The Pursuit Of Economic Growth

Summary

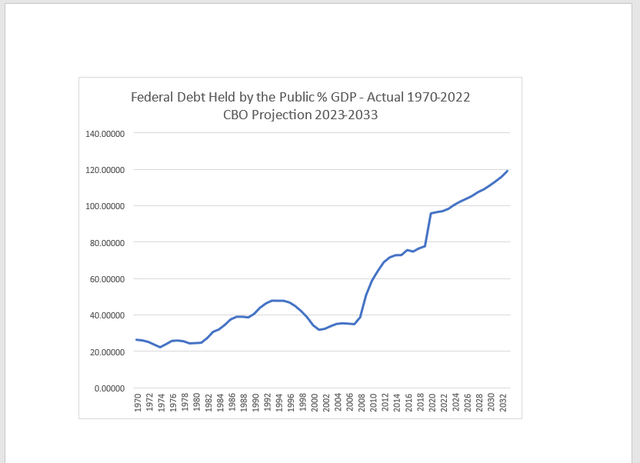

- The federal budget process is out of control, with spending climbing from about 20% to 23% of GDP, leading to projected deficits of over $1 trillion annually and a debt-to-GDP ratio of 120% by the early 2030s.

- Three potential solutions are suggested: the introduction of artificial intelligence to boost productivity and economic growth, addressing climate change through nuclear fusion rather than subsidies, and reforming the federal appropriations process.

- However, these solutions face challenges, including the high cost of AI development, legal and geopolitical obstacles to nuclear power, and the difficulty of changing established budget processes.

Sakorn Sukkasemsakorn

The federal budget process is out of control. While federal revenue has held steady at roughly 20% of GDP, federal spending in recent years has climbed from about 20% to 23% of GDP and is forecast by the Congressional Budget Office "CBO" to remain at this higher rate. With economic growth projected by CBO to be less than 2% annually over the next ten years, deficits in excess of $1 trillion annually lie ahead. And this estimate is probably conservative as this year's deficit will likely exceed $2 trillion even as the economy shows positive growth. And this presumes expiration of the Trump tax cuts, no wars, pestilence, or business cycle downturns. As a result, the debt to GDP ratio is projected to climb toward 120% by the early 2030s as shown on Chart I and interest on that debt is projected to soon exceed the amounts spent on national defense.

For us there are three pillars that could potentially clean up this mess and restore American exceptionalism. One is the positive impact the introduction of artificial intelligence ("AI") applications would have on productivity and thus economic growth. The second is addressing climate through nuclear fusion rather than granting huge subsidies for questionable eccentricities. A third is the reform of the federal appropriations process.

In our June 2023 article Determinants of Economic Growth Part II - Productivity, we discussed the potential for artificial intelligence and other technological advances to significantly boost productivity and economic growth, drawing parallels to the productivity boom of the 1920s.

For most of the last 100 years the USA was in the best position to capitalize on technological breakthroughs, relative to most of the rest of the world. This country generally has had less government industrial policy, in terms of the protectionism, barriers, rules and subsidies that much of the rest of the world embraced to varying degrees.

In a recent Wall Street Journal article, Welcome to Biden's Tale of WOE, Robert Zoellick, an advocate of free trade, bemoans the ascendancy of "the White House's embrace of national economic planning" in contrast to the "Clinton-Obama Democrats and Republicans who favor market discipline, openness and freedom". Zoellick points out that it is particularly unfortunate that the new approach by the progressives in the Biden Administration regarding antitrust rules and regulations is being adopted just as the enormous potential of artificial intelligence is becoming known.

To quote Zoellick: " Antitrust authorities are blocking acquisitions on the theory that 'big is bad,' regardless of consumer interests and price effects. That comes right as the advent of artificial intelligence and cloud services has intensified competition and probably will create opportunities for invention within more open-source systems."

