Eldorado Gold: A Stronger H2 On Deck

Summary

- Eldorado Gold is set to report solid Q2 results, benefiting from a weaker Turkish Lira, and a stronger gold price.

- And despite recent ~9% share dilution for Skouries financing, Eldorado Gold remains reasonably valued and is expected to transform into a low-cost producer post 2025.

- That said, although EGO will see healthy margin expansion in Q2 (YoY basis) and FY2023, I don't see enough margin of safety here with the stock trading at US$11.00.

Juan Jose Napuri

The Q2 Earnings Season for the Gold Miners Index (GDX) has finally begun, and it's been a tepid start to earnings season with Newmont (NEM) a miss on sales and earnings, affected by lower production at some of its higher margin assets, a slow start to the year from NGM (38.5%) and PV (40%), and a strike at one of its key mines: Penasquito. Fortunately, Eldorado Gold (NYSE:EGO) which reports next week, should help balance some of this negative sentiment in the sector after the rough start to Q2, benefiting from a weaker Turkish Lira, continued softness in oil prices, and a higher average realized gold price. And while Q2 may only see a minor step up in production vs. Q1 2023 levels, we should see a much stronger H2 on deck. Let's take a look at its Q2 outlook, recent developments, and Eldorado Gold's valuation after its outperformance over the past year:

Kisladag Gold Pour (Company Website)

All figures are in United States Dollars unless otherwise noted.

Q2 Outlook

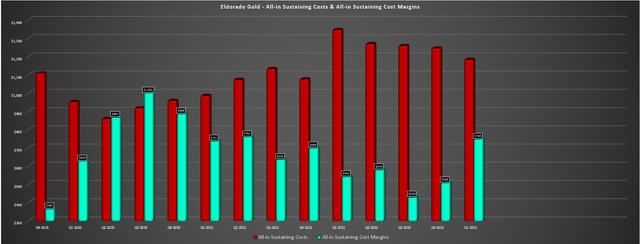

Eldorado Gold will report its Q2 results on July 27th after the market close, with consensus estimates sitting at $0.08 in quarterly earnings per share and revenue of ~$264 million. Over the past four quarters, Eldorado has reported two beats and two misses on earnings, but the company's two most recent earnings reports showed significant beats, and a healthy beat on revenue as well in Q1 2023 (~$229.4 million vs. ~$226.0 million estimates). Digging into the company's Q2 2023 production and cost outlook, the company is benefiting from lapping relatively easy year-over-year comps with ~113,500 ounces produced at $1,270/oz all-in sustaining costs [AISC] in the year-ago period, with an average realized gold price of $1,849/oz. And assuming a moderate step up in production in Q2 vs. Q1 with what should be a stronger Q2 from Kisladag, we should see a significant improvement in AISC margins vs. Q2 2022 levels.

US Dollar vs. Turkish Lira (XE.com)

Looking at Q2 2022 figures, Eldorado reported AISC margins of $579/oz, a significant step down from $766/oz in Q2 2021 because of the impact from inflationary pressures and minimal help from the gold price. And while we haven't much of a pullback regarding inflation, even if costs are stabilizing (according to other producers), Eldorado is benefiting from two key tailwinds in Q2: a weaker Turkish Lira and a higher average gold price. The former will benefit the company's Efemcukuru and Kisladag mines in Turkiye, while the latter will benefit its overall sales, with Eldorado likely to report an average realized gold price of $1,950/oz or higher, in line with the producer average on those that pre-reported or have already reported their Q2 results. So, even if we assume AISC of $1,255/oz in Q2 to be conservative, Eldorado Gold should report AISC margins closer to $700/oz, a 20% improvement year-over-year.

Eldorado Gold - Quarterly Costs & AISC Margins (Company Filings, Author's Chart)

That said, while Q2 is expected to be a decent quarter, H2-2023 should be even better for Eldorado Gold. This is because the company has guided for second-half weighted production, with a much stronger H2 from Lamaque consistent with previous years (Q4 has historically been much stronger), improved production levels at Kisladag that began in Q2 with the benefit of improved materials handling and agglomeration equipment and a stronger H2 from Efemcukuru with better grades. So, assuming the gold price remains above $1,850/oz into year-end, Eldorado is set up for a great Q3 and Q4, lapping easy comparisons from a gold price standpoint with an average realized gold price of $1,688/oz and $1,754/oz, respectively, which weighed on the company's revenue and cash flow in H2 2022 when combined with worse than expected inflationary pressures.

