Curis: A Speculative Microcap Worth A Second Look

Summary

- Curis, a microcap biotech company, is focusing on the development of cancer drugs, currently supporting six drug trials with a burn rate of over $30 million per year.

- Despite a recent direct offering adding $15.1 million to its balance sheet and a lowered quarterly cash burn, the company's stock price has significantly declined due to toxicity concerns of their lead drug in 2021.

- Curis' pipeline includes three drugs focused on Heme Malignancies and three on Immune Checkpoint Inhibitors, with updates on their two primary programs expected in 2024.

Thicha Satapitanon/iStock via Getty Images

Curis (NASDAQ:CRIS) is a microcap biotech company that focuses on the discovery and development of cancer drugs. With only one approved drug, Erivedge®, the company is currently burning through over 30 million a year supporting six drug trials in the clinical stages.

These small biotech companies are very boom or bust. Good results from a trial drug could cause huge gains and bad results could cause substantial losses. It is important to avoid hyped up biotech companies and only buy companies with a good risk reward profile. Curis is currently priced as if the worst has already happened but that doesn't mean it can't go lower.

Balance Sheet

A recent direct offering written about here added 15.1 million dollars to its balance sheet. As a biotech swing trader, I have learned that buying after a company raises funds is typically better than buying before a company raises funds and a direct offering is way better than an at the market offering.

Since Curis already had around $70 million in cash before the offering, the additional money means that Curis has enough cash on hand for at least a year. Curis' CFO Diantha Duvall claimed that current cash should last into 2025 and that was before the direct offering, "We continue to be in a strong cash position and expect that our existing cash, cash equivalents and investments should enable us to maintain our planned operations into '25."

Curis has also lowered its quarterly cash burn due to a lower headcount at the company. It seems that Curis is focused on using all of their cash on developing their current drugs.

Current Sentiment

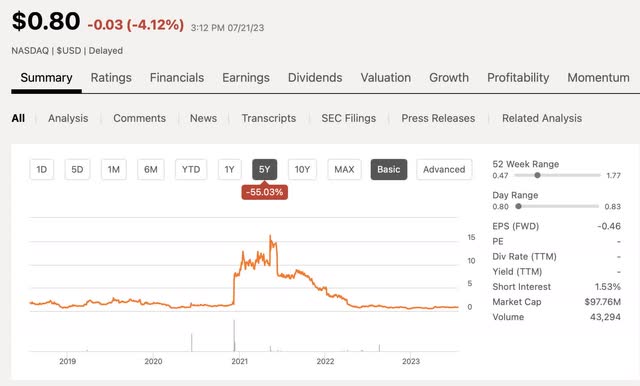

Curis is a relatively unknown company with only 11k followers on Seeking Alpha. Since June 2021, Curis' stock price has collapsed from $14 down to a current price of $0.80.Toxicity concerns of their lead drug in 2021 led to the massive destruction of shareholder value. With a current market cap of less than $100 million, Curis presents the potential for outstanding gains on any good news and the potential to drop all the way to zero if their drugs fail.

Curis 5 Year Chart (Seeking Alpha)

Curis has seemingly little going for it and almost no buzz when compared to 2021. Yet that is exactly what creates the opportunity. I imagine the people that bought the 2021 hype in Curis are regretting their decision. Maybe there are still some bag holders hoping for the miracle turnaround just to break even.

I feel for these buyers but their hopelessness is what presents the opportunity. These factors contribute to Curis having a very negative current sentiment. For those that prefer to buy low and sell high, this is good news. For those that follow the herd, Curis just won't cut it.

The Pipeline

Curis' current pipeline is broken down into two categories. Three drugs in clinical stages focused on Heme Malignancies, and three drugs focused on Immune Checkpoint Inhibitors. This combined with their Basal Carcinoma drug, Erivedge®, provides all of the potential upside for Curis.

Curis' Pipeline (Curis Website)

Curis' current pipeline is broken down into two categories. Three drugs in clinical stages focused on Heme Malignancies, and three drugs focused on Immune Checkpoint Inhibitors. This combined with their Basal Carcinoma drug, Erivedge®, provides all of the potential upside for Curis.