It is not only progressives that are calling for government regulation of AI. The New York Times recently reported that leaders from OpenAI, Google DeepMind, Anthropic and other AI labs warn that future systems could be as deadly as pandemics and nuclear weapons. "Mitigating the risk of extinction from A.I. should be a global priority alongside other societal-scale risks, such as pandemics and nuclear war," reads a one-sentence statement released by the Center for AI Safety, a nonprofit organization. The open letter was signed by more than 350 executives, researchers and engineers working in the area.

AI will require enormous expenditures of capital. Global spending on AI, including software, hardware and services for AI centric systems is projected at $154 billion this year, a 27% rise from 2022.The massive capital expenditures are not just for the very expensive NVIDIA (NVDA) chips. A set of eight of the most advanced chips can cost $300,000. Companies buy thousands of them. Even more expensive is the vast number of people employed as annotators. AI learns by finding patterns in enormous quantities of data, but first that data has to be sorted and tagged by people, a vast workforce mostly hidden behind the machines. Many facts about AI are closely guarded secrets. Consequently, there are no granular estimates of the number of people who work in annotation. But millions is a good estimate according to a recent Google research report.

In Preparing for the 2020s Stock Market, published in August 2022, we noted that from the business cycle trough in 1921, real economic growth averaged 4.2% yearly in the decade of the 1920s, and the economy was free of recession. Over the course of the decade productivity was estimated to have increased by an average of 5.4% yearly. That technology-driven surge in growth and productivity, along with the booming stock market, allowed the Federal government to generate budget surpluses every year and retire a significant portion of the debt incurred during WWI. Goldman Sachs estimates that widespread adoption of AI puts S&P500 fair value up to 14% higher assuming that widespread AI adoption boosts productivity growth by 1.5% per year over a 10-year period. Another recent estimate from Dr. Ed Yardeni was that AI tools could spark another 'roaring 20s' for the stock market.

In our June 2023 article we pointed out that over the current forecast period CBO is projecting that productivity will rise by an average of 1.9% per year. But if productivity was to rise 0.5% higher in each year, i.e., 2.4% yearly, federal revenues would be higher by a cumulative $2,2 trillion. This would significantly dent future budget deficits and the amount of debt accumulation.'' While the CBO states that the coefficients and algorithms used to estimate the impact of higher productivity can only be relied on for changes in productivity up to 0.5%. If Goldman Sachs assumption of triple that were to occur, it could potentially result in a cumulative $6.6 trillion reduction in the federal deficit.

All this suggests that given the massive amounts of capital that will be required for AI to have the impacts on productivity that some are projecting, it is not a good time for the antitrust regulators to be adopting a "big is bad" posture. And don't leave out the lawyers. A California-based law firm is launching a class-action lawsuit against OpenAI, alleging the artificial-intelligence company that created popular chatbot ChatGPT massively violated the copyrights and privacy of countless numbers of people when it used data scraped from the internet to train its tech.

Electrification:

The major economies of the world, including the USA, are replacing fossil fuels with electricity to an extent that even the Swedish teenage environmental activist Greta Thunberg could not have imagined. But if electricity generated by fossil fuels is eliminated, there is not nearly enough electric generation capacity to supply all of the new electric vehicles and buildings to be heated with electricity. Additionally, on June 28, 2023, Joby Aviation said the F.A.A has granted a Special Airworthiness Certificate giving the nod for flight testing of its electric air taxi, taking it a step closer to securing approvals for commercial operations.

Trillions of dollars would be required to construct enough solar and/or wind generating capacity to supply all the new electricity that is on track to be used in transportation, heating and cooking. At one time it was thought that nuclear power would replace fossil fuels for electricity generation.

As we know, that did not exactly work out. Aside from the various legal and domestic political obstacles to nuclear power, there are also geopolitical considerations. Indeed, a June 14, 2023, New York Times article highlighted that this is one of the most significant remaining flows of money from the United States to Russia, and it continues despite strenuous efforts among U.S. allies to sever economic ties with Moscow. The enriched uranium payments are made to subsidiaries of Rosatom, which in turn is closely intertwined with Russia's military apparatus.

