TransUnion: Long-Term Tailwinds, High Barriers To Entry

Summary

- TransUnion's industry is dominated by two other companies - Equifax and Experian - limiting competition.

- Over the years, the company has diversified its revenue stream, making it less reliant on the macro environment.

- TRU is benefiting from favorable long-term tailwinds, such as rising demand for ID verification, fraud reduction, and the advent of digital commerce.

JHVEPhoto

Thesis

TransUnion (NYSE:TRU) operates a triopoly with Equifax (EFX) and Experian (OTCQX:EXPGF). The company's industry is underpinned by high barriers to entry, enabling a strong competitive advantage. Over the years The firm has diversified its revenue stream, making it less reliant on the macro environment. TRU is benefiting from favorable long-term tailwinds, such as rising demand for ID verification, fraud reduction, and the advent of digital commerce. I will explain the main points of my thesis below.

Company Overview

TransUnion is a leading global information and insights company that generates credit reports for consumers and provides businesses with services for credit risk, fraud mitigation, marketing, analytics, and more. The firm operates in three main business segments: U.S. Markets, International, and Consumer. The company has a presence in more than 30 countries, with 66% of its revenue coming from the United States.

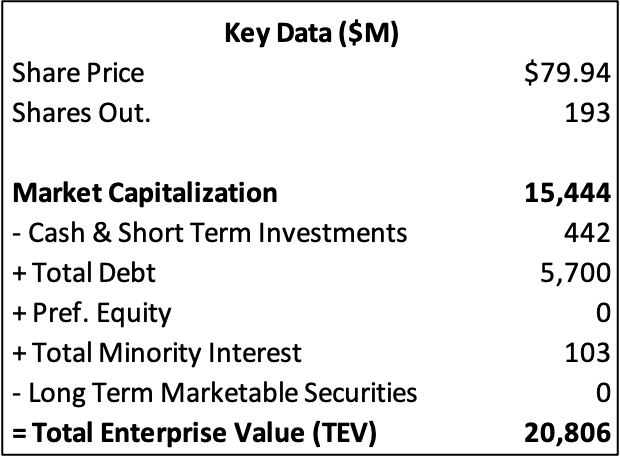

Capital IQ

I believe TRU draws most of its competitive advantages from its industry. Credit, fraud, and identity verification are highly sensitive and regulated industries. It would be pretty hard for a start-up to try and convince banks or other financial institutions to do business with them, considering the data of millions of customers.

Business Segments

U.S. Markets (66% of Revenue, 35.60% ADJ EBITDA Margin)

The U.S. Markets segment has two business units: Financial services and Emerging verticals. Financial services is the core business unit of the segment, accounting for 51% of the segment's revenue and 34% of total revenue, The unit works with banks, credit unions, lenders, and others. This unit's services include consumer lending, mortgage, auto, and card and payment lines of business.

As the firm started diversifying its revenue to be less exposed to macro conditions, It moved on into emerging markets such as Commerce, Communications, Insurance, media, and more. The services of the business unit include marketing solutions, fraud and identity management solutions, and more. This segment is close to surpassing financial services in terms of revenue. In 2020, This unit accounted for 23% of total revenue, and as of 2022, it accounts for 32% of revenue

International (20.4% of Revenue, 43.60% ADJ EBITDA Margin)

The international segment has the same services as the U.S. Market but to companies globally. Some of these countries include Canada, the U.K., India, and more.

Consumer Interactive (15.8% of Revenue, 48.20% ADJ EBITDA Margin)

Consumer Interactive works with consumers and helps companies respond to data breaches. Services include credit reports and scores, credit monitoring, identity protection, and more. This segment is also by far the most profitable in terms of ADJ EBITDA margin. I like to think this business is well positioned than others because consumers are unlikely to stop using services such as credit reports and identity protection services even in a recessionary environment.

2.2% is the elimination of corporate

Outlook

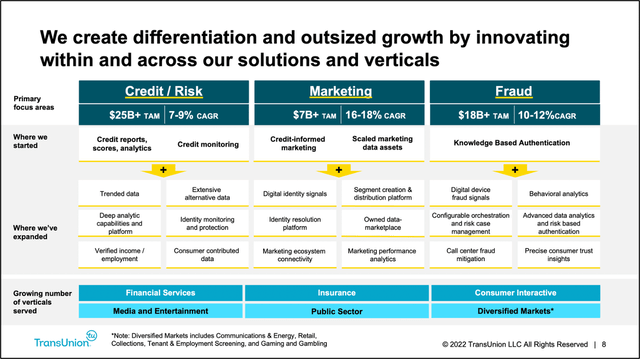

As the company diversified its revenue over the past few years, it exposed itself to new markets such as Fraud and marketing. According to the company, The total addressable market for fraud is +$18 billion and is expected to grow at a CAGR of 10-12%. Marketing's TAM is $7 billion and is expected to grow at an annual rate of 16–18%. I expect the firm to benefit from this growth given its strong market position.

