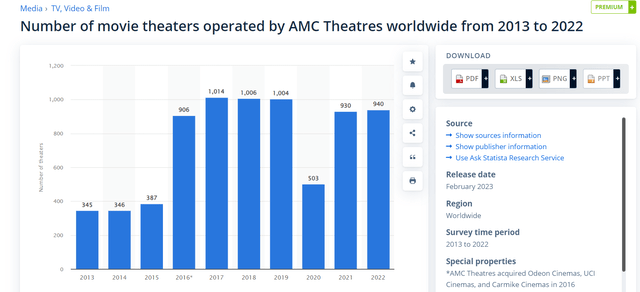

AMC Entertainment Holdings, Inc. is a company in the theatrical exhibition business. It owns, operates, or has interests in 940 theaters in the United States and Europe [as of 2022]:

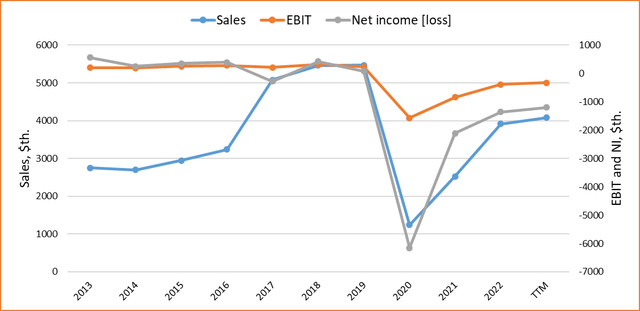

Moviegoers at AMC Theaters-operated theaters totaled ~200 million in FY2022 [based on Statista], up from 128.55 million the year before. However, the 2022 figure is still well below the 356 million reported in 2019, before the COVID-19 outbreak. Zooming out further, we see that attendance at AMC theaters declined 63% between 2017 and 2021. As a result, AMC's net loss is still a major problem for the firm:

Author's work, Seeking Alpha data

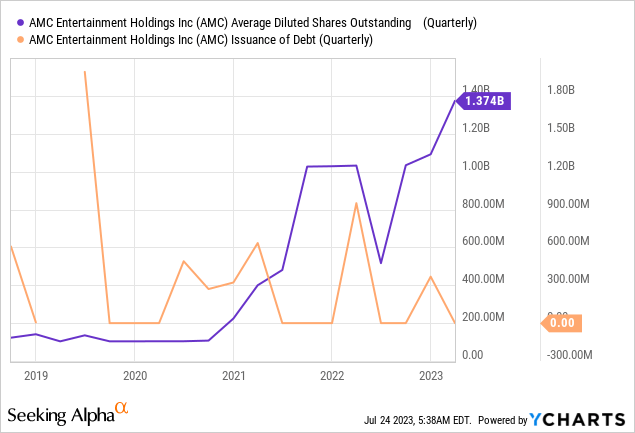

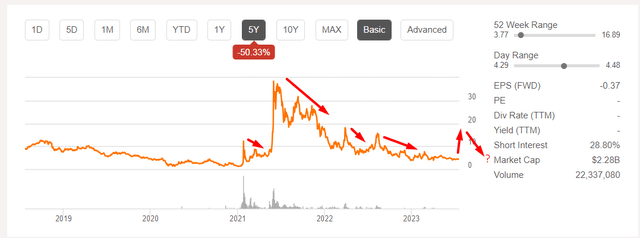

Faced with this dramatic change in moviegoers, AMC's management faced the challenge of financing operations. As far as I can tell, they chose to increase equity over taking on debt, steadily diluting the shares of existing shareholders [the share price has fallen by >50% in the last 5 years]:

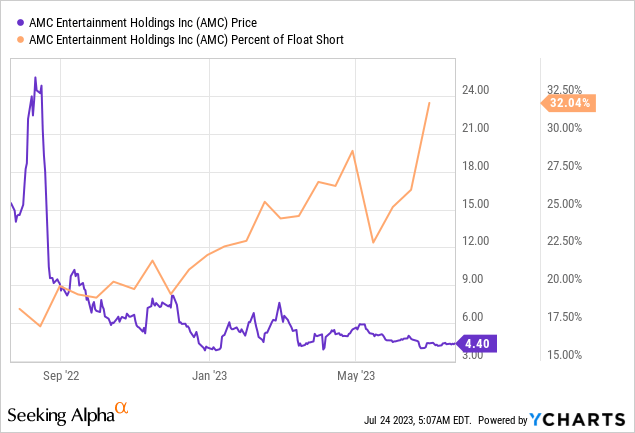

This is why the news that AMC will not be able to dilute in the near future has caused so much excitement among investors, especially amid the sharp increase in short interest in the meantime.