Currently about 20% of US electricity is derived from nuclear power. This must be replaced as existing nuclear plants are eventually retired. The last nuclear power plant to be completed in the United States is the Watts Bar Unit 2, located in Tennessee. It began construction in 1973 and was initially expected to be completed in the late 1970s. However, regulatory changes and shifting priorities caused construction to be halted in 1985 when the plant was about 80% complete. Construction resumed in 2007, and the plant finally achieved commercial operation in October 2016.

The net result, in terms of the federal budget deficit, is that for all practical purposes the USA has de facto enacted the original "Green New Deal". The first specific call for a Green New Deal and the first published use of the term can be attributed to Thomas L. Friedman: The power of green in the April 15, 2207, New York Times Magazine. Freidman's original version of the "Green New Deal" called for replacing some dirty coal with cleaner coal, natural gas and nuclear along with modest subsidies electrification or a carbon tax.

The open-ended subsidies for conversion from fossil fuel to electrification in the Inflation Reduction Act ("IRA"), go beyond what Freidman envisioned in the original "Green New Deal". These are now forecast by many, including us, to be two or three times as large as forecast in the IRA, since adoption of electricity for transportation and other uses, is on track to occur far sooner than the CBO was assuming. Once most Americans' cars are electric and their homes are heated with electricity, political pressure to have the federal government spend whatever is necessary to build enough windmills and batteries to keep those cars and homes supplied with electricity will be insurmountable.

There is the possibility that nuclear fusion could be a solution to the world's energy needs. It would provide a reliable source of baseload power while reducing greenhouse emissions. In 2021 the private sector invested over $2.5 billion in fusion technology. In December 2022, the Energy Department announced a long-awaited milestone in the development of nuclear fusion energy. At the Lawrence Livermore National Laboratory in California a net energy gain was achieved by using 2.05 megajoules of laser energy to create 3.15 megajoules of fusion energy, a gain of about 1.5 times. Fusion's possibilities are huge. The technology is much, much safer than nuclear fission, since fusion can't create runaway reactions. It also doesn't produce radioactive byproducts that need to be stored, and the fuel is found in water.

The Budget Process:

Discussion and debate over the Federal budget deficit have waxed and waned for decades. During the 1920s and earlier, The President had relatively more discretion in determining the budget. The President would prepare and submit a budget proposal to Congress, but Congress did not have a formal process for developing its own budget resolutions. During peacetime the president normally would never submit a budget proposal that called for a deficit. Borrowing via deficits was generally reserved for wars. During periods of peace, the Federal government usually ran surpluses for the purpose of retiring the war debts. Each agency or program received separate legislation authorizing its funding. This meant that Congress considered funding for various programs individually rather than as part of an overarching budget.

In contrast, there are presently standing budget committees, budget resolutions, and the expectation of adoption of a unified budget. In the 1930s Keynes and his followers introduced the concept of deficit spending for the purpose of countering cyclical unemployment. To counter criticism of his focus on the short-term rather than the longer-term consequences of his policy proposals, Keynes famously wrote "In the long run we are all dead". When inflation and stagflation became problematic in the 1970s, a quip was "It is now the long run, Keynes is dead, but we have the inflation."

The apparent success of the Greenspan Commission, and continuing concern about the inability of Congress to address deficits in the normal course of business, prompted enactment of the Gramm-Rudman-Hollings Balanced Budget and Emergency Deficit Control Act of 1985 and the Balanced Budget and Emergency Deficit Control Reaffirmation Act of 1987 (both often known as Gramm-Rudman). These were the first binding spending constraints on the federal budget.

The Acts provided for automatic spending cuts ("cancellation of budgetary resources", called "sequestration") if the total discretionary appropriations in various categories exceed in a fiscal year the budget spending thresholds. Under the 1985 Act, allowable deficit levels were calculated in consideration of the eventual elimination of the federal deficit.

