Acme United's Q2 2023: Strong Financials Amid Market Risks

Summary

- Acme United Corporation has shown financial resilience despite challenges such as increased shipping costs and operational expenses, with Q2 2023 net income rising to $3.4 million and earnings per share increasing by 35%.

- The company's sales have suffered, with a 6% downturn in Q2 2023 due to inventory drawdown and an 8% decrease in domestic sales, while European sales fell due to economic contraction; however, Canadian sales increased by 21% in Q2.

- The absence of guidance for 2023 raises some red flags.

Arisara_Tongdonnoi/E+ via Getty Images

Thesis

This article offers a post-Q2-earnings comprehensive analysis of Acme United Corporation (NYSE:ACU), a seasoned player in the market providing a diverse range of safety and cutting solutions. I argue that despite facing various challenges like spiraling shipping costs, fluctuating regional sales, and increased operational expenses, the company has demonstrated commendable resilience through the years. However, a careful examination of Acme's growth strategy, coupled with the existing market risks, paints a picture that demands cautious optimism.

Company Profile

Established in 1867, Acme United Corporation is a well-established player in the market that has weathered numerous market fluctuations by supplying an extensive portfolio of first aid, safety, and cutting solutions to diverse industries across the globe - encompassing sectors like education, consumer goods, hardware, sports, and industrial. They're far from being a one-trick pony; their expansive product line boasts a gamut of offerings from scissors and knives to safety cutters and measuring tools.

Acme utilizes both direct sales and independent manufacturer representatives to reach its target market, including wholesale distributors, office supply stores, drug store retailers, e-commerce retailers, and even hardware chains. They have also embraced the digital wave, selling products through their websites.

Acme United's Q2 2023 Earnings Highlights

The firm enjoyed a 26% uptick in net income to $3.4 million, up from the $2.7 million recorded in the corresponding period of 2022. Their earnings per share also showcased a dramatic leap, ascending by 35% to reach $0.96.

Previously, Acme found itself at the mercy of spiraling shipping costs that peaked at an eye-watering $19,000 per container in 2022, thus incurring an extra expenditure of about $4 million. However, the tides changed in 2023 when the cost per container deflated to around $5,000, a welcome reprieve. A cost-saving blueprint, birthed in September 2022, appears to be paying dividends and on the verge of saving Acme a cool $5 million. According to management, this fruitful endeavor, piloted by a newly recruited Director of Distribution, has spurred an uplift in training, an enhancement in wages, and the advent of automation at the firm's North Carolina outpost.

The company also effectively trimmed its inventory by $9.1 million since June 2022, without compromising its readiness to cater to unforeseen customer demands. This lean approach to inventory management has opened doors for Acme to clear its debt and explore prospective acquisition opportunities for future growth.

While the firm refrained from setting explicit expectations for 2023 (more on this below in "Risks & Headwinds"), it envisages outdoing its 2022 performance, notwithstanding potential supply chain reductions worldwide. Fresh programs across all sectors are poised to be the catalyst for sustained progress.

Scrutinizing the company's regional standing, Acme's net sales in Q2 2023 suffered a 6% downturn to $53.3 million due to the inventory drawdown. Half-year sales in 2023 also followed suit with a minor 1% decline to $99.2 million. On the domestic front, Q2 sales took an 8% hit as a result of inventory contractions in school and office product lines. European sales took a tumble due to economic contraction, while Canada relished a 21% sales boost in Q2, and 8% year-to-date, primarily fueled by the popularity of First Aid product lines.

The Q2 2023 gross margin of Acme experienced a favorable swing to 37.5%, up from 32.7% in 2022, a testament to effective productivity measures and lower transportation overheads. Despite a slight increase in SG&A expenses to 28% of sales in Q2 2023, the firm still recorded a 32% climb in operating profit, thanks to an elevated gross margin and stringent SG&A expense management. The firm also incurred higher interest costs as a result of increased interest rates, even though it had successfully decreased average debt.

To sum up, Acme United put on a fairly impressive show of financial stability, with its net debt receding by $8 million from December 2022. Over the preceding 12-month period, the company has remunerated shareholders with $2 million in dividends while creating roughly $14 million in free cash flow.

Performance

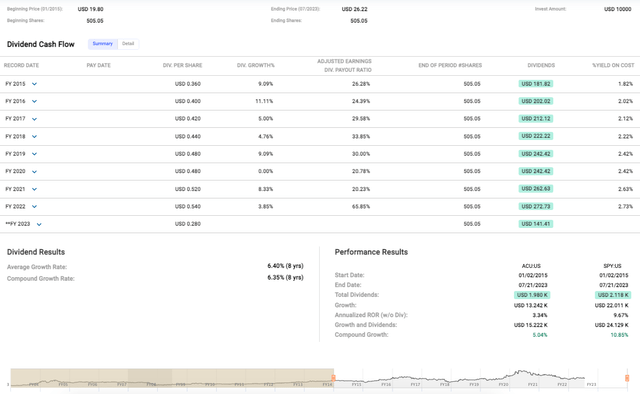

First off, Acme United’s stock price has seen a underwhelming uptick, going from USD 19.80 in 2015 to USD 26.22 as of July 2023. That's a growth of roughly 32.42% over an 8-year period. Breaking that down to its annualized rate of return, we see an uninspiring 3.34% without dividends compared to 9.67% for the broad market as represented by the S&P 500 Index during that same time.

