Occidental Petroleum: Buffett's Likely Wrong

Summary

- Warren Buffett's likely to be disappointed by his $25 billion investment in no moat Occidental Petroleum.

- OXY has a high breakeven price and is thus a bet on oil staying elevated. It may make a better hedge than an investment.

- This article offers insights into how profitable OXY would be at $60 per barrel Brent.

- I expect long-term returns of 5% per annum.

Alex Wong

The Thesis

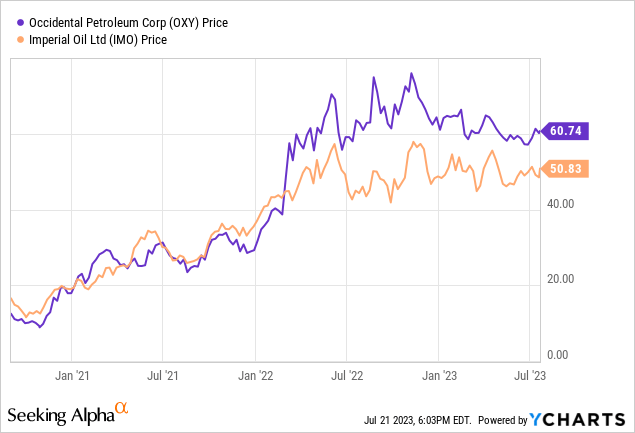

Watching oil stocks crash in 2020, I opened a small position in Occidental Petroleum (NYSE:OXY) and Imperial Oil (IMO), with average purchase prices around $13 for OXY and $14 for IMO. I would be a much richer man today if I had not sold those positions too early:

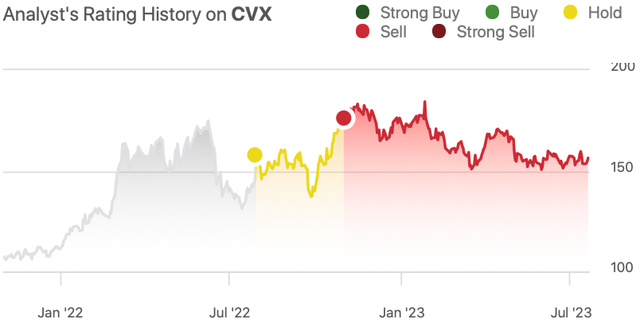

In 2022, I turned bearish on North American oil companies, issuing a "Sell" rating on Cenovus (CVE) and Chevron (CVX):

Author's Chevron Rating History (Seeking Alpha)

I don't love North American energy companies for two reasons:

- They often have a lot of exposure to high-cost shale and will likely be the first to suffer when oil prices fall.

- They are expensive compared to their global peers.

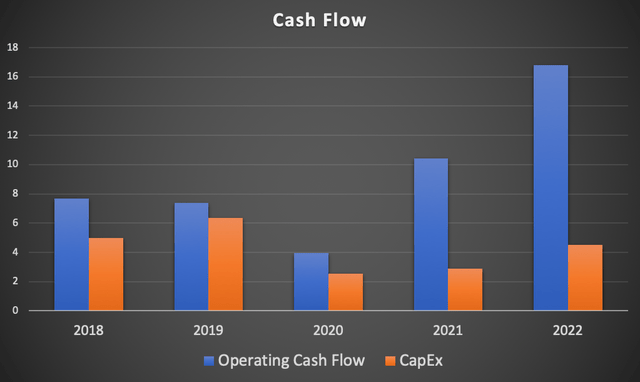

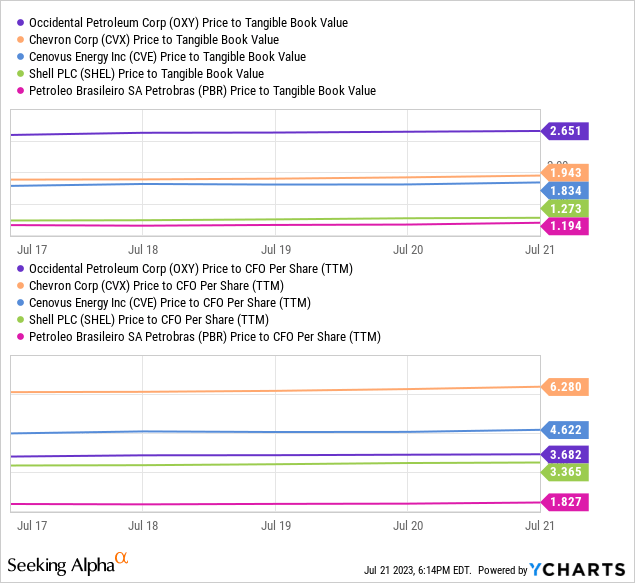

Occidental is far from an asset play, trading at the highest price to tangible book. But, it does produce a ton of free cash flow when crude oil prices are high:

So, it's more of a bet on oil prices. Meanwhile, companies like Shell (SHEL) and Petrobras (PBR) are highly profitable at much lower prices. As I've explained before:

In commodity businesses, where there is no product differentiation, the key moat is being the low-cost producer."

