Boot Barn Holdings: Shares Have Run Their Course

Summary

- Boot Barn Holdings, a US retailer of western and work-related footwear, apparel, and accessories, has seen significant share price growth over the past few months due to strong fundamental data.

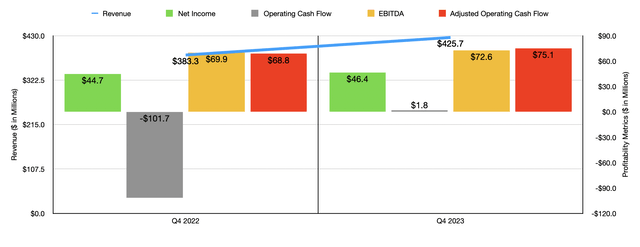

- Despite a 5.5% decline in comparable store sales, the company's revenue increased by 11.1% to $425.7 million in the final quarter of 2023, largely due to the opening of 45 new stores.

- Despite this success, I suggest investors should be more cautious moving forward, and I am downgrading the company from a 'buy' to a 'hold'.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

xavierarnau/E+ via Getty Images

As a rule of thumb, when you make an investment decision, you should expect to be prepared for the long haul. It is extraordinarily rare that an opportunity pays off quickly. So you should not expect it to at any time. But every so often, you will get lucky and a prospect that you expected to take a while to pay off will do so in a rather short window of time. One great example that I could point to in this regard involves a company called Boot Barn Holdings (NYSE:BOOT). For those who may not be familiar, the company provides customers with western and work-related footwear, apparel, and accessories through the retail establishments that it has located across the US. Even though this may not sound exciting, shares of the company have experienced a significant upside over the past couple of months. This has been courtesy of the strong fundamental data provided by management. Fast forward to today, however, and I would say that investors would not be wrong for taking a more cautious approach moving forward.

Great results over a short period of time

In early March of this year, I wrote an article discussing the investment worthiness of Boot Barn. In that article, I talked about how rising sales were instrumental in pushing the company's stock price up rather significantly in prior months. Even in spite of bottom line pressures, market participants came to view the company in a very promising light. From the time I had previously written about the company in the middle of December of last year through my March article, shares had risen 36.7% compared to the 3.9% seen by the S&P 500. Even with that upside, however, I felt as though additional potential still existed. This led me to keep the company rated a 'buy'. So far, that decision has played out remarkably well. While the S&P 500 has jumped another 13.5%, shares of Boot Barn have outperformed that, jumping 21%. This translates to an upside of 64.8% since I first rated the company a 'buy' last year compared to the 18.7% return the S&P 500 enjoyed.

This tremendous upside was driven in part by attractive sales growth. To see what I mean, we need only look at data covering the final quarter of the company's 2023 fiscal year. This is the most recent quarter for which data is available. According to management, revenue for this time totaled $425.7 million. That's 11.1% above the $383.3 million generated one year earlier. This increase was in spite of a 5.5% decline in comparable store sales, with retail same store sales dropping 3.3% while e-commerce same store sales plummeted 18.4%. The upside for shareholders, then, was largely associated with two things. For starters, the company did have an extra week of operating results in the final quarter of 2023 compared to the same time last year. And second, management has been very active in opening up new locations. During its 2023 fiscal year alone, the business opened 45 new stores, bringing its total store count to 345.

The improvement on the company's top line brought with it a slight improvement on its bottom line. During the final quarter of 2023, net income came in at $46.4 million. That was up marginally compared to the $44.7 million reported the same time one year earlier. Operating cash flow shot up from -$101.7 million to $1.8 million. If we adjust for changes in working capital, however, the increase would have been far more modest from $68.8 million to $75.1 million. Meanwhile, EBITDA for the company grew from $69.9 million to $72.6 million.

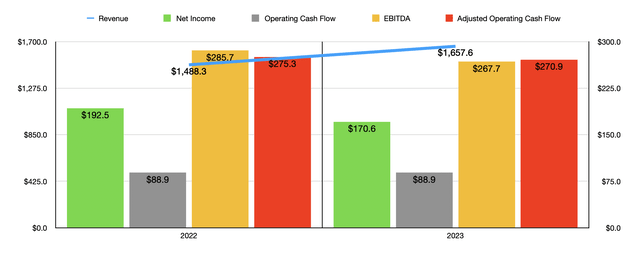

Some of the optimism centered around the company recently likely stems from the fact that the final quarter of last year was, in some ways, different than the 2023 fiscal year in its entirety. As you can see in the chart above, revenue for the year as a whole did increase. But with the exception of operating cash flow, which remained unchanged year over year, all of the company's profitability metrics dropped relative to what they were in 2022. Given broader economic concerns centered around inflation and rising interest rates, none of this is a surprise to me.

The good news is that management actually believes that revenue will continue to climb this year. Overall sales should come in between $1.69 billion and $1.72 billion. This is growth of between 2% and 4%. Unfortunately, it's not the kind of growth we would love to see. I prefer to see growth as a result of stronger same store sales. That's because such improvements usually bring with them margin expansion. But overall same store sales for the year should actually drop by between 4.5% and 6.5%. This will only be offset by the addition of 52 additional stores to the company's network.

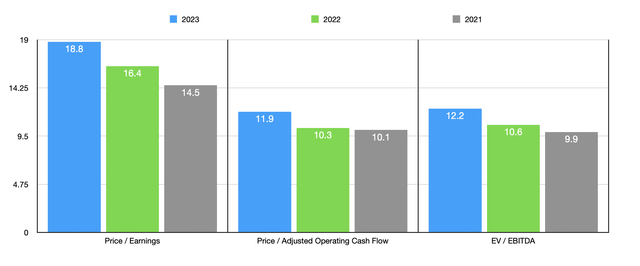

When same store sales drop, profitability also tends to suffer to some extent. And that's what we should see for the 2024 fiscal year as well. At present, analysts believe that net profits for the company will come in at between $143.8 million and $153 million. If we assume that other profitability metrics will follow a similar trajectory, we would get adjusted operating cash flow this year of $235.6 million and EBITDA totaling $232.9 million. In the chart above, you can see how shares are priced using these estimates, as well as how they are priced using results from both 2021 and 2022. Shares don't look great from a valuation perspective. But they don't look awful either. Meanwhile, in the table below, you can see how the stock is priced relative to five similar firms. On a price to earnings basis, only two of the companies ended up being cheaper than Boot Barn. When it comes to the price to operating cash flow approach, four of the companies ended up being cheaper than our target. And using the EV to EBITDA approach, I found that our prospect was the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Boot Barn Holdings | 16.4 | 10.3 | 10.6 |

| The Buckle (BKE) | 7.2 | 6.8 | 4.6 |

| Guess? (GES) | 10.4 | 6.0 | 5.7 |

| Abercrombie & Fitch (ANF) | 51.5 | 8.8 | 6.0 |

| Urban Outfitters (URBN) | 17.7 | 12.5 | 8.2 |

| American Eagle Outfitters (AEO) | 23.5 | 4.9 | 5.5 |

Takeaway

The way I see it, Boot Barn is doing just fine for itself. It is true that we might experience some margin compression throughout the current fiscal year. But that's not a shocker. All in all, shares are priced reasonably well. But they definitely aren't on the cheap side of the spectrum on a forward basis. On top of this, I found that other companies are cheaper than it is. Given these factors, I do believe that downgrading the company from a 'buy' to a 'hold' is only appropriate at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.