Trex: Good Long-Term Growth Prospects But Expensive Valuation

Summary

- Trex Company's revenue growth is expected to recover in the latter half of 2023 due to easing comparisons and completed channel inventory destocking.

- The company's investment in R&D and new product launches, along with its exposure to the repair and remodel end-market, should support sales in a tough macro environment.

- Despite good growth prospects, the company's current premium valuations suggest these are already reflected in the stock price, leading to a neutral rating for Trex.

FeelPic

Investment Thesis

Trex Company, Inc.'s (NYSE:TREX) revenue growth should start recovering in the back half of 2023 due to easing comparisons and a more in-line sell-in and sell-out as channel inventory destocking has been completed. The company's repair and remodel end-market exposure should also support sales in a tough macro environment due to less cyclicality and good long-term drivers. Moreover, the company's investment in R&D and new product launches should also help revenue growth in the coming years.

On the margin front, moderating inflation and volume leverage due to recovering sales growth moving forward should help the recovery in margins. However, these growth prospects already seem to be reflected in the company's current premium valuations with the stock trading over 40x FY23 consensus EPS estimates. So, despite good growth prospects, I would like to wait on the sidelines for a better entry point and rate TREX neutral for now.

Revenue Analysis And Outlook

The COVID-19 pandemic benefited Trex Company's revenue growth due to healthy demand for the outdoor living category driven by lower interest rates and stimulus checks boosting discretionary spending. However, halfway through last year, Trex experienced a sudden drop in demand as a significant increase in interest rates resulted in a slowdown in the economy. This led to inventory destocking in the channel, impacting Trex's revenue growth in the second half of 2022.

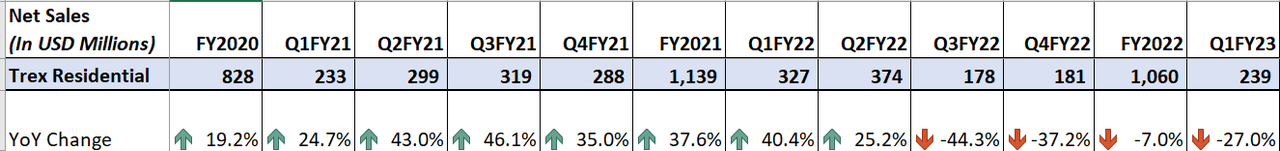

The first quarter of 2023 continued to see an adverse impact of lower spending in the discretionary space, and demand normalization. Moreover, the first quarter also saw tough comparisons from the previous year's quarter, when demand was solid. As a result, revenue decreased by 27% YoY to $239 million in the TREX residential segment.

Trex's Historical Revenue (Company Data, GS Analytics Research)

Looking forward, while there are near-term headwinds for the company's product and services from lower discretionary spending, I believe the company should be able to recover its revenue growth in the back half of the year. Revenue should benefit from easing comparisons, strength in repair and remodeling services, and focus on new product innovation.

Fiscal 2022 was an uneven revenue growth journey for TREX. Over the last year, the biggest pain point for the company's sales growth was the continuous inventory adjustments by customers and dealers in the channel. In the first half of the calendar year 2022, retailers built surplus inventory in advance as they saw strong end-market demand. However, in the back half of the year, consumer demand started to soften as a result of the high inflationary environment and rising interest rates, which tightened consumer spending for discretionary categories. This led to major inventory destocking by dealers in the channel and affected TREX's sales.

The good news moving forward is that channel inventory adjustments have been almost completed, and the channel partners are in good shape to reorder in line with the sell-through. While demand is normalizing from peak levels during the pandemic and impacts of lower consumer discretionary spending persist, a more in-line sell-in and sell-out along with easing comparisons in the second half of 2023 should help with revenue recovery as we move forward in the year. Further, comparisons are also easier in the back half. So, I expect revenue growth should resume in the back half of this year.

In addition, management also plans to increase R&D investments as a percentage of sales in the current year to help support new product innovations and increase demand for its portfolio. Last year the company launched two new products Trex Transcend Lineage and Trex Signature. Both products were received well by the consumers and helped the company strengthen its market position in the outdoor decking category. Now, the increasing R&D investment should enable the company to further meet evolving trends in the outdoor living space and help the top-line growth.

