Phillips 66: Q2 Results To Show, Once Again, Weak Chemicals Margin

Summary

- Phillips 66's upcoming Q2 results (due out Aug. 2) are likely to show continued weakness in its Chemicals Segment.

- The company's long-term strategy to diversify away from its Refining Segment by investing in its Midstream & Chemicals Segments has not delivered the expected mid-cycle returns.

- Despite successful midstream growth investments, mid-cycle Chemicals margins have been extremely disappointing.

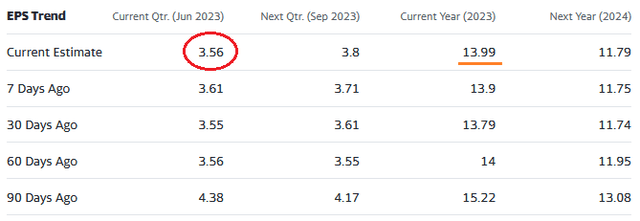

- The good news is that new CEO Mark Lashier is making headway on improving Refining margin: RIN-adjusted market capture in Q1 was 93%, up from 84% in the previous quarter.

George Frey

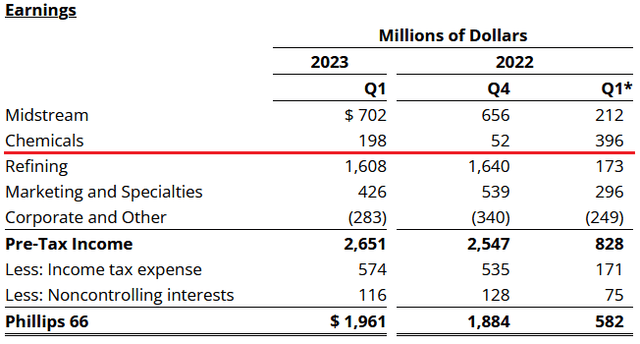

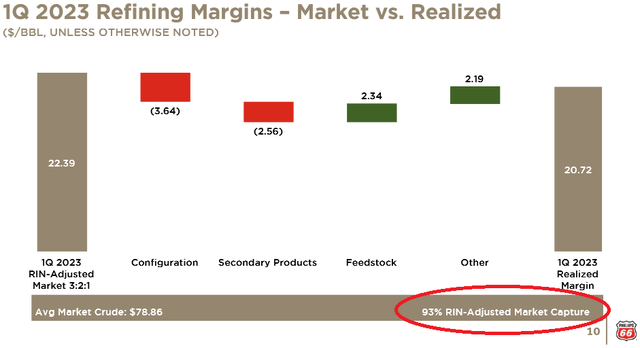

In my last Seeking Alpha article on Phillips 66 (NYSE:PSX), I highlighted the company's significant investments over the past few years to grow its Chemicals Segment - primarily through Chevron Phillips Chemical ("CPChem"), the 50/50 joint venture with Chevron (CVX). However, I also pointed out that FY22 full-year earnings in PSX's Chemical Segment were down nearly $1 billion on a year-over-year basis, as compared to 2021 (see: PSX: Importance Of The Chemicals Segment and the chart below). Unfortunately for PSX shareholders, its upcoming Q2 results (due out on Aug. 2) will likely show, once again, the trend of weak chemicals margins is continuing. Luckily, strength in PSX's Midstream and Refining Segments, and increased contributions from the DCP Midstream acquisition, should make up for weak chemical margins.

Investment Thesis

Years ago, Phillips 66 outlined a long-term strategic plan to diversify away from its Refining Segment by investing heavily to grow its Midstream & Chemicals Segments. The thought process was that the (supposedly…) higher full-cycle margins of its Midstream & Chemicals Segments would result in higher returns and a higher valuation level for PSX as a whole vs. its pure refining peers who would be more tied to the historically quite cyclical refining sector. At the time, and as a long-time PSX shareholder since its spin-off from ConocoPhillips (COP), the strategy appeared to make sense to me given the cyclicality of refining profits I had witnessed over the years.

However, the plan certainly has not worked out as expected. As can be seen in the chart below, PSX's five-year total returns have significantly trailed those of its more refining centric peers Valero (VLO) and Marathon Petroleum Corp (MPC) while the broad market as measured by the Vanguard S&P 500 ETF (VOO) has delivered 4x+ greater returns than PSX did over that time frame:

The reasons for PSX's chronic under-performance are relatively clear: PSX's refining assets continue to underperform its peers on a market-capture basis, and while PSX's Midstream Segment growth investments have arguably been a success, its investments in large-scale chemicals plants have not delivered decent full-cycle margin. In fact, to date PSX's large investments in global petrochemicals projects have delivered extremely poor mid-cycle returns.

