Martin Midstream Partners Q2 Earnings: Assessing The Timeline For An Increased Distribution

Summary

- Martin delivered decent results in the first half of 2023.

- It appears capable of reducing debt by $45 million to $50 million in 2023, helped by selling off its butane inventory.

- Distribution may not be increased for a while though, if it decides to prioritize debt reduction.

- With its current distribution, I'd expect Martin to reduce its leverage to 3.7x to 3.8x by the end of 2024.

- This would allow for an increased distribution in 2025.

- Looking for more investing ideas like this one? Get them exclusively at Distressed Value Investing. Learn More »

Chun han/E+ via Getty Images

Martin Midstream Partners (NASDAQ:MMLP) reported decent results in the first half of 2023 and may be able to reduce its debt by $45 million to $50 million (with the aid of its exit from its butane optimization business) in 2023.

I am assuming that Martin will not significantly increase its distribution until 2025 though, as that would allow it to pay its debt down quicker and end up at around 3.7x to 3.8x leverage by the end of 2024.

After that point, Martin may be able to offer a quarterly distribution of $0.10+ per unit while continuing its debt reduction efforts. An increased distribution is likely necessary for Martin's units to appreciate significantly as it is currently hampered by offering a yield of less than 1%.

My expectation for Martin to take a more conservative approach to increasing its distribution pushes my timeline for its units to be potentially worth $5 to $6 into 2025.

1H 2023 Results

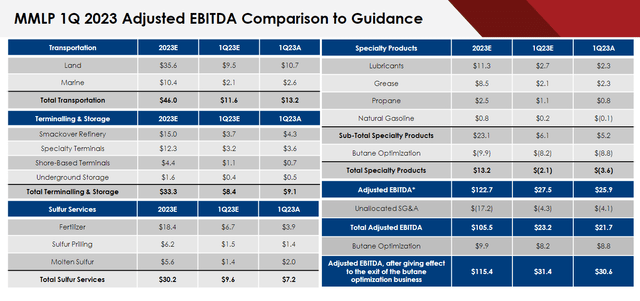

Martin reported adjusted EBITDA of $30.6 million in Q1 2023, after giving effect to its exit of the butane optimization business. This was largely in-line with its guidance, which called for slightly higher $31.4 million adjusted EBITDA during the quarter.

Martin's Q1 2023 Results (mmlp.com)

Martin's transportation business exceeded expectations during the Q1 2023, although this was counterbalanced by weaker agriculture related results in its fertilizer business.

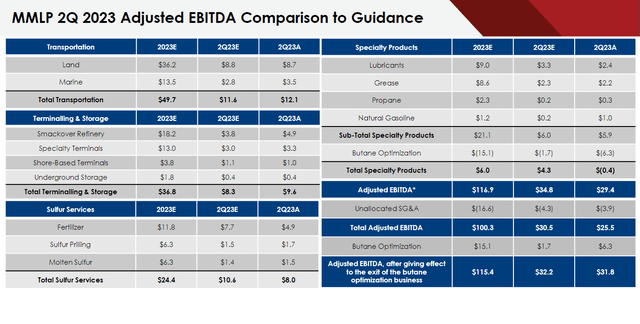

Martin then reported $31.8 million in adjusted EBITDA in Q2 2023, also after giving effect to its exit from its butane optimization business. This compared to Martin's guidance for $32.2 million in adjusted EBITDA for Q2 2023.

Martin's Q2 2023 Results (mmlp.com)

In Q2 2023, Martin's terminalling and storage business performed relatively well versus expectations, while its agriculture related businesses continued to face some challenges.

Martin noted that the strong performance of its terminalling segment was driven by reduced operating costs, primarily related to lower than forecasted natural gas costs (as natural gas prices were particularly weak in Q2 2023) at its Smackover refinery.

Potential 2023 Results

Martin currently continues to expect full year adjusted EBITDA of $115.4 million for 2023, after giving effect to the exit of the butane optimization business. It has also allocated $17.5 million in growth capex (including $12.5 million to $13.5 million for its electronic level sulfuric acid joint venture) and $26.6 million to maintenance capex.

