Western Midstream Partners LP: Occidental Benefits

Summary

- The Western Midstream Partners, LP partnership has achieved investment grade status.

- Distributions will have a base and variable component.

- Management has improved tremendously since Occidental Petroleum Corporation took over.

- Valuation does not reflect profitability and debt ratio improvements.

- This is likely to be an income and growth investment consideration.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

imaginima

Western Midstream Partners, LP (NYSE:WES) management, in its Q1 press release, noted that the firm had achieved investment-grade status which is something that few in the industry achieve. While much of the industry has been focused on the upstream operations of Occidental Petroleum Corporation (OXY) to justify the acquisition of Anadarko Petroleum, Occidental management has clearly been working on shaping up a midstream company that was way overboard on leverage.

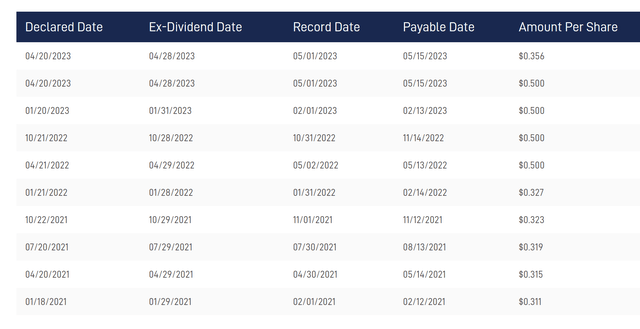

Western Midstream Partners Distribution History (Western Midstream Partners Website June 10, 2023)

Additionally, the structure of the distributions makes this a variable distribution entity which is atypical of midstream companies. However, it also provides management with the opportunity to redirect cash flow as needed.

Management recently announced an increase in the distribution to $.5625 from $.50 per share. They also raised the guidance for the annual base dividend. At this time, there was no additional variable distribution announced.

Management may have sent a message meant to undercut the sell position of this midstream that has been expressed by some. The midstream business tends to change slowly. There is every chance that at least some of the management improvements will be apparent to shareholders over time rather than right away. Therefore, the quarter could be "light" or even disappointing. But that does not mean improvements will not become apparent in the near future and continue to build more improvements in the future. The market is forward-looking. So, equities often move based upon the future as long as "the current" is not real damaging.

Mr. Market and the debt market have long soured on the idea of rushing to the capital market to raise money for projects of any kind. Therefore, this partnership (which issues a K-1) like so many other midstream partnerships, needs to keep cash flow available for capital projects that are needed.

Occidental has a huge Permian presence, and that basin is going to be one of the basins that needs probably a lot of additional capacity compared to what is now available. Therefore, investors should expect that extra component to vary with capital needs.

Western Midstream History Of Balance Sheet Financial Ratio Improvements And EBITDA Growth (Western Midstream Partners First Quarter 2023, Earnings Conference Call Slides)

Some long-term followers of this partnership may remember that it was essentially talked about as a candidate for sale when Occidental was looking to reduce debt. Obviously, that idea never materialized in acceptable fashion because Occidental still owns enough of the partnership to control it.

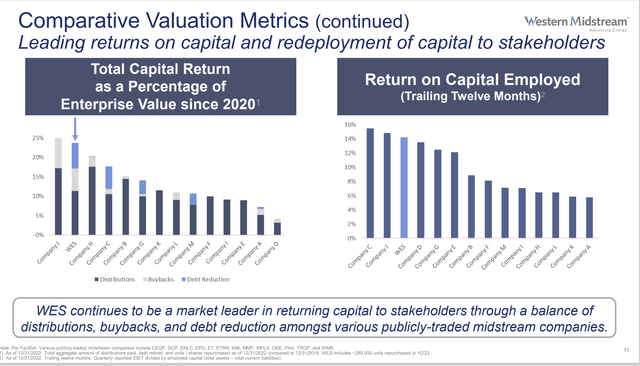

There are more than a few managements that would have let an asset like this languish and concentrated on what they thought was material. Clearly, that was not the case for Occidental. By increasing profitability and decreasing debt, Occidental has made this midstream company far more valuable than it was in the past.

Back in 2018, Occidental was busy selling midstream assets for about $2.6 billion and was otherwise rationalizing the operation in what management figured was a great time to sell stuff. With typical insider timing, the sale reflected that a market top for the industry was on its way. Fiscal years 2019 and (especially) 2020 reflected the wisdom of that. Investors may suspect that this midstream asset will eventually be for sale at the right price in the future because Occidental management has been flexible enough about that in the past.

The Common Units

This is, of course, the story of the key business ratios heading North while the common unit price goes South.

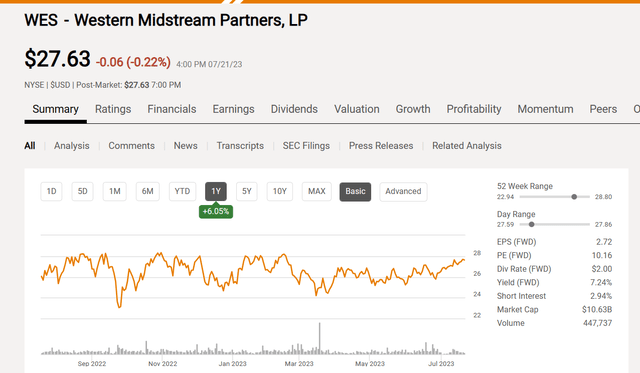

Western Midstream Partners Common Unit Price History And Key Valuation Measurements (Seeking Alpha Website July 23, 2023)

The oil and gas industry in general is just beginning the upcycle after years of being in the doghouse. These common units, as is the case across the board in this industry, do not reflect the improvements shown before of some very important measures.

