Oilfield Services Update: Offshore And International Make Up For North America Weakness

Summary

- The Big 3 oilfield services players SLB, BKR and HAL all reported this week.

- All 3 see strength in international and offshore more than offsetting temporary weakness in North America.

- We are in the early stages of a multi-year capex cycle that positions oilfield services stocks for continued outperformance.

JHVEPhoto

Schlumberger (SLB), Baker Hughes (BKR) and Halliburton (HAL) - the three oilfield services (or OFS) majors - all reported this past week so it's a good time to revisit the investment thesis for this still undervalued sector. Back in December, one of my main expectations for 2023 was that OFS would outperform the broader energy sector. So far this seems to be playing out although it hasn't been a linear path:

The regional banking worries in March reflected more on OFS than on exploration and production (or E&P) companies, but the services sector rebounded strongly and is again ahead year-to-date. Natural gas prices (NG1:COM) crashed earlier this year, after a warm winter, so that is part of the story too, although onshore North America exposure is limited for the constituents of the VanEck Oil Services ETF (NYSEARCA:OIH).

Some weakness in North America but strength in offshore and international

The OFS majors' macro views were aligned on the differential performance between onshore North America and offshore/international.

Schlumberger's Olivier Le Peuch:

The international and offshore markets continue to exhibit strong growth as North America has moderated. This is playing to the strengths of our business, as international revenue represents nearly 80% of our global portfolio, and offshore comprises nearly half of that.

Our second quarter international revenue increased 7% sequentially due to solid product sales, activity increases and pricing gains across multiple product lines...

In North America, revenue in the second quarter was $2.7 billion, a 2% decrease sequentially. This decline was primarily driven by decreased stimulation activity in U.S. land, partially offset by increased artificial lift activity in U.S. land and higher activity across multiple product service lines in the Gulf of Mexico.

In Oilfield Services & Equipment, we continue to be encouraged by the multi-year cycle unfolding in international markets, particularly in offshore basins. With approximately 70% of our OFSE business internationally focused, and around 40% exposed to offshore, we remain well positioned to benefit from these market dynamics.

On a regional basis, we are experiencing strong growth in most areas, with particular strength in Latin America and the Middle East. We see no change to the pace of activity across international markets and continue to see promising signs in markets such as West Africa and the Eastern Mediterranean...

In North America, the market continues to trend softer on lower oil and gas prices. However, the impact of price volatility in the first-half of the year has largely been limited to the activity of private operators and in gas basins.

Baker is also benefitting from its exposure to LNG FIDs (as a supplier of gas compressors, turbines and other equipment). I talked more about the LNG boom in a recent article:

On the liquefaction side, FIDs have also accelerated. The International Gas Union, an advocacy organization for LNG, now expects global liquefaction capacity to reach 800 MTPA in 2028.

The North America revenue slowness highlighted by the "Big 3" also has to be put in perspective:

| Company | NAM, QoQ | NAM, YoY | Int'l, QoQ | Int'l, YoY |

| SLB | +3% | +14% | +5% | +21% |

| BKR | +5% | +13% | +10% | +23% |

| HAL | -2% | +11% | +7% | +17% |

Source: Company press releases; author's calculations

SLB and Baker were still up sequentially in Q2 in NAM; only Halliburton registered a modest 2% drop. Based on the guidance that Q3 will be slightly down and Q4 will be flat to Q3, we are at worst looking at "moderation" or "flattening." It is not 2020 when everything came to a halt. Furthermore, only HAL has a significant tilt to North America; for SLB and BKR the international growth will more than offset any NAM weakness.

The long-cycle capex spend is robust

As I have written before here, North America means mostly "shale" which is a "short-cycle" play with smaller lag between investment and production. The ability of shale to quickly ramp up or down turned it into the global swing producer for much of 2014-2021, and the shale "threat" curtailed the appetite for long-cycle investments internationally. Even if the oil prices incentivize a project with 5-10 year lead time, how can you be sure the supply response from U.S. shale won't make it uneconomical by the time you're finished?

However, there are many signs that shale is reaching its limits. This makes the international and offshore returns more predictable and increases the chance long-cycle projects will be authorized. Add to this the energy security concerns (particularly natural gas) that resurfaced after the war in Ukraine began and you have the perfect investment environment.