The company is riding some nice tailwinds, such as an increase in online purchasing activity, which will in turn pressure businesses to improve targeting precision and identity verification in order to enable a better customer experience. Another tailwind is the funds lost in e-commerce globally (+$20 billion lost in 2021). I believe these trends will increase demand for the company's products, thus increasing its long-term earning power. TRU's core market credit and risk are expected to grow at a CAGR of 7-9%.

Company Presentation

The firm has had a global presence for more than 30 years by expanding into multiple countries. I believe TRU's long-term potential stems from its expansion into India, which has recently surpassed China as the most populous country. Given the country's massive population, I believe the firm's biggest opportunity is not in business but in consumers. This will do well for the company's consumer incentive segment.

Revenue from India stood at $174 million in 2022 and has grown by 30% annually in the past two years, leaving other countries in the dust. TRU was able to develop a foothold in the region since it was one of the first firms to enter it in 2001. The firm was the first to create consumer and business credit reporting agencies in India. I think over the long term, India can be a crown jewel if approached correctly. Overall, I believe TRU is well-positioned to capitalize on the growth coming from its markets and regions.

Valuation

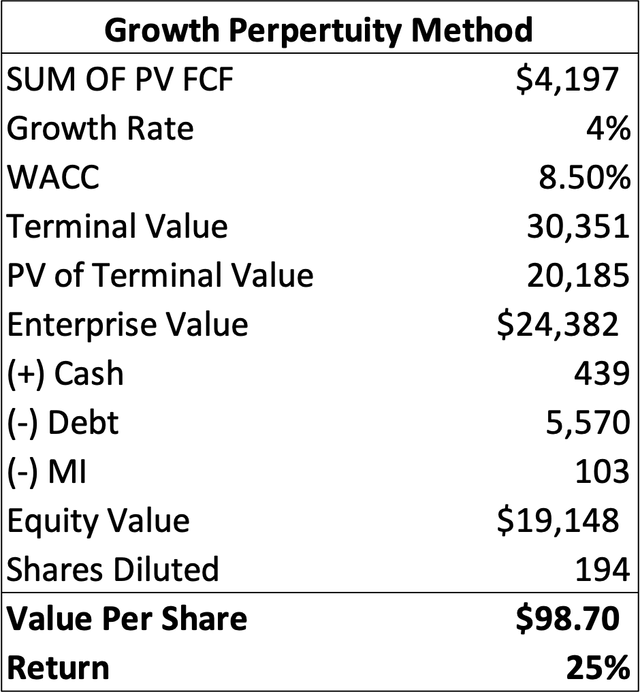

TRU is currently trading at a P/E ratio of 59.77x and an EV/EBITDA of 17.41x. My fair value of TRU is $98.70, which translates into a 32% return from the current price of $79. I expect revenue to grow at a CAGR of 7.36% from 2023 to 2027, With the international segment experiencing the most growth at 11% CAGR. I project a 200-basis-point improvement in operating margins over the next five years. Using a discount rate of 8.5%, I discounted the cash flows and terminal value. I get an equity value of $19 billion.

Created by the author

Risks

1) Because of its exposure to mortgages and other credit applications, TRU can be influenced by macroeconomic conditions. A downturn in the economy might diminish demand for certain services, thus decreasing the firm's revenue. Although the company has diversified its business to avoid this risk, one should still consider it.

2) For TRU's business to thrive, its reputation has to be intact, and data breaches or hacks can jeopardize that.

4) The company does carry a $5.6 billion debt on its balance sheet. Most of the debt was the capital needed to fund acquisitions.

Conclusion

The bottom line is that TRU operates in an industry with high barriers to entry. The industry is dominated by two other companies, limiting competition. The firm's strategy to offer its U.S. market services to other countries has made them less dependent on one region, and the expansion into new segments and markets has helped them further diversify revenue. I truly believe India is the most attractive opportunity for the firm in the long term.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not a qualified financial advisor or investing professional. My content and analysis are based on my opinion and are intended to be used and must be used for educational purposes only. No content or analysis constitutes or should be understood as constituting a recommendation to enter into any securities transactions or to engage in any investment strategy. It is very important to do your own analysis before making any investment based on your own personal circumstances. Readers should always seek the advice of a qualified professional before making any investment decision. Past performance is not indicative of future performance. A reader should not make personal financial, or investment decisions based solely upon this analysis.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.