TLTW: Fat Yield And Easily Hedged

Summary

- TLTW is currently generating an average monthly yield of 1.56% by using a buy-write strategy on TLT.

- Year to date, it is outperforming its underlying by 6.73%.

- If so desired, the position's variance can be mitigated by shorting TMF.

- I currently rate TLTW as a Buy.

scanrail

Thesis

I have been researching high-yield low-variance portfolios and the iShares 20+ Year Treasury Bond Buywrite Strategy ETF (BATS:TLTW) presents itself as particularly attractive. Because it's correlated to the value of bonds, it is frequently brought up as an available choice when trying to lower variance through diversification. After looking over the funds performance, and the mechanics behind how it generates its yield, I currently rate TLTW a Buy.

Fund Background

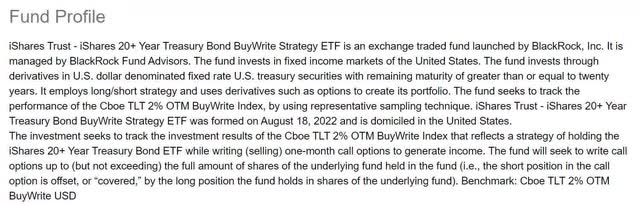

TLTW began trading in August of 2022 and uses a buy-write strategy on iShares 20+ Year Treasury Bond ETF (TLT). TLTW purchases shares of TLT, which pay a 3% annual yield. TLTW then sells covered calls against their TLT position. They pass on to shareholders both the 3% yield from holding TLT shares and the premium collected from selling calls. The fund currently carries a net expense ratio of 0.35%.

TLTW Fund Summary (Seeking Alpha)

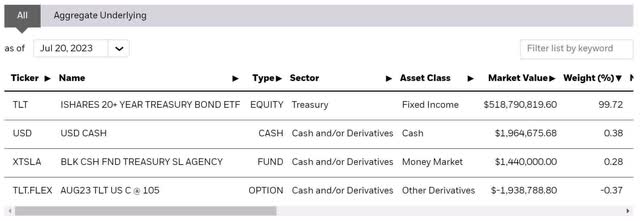

Their holdings show most of their assets are in TLT shares. The current set of calls is set to expire in August and have a strike price of $105.

TLTW Holdings (iShares.com)

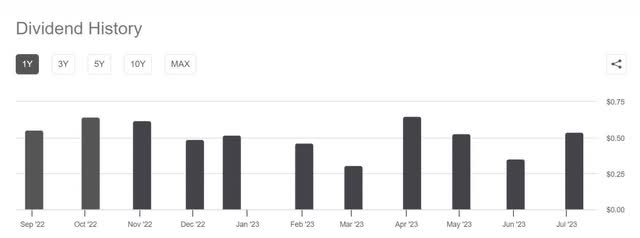

They first began offering a dividend last September and have a ttm yield of 13.57%. Although variable, the 11 distributions shown come to a total of $5.67 per share and have an average of $0.5154 per month. As of July 21st, 2023, TLTW had a share price of $32.93. Comparing the average monthly distribution to today's share price comes out to a monthly yield of 1.56% and a non-compounded annual yield of 18.72%.

TLTW Distribution History (Seeking Alpha)

TLTW has outperformed TLT on a total return basis. TLT is up 1.83% since the beginning of the year while TLTW is up 8.56%. This puts TLTW 6.73% ahead of TLT. This is typical of buy-write strategies. They tend to outperform their underlying during ranging, bearish, and gradually climbing markets. They typically underperform during periods when their underlying goes past the strike price of the calls they sold. Buy-write strategies like this one miss out on a portion of the gains during violent rallies.

TLTW vs. TLT Total Returns (Seeking Alpha)

The Hedge

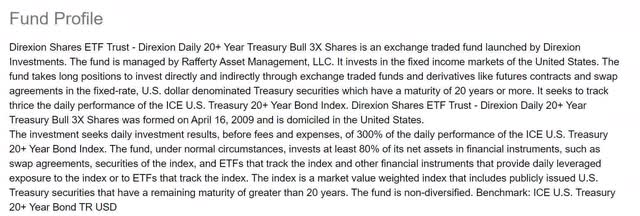

The Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF) is a triple leveraged ETF. Their fund is designed to experience 300% of the moves of TLT.