Schlumberger:

In the international markets, the investment momentum of the past few years is accelerating. This is supported by resilient long-cycle developments in Guyana, Brazil, Norway, and Turkey; production capacity expansions in the Middle East, notably in Saudi Arabia, UAE, and Qatar; the return of exploration and appraisal across Africa and the Eastern Mediterranean; and the recognition of gas as a critical fuel source for energy security and the energy transition.

SLB also narrowed down on the Middle East which hadn't done as much before shale's limits started to become apparent:

In the Middle East, this is resulting in record levels of upstream investment. From 2023 to 2025, Saudi Arabia is expected to allocate nearly $100 billion to upstream oil and gas capital expenditure, a 60% increase compared to the previous three years, as they invest to attain a maximum sustained production capacity of 13 million barrels per day by 2027. Several other countries in the region have also announced material increases in capital expenditures that extend beyond 2025.

Halliburton and Baker made similar comments. The long-cycle activity is robust and is looking to deliver production beyond the cyclical worries in the U.S., China and Europe. Even the IEA, which has been beating the "peak oil demand" drum, has now come out with growth projections at least until 2028.

Offshore is the place to be

SLB made some very bullish comments on the offshore sector:

So this momentum is driven by the economics of offshore assets where the FID now – the vast measure of the FID are below $50 and favorably positioned for FID. Also, the geologic and the low carbon nature of most of the assets, accessibility to these resources, and is both oil and gas. So offshore is having a resurgence that is translating into a very significant pipeline of FID, and we see it across not only the IOCs and independents that capturing this opportunity, but also the NOCs that have placed a bet on offshore, as you can see from Brazil to Middle East or the North Sea.

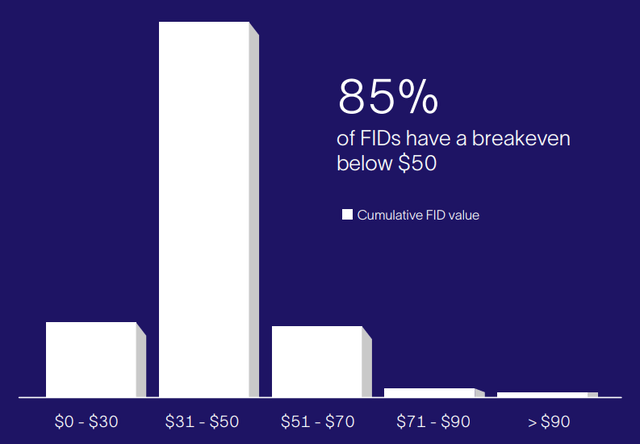

The company believes 85% of the offshore FIDs have a breakeven below $50:

Schlumberger Presentation

This is huge because at $70 oil the smaller and private shale producers seem to be struggling while offshore plays are deep in the money. SLB also spoke of a "second wave" in offshore investment:

We see also the emergence sort of the second leg of FID and future offshore expansion driven by exploration appraisal. Exploration appraisal is happening in many countries. There are many rounds of licensing rounds happening, a lot of exploration and appraisal is happening to find this next reserve and develop. So offshore is there to stay and not only in 2024 or 2025, but beyond as we can see, and with the second leg materializing.