Since policymakers were able to comply with Gramm-Rudman-Hollings targets by using overly optimistic budget projections and other budget gimmicks, Gramm-Rudman-Hollings was eventually viewed by policymakers as contributing to, rather than solving, the problem of rising deficits. By October 1990, the president's Office of Management and Budget projected a budget deficit for fiscal year 1991 that exceeded the statutory target; if Congress did not enact a deficit reduction plan, sequestration would have cut discretionary spending by about one-third.

In November 1990, Congress and President George H.W. Bush agreed to a bipartisan deficit reduction deal, i.e. The Budget Enforcement Act of 1990 (BEA) that would achieve roughly $500 billion in savings over five years through a combination of spending cuts and tax increases. These savings were enacted through the Omnibus Budget Reconciliation Act of 1990 and enforced by the budget procedures contained in the BEA, which was signed into law on November 5, 1990.

Sequestration was triggered only twice under the BEA, resulting in small discretionary spending cuts in 1991. However, Congress began to weaken the BEA's budget controls when faced with budget surpluses in the late 1990s. The BEA was extended by the Omnibus Reconciliation Act of 1993, and again by the Balanced Budget Act of 1997. It expired in 2002, but the democratic majority adopted some of its principles, known as PAYGO, or Pay-As-You-Go, in their rules during the 110th Congress. Statutory PAYGO was reinstated by the Statutory Pay-As-You-Go Act of 2010, which President Barack Obama signed on February 12, 2010. Discretionary spending caps, as well as deficit reduction targets, were reintroduced by the Budget Control Act of 2011

The Budget Control Act of 2011 brought conclusion to the 2011 US debt-ceiling crisis. The bill directly specified $917 billion of cuts over 10 years in exchange for the initial debt limit increase of $900 billion. If Congress failed to produce a deficit reduction bill with at least $1.2 trillion in cuts, then Congress could grant a $1.2 trillion increase in the debt ceiling but this would trigger across-the-board cuts ("sequestrations"), as of January 2, 2013. These cuts would apply to mandatory and discretionary spending in the years 2013 to 2021 and be in an amount equal to the difference between $1.2 trillion and the amount of deficit reduction enacted from the joint committee. There would be some exemptions: reductions would apply to Medicare providers, but not to Social Security, Medicaid, civil and military employee pay, or veterans. Medicare benefits would be limited to a 2% reduction.

As shown in Chart II, as the economy slowly recovered from the financial crisis of 2008, the deficit as a percent of GDP declined to 2.4% by 2015. After that it increased steadily to 4.6% by 2019, even as the longest expansion in history continued. The Trump Administration did not exhibit any real interest in deficit reduction. Then the pandemic occurred, and budget deficits exploded. Even if some semblance of spending discipline were to take hold, the deficit issue will not disappear. The future of the Trump tax cuts will be determined by the outcome of the 2024 elections. The issue of the trust funds will have to be addressed regardless of the outcome of the elections.

Estimates of the solvency of the trust funds are subject to wide ranges of variability and revision, with the Medicare Trust Funds being much more volatile than Social Security Trust Funds. The 2022 annual report had the estimated depletion date for the Medicare Trust Funds as 2028. In the 2023 annual report the estimated depletion date is 2031. The projected reserve depletion date for the Social Security trust funds is 2034, a year earlier than in last year's report.

While all very long-term economic projections are problematic, projections of the Medicare Trust Funds actuarial deficit as a percent of GDP are much more variable, in terms of ranges from high to low. There are many more variables involving drug costs and hospitalization rates, than there are in models to predict actuarial deficit as a percent of GDP for Social Security. Furthermore, Medicare is much more politically controversial and less revered as sacred than Social Security. The projected actuarial deficit for Social Security over the next 75 years is 1.3 percent.