Including the proceeds from liquidating its butane inventory, Martin provided guidance for approximately $55 million in debt reduction for 2023. I am more conservatively using $45 million to $50 million as my 2023 debt reduction number for Martin currently. This is slightly lower than Martin's original expectations due to the declining butane prices as Martin was liquidating its inventory, along with its potential to end up slightly below guidance for 2023 adjusted EBITDA.

Martin had $516 million in debt at the end of 2022, so this debt reduction would leave it with $466 million to $471 million in debt at the 2023. This would be leverage of approximately 4.2x, and is based on more typical working capital levels (which Martin estimates at $45 million to $50 million in working capital).

Going Forward

After the electronic level sulfuric acid facility starts up (expected in early 2024), Martin may be able to generate approximately $120 million in adjusted EBITDA during a typical year. It expects to start receiving distributions from its electronic level sulfuric acid facility joint venture in 2H 2024.

Martin has a high amount of interest costs, including $46 million in annual interest for its $400 million in 11.5% second-lien notes due 2028. Total interest costs may be around $50 million for 2024. It also should have around $30 million to $35 million in combined maintenance and growth capex, in a typical year without any major new projects.

Thus I'd expect Martin to end up with around $37 million per year in free cash flow in a typical year. This may be slightly lower in 2024 since it appears to have approximately $7 million in growth capex remaining in 2024 for its electronic level sulfuric acid facility project, along with only half a year of distributions.

If Martin's overall performance is average in 2024, it may end 2024 with approximately $440 million in debt, or leverage of 3.7x to 3.8x.

Distributions

Martin theoretically should be allowed (under the terms of its credit facility agreement) to increase its quarterly distribution above $0.005 per unit by early 2024. I believe that Martin is more likely to keep its quarterly distribution at $0.005 per unit for longer to help facilitate continued debt reduction though.

By early 2025, Martin should be able to increase its distribution, although I'd expect it to still keep its payout ratio low enough to continue reducing its debt. A $0.10 per unit quarterly distribution would allow Martin to put over $20 million per year towards debt reduction, assuming it generates around $120 million in adjusted EBITDA.

Estimated Valuation

I've reduced Martin's valuation multiple to 5.5x EBITDA to account for its selloff of its butane inventory. At $120 million per year in adjusted EBITDA and its projected 2024 year-end $440 million in debt, this could make Martin would an estimated $5.70 per unit by that point in time.

To be able to get near that unit price, Martin will likely need to increase its distribution to at least $0.10 per quarter though. There isn't much investor interest for an MLP that provides a yield of under 1%.

Conclusion

Martin Midstream's 1H 2023 results were decent and it appears to be on track (with the help of selling off its butane inventory) to reduce its debt by $45 million to $50 million in 2023.

Martin's distribution remains minimal, and I am currently modeling that it doesn't increase its distribution until 2025. By that time, Martin's leverage may be under 3.8x and it could then offer a quarterly distribution of $0.10 per unit while allowing for enough continued debt paydown to reduce its leverage to around 3.1x to 3.2x by the time its 2028 notes mature.

The resumption of a meaningful distribution is probably necessary for Martin's unit price to recover back to mid-2019 levels though.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

This article was written by

Elephant Analytics has also achieved a top 50 score on the Bloomberg Aptitude Test measuring financial aptitude (out of nearly 200,000 test takers). He has also achieved a score (153) in the 99.98th percentile on the WAIS-III IQ test and has led multiple teams that have won awards during business and strategy competitions involving numerical analysis. In one such competition, he captained his team to become North American champions, finishing ahead of top Ivy League MBA teams, and represented North America in the Paris finals.

Elephant Analytics co-founded a company that was selected as one of 20 companies to participate in an start-up incubator program that spawned several companies with $100+ million valuations (Lyft, Life360, Wildfire). He also co-founded a mobile gaming company and designed the in-game economic models for two mobile apps (Absolute Bingo and Bingo Abradoodle) with over 30 million in combined installs.

Legal Disclaimer: Elephant Analytics' reports, premium research service and other writings are personal opinions only and should not be considered as investment advice. Only registered investment advisors can provide personalized investment advice. While Elephant Analytics attempts to provide reports that include accurate facts, investors should do their own diligence and fact checking prior to making their own decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.