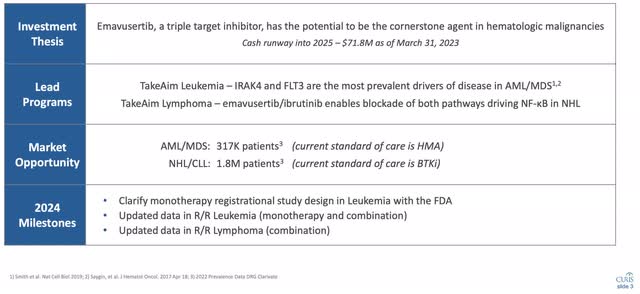

Recently, the "FDA removed the partial clinical hold placed on the company's Phase 1/2 TakeAim Leukemia trial for lead candidate emavusertib" which you can read about here. This development was positive news for Curis but made no impression on the stock price.

Investor Presentation Slide 3 (Curis)

2024 will provide updates on their two primary programs both as monotherapies and combination therapies.

Royalty Payments from Erivedge

According to Curis' Website, the collaborative agreement between Curis and Genentech in June 2003 granted Genentech a secured an exclusive global license, with the right to sublicense, for the development and commercialization of small molecule and antibody Hedgehog pathway inhibitors, specifically for human therapeutic applications, including cancer therapy. Roche was granted a sublicense by Genentech for non-U.S. rights to Erivedge®.

Genentech and Roche are primarily responsible for the worldwide clinical development, regulatory affairs, formulation, manufacturing, supply, and sales and marketing of Erivedge®. Curis stands to receive up to $115 million in contingent cash payments for the development of Erivedge® or another small molecule, subject to the successful achievement of specified clinical development and regulatory milestones by Genentech and Roche, of which Curis has already received $59 million to date. Additionally, Curis is entitled to receive royalties on the sales of Erivedge® and any Hedgehog pathway inhibitor products successfully commercialized by Genentech and Roche.

In March 2019, Curis entered an agreement with Oberland Capital Management, selling a portion of its rights to future royalty payments related to Erivedge®. In exchange, Curis received $65.0 million as upfront consideration for the purchase of these royalty rights. Furthermore, Curis remains eligible to receive up to approximately $70.7 million in milestone payments based on the sales of Erivedge®.

Hematological Malignancies Market and Competition

Based on the latest market research, the global hematological malignancies drugs market was valued at US$ 13.76 Billion in 2021, and it is projected to surge to US$ 42.78 Billion by 2030, indicating an impressive CAGR of 13.7% throughout the forecast period from 2022 to 2030.

Curis is not alone in this space, and faces heavy competition in the fast-evolving landscape of hematological malignancies drugs, pharmaceutical giants like Novartis (NVS), Sanofi (SNY), and GlaxoSmithKline plc have gained significant ground with their recent FDA approvals for treatments targeting chronic myeloid leukemia, multiple myeloma, and B-cell non-Hodgkin's lymphoma. Novartis' Scemblix, Sanofi SA's Sarclisa, and GlaxoSmithKline's BLENREP have all made notable strides in the market, intensifying the competition. Additionally, AbbVie (ABBV) and Genmab A/S's investigational therapy epcoritamab is showing promise in treating relapsed/refractory B-NHL, adding to the competitive dynamics in this rapidly expanding space. As the demand for more effective and innovative treatments rises, the race to dominate the hematological malignancies drugs market is becoming fiercer, with each company vying to make a significant impact and gain a larger share of this lucrative market.

Immune Checkpoint Inhibitors Market and Competition

In 2021, the global immune checkpoint inhibitors market reached a substantial value of USD 31.4 billion, and it is anticipated to soar to approximately USD 148.1 billion by 2030, showcasing an impressive CAGR of 18.81% during the forecast period from 2022 to 2030.

The market for immune checkpoint inhibitors is also witnessing intense competition as major players vie for prominence. Companies like AbbVie Inc. (ABBV), Amgen Inc. (AMGN), Bristol Myers Squibb Company (BMY), F. Hoffmann-La Roche Ltd., Gilead Sciences (GILD), Inc., GlaxoSmithKline plc, Immune-Onc Therapeutics, Inc., Johnson & Johnson Services (JNJ), Inc., Merck & Co. (MRK), Inc., Novartis International AG, Pfizer Inc. (NVS), Sanofi S.A. (SNY), Takeda Pharmaceutical Company Limited (TAK), and several others are leading the charge in this high-stakes arena.