Q2 Expectations

Indeed, as can be seen in the chart below, the under-performance of PSX's Chemicals Segment continued in Q1 of this year:

While the Chemicals Segment results in Q1 were an obvious improvement on a sequential basis (Q4 results were unusually weak), results were still ~50% lower on a year-over-year basis.

Chevron reported preliminary Q2 results yesterday, and while the report was generally better than expected, the Downstream Segment (primarily Refining and Chemicals) was weaker than expected and down almost $300 million from Q1. Considering Chevron, like Phillips 66, is a 50% owner in the CPChem JV, this doesn't bode well for PSX, especially given that CPChem is a much larger percentage of EBITDA for PSX as compared to Chevron.

Indeed, analysts are starting to make the same observations I made in my previously referenced Seeking Alpha article wherein I observed:

One thing that would help is if PSX would finish one world-class Chemicals expansion project, and start seeing some good returns on it, before spending more capex building yet another big expansion project. I certainly see no reason whatsoever to build two world-class pet chem projects at the same time. That "strategy" seems to be baking in terrible short-term margins after start-up due to overcapacity.

The reference to two world-class pet-chem plants was in reference to PSX's announcement that its share of spending on the new U.S. Gulf Coast II and Ras Laffan pet chem projects would be an estimated $3 billion.

Yesterday, Yahoo Finance published a Bloomberg article titled Big Oil's Weak Chemical Margins Add To Pain Of Cheaper Crude. Like my Seeking Alpha article back in May, this article points out that "a flood of new factories in the US and China, means margins face a potentially protracted downturn" and:

Some 49.5 million tons of new ethylene capacity has or will come online globally from 2020 to 2024, outstripping projected demand by 55%, according to S&P Global. More than half is coming from China, which wants to reduce imports of chemicals key to its manufacturing industry, the world's biggest.

At least a dozen giant new facilities are being built or are due to start construction over the next four years, with an additional 9.5 million tons coming online from 2025 to 2030. Three new plants in the US and Canada will increase North American polyethylene production by 13% this year alone, according to ICIS.

Yet demand is failing to keep up. As higher interest rates take their toll, global economic growth (and chemicals demand) is weakening. Meantime, a weaker-than-expected Chinese recovery is weighing on the sector. So too is lower demand for disposable masks and medical equipment related to COVID-19. As a result, chemical companies like FMC Corp. (FMC), Ashland (ASH), and Olin Corp. (OLN) have all warned of substantially lower earnings for the remainder of the year.

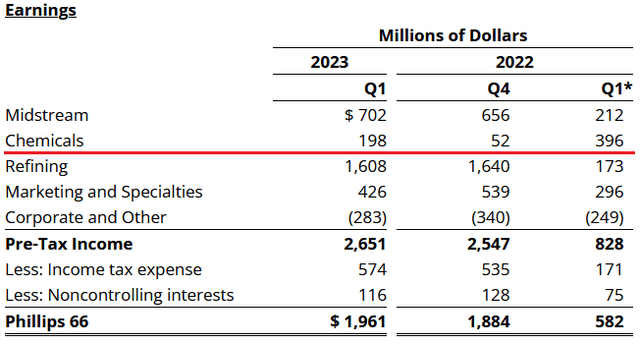

This is likely a primary reason that PSX's consensus Q2 earnings estimates, per Yahoo Finance, have declined by nearly 19% over the past month:

The Good News

The good news for PSX shareholders is that the recent rise in the price of oil is good for its LPG export pricing as well as its fractionation capacity and its recent increased purchases of DCP Midstream public stock - which is supposed to be completed by the end of this month. Enbridge (ENB) will still own a 13.2% interest in DCP, which - at some point in the near future - I fully expect PSX to buyout. Meantime, PSX's increased economic interest in DCP should help yoy EPS comparisons.

Meantime, new President and CEO Mark Lashier is trying to make his mark on the company by finally and meaningfully addressing PSX's chronic and long-term under-performance in its still dominant Refining Segment (see How Phillips 66's New CEO Plans To Boost Shareholder Returns). That's something previous CEO Greg Garland discussed for years, but - in my opinion - never seemed to achieve much (if any) long-term improvement in the segment. However, there are already indications that PSX's market-capture under Lashier is starting to significantly improve. The slide below from PSX's Q1 presentation shows that PSX's market RIN-adjusted market capture in Q1 was 93% (up from 84% in the previous quarter):

Meantime, I continue to expect PSX's Midstream Segment to continue its strong performance - led by LPG exports and rising volumes from Frac-4 (which went online in Q4) and increased contributions from DCP.