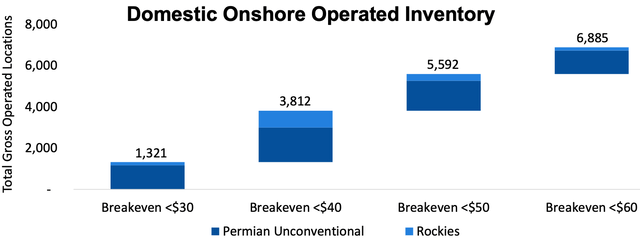

Occidental Petroleum doesn't have great breakeven prices with the majority of its domestic portfolio breaking even between $40 and $60 WTI:

Domestic Breakeven Prices (Company Presentation)

This means Occidental isn't all that profitable when oil prices drop below $60.

Still, Warren Buffett doesn't seem to mind buying tons of OXY stock at these levels. Maybe he has greater insights than I do into the future of oil prices, or maybe this is just a hedge against sky-high energy costs and global conflict that could greatly hinder the profitability of Berkshire's (BRK.A) (BRK.B) other businesses. Either way, Buffett is buying. As of last quarter, Berkshire Hathaway held an over $25 billion position in OXY, which made up about 7.8% of his U.S. holdings.

I, on the other hand, am a little skeptical.

Oil & Gas Reserves

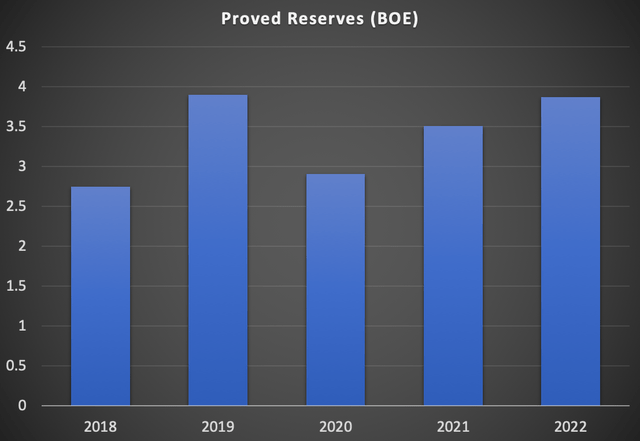

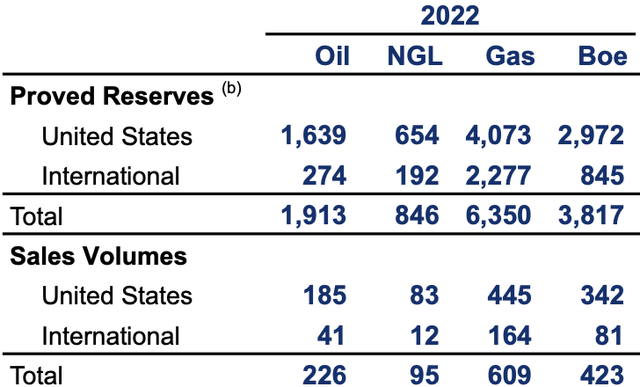

At the end of 2022, Occidental had 3.817 billion barrels of oil equivalent in proved reserves:

OXY's Reserves And Production (Annual Report)

The company draws from these reserves to produce its cash flows. During the same year, the company used up 423 million barrels of oil equivalent in production. So if production were to remain steady and no new discoveries were made, the company would have only 9 years of oil reserves left.

Here's how reserves have trended at Occidental:

There was a big drop-off in 2020 because the company had to write off its high-cost reserves, gained in the acquisition of Anadarko Petroleum. Come 2021 and 2022, Occidental was underspending on CapEx because it could simply put these reserves back on its books as they become economically viable again at higher oil prices.

Maintenance CapEx

Going forward, Occidental says it will spend approximately $5.8 billion on capital expenditures, of which $3.5 billion is "sustaining capital" to maintain its current level of production and reserves. But, I think maintenance CapEx is higher than that. The company will now have to spend more on exploration to improve its reserve levels and spend $200-600 million to work toward its net-zero goals. I have OXY's maintenance CapEx at $4.5 billion.

Normalized Earnings At $60 Brent

Apologies in advance, this section gets a little dry.

