Twilio: Analyzing Revenue Trends

Summary

- Twilio, a customer data and communications platform, once overcharged customers, but they later found cheaper alternatives, leading to slowing revenue growth rates.

- As Twilio's growth rates decline, investors may be less likely to assign it a high "growth multiple" on its stock, affecting its perceived value.

- Profitability is a concern for Twilio, aiming for 10% operating income profits in 2023, but investors are now focused on clean GAAP profitability, which is still years away.

- I'm neutral on this name. It's not overvalued. But I'm not chasing this stock either.

- I do much more than just articles at Deep Value Returns: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

jaanalisette

Rapid Recap

Here's a quote from my previous analysis of Twilio (NYSE:TWLO):

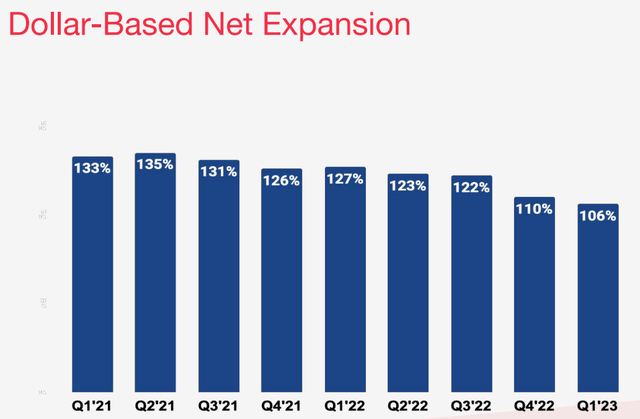

Here's the core of it: Twilio was able to over-charge customers and drive its revenue higher with this technique [relying on a usage-based revenue model]. But over time, the graphic [below] shows its customers figured out how to spend less with Twilio.

It's this insight that we are going to dig deeper upon. Here's why I struggle to get bullish on Twilio and remain neutral on this stock.

Why Twilio? Why Now?

Twilio is a customer data and communications platform. Its whole business model allows companies to interact directly with their customers. Its highly customizable Application Programming Interfaces ("APIs") have made it a popular offering amongst developers looking to communicate with customers.

How do you market your brand's message? How do you measure your brand's communication so that you can iterate the messaging? How do you gain visibility into your messaging?

Twilio provides APIs for building in-app chat functionality, for instance on WhatsApp, facilitating real-time communication between users.

The problem for Twilio is that during the pandemic years, in a low-interest rate environment, small- and medium-sized businesses were more than willing to invest in any infrastructure IT platforms. And they make up the bulk of Twilio's customer base.

But with time, SMBs have attempted to figure out cheaper ways of getting around their communication requirements. And this is what we'll discuss next.

Revenue Growth Rates Slow Down

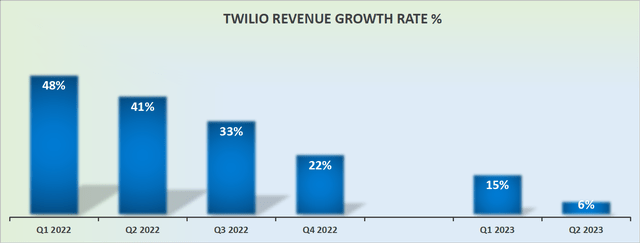

The trend above is undeniable. Twilio growth rates are slowing down.

The best that investors can now aim for is for Twilio's comparables to start to ease up in Q4 2023. But even in that case, I believe we can assume that Twilio is unlikely to see around 20% CAGR in Q4 2023.

Meaning that, as we look out to 2024, Twilio is no longer going to be perceived as a rapidly growing company. And without that perception of Twilio as a rapidly growing company, investors will be unwilling to award it ''a growth multiple'' on its stock.

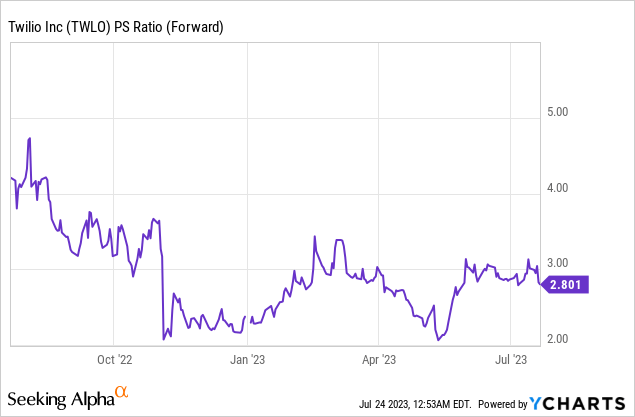

Put another way, Twilio today is priced at about 3x forward sales. That's not a heroic multiple by any stretch. One could make the case that it's a relatively petite multiple.