However, Acme has shown great consistency with their dividend payments over time; and I applaud that as they've experienced an average compound annual growth rate of 6.40% over eight years.

Valuation

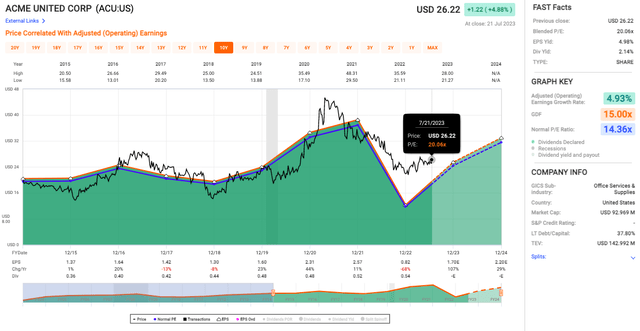

One key metric that immediately pops out is the Blended P/E of 20.06x vs. the Normal P/E ratio that stands at 14.36x hinting at a potential overvaluation and suggesting that investors are expecting higher earnings growth in the future, a promise that Acme has to deliver.

Then we've got the adjusted (operating) earnings growth rate at 4.93%, which is a decent number but not a standout figure. It does show some resilience in earnings, but it also indicates that growth is not particularly aggressive.

Risks & Headwinds

In Q2 2023, we witnessed the abovementioned 6% dip in net sales, which, on the face of it, points to a decline in the company's sales performance. Though this decrease was attributable to planned inventory reductions, it's imperative to consider the broader implications. Could this suggest a dampening demand for Acme's offerings? Or does it underscore a strategic shift in inventory management?

The sales slump becomes more worrisome when we focus on Acme's key markets. In the U.S., the sales contracted by 8%, while in Europe, they plummeted by 7% in local currency. Clearly, Acme is facing headwinds in its principal markets. The ongoing recession in Europe and the intentional inventory pullbacks in the U.S. could be weighing on sales. If these conditions persist, they might keep hampering Acme's top-line growth.

As we pivot to expenses, Acme's Selling, General & Administrative (SG&A) expenses nudged 1.4% higher in Q2 and in the first half of 2023, signaling that operating costs are expanding at a pace slightly higher than revenues. Even though the amount wasn't that much higher year-over-year, it's still a dent because it’s one thing to absorb higher costs during a high growth phase, but when sales are taking a hit, the rising SG&A expenses can carve into profitability. If Acme doesn't keep a tight rein on its costs, it could hamper the company's ability to maximize its earnings.

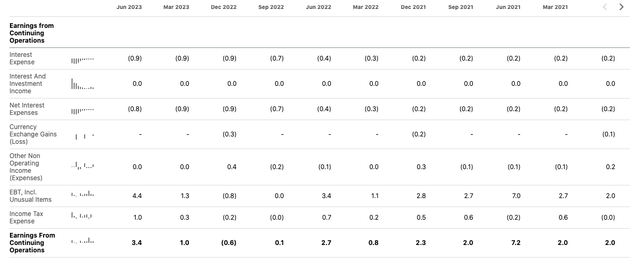

Shifting the focus to Acme's finance costs, we notice that interest expenses (see data above) in Q2 2023 were twice that of Q2 2022. Per the conference call:

Interest expense for the second quarter of 2023 was $830,000 compared to $420,000 in the second quarter of '22.

This uptick reflects the increase in borrowing costs triggered by rising interest rates. Higher finance costs are never a good sign, and this could erode Acme's profitability if left unchecked.

The absence of guidance for 2023 raises some red flags too. As an investor, I find comfort in a company's outlook, as it provides a sense of the management's confidence and strategic direction. But without any guidance, it adds a layer of uncertainty and speculations around Acme's future earnings potential, which isn't ideal for investors who prefer predictability and transparency.

Lastly, Acme's future growth strategy appears to lean heavily on acquisitions. While this can indeed fuel growth, it's not devoid of risks. Acquisitions often involve challenges around integration, risks of increased financial leverage, and the possibility of having to make costly write-downs if the acquired assets don't pan out as planned. So, Acme's growth strategy, while potentially rewarding, does carry a share of its own complexities and risks.

Final Takeaway

Given the company's financial resilience and steady performance, alongside the successful implementation of cost-saving measures, I'd rate Acme United Corporation's stock as a "Hold". However, I recommend keeping a close eye on their declining sales, rising expenses, and absence of guidance for 2023, all of which contribute to an air of uncertainty around their future performance.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)