Truist Financial: Why I Am Downgrading This 6.3% Yield To Hold

Summary

- Truist Financial reported weaker-than-expected Q2 earnings due to rising deposit costs and declining net interest margins; the bank's deposit base also decreased quarter over quarter.

- Despite not performing as well as other regional banks, Truist Financial recently passed the Fed's stress test, clearing the way for a stable dividend.

- I am downgrading shares to 'hold' due to a disappointing deposit situation and stress test results.

J. Michael Jones

Truist Financial (NYSE:TFC) submitted earnings for its second-quarter last week that missed top and bottom line expectations due to rising deposit costs and weaker net interest margins. Truist Financial's deposit base also declined quarter over quarter, which is a negative for the bank as well as the shares. On the positive side, the bank recently passed the Fed's stress test. While I continue to see TFC has an attractive yield play, I am downgrading the financial institution to a hold as the bank's deposit situation has disappointed, and the bank didn't do as well in the stress test as other regional banks. A better alternative than TFC may be U.S. Bancorp (USB) which offers a comparable yield as well as higher revaluation potential, in my opinion!

Previous rating

Since my last Truist Financial coverage, shares of TFC have increased 2.58%. While I don't see the dividend as unsustainable, the bank's stress test results, disappointing deposit results, and NII decline made me change my outlook on Truist Financial.

Net interest margin decline

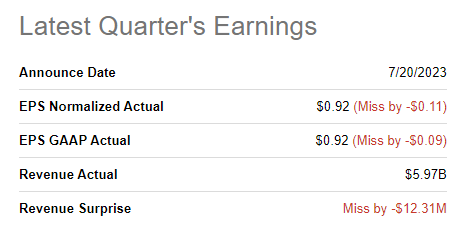

Truist Financial reported weaker-than-expected second-quarter earnings last week due to higher capital costs and weaker net interest margins in a rising-rate world. Truist Financial missed revenue estimates by $12M and adjusted EPS estimates by $0.11 per share.

Seeking Alpha

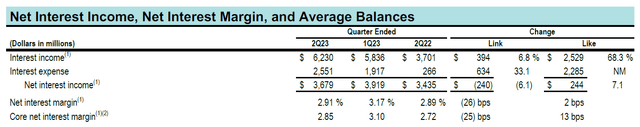

Banks' net interest margins are under pressure from the Fed, and Truist Financial reported a quarter-over-quarter decline in its NIM as well. Truist Financial's Q2'23 net interest margin contracted 26 basis points from 3.17% in Q1'23 to 2.91% in Q2'23. Since the labor market is not weakening, the odds are in favor of continued rate increases on the part of the Fed... meaning banks like Truist Financial may see a continual contraction of its net interest margin in the second half of the year.

Deposit situation

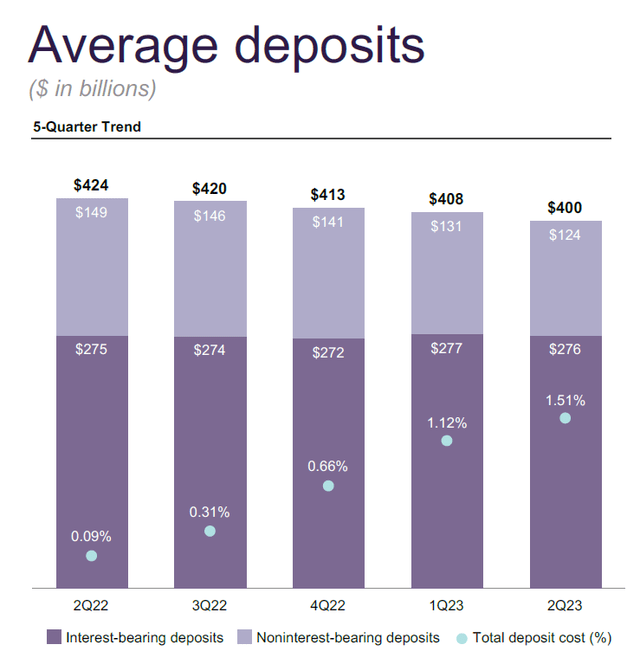

Unfortunately, Truist Financial reported an $8B quarter-over-quarter decline in its deposit base for the second quarter. The bank had $400B in deposits at the end of Q2'23 compared to $408B in Q1'23. Deposit costs for interest-bearing accounts soared to 1.51% in the second-quarter and are one reason why the bank underperformed earnings and net interest margin expectations for the second quarter. Almost the entire decline in Q2 deposits came from non-interest-bearing deposits, which declined 5.6% quarter over quarter. Depositors have been moving funds into higher-yielding investments, like money market funds, for more than a year, and this trend will likely continue until the Fed reverses the interest rate trend.

