Broadstone Net Lease: Safe, High Yield From This Diversified REIT

Summary

- Broadstone Net Lease, Inc., a real estate investment trust, is trading at a discount compared to the REIT sector while yielding an attractive 6.71%.

- The company has a diversified tenant base, near-perfect occupancy rate, and very long-term contracts. Stability is the name of the game.

- Despite the challenging macro environment, the company's prudent approach to capital allocation and good debt management makes it a promising investment.

buzbuzzer

Broadstone Net Lease, Inc. (NYSE:BNL) is a real estate investment trust (“REIT”) that is primarily focused on single-tenant commercial real estate properties, rented out to tenants from a multitude of different industries on a net lease basis with long-term contract durations. The company timed its IPO somewhat unfortunately during 2020: its stock got immediately caught in the stock market frenzy and was bid up alongside everything else during 2021 and then was inevitably crushed when the Federal Reserve started the fastest interest rate hiking cycle in decades.

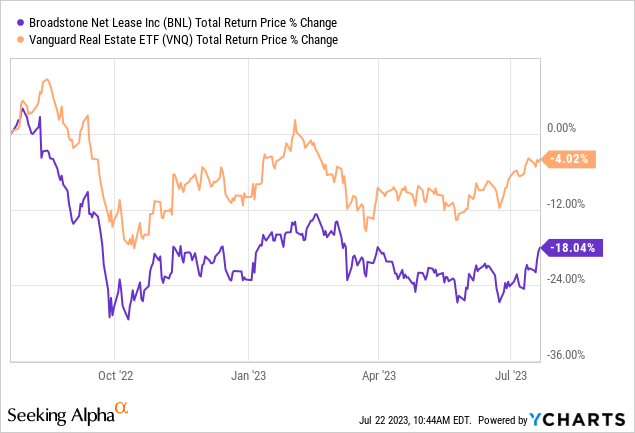

The result is that BNL has underperformed the REIT sector in the past year and is now trading at a very attractive valuation of 11.82 Forward Price to AFFO, a discount of about 23% compared with the sector as a whole while yielding a very intriguing 6.71%. I believe the market is discounting the stock a lot mainly due to few problems at a handful of tenants, but I believe the risks here are probably a bit overblown. I like today’s price as an entry point, let’s see why.

BNL has underperformed the sector in the past year (YCharts)

Diversified and strong tenant base

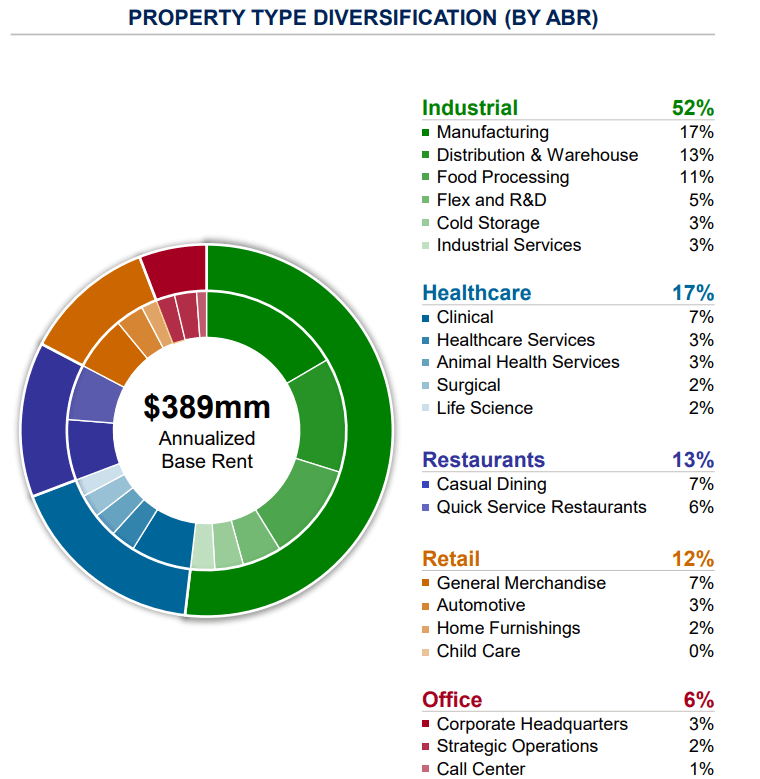

The appeal of BNL’s real estate portfolio, as with other similar companies such as Essential Properties Realty Trust, Inc. (EPRT), is the deep diversity achieved in the tenants base both in geographic terms (BNL owns properties in 44 U.S. states and a small number in Canada) as well as industry wise. The company is primarily focused on industrial, healthcare, restaurant, and retail property types. Within these sectors, there is a meaningful concentration in manufacturing, distribution and warehouse, food processing, casual dining, clinical, quick service restaurants, general merchandise, and research and development.