But that assertion is only true if it's compared with the multiple Twilio had when it was growing at a much faster rate. If we no longer see Twilio as a +30% CAGR company, but one that may or may not reach stably grow at 20% CAGR, then, paying around 3x forward sales already is a fair multiple.

What's more, as you can see above, since June, Twilio's multiple has already expanded significantly from around 2x forward sales to 2.8x forward sales.

In sum, with slowing growth rates and an already expanded multiple, investors will be looking toward its profitability to support its valuation. The topic that we'll now turn to.

The Pursuit of Promising Profitability

Here's a quote from Twilio on its profitability targets,

We've committed this year to profit in terms of throwing off on a profit this year. We've also committed to 300 to 400 bps of sustained growth year-after-year after this. And so we have also said that we feel confident that we can hit those growth goals in any macro environment. So we have our hand on the wheel in terms of moderating our spend. And our biggest source of spending, as you can imagine, most technology companies is headcount.

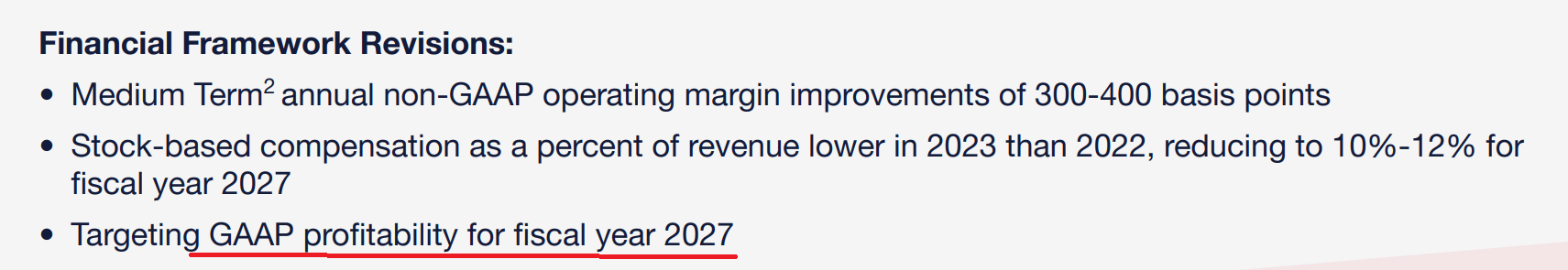

Twilio believes that it can get to 10% operating income profits in 2023. The problem for Twilio is that investors are now less interested in non-GAAP operating profits, where management's running costs are not factored in the costs of the business. Investors crave clean GAAP profitability.

TWLO Q4 2022

And on that front, Twilio is still more than 3 years away. Twilio believes that it can get to GAAP profitability in 2027.

But what sort of GAAP profitability should investors expect? 1% GAAP operating profit margins? Maybe 3%? Realistically, I don't believe 3% of GAAP operating profits to be on the cards.

That means that investors are ultimately having to pay more than $10 billion market cap for a business whose clean profitability is still many years off and has to grow to support its valuation.

To be clear, I don't argue that Twilio is overvalued. Not at all. Simply that I can't see this stock as undervalued.

The Bottom Line

Twilio operates as a customer data and communications platform, offering highly customizable APIs that allow companies to interact directly with their customers. However, Twilio's CAGR has been slowing down, leading to a shift in investor sentiment.

As the perception of Twilio as a rapidly growing company wanes, investors may be less willing to award it a high "growth multiple" on its stock.

Additionally, Twilio's pursuit of profitability is a crucial concern. While the company aims for 10% operating income profits in 2023, investors are increasingly interested in clean GAAP profitability, which Twilio is still several years away from achieving.

As a result, investors may be hesitant to pay a high valuation for a business whose profitability is distant and uncertain, raising questions about the stock's perceived value.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.