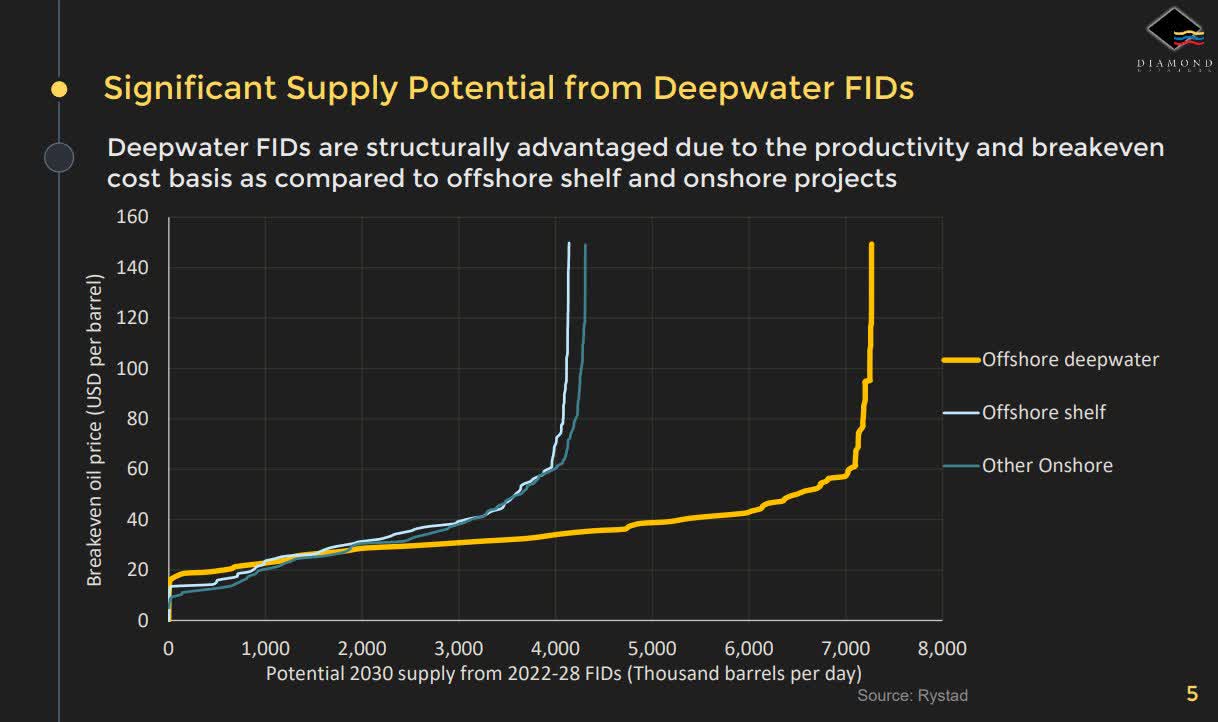

While there are other potential sources of low cost, low decline oil such as Canada (CNQ) or even Venezuela, if the geopolitical issues ever go away, for now it appears offshore is the leader in replacing shale growth:

Diamond Offshore Presentation

The offshore thesis is bolstered by the fixed supply of offshore assets such as drilling rigs or offshore support vessels (or OSVs). Much of the rig and OSV fleet was scrapped during the 2014-2020 downturn and new assets can't be built easily because shipyards are backlogged with LNG carrier orders:

The Energy Realist

This allows the owners of the still functioning assets to extract higher rents. Some stocks I am bullish on in this space include Transocean (RIG), focusing exclusively on deepwater, and Borr Drilling (BORR), a provider of shallow water premium jack-up rigs. Ideas focused on OSVs include Tidewater (TDW) and SEACOR (SMHI).

NOCs are a big driver behind the capex cycle

SLB also highlighted the capex of plans of Middle East NOCs:

Middle East has made a significant commitment of capacity expansion both in oil of 4 million barrels or so and in gas for regional consumption, displacing oil for energy or for generating some blue ammonia or blue hydrogen products as well as further expanding the NG exports in Qatar, particularly. So the Middle East capacity expansion is leading to, as we have been quoting a record level of investment from this year onward, and is not set to again stop in 2024 as the vast majority of this capital expansion are towards the second half of the decade 2027 or 2030 for some of the target.

The reason I'm bringing this up is because NOCs (or national oil companies, such as Saudi Aramco or the UAE's ADNOC) aren't directly investable ideas. Yes, Aramco is listed on the Tadawul, but good luck with that. So as the balance of power shifts back from U.S. shale to the Middle East, the only meaningful way to participate, in my view, is through services.

Don't leave onshore North America for dead either

With all the negativity around NAM onshore services, let's also look longer term past Q2 and Q3. First, as shale matures, it takes more work to get the same output. Halliburton's Jeff Miller:

Service intensity in North America never lets up. In fact, it only gets harder and you can't – you got to – you got to work harder just to stand still. So all of this is constructive for Halliburton's business as I look out into ‘24 and beyond.

Second, premium providers such as HAL have more exposure to larger operators. It is the smaller and private E&Ps that are more likely to cut down on activity:

We really don't see, we don't participate in the bottom part of that market particularly at all, really where that’s the spot type market. Most of our work, I'd say over 70% of our work is with large privates and publics and so – you know these are customers that execute their plans and they do execute their plans.

