NIE: Tech Weighting Could Be A Problem, But It's A Solid Fund

Summary

- Anyone that's followed me for a while knows I'm obsessed with the word "conditions" when it comes to investing.

- Virtus Equity & Convertible Income Fund has done quite well for some time now, consistently being in the top of its category for several years.

- I typically like more mean reversion plays with funds that have fared relatively poorly over the last several years, but the consistency can't be ignored on a relative basis.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Learn More »

Eoneren

Our incomes are like our shoes; if too small, they gall and pinch us; but if too large, they cause us to stumble and to trip. - John Locke.

The Virtus Equity & Convertible Income Fund (NYSE:NIE) operates under normal circumstances with a minimum of 80% of its net assets (plus any borrowings for investment purposes) invested in a combination of equity securities and income-producing convertible securities. This mix allows the fund to seek both growth and income - a desirable combination for many investors.

The equity portion of the closed-end fund ("CEF") can range from 40-80%, and the convertible component can vary from 20-60% of assets. This flexibility enables the fund to adjust its portfolio based on market conditions and investment opportunities.

Anyone that's followed me for a while knows I'm obsessed with the word "conditions" when it comes to investing, so I tend to favor more flexible funds like this that can adapt. With that said, is there a case to be made to allocate to NIE here?

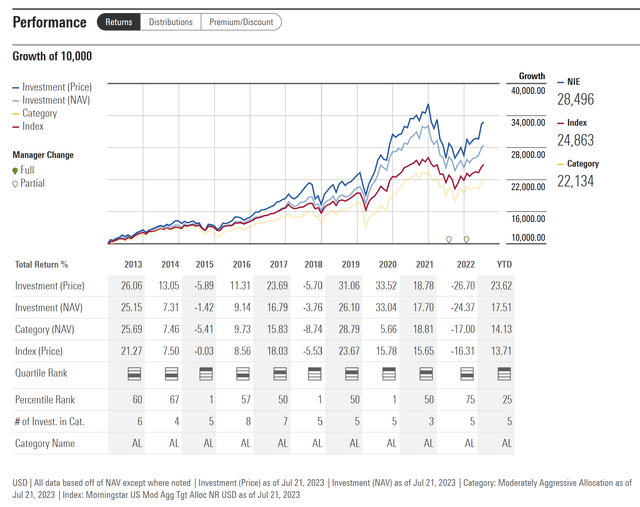

Performance & Risk

NIE has done quite well for some time now, consistently being in the top of its category for several years. Much of this can be attributed to the options overlay approach that generates income, and flexible ranges of risk-taking the fund can take.

I typically like more mean reversion plays with funds that have fared relatively poorly over the last several years, but the consistency can't be ignored on a relative basis compare to the fund's peers.

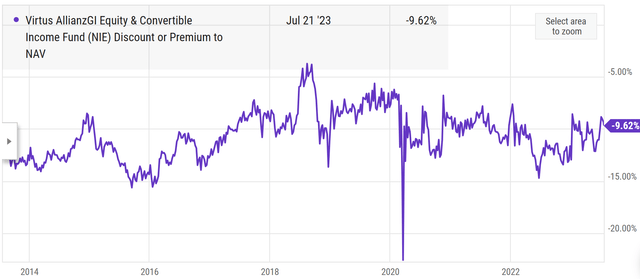

It's also worth noting the fund trades at a discount, consistent with history.

Portfolio Breakdown

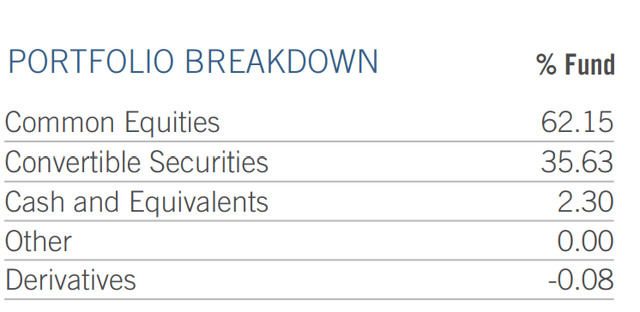

As of June 30, 2023, the fund's assets were divided among common equities, convertible securities, cash and equivalents, and other derivatives. The convertible securities portion of the portfolio makes it different than more traditional funds you see out there.