Recent Developments

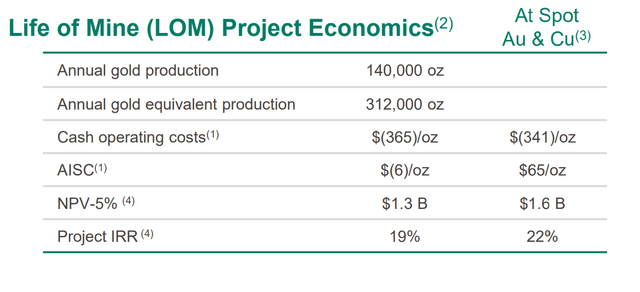

While Eldorado Gold successfully secured project financing (~$750 million) in early Q2 for its Skouries Project, which has restarted at this future high-margin asset (~140,000 ounces of gold per annum at sub $100/oz all-in sustaining costs), the one negative to the financing package was that it was set up to provide 80% of total funding with 20% to be funded by the company. Unfortunately, this led Eldorado Gold to complete two private placements at ~US$9.75, with a ~6.3 million share investment by the European Bank for Reconstruction and Development, and a separate ~$100 million bought deal of ~10.4 million shares announced in June. The result was ~9% share dilution from these two equity raises, which was higher than what I was expecting even if the price at which capital was raised was quite reasonable, in line with the stock's 3-year moving average.

Skouries Production, Costs & NPV (Company Website)

Fortunately, other recent developments have been positive, with the gold price rebounding to settle just a few percent shy of its all-time highs, and most producers reporting an average realized gold price of $1,960/oz or higher in Q2, a meaningful improvement from the average realized price closer to $1,890/oz in Q1 2023, and a 5% plus increase from Eldorado's average realized gold price of $1,849/oz in Q2 2022. Just as importantly, commentary on conference calls continues to suggest that while labor/contractor inflation has remained sticky, costs for key consumables or stabilizing, suggesting the worst is in the rear-view mirror from an inflationary standpoint. Elsewhere, Eldorado Gold noted that treatment charges had eased for lead and zinc in its Q1 Call, a positive development.

The only negative development other than the recent ~9% share dilution is that zinc prices have remained under pressure, sinking nearly 20% from its Q1 2023 lows, which will affect its polymetallic Olympias Mine. Fortunately, zinc concentrate sales represent a relatively small portion of total revenue (less than 5% of total revenue), and the mine should operate at much lower costs if it can ramp up to a planned production rate of 600,000 tonnes per annum later this decade. So, between a weakening Turkish Lira and some easing of inflationary pressures, Eldorado Gold should be able to report sub $1,220/oz AISC this year, beating its guidance midpoint of $1,240/oz and its FY2022 costs of $1,276/oz, and translating to margin expansion on a year-over-year basis.

Valuation

Based on ~206 million fully diluted shares and a share price of US$11.00, Eldorado Gold trades at a market cap of $2.27 billion, making it one of the more expensive sub 500,000-ounce producers, especially relative to Torex Gold (OTCPK:TORXF), New Gold (NGD), Perseus Mining (OTCPK:PMNXF) and Fortuna Silver (FSM). That said, and as I've highlighted in past articles, Eldorado Gold is unique in the sense that it's more diversified than most of its peers, it has a ~20% stake in one of the strongest developers in G Mining Ventures (OTC:GMINF), and it's bringing a new asset online in 2025 (Skouries) which is expected to be one of the sector's lowest-cost producers. And while recent equity raises have contributed to ~9% share dilution and Eldorado will be one of the few companies reporting meaningful free cash outflows this year and next as it ramps up construction at Skouries, the mine should transform Eldorado into a low-cost producer.