Broadstone Net Lease Investor Presentation (May 2023)

The leases currently in place look quite favourable for shareholders as the company built a very stable tenants foundation with a weighted average lease term of 10.8 years, and minimal actual contract expirations in the next few years (1.2% in 2023, 2.7% in 2024, 1.8% in 2025). Additionally, over 97% of contracts in place actually have built-in mechanisms for rent escalators, which means that virtually every lease will automatically grow based on contractually agreed terms over a certain period (usually annually). 85% of the contracts have a fixed increase and 11% enjoy a Consumer Price Index (“CPI”) linked rent escalation, meaning that in these cases the rent automatically tracks the general inflation measured in the economy. Overall, BNL enjoys a healthy average of 2% annual escalators which assures at least some growth in Funds From Operation (“FFO”) every year for the duration of these contracts.

Although only 15.6% of the tenants are actually investment grade themselves, over 94% of the tenants are obligated to provide accurate and periodic financial reporting, either through SEC filings (if publicly traded) or privately to BNL if the company is not listed on the public markets. This allows management to continuously monitor the health of its tenants, and apply countermeasures in cases where some of them might be in distress (as we’ll discuss later).

No near term maturity for a well-managed long-term debt

The company has managed to maintain an investment grade rated (S&P – BBB, Moody’s – Baa2) balance sheet thanks to a net debt to annualized adjusted EBITDAre of 5.1x. This is quite important for a REIT as it signifies a financially stable company that is therefore theoretically able to access cheaper capital through more favourable loans.

I believe investors should pay a bit more attention than usual on long-term debt when assessing REITs compared with other companies as access to debt in their case is intrinsically part of the business model.

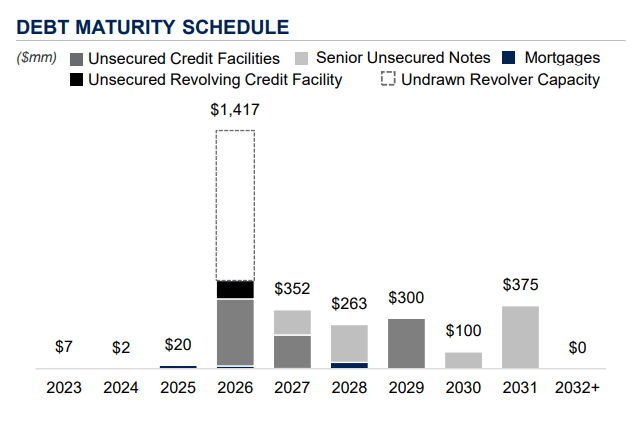

As per the latest filing (May 2023 10-Q), the company has about $1.94 billion of long-term debt which is divided in about $100 million of drawn revolving credit facility, $900 million in loans and $850 in senior notes, all of them unsecured. In addition, a minor share of $85 million is tied to mortgages.

The debt is well laddered with almost no near-term maturity given that between 2023-2025 only about $29 million will come due. 2026 will be a busy year as the $1 billion revolver credit facility will need to be restated, although as of now the bulk of it is still undrawn. On top of that, about $400 million of loans will also mature. From 2027 onwards the company will have to manage an average of about $280 million of maturity per year that will need to be refinanced or extended. That is nothing new as BNL already during 2022 had to refinance a $190 million loan maturing in 2024 as well as amend and restate an upsized revolving credit facility (now up to $1 billion).

Broadstone Net Lease Investor Presentation (May 2023)

Although the weighted average interest rate on all outstanding borrowings was currently 5.03% as of March 2023, that is before taking into consideration the extensive use of interest rate swaps that management accumulated. Thanks to this, a lot of pain was mitigated and the company was able to actually fix the outstanding obligations at a quite interesting rate. Management commentary on this:

Our substantially fixed rate debt capital structure has insulated us for many of the upward pressures associated with higher for longer interest rate expectations. All of our debt, excluding our revolver, is fixed at a weighted average interest rate of 3.7% after considering the effect of our nearly $974 million interest rate swaps that have staggered maturities beginning in 2024 and running through 2034.