Below, I use figures from 2021, 2020, and 2019. The price of Brent crude averaged $60 per barrel over this period. I see this as a normalized oil price; it's slightly above global break-even points.

| All figures in billions USD ($) | 2021 | 2020 | 2019 |

| Cash From Operations | $7.38 | $3.96 | $10.43 |

| Less: Maintenance CapEx | ($4.5) | ($4.5) | ($4.5) |

| Add: Efficiency Improvements | $0.9 | $0.9 | $0.9 |

| Normalized Earnings | $3.78 | $0.36 | $6.83 |

Average out the normalized figures, and I think Occidental would make roughly $3.65 billion at $60/barrel Brent.

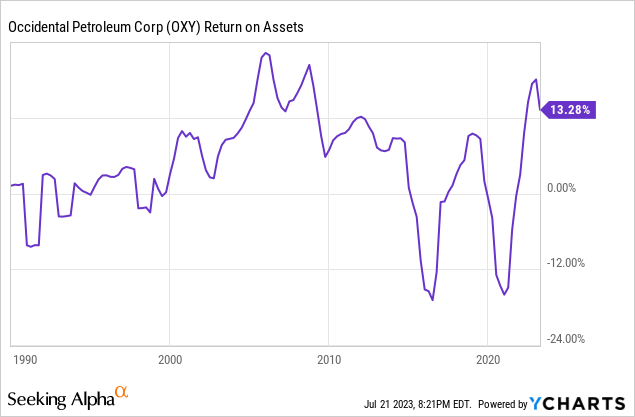

If you're skeptical of that number, just look at Occidental's 30+ year returns on assets.

The company has averaged roughly a 5.3% ROA. Apply this against OXY's total assets of $71.6 billion and you get normalized earnings of $3.79 billion, very close to the earlier $3.65 billion figure.

Valuation

If we divide Occidental's $3.65 billion of normalized earnings by its diluted shares outstanding, we get $3.75 per share, giving OXY a normalized P/E ratio of 16x. Not terrible but also not great.

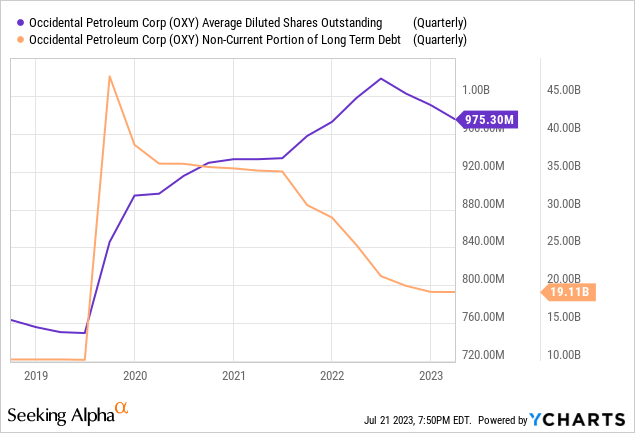

Before we get into the long-term returns, let's take a look at some of the positive things happening at Occidental Petroleum. The company's diluted shares outstanding have been coming down over the past year, increasing your ownership percentage. Long-term debt has also been declining in a big way:

Shares buybacks will be a big growth driver for OXY. The company also grows alongside inflation in oil prices. Since we normalized earnings at $60 per barrel Brent, we can expect some organic growth from here.

My 2033 price target for OXY is $85, implying compound returns of 5% per annum with dividends reinvested.

| Normalized EPS | $3.75 |

| Current Dividend | $0.72 |

| Compound Annual Growth Rate | 6.5% |

| Year 10 EPS | $7.05 |

| Terminal Multiple | 12x |

| Year 10 Share Price | $85 |

| Annualized Returns (Dividends Reinvested) | 5% |

Note: This is a base-case estimate. The compound annual growth rate is for dividends and earnings. If oil prices are sustained at materially higher or lower levels, it would change the return profile (I've assumed a normalized oil price of $60 per barrel Brent that grows to $90 per barrel by 2033).

I've got Occidental's terminal multiple at 12x because I think its upstream oil business will enter stagnation or decline in the 2030s due to the vast adoption of hybrid and electric vehicles. That said, Occidental has a great chemicals business, and the price of oil may continue to climb for decades as the commodity becomes increasingly scarce.

In Conclusion

Warren Buffett and OXY investors will likely get disappointing returns due to Occidental's high breakeven price and relatively high share price. I have Occidental growing its normalized earnings of $3.75 per share at a healthy clip because of its commitment to buybacks, but the company isn't well prepared for the energy transition and has no moat in a cyclical industry.

There are still great opportunities in the oil & gas industry. I've written multiple "Strong buy" articles on the below global players, each of which has a wide cost moat and cheap valuation (Article links are in the names):

- Petrobras: The Worst Has Been Avoided

- TotalEnergies: Enormous Total Returns

- Shell: Don't Fear Declining Oil Prices

Until next time, happy investing!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PBR, SHEL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (10)