TMF Fund Summary (Seeking Alpha)

I must include a warning about leveraged ETFs because they are notorious for experiencing value decay over longer time frames. This is because they are designed to perform in specific ways compared to the daily performance of their underlying. The number of investors who misunderstood or misjudged this long-term degradation was large enough that FINRA and the SEC both issued warnings. Because of this value erosion, holding leveraged ETFs long-term is not recommended.

Thankfully, the plan here is to form a low variance couple by shorting TMF. This means instead of working against us, the long-term erosion of its Net Asset Value will work in our favor. While looking at their performance since the beginning of the year on a price basis, TLT declined 0.27%. Over this same time period TMF has declined 6.23%.

TLT vs. TMF (TradingView via Seeking Alpha)

Correlation

Because they are both based on the same underlying, TLTW and TMF are highly correlated. As is to be expected with a triple leveraged asset, TMF has significantly higher volatility than TLTW.

TLTW vs. TMF Correlation (TradingView via Seeking Alpha)

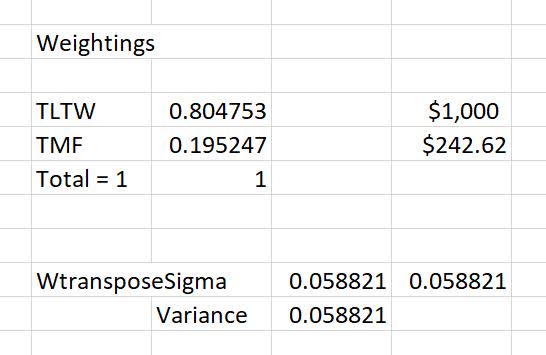

The minimum variance calculator I built in Excel is telling me that if TLTW is weighted at 80.47% and TMF is weighted at 19.52%, the variance comes out to 0.0588. To achieve this ratio, one would need to short TMF $242.62 for every $1000 they are long TLTW.

TLTW TMF Minimum Variance Weighting (By Author)

Risks

The act of shorting TMF lowers variance and places cash back into your account. Although lowering variance and increasing your available cushion for avoiding margin calls is beneficial, they can still happen to a hedged portfolio.

While a correctly hedged position will diminish the risk of catastrophic loss, never underestimate human error's ability to get in the way of a good plan. Assuming the hedge is set up correctly, the risk of infinite loss attached to shorting should be canceled out by gains made on the inversely correlated asset. If the two assets are not weighted correctly, the chosen assets are not strongly inversely correlated, or one fails to also hedge the entire portfolio against potential black swan events, then you may find yourself in an unexpected margin call. MIT OpenCourseWare has a series on Portfolio Theory on YouTube for anyone wanting to understand this topic on a higher level.

Anyone planning on owning TLTW without shorting TMF should also consider selling their own covered calls. Although not horrible, when one side of a low variance couple has some of its shares exercised the position needs immediate rebalancing.

As the Fed is still fighting inflation, they may be forced to raise rates even further. The bond market is already trading at diminished valuations, but it can always go lower. Similar to what Volcker had to deal with in the 1970's, if inflation resurges, Powell may be forced to temporarily increase rates up even higher. The silver lining here is that while bond valuations should go down from rate increases, their yield should go up.

Catalysts

The Fed is currently holding the rates elevated to allow their effect to soak into the economy. With inflation dropping, the required duration of soak may be drawing to a close. When rates are lowered, bonds tend to rise in valuation while yields tend to drop. The 3% yield that flows into TLTW from TLT will shrink, but the rest of the TLTW yield is based off of volatility. The portion of yield that comes from selling calls should remain relatively detached from changes in interest rates. While I cannot accurately predict when the Fed will begin lowering, I consider this a fairly strong catalyst.

Conclusions

TLTW is already appealing for its high yield and low correlation with stocks. It becomes even more appealing when coupled with a short TMF position. I am currently searching for high-quality couples to put into a low variance portfolio, and TLTW coupled with TMF is clearly an attractive option. I do not currently have a position in either ETF, but when the time comes for me to test out the portfolio on a small scale, this couple will almost certainly be part of it.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)