In particular, Mr. Market and the debt market have been adamant about less debt. Management cut the debt ratio by roughly 40% since Occidental gained control of the business. Management also increased the profitability as shown by the climbing EBITDA shown before. Yet Mr. Market remains clearly unimpressed with the progress so far.

That is likely because the recent gains are due to Occidental management (and that had to be a huge improvement over what was before the current management). So, what is really needed now is a track record of superior profitability and low debt. But that process providing superior profitability and low debt is clearly already in place or the partnership would not have made it to investment grade. So, all management has to do is keep doing what it is doing, and the market will realize that the debt market "has it right."

That makes this probably one of the easier "sells" to investors as an income and appreciation play. So many times, investors look for sky high leverage and a lot of risk when they want capital appreciation because they have a hard believing a story like this can lead to some decent returns.

Distribution

But the distribution shown above is already historically high (even though it is variable). Now, if that distribution declines as management redirects the cash flow to growth projects, then an investor can likely look forward to higher distributions in the future due to a larger business.

Management just announced the sanctioning of a cryogenic plant and a drop in free cash flow due to that sanctioning. Now there are share repurchases as well. So, how management decides to redirect the cash flow as a result of this project should show investors how Occidental will manage the coming capital-intensive part of the midstream cycle.

The Requirements

Occidental management has likely directed the following guidelines:

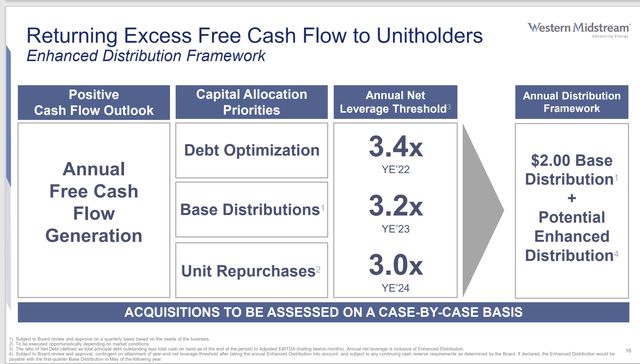

Western Midstream Return Of Capital Guidelines (Western Midstream First Quarter 2023, Earnings Conference Call Slides)

Since management declared a base distribution along with a variable distribution for the current quarter, then clearly the debt ratio is a very conservative 3.2 going forward under a variety of industry condition forecasts.

The midstream industry is known as the utility part of the oil and gas industry because the downside to earnings forecast is often protected by take-or-pay provisions. Indeed, in the first quarter letter to shareholders, management mentioned that volume progress was offset by less deficiency payments.

That debt ratio shown above will lower interest rate payments in the future because the higher company debt ratings makes that debt more desirable for debt holders. It also gives the partnership considerable flexibility to finance growth projects.

Realistically, that debt ratio could probably be as high as 4.0 before there is any worries about the debt market seriously raising interest rates on the debt financing. However, there is also no reason to put that idea to the test.

For those investors looking for a steady stream of income, the base distribution probably fits that definition. That (newly announced) $2.25 distribution is a historically high yield on the current price that many investors report as an average total return over the long term. Any growth projects (like the one mentioned before) are icing on the cake.

The fact that the midstream business has a variable component tells any potential investor that Occidental intends to grow this business. Therefore, this is likely to be an income and growth vehicle with that rare (for midstream) investment grade rating. Investors can assume that the variable part will eventually be redirected to growth projects as needed.

Western Midstream Partners LP Return Of Capital Comparison (Western Midstream Partners First Quarter 2023, Earnings Conference Call Slides)

What clearly changed for the better was Occidental gaining control of this midstream. Occidental needed to justify the Anadarko acquisition, and this is clearly a part of that justification.

However, Mr. Market will not give that proper valuation until management proves that better management is "here to stay." Therefore, potential investors can likely enjoy some above average returns from this income and growth vehicle with the typical midstream reduced risk.

The current unit price clearly does not reflect the future just as the unit price back in 2019 was overly optimistic. But that is not all that unusual for this part of the business cycle. There is likely more growth to come as the Permian has "filled up" a lot of excess capacity. Therefore, many in the industry are beginning to discuss a willingness to "sign up for" obligations that will lead to more construction.

The fact that Occidental also has a large upstream operation allows this midstream an unusual amount of cooperation with the upstream customers that leads to improved profitability. Most captive midstream operations, like this one, have superior profitability as a result. But that only makes the future outlook look far better than any downside risk.

I analyze oil and gas companies and related companies like Western Midstream Partners LP in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OXY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor and this is not a recommendation to buy or sell a security. Investors are recommended to read all of the company's filings and press releases as well as do their own research to determine if the company fits their own investment objectives and risk portfolios.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

Now it is a whole different story.