Moreover, I expect demand to remain at good levels even after normalizing. This is due to the fact that the company's repair and remodeling sector is seeing healthy demand despite weakening consumer discretionary spending. As interest rates are high and purchasing a new house is challenging given the current macroeconomic conditions, people are focusing on repairing and remodeling their current house because that is more affordable than buying a new house. Further, according to the management, the average age of housing stock in the United States is around 40 years old, driving additional remodeling spending. So, the repair and remodeling sector should support the end market for Trex's decking composite even during a tough macro environment.

In a nutshell, while the current environment remains uncertain given high inflation and lower discretionary spending, the company has a good growth potential starting with volume recovery in the back of 2023. Hence, I am optimistic about the revenue growth prospects ahead.

Margin Analysis And Outlook

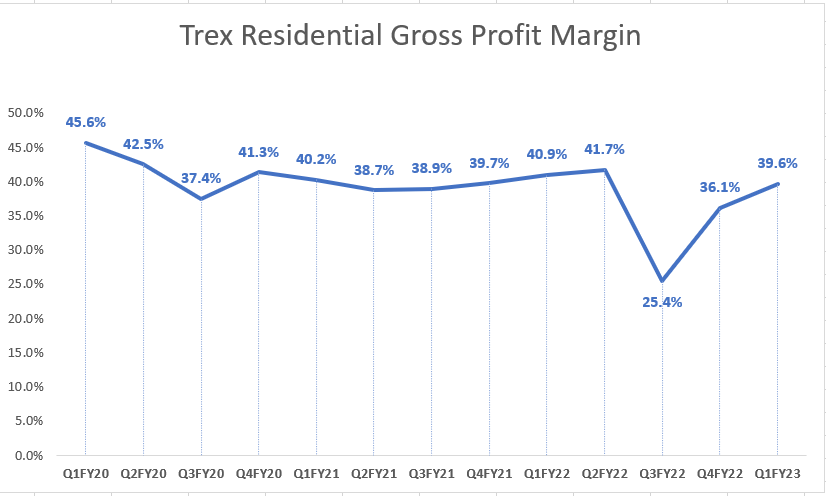

In the first half of the last year i.e., FY2022, TREX's margins benefited from price increases and volume leverage as channel partners built and increased their inventory. However, margin growth took a hit in the second half of last year due to inflationary pressure and volume deleverage. In the first quarter of fiscal 2023, the negative impact of volume deleverage continued to pressure margins. This resulted in gross margins for the Trex Residential segment declining 130 bps YoY to 39.6%.

TREX's Historical Residential Gross Margin (Company Data, GS Analytics)

Looking forward, I believe the company should be able to recover its gross margin. Over the past couple of quarters, the company has been able to sequentially improve gross margin with the help of cost-saving initiatives. The company has reduced unproductive headcount and right-sized its employee base to optimize cost structure over the last few quarters. As volume declines bottoms and the company is able to leverage higher volumes on an optimized cost base, I believe margins should benefit.