Valuation

The following chart compares PSX's TTM P/E (per Yahoo Finance), forward P/E (per Seeking Alpha), and yield with that of peers VLO and MPC:

| TTM P/E | Forward P/E | Yield | |

| PSX | 4.1x | 7.5x | 4.10% |

| VLO | 3.6x | 5.7x | 3.32% |

| MPC | 3.9x | 6.7x | 2.38% |

As you can see, PSX trades at a valuation premium to both VLO and MPC. Part of that is due to its higher yield, but the other part is likely due to investors assuming (hoping?) that CEO Lashier will continue to deliver on his promise to increase PSX's overall returns and that the expected EBITDA growth from the DCP acquisition will actually come to fruition.

Risks

With the massive build-out of global petchem capacity by companies like Exxon Mobil, CPChem, and state actors in China and the Middle East, PSX's allocation of another estimated $3 billion in capital to two more new world-class petchem projects will likely put pressure on PSX's returns for another couple of years, continuing the company's chronic under-performance against its peers. My opinion is that PSX would have been much better off allocating that petchem targeted capital to wind, solar, and battery backup projects instead - all of which typically deliver midstream like 8%-12% annual returns, which would have been much (much) better than what PSX's mid-cycle Chemicals Segment has been delivering over the past five years. It also would help reduce PSX's risks when it comes to the EV and clean-energy transition, which is accelerating. The 50,000 bpd "Rodeo Renewed" project - arguably PSX's only "green" project - is a drop in the bucket as compared to PSX's entire portfolio of fossil fuels and chemicals capacity.

Summary and Conclusion

Despite the challenges of a weak chemicals outlook, PSX is on track to deliver close to an estimated $14/share in earnings this year. That bodes well for shareholders considering the current dividend is only $4.20. However, investors will be watching two things very closely: Continued improvement in PSX's Refining Segment and if the DCP acquisition will actually deliver the expected increase in incremental adjusted EBITDA (PSX management says it will be an estimated $1 billion).

I rate PSX a HOLD based on recent strengthening crude price, the attractive 4.1% yield, and the prospects for excellent dividend growth given the company's earnings profile.

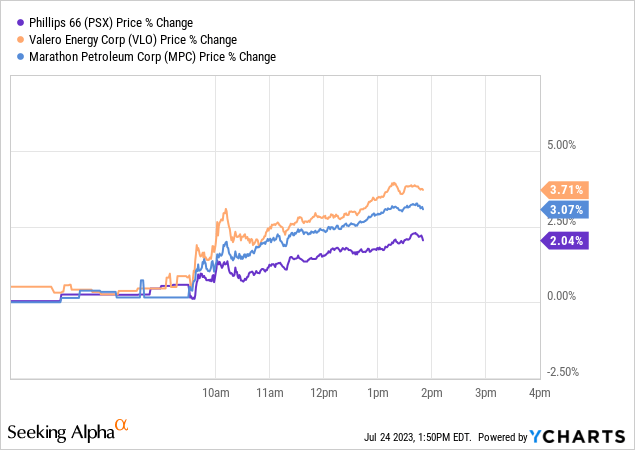

I'll end with a daily stock chart comparison of the three refiners mentioned in this article and as a result of Chevron's preliminary results release and a rise in oil prices today:

Obviously, one day of trading does not make a market, but once again we see VLO and MPC significantly outperforming PSX.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PSX, VOO, ENB, COP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)

2022: $4.20 (estimated)Maybe if mgt tried a lil 420 they'd stop blowing so much shareholder capital on large-scale global petchem plants. Note that despite all the money mgt has plowed into growing the chemicals segment over the past 5-years, adjusted EBITDA last year was only $1.4 billion, actually less than it was in 2019: $1.5 billion. Any way you look at that, it is a pitiful return. As I mentioned in the piece, PSX would have been better off pouring that money into wind, solar, and battery backup and at least achieving decent midstream like returns. I fear the $3 billion PSX has already committed to spend on the two new CPChem plants will be more of the same. Bottom line: shareholders pay the CEO and executive mgt team a ton of money to manage shareholder capital, and PSX has arguably dropped the ball (big time) on its massive spending on growing chemicals. I guess it's all about growing PSX's volumes to make the executive bonus plans payout more (whether or not that actually achieves strong total returns for ordinary shareholders ...or, in this case, not). I am surprised more PSX (and Chevron ... and Exxon ...) shareholders don't object to this. At least Engine #1 got Exxon to slow down their massive cap-ex overspend on such projects. I guess that is some progress. Very surprised PSX and Chevron have not done likewise.