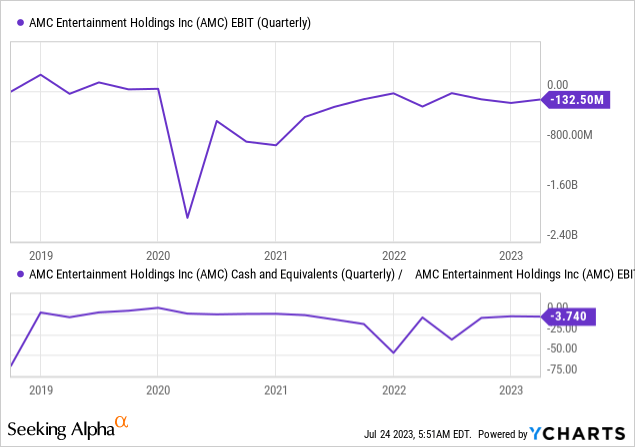

Financially, the situation is still not looking good for AMC - at the level of operating profit, the company still struggles to break even. But the cash on the balance sheet should be sufficient for another 3.5 quarters - it's unlikely that the company will delay raising new funds for that long, but in my opinion, another 3 months without dilution could turn out to be a base case scenario.

Because of the recent court ruling, the supply of shares has hit a kind of limit, so to speak, at least for a short time. That is why speculatively, I'd consider buying AMC stock because my further research shows that moves like the one we are seeing now in after-hours trading do not end with a one-day pump. It is usually a short-term swing move that lasts at least a few trading days. Let me show you some charts.

YCharts, Seeking Alpha data [author's compilation and notes]![YCharts, Seeking Alpha data [author's compilation and notes]](https://static.seekingalpha.com/uploads/2023/7/24/49513514-16901944039312594.png)

I would like to point out again that this is just the speculative side of AMC - in the end, each pump led to a bursting of the formed bubble, when fundamentals again took over from market sentiment and apes' excitement:

Seeking Alpha, AMC stock, author's notes

I may be wrong, but AMC's offline cinemas are gradually giving up their share to online cinemas and various services, and this started before the pandemic and subsequent closures:

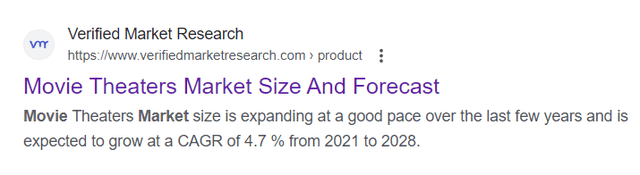

Industry experts predict that this trend, initially accelerated by the pandemic, will gradually continue over the next few years. Judge for yourself - according to a recent report by Grand View Research, the global video streaming market is expected to reach $416.84 billion by 2030, registering a CAGR of 21.5% between 2023 and 2030. This growth will be driven by the increasing popularity of streaming services such as Netflix, Hulu, and Amazon Prime Video. These services offer a wide selection of movies and TV shows and can be accessed on a variety of devices including smartphones, tablets, and smart TVs. At the same time, the offline cinema market will grow much more slowly:

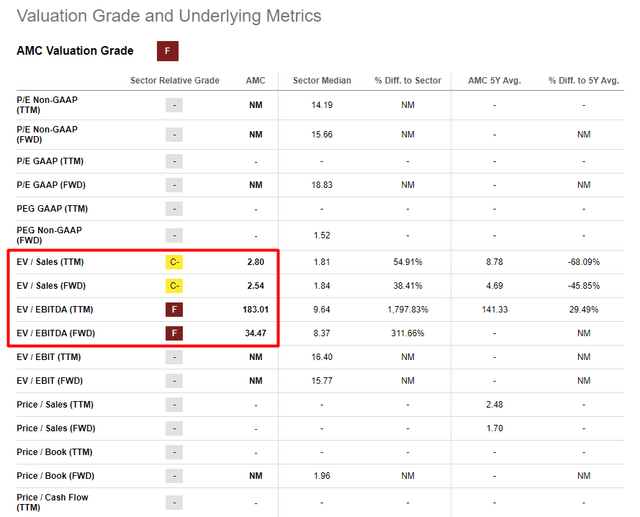

For this reason, I would not buy AMC shares in the long term, because even now - before the post-market price increase materialized - we see a strong overvaluation, in my opinion:

Seeking Alpha, AMC, author's notes

AMC's forwarding EV/EBITDA of 34.47x is even higher than Netflix's (NFLX) one [26.58x]. The latter firm is cheaper despite being more stable financially and operationally - the relative overvaluation of AMC is evident with the naked eye I believe.

Your Takeaway

I think a return of the apes to the market is the most likely scenario after AMC stock rose more than 50% from Friday's close. The rally is likely to last for a few more days, and the stock could continue to force short sellers to cover, fueling the upward movement on the way to new local highs. However, this cannot go on for too long. In the longer term, AMC stock is likely to fall off the cliff again due to its poor fundamentals.

Since my short-term view does not match what I see for AMC in the long term, I rate the stock a Hold today. I urge all speculators not to forget the stop-losses when buying AMC and wish all long-term investors good luck in selecting other companies for their portfolios.

Thank you for reading!

Hold On. Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

This article was written by

The chief investment analyst in a small family office registered in Singapore, responsible for developing investment ideas in equities, setting parameters for investment portfolio allocation, and analyzing potential venture capital investments.

A generalist in nature, common sense investing approach. BS in Finance. The thesis description can be found in this article.

During the heyday of the IPO market, I developed an AI model [in the R statistical language] that returned an alpha of around 24% over the IPO market's return in 2021. Currently, I focus on medium-term investment ideas based on cycle analysis and fundamental analysis of individual companies and industries.

Get a free 7-day trial +25% off for up to 12 months on TrendSpider with the coupon code: DS25

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)