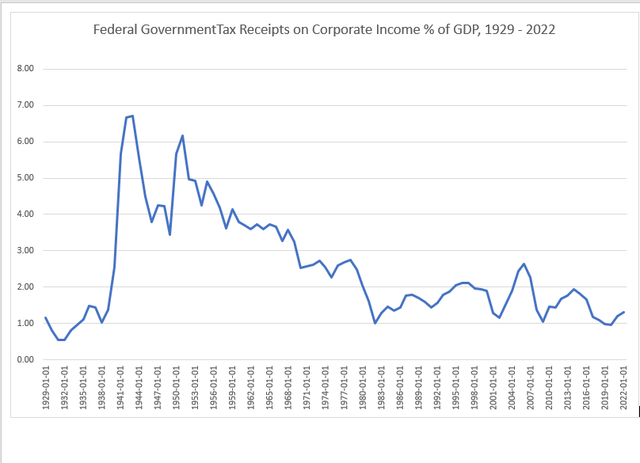

In the 1950s federal corporate income tax receipts were about 6% of GDP. By 2019 that was only 1% of GDP as shown on Chart III. The entire incidence of a corporate income falls on the owners of the corporation. If a corporate income tax is a percentage of pre-tax income, none of the corporate income tax can ever be passed on to employees or customers. That is because any wage or price decision that maximizes pre-tax profits would also maximize after-tax profits. Thus, the tax cannot cause any change in the price and thus is not passed on to consumers. The same applies to a corporation that is paying a wage that maximized its pretax profits, which is also the wage that maximizes its' after-tax profits. It also applies to the output decision. The level of output that maximizes pre-tax profits would also maximize after-tax profits.

Until 1984, social security benefits were not subject to Federal income tax. Beginning in 1984, pursuant to the Greenspan Commission directives, included in taxable income was up to one-half of Social Security benefits received by taxpayers whose incomes exceed certain base amounts. The base amounts in 1984, were $25,000 for a single taxpayer and $32,000 for married taxpayers filing jointly and zero for married taxpayers filing jointly and zero for married taxpayers filing separately

Today the threshold for the taxation of Social Security benefits is still only $32,000 for married taxpayers filing jointly. Furthermore, now those with incomes above $34,000 are taxed on 85% of Social Security benefits. In contrast, in 1984 the threshold below which estates were not subject to Federal estate taxes was $3,000,000. The amounts above $3 million were taxed at a rate of 55%. Currently the threshold below which estates were not subject to Federal estate taxes, which has been adjusted for inflation, is $11.7 million. Furthermore, the rate at which amounts of estates above $11.7 million are taxed on a sliding scale that starts at 18% with a maximum of 40%.

For the social security safety net to be viable via corporate tax restoration, federal corporate taxes would have to rise to 2.6% GDP, which was the level prevailing in 2006. It would be very difficult to get federal corporate taxes to even half that percentage that prevailed in the 1950s or even to 2.6% because other countries now offer lower corporate taxes.

Perhaps this is a reason why current Treasury Secretary Yellen is trying to persuade countries to adopt a global minimum tax. She has been a longtime advocate for it and it would be a mechanism for avoiding the tough spending decisions that would otherwise be required to address the solvency issue.

Chart I

Federal Debt Held by the Public % GDP (FRED)

Federal Debt Held by the Public % GDP - Actual 1970-2022 CBO Projection 2023-2033 (FRED)

Chart II

Federal Surplus or Deficit [-] as Percent of GDP Actual 1970-2022 CBO Baseline 2023-2033 (FRED)![Federal Surplus or Deficit [-] as Percent of GDP Actual 1970-2022 CBO Baseline 2023-2033](https://static.seekingalpha.com/uploads/2023/7/22/571273-16900454729602625.png)

Chart III

Federal Government Tax Receipts on Corporate Income % of GDP, 1929 - 2022 (FRED)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please note that this article was written by Dr. Vincent J. Malanga and Dr. Lance Brofman with sponsorship by BEACH INVESTMENT COUNSEL, INC. and is used with the permission of both.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.