Curis is a small company compared to many of these giants however any positive readouts in their data would make them an immediate target for acquisition and substantially increase their market value.

With groundbreaking advancements and innovative therapies, industry giants are investing heavily in research and development to gain a competitive edge. As the demand for immune checkpoint inhibitors continues to rise, companies are actively seeking to expand their product portfolios and explore novel therapeutic approaches to meet the growing needs of patients worldwide.

Moreover, strategic collaborations, mergers, and acquisitions are on the rise as companies seek to bolster their market position and harness the potential of synergies. The race to develop more effective and targeted immune checkpoint inhibitors has intensified, with each player aiming to establish a stronghold in this rapidly evolving market. This could all benefit Curis but only if Curis is able to deliver positive news.

While the competition is fierce, this environment fosters a spirit of innovation, driving companies to push boundaries and accelerate scientific breakthroughs. As they compete to unlock the full potential of immune checkpoint inhibitors, patients stand to benefit from an array of cutting-edge therapies that hold the promise of transforming the landscape of cancer treatment.

Risks and Concerns

Investing in Curis comes with several significant risk factors that investors should carefully consider. As a biotech company, Curis' success hinges on the outcomes of its ongoing clinical trials. Any failure of key drug candidates to meet endpoints or gain regulatory approval could severely impact the company's financial prospects and stock performance. Moreover, the biotech industry is fiercely competitive, and Curis faces challenges from established pharmaceutical giants and emerging biotech firms with more resources and commercialization experience.

The company's heavy reliance on partnered programs with Genentech and Roche for the development of Erivedge® adds another layer of risk, as any delays or changes to these collaborations could affect revenue generation. Furthermore, the industry's cash burn nature may necessitate additional fundraising through equity offerings or debt, diluting existing shareholders' ownership. Regulatory and reimbursement challenges, intellectual property risks, and market volatility also add to the complexity of investing in Curis. With limited product diversification and the inherent risks associated with clinical development, potential investors should carefully assess their risk tolerance and conduct thorough research before considering an investment in Curis.

Conclusion

Curis presents a compelling yet challenging opportunity for investors in the dynamic biotech landscape. As a micro-cap biotech company, it focuses on the development of cancer drugs, which inherently comes with significant risks and potential rewards. With limited approved drugs and a history of stock price volatility, investing in Curis requires careful consideration and a good risk-reward profile.

Recent developments, such as the direct offering that strengthened their balance sheet and the FDA removing the partial clinical hold on their Phase 1/2 TakeAim Leukemia trial, offer glimmers of hope for the company's future. Curis' focus on developing its current drugs and its lowered quarterly cash burn show a commitment to its pipeline, which is divided into Heme Malignancies and Immune Checkpoint Inhibitors.

While Curis currently faces negative sentiment and has seen a significant decline in stock price, it is precisely this lack of buzz that creates an intriguing opportunity for value investors. The potential upside, especially with updates on primary programs scheduled for 2024, could result in outstanding gains for those willing to take a calculated risk.

In 2020-2021, Curis' share value exploded from $1.20 to over $14 only to fall to its current level of $.80. Any positive news will likely see Curis rise to at least $7 and negative outcomes will cause it to drop closer to zero. In many ways Curis is priced like an option for good reason. The most you can lose is $.80 and the upside is between $7-$14. We consider this an acceptable risk reward for a speculative position.

Although Curis is acceptable as a speculative investment in a well-diversified portfolio, no one should be going all in on these types of investments. Using a disciplined approach and calculating the risk and reward of all positions in your portfolio is extremely important. Appropriate caution, diversification and small position sizing is a must when buying highly speculative micro-cap positions.

As always, investors must approach Curis with caution and conduct thorough research before making any investment decisions. While the road ahead may be uncertain, the potential rewards make Curis a captivating prospect for those looking to explore the biotech sector and uncover hidden gems in the market.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)