Sector Allocation

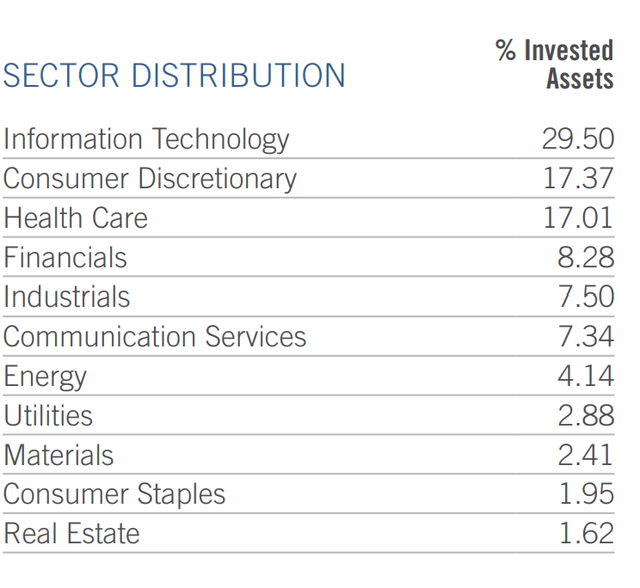

The fund's sector allocation provides insight into how the fund's assets are distributed among various sectors. As of June 30, 2023, the fund had significant investments in sectors like Information Technology, Consumer Discretionary, Health Care, and Financials, among others.

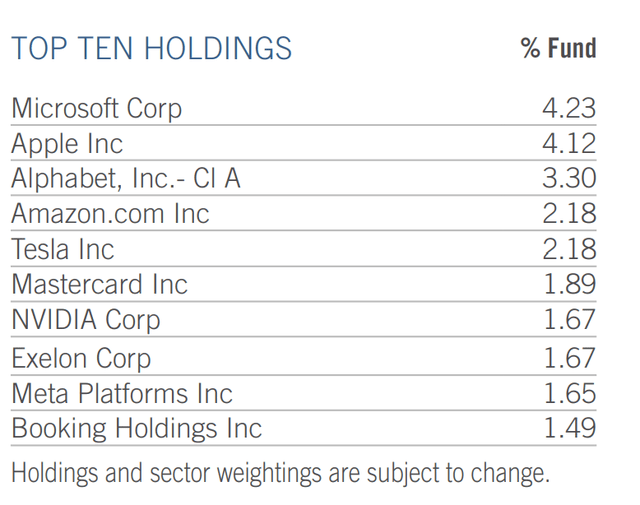

This is where it gets a bit concerning for me, only because I think Technology is due for a significant pullback. Clearly Technology momentum has been incredible, this year in particular, but the allocation here could leave the fund quite vulnerable for a moment in time. As of June 30, 2023, the fund's top holdings included prominent companies like Microsoft Corp, (MSFT), Alphabet Inc.- Cl A (GOOGL), Apple Inc (AAPL), and Tesla (TSLA). On the plus side, the weightings are a lot lower in these stocks than other funds I track, but it also suggests that investing here isn't a real diversifier against other core equity funds.

Conclusion: A Solid Fund

The fund provides distributions to its shareholders, which may be comprised of net investment income, capital gains, and/or return of capital. The distribution history gives information about the ex-dates and payable dates of past distributions. The current distribution as of 6/30/23 stands at 9.46%, providing some consistency of cash flow return.

Overall I think Virtus Equity & Convertible Income Fund is a solid fund, but the sector allocations concern me given my overall views on markets now. If you're a long-term investor, the track record suggests it's a good strategy to consider. I would just caution on adding or initiating new positions in the event I'm right that a credit event is around the corner.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.