Third, NAM onshore providers (helped by industry consolidation) aren't giving up on pricing as in 2014-2020. Liberty Energy's (LBRT) Chris Wright made this point clear:

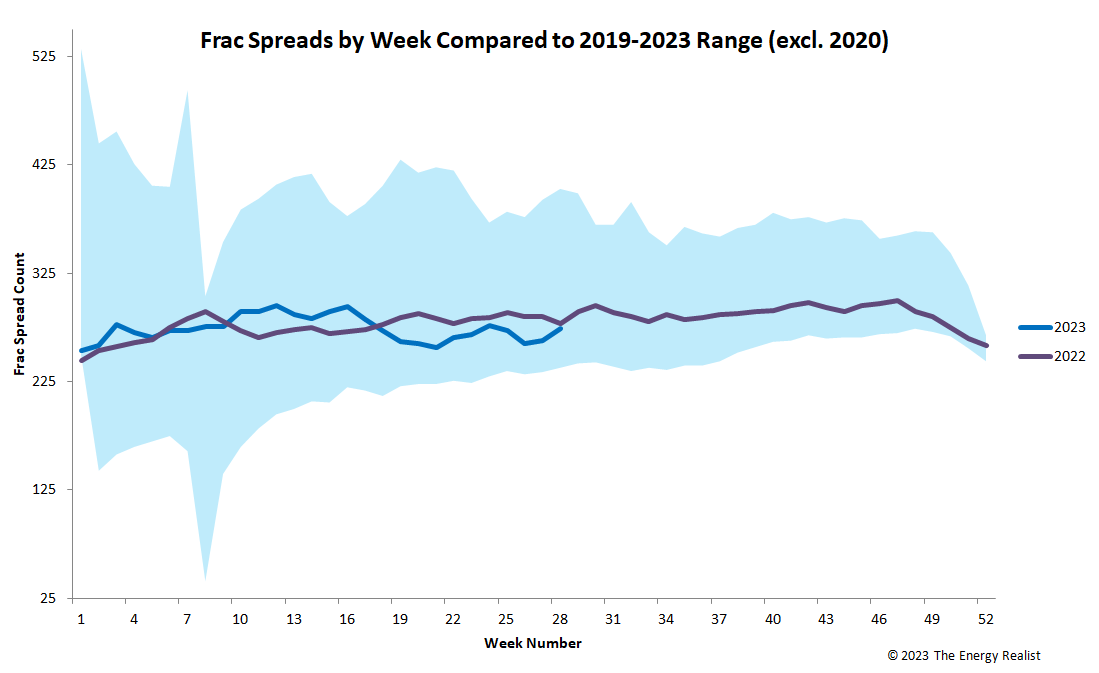

We anticipate North American completions activity will moderate in the second half of the year versus the first half. Service companies are reducing fleets in response, supporting a balanced frac market and largely stable pricing environment. Our internal bottoms-up industry analysis already shows a decline of the industry frac demand for nearly 30 active fleets and the industry has successfully navigated this softer activity.

Liberty is well positioned to navigate these trends. While Liberty may reduce fleets to adjust to lower activity levels should they persist, we do not expect meaningful change in service prices.

U.S. frac fleets actually went up +11 this week although as Chris Wright commented there is a one-quarter lag between rigs and frac fleets:

The Energy Realist

The market action maybe agrees now to some extent, as LBRT's peer group including ProPetro (PUMP) and NexTier (NEX), among others, are all sharply higher since May:

So I will say it again, but this capex cycle indeed appears to be different.

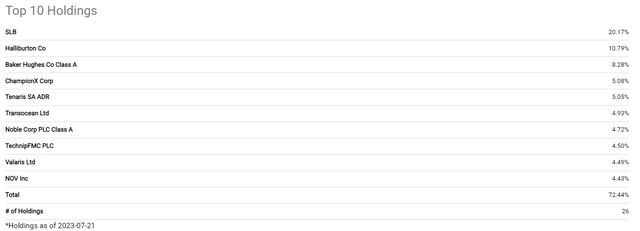

OIH is weighted towards the majors and offshore drillers

The OIH ETF is well positioned to benefit from the oilfield services trends:

Seeking Alpha

The OFS Big 3 form 40% of the ETF. Among the other top holdings, you'll find offshore drillers such as Transocean, Noble (NE) and Valaris (VAL). Pipe and tubular goods suppliers such as Tenaris (TS) also have an international footprint. On balance, I would say OIH is more of an international than North American play and is well-positioned to benefit from the macro trends highlighted above.

Bottom line

While onshore oilfield activity in North America is indeed moderating (low natural gas prices, oil prices not sufficient enough for smaller operators to produce more), the strength in international and offshore more than makes up for it. Opportunity exists even with North America onshore services as valuations declined disproportionately although that was somewhat corrected during the last few weeks. I remain bullish on the OFS sector and believe it is positioned for multi-year outperformance.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BORR, CNQ, LBRT, PUMP, RIG, SLB, TDW, XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)