Truist Financial passes stress test

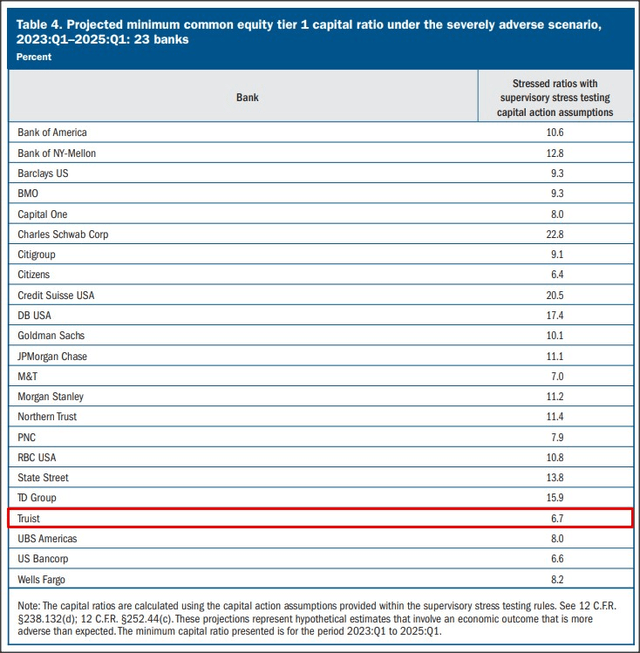

The Federal Reserve recently conducted its annual stress test exercise in which it probed the capital levels of 23 major banks in the U.S. The stress test is meant to reveal capital deficiencies for America's top tier banks as well as largest regional banks, by testing how banks' capital positions change in the event of a severe economic recession. In the latest round of this annual stress test, all 23 banks passed the test, including Truist Financial.

However, Truist Financial was one of the weaker banks and the stress test revealed a projected minimum common equity tier 1 capital ratio of 6.7%. The bank's common equity tier 1 capital ratio at the end of the fourth quarter, which marked the basis for the stress test, was 9.0%. The four weakest banks with the lowest capital ratios, besides Truist Financial, were Citizens (CFG), U.S. Bancorp, M&T (MTB), and PNC Financial (PNC).

Federal Reserve

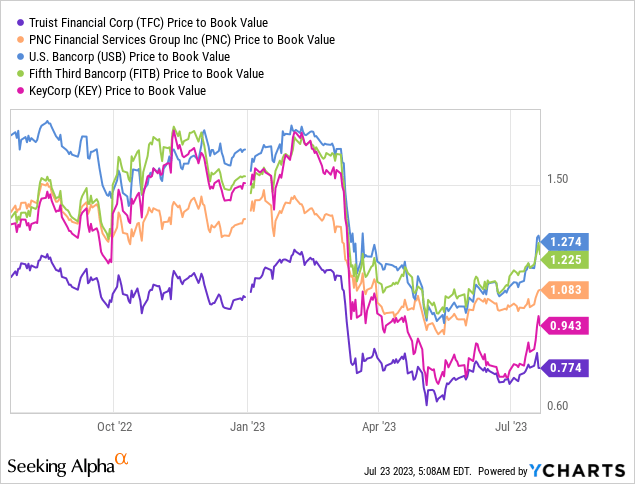

Truist Financial's valuation vs. regional banking rivals

Truist Financial continues to trade at an outsized discount to book value, which is the result of the bank failing to perform as well as others during the stress test exercise. The higher risk associated with Truist Financial has been reflected in the bank's valuation… which currently shows a 23% discount to book value. Other regional banks like U.S. Bancorp, PNC Financial, Fifth Third Bancorp (FITB), and KeyCorp (KEY) trade at significantly higher price-to-book ratios, in part because their deposit bases are growing, and they have stronger capital positions that protect them from a severe recession.

One of my best choices in the industry group above is U.S. Bancorp, which I recommend and for which I see a 17% revaluation potential.

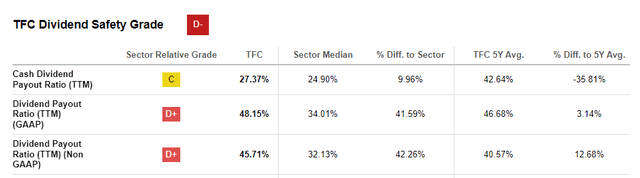

Payout ratio of less than 50%

Like KeyCorp, which I also like for its dividend and recovery potential, Truist Financial stands out with a high dividend yield of 6.3% and pays out less than 50% of its earnings. Truist Financial is currently paying $0.52 per share and confirmed its dividend after passing the stress test.

Risks with Truist Financial

With the stress test out of the way, the biggest risk that I see with Truist Financial relates to its deposit base. Interest rates appear set to increase further in the second half of the year after a much better-than-expected ADP Employment Report, which suggests that depositors will continue to move deposits over to higher-yielding money market funds. Pressure on the net interest margin is therefore a concern going forward.

Closing thoughts

Truist Financial reported weaker-than-expected second quarter earnings, driven by higher deposit costs and a declining net interest margin. This was expected, however.

What surprised me was to see a decline in Truist Financial's deposit base, which shrunk 2% quarter over quarter. The decline in deposits was driven chiefly by a mid-single digit-decline in non-interest-bearing accounts, meaning depositors shuffled funds over to higher-yielding investment alternatives.

On the positive side, Truist Financial passed the Fed's stress test, although not with flying colors. I believe the dividend is safe going forward (TFC pays out less than 50% of its earnings), but I am downgrading Truist Financial to a hold given the factors discussed in this article!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TFC, PNC, FITB, USB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)