I like how management has managed debt so far and I do not have huge concerns that they will be able to refinance the debts due from 2026 onwards, especially thanks to the investment grade rated balance sheet.

What to look forward to?

Clearly the market has reasons to discount the stock given its current depressed valuation. But what is exactly the problem here?

Well, for starters the macro environment is definitely skewed on the challenging side primarily due to steep (and still growing) interest rates, and as such it became increasingly hard to find good deals. From the latest earnings call:

As stewards of investor capital we believe a conservative, prudent, and selective approach to capital allocation is the best path to navigate this uncertain market and our first quarter results reflect that belief.

While we sourced and evaluated billions of dollars in potential new acquisitions, given current pricing dynamics and market risks, we did not feel that cap rates had increased enough to justify significant outlays of capital. [...] We are not interested in growth for growth's sake

As such, particular scrutiny should be put in place in the next quarters to review the cap rates at which the company is signing in new deals (if any), to evaluate if management is following a prudent pathway or not. I personally expect slower FFO growth compared to pre-pandemic years but still positive, as even in absence of new deals the rent escalators will provide a nice boost.

Tenants-wise, currently the company is enjoying 100% rent collection and near perfect 99.4% occupancy rate. Although management confirmed that nearly all tenants are providing recurring reporting related to their own financial profile, I haven’t found anywhere disclosed the tenants’ rent coverage ratio, a crucial metric that measures how comfortably tenants are able to cover rent obligations through their normal operation. My general assumption when any company avoids publishing a certain metric is that it is probably at least subpar compared to the competition. In BNL’s case I would monitor closely any metric and commentary around the financial health of tenants due to this specific opaqueness, however it must be said that every information available on this regard seems to point toward very high quality tenants.

The overall good health of the tenants base does not mean however that individual companies may not be experiencing some difficulty. Management has specifically called out Carvana, Red Lobster and Green Valley Medical Center (together with a handful of smaller, undisclosed ones) as tenants that are currently on their watch list for potential trouble. As previously explained though, BNL has quite a diversified tenancy base which mitigates the impact from one specific tenant missing payments: Carvana and Red Lobster for example only constitute 1.2% and 1.6% of the Annualized Base Rent (“ABR”), while Green Valley Medical Center is undisclosed which makes me think its share is most likely considerably smaller. Something to monitor, but I would not be particularly worried as even if Carvana and Red Lobster close their location, these types of buildings are fairly fungible and BNL should not have huge issues in finding new tenants.

Valuation and key takeaways

For FY2023 management is seeing AFFO per share between $1.40 and $1.42, which would represent basically flat growth from FY2022. The per-share results are clearly influenced by the company issuing stock particularly when completing acquisitions, which is common among REITs as alternative source of capital to loans and bonds. For example, between FY2020 (IPO year) and FY2022, the company grew AFFO from $181 million to $252 million (up 39%), however diluted weighted average shares outstanding also grew from 128 million to 180 million (up 40%). Nevertheless, despite the per-share result being somewhat stagnant, during the same time frame the dividend grew from $1.015 to $1.08 and it currently sits at an annualized $1.12 based on the latest quarter hike to $0.28.

Buyers today can lock in a 6.71% dividend yield that is fairly safe as management targets an AFFO payout ratio around 75% and that should also keep growing. Granted, BNL is fairly new to the public market and as such there is no long track record on hiking dividends, however I like management’s prudent capital approach and their ability to apply countermeasures to the rising of interest rates through swaps, which is a nice competitive advantage against some smaller peers as these measures might be inaccessible to some of them.

BNL’s shares are currently trading at 11.82 Forward Price to AFFO, a discount of about 23% compared with the REIT sector. It is enjoying near perfect occupancy rate, 100% rent collection, very long lease durations and built-in rent escalators for some automatic growth. Management does not seem interested in bad deals, which is a good thing, and has a few years ahead with no debt maturity and ample liquidity (from the revolver credit facility) to use in case goods deals are presented. I think the 6.71% dividend yield is quite safe as of today and I expect it to grow. Meanwhile, any potential improvement in the economy might even convince the market to reprice a bit higher the stock closer to the REIT sector’s average P/AFFO multiple which would unlock some capital gains as well.

I like the risk-reward here and will look for initiating a new position soon.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BNL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.