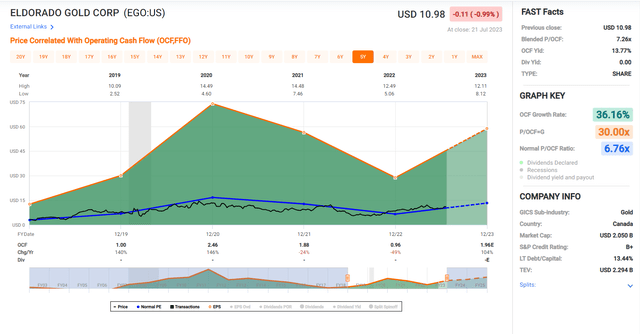

Eldorado Gold - Historical Cash Flow Multiple (FASTGraphs.com)

Looking at the chart above, we can see that Eldorado has historically traded at ~6.75x cash flow (5-year average), and it currently trades at ~5.9x FY2024 cash flow per share estimates ($1.85). However, I would argue that a 5% premium is more than reasonable for current multiples (7.1x) given that the company is now just two years away from long-awaited production at Skouries, which will be one of the top-10 lowest-cost gold assets sector-wide once in production. And if we multiply this figure by FY2024 cash flow per share estimates of $1.85, we arrive at a fair value of US$13.15 per share. Meanwhile, from a net asset value standpoint, Eldorado also remains reasonably valued, trading at less than 0.85x P/NAV vs. an estimated net asset value of ~$2.70 billion (Skouries at a 7% discount rate).

Eldorado Gold - July 2022 Analysis (Seeking Alpha Premium/PRO)

That said, I am looking for a minimum 40% discount to fair value to justify starting new positions in mid-tier producers, and while Eldorado has over 20% upside to fair value (18-month target price), I don't see nearly enough margin of safety at current levels. And if we apply this 40% discount vs. its estimated fair value, Eldorado Gold would need to dip below US$7.90 to move into a low-risk buy zone. Some investors might argue that the stock may not become this cheap again, and this may be true, but there was ample to buy the stock at a steep discount to fair value last year and I don't believe in paying up for cyclical stocks after they've rallied 100%. Plus, I would argue that there's far more attractive value elsewhere in the sector. This is evidenced by some small-cap producers trading at ~5.0x FY2024 cash flow per share estimates and below 0.50x P/NAV, and more diversified producers trading at similar multiples to Eldorado but with higher-quality assets, like Barrick (GOLD) at just ~5.7x FY2024 cash flow per share estimates.

Summary

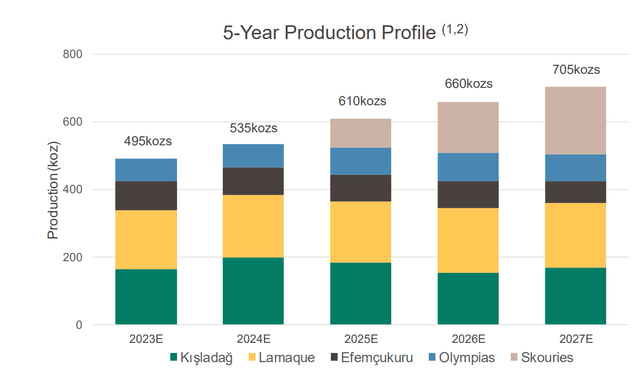

Eldorado Gold is set up to report solid Q2 results compared to year-ago levels, with the benefit of lower energy prices, a weaker Turkish Lira, and a stronger gold price. This should allow the company to report all-in sustaining cost margins of $670/oz plus in Q2, a significant improvement from the $579/oz margins reported in Q2 2022. And while free cash flow will remain under pressure due to $250+ million expected to be spent at Skouries or (~$400 million in total growth capital across its portfolio), these investments are fueling a transformation into a much different looking gold producer post-2025, with Eldorado Gold set to be a ~650,000-ounce producer with sub $920/oz all-in sustaining costs, making it one of the lowest-cost producers sector-wide.

Eldorado Gold - 5-Year Production Profile (Company Presentation)

However, while Eldorado Gold continues to be one of the better turnaround stories sector-wide and boasts a similar profile to Alamos Gold (AGI) with growing gold production at much higher margins. That said, I believe the best to buy when miners is when they're hated and trading at deep discounts to fair value, and while Eldorado remains reasonably valued given that it's transforming into a higher-quality and more diversified miner that's less sensitive to gold price weakness, it's hard to justify paying up for the stock above US$11.00. Therefore, I continue to focus on more attractively valued names elsewhere in the sector. And if Eldorado Gold to rally above US$12.60 before October, I would view this as an opportunity to book some profits and switch into more beaten-up names elsewhere in the sector.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.