AVES: One Of The Best Among Peers, But Beware Of Geopolitics

Summary

- Avantis Emerging Markets Value ETF holds about 1400 stocks with value and profitability characteristics.

- It is well diversified across holdings and sectors.

- Exposure to geopolitical and regulatory risks related to China is very high.

- It has been one of the best-performing emerging markets funds since its inception.

- Quantitative Risk & Value members get exclusive access to our real-world portfolio. See all our investments here »

Tanaonte

This article series aims at evaluating ETFs (exchange-traded funds) regarding past performance and portfolio metrics. Reviews with updated data are posted when necessary.

Emerging markets have lagged U.S. equities for years, but some analysts think they will outperform in the next decade. A number of ETFs provide exposure to emerging countries, but all are not equals.

AVES strategy and portfolio

Avantis® Emerging Markets