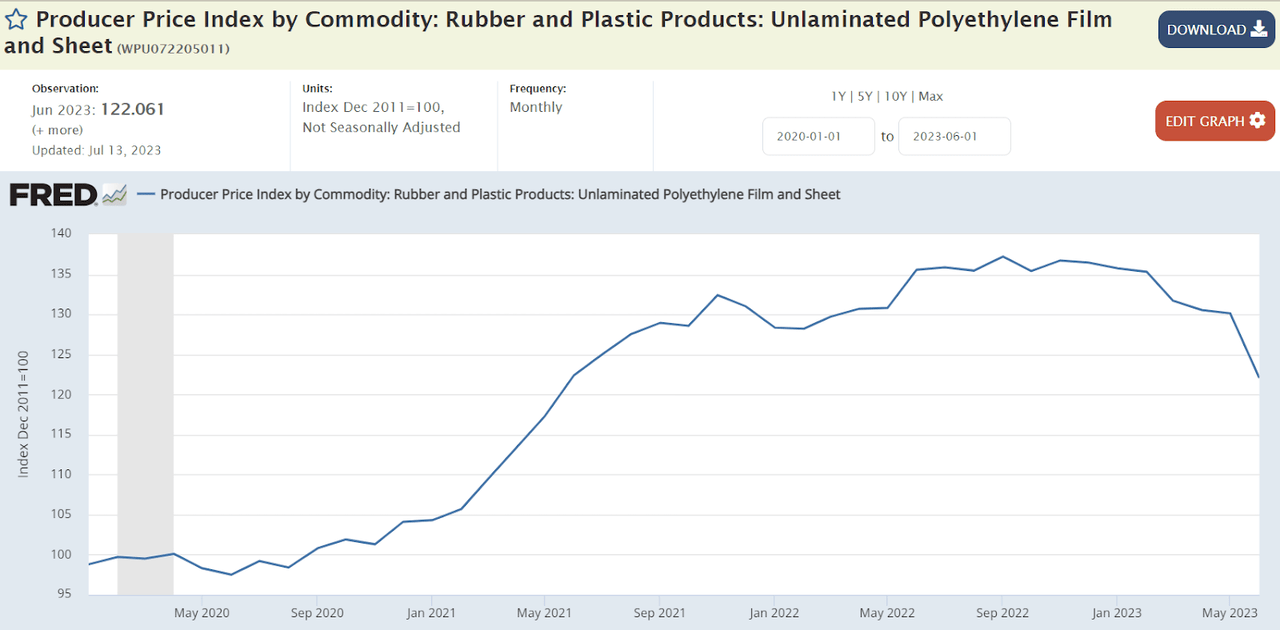

In addition, inflation is also moderating. The company's major input in polyethylene film is coming off its peak levels. This should result in less of a drag from inflation pressure in the coming quarters and help with gross margin recovery moving forward.

PPI of Polyethylene film (FRED)

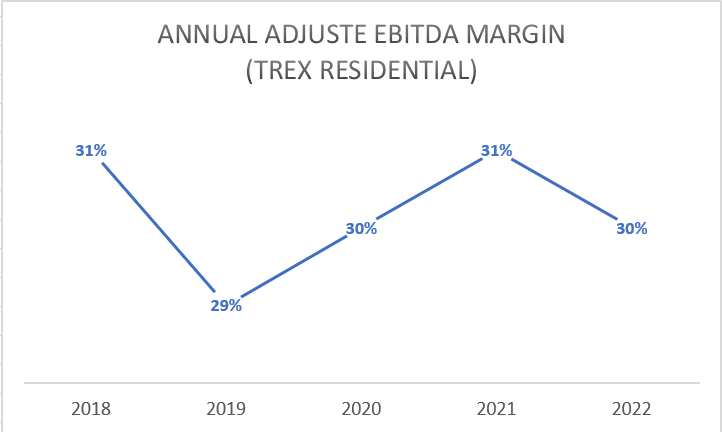

While the gross margin is expected to recover, the company's adjusted EBITDA margin should remain under pressure in 2023. This is due to high SG&A as a percentage of sales in 2023 and lower operating leverage. SG&A as a percentage of sales is anticipated to increase due to higher employee incentives and commissions in 2023. Moreover, the company is also increasing SG&A through higher levels of branding and R&D investments.

TREX's Historical Annual Residential Adjusted EBITDA Margin (Company Data, GS Analytics)

Management has targeted a 26% to 27% adjusted EBITDA margin for the current year, indicating a 300-400 bps YoY decline as compared to 2022. I expect the adjusted EBITDA margin to improve beyond 2023 with the help of recovering volume leverage and gross margin growth, along with the normalization of SG&A investments as a percentage of sales. So, I remain optimistic about the company's medium-term margin growth prospects.

Valuation And Conclusion

Trex is currently trading at a P/E of ~43x FY23 consensus EPS estimate of $1.58. The stock is trading at a premium to its historical 5-year average forward P/E of 38.27x. The company's valuation is also a significant premium to other building product companies levered to residential remodel end-markets like Fortune Brands (FBIN) and Masco (MAS). While Fortune Brands is trading at a P/E of ~19x based on the consensus FY23 EPS estimate, Masco is available at ~18x.

The company has good growth prospects due to recovering volume in the second half of 2023, further supported by long-term demand tailwinds. Moreover, margins should continue to improve moving forward with moderating inflation and cost-saving measures. However, the current valuation is already reflecting these growth prospects. As, a result I would like to wait for a better entry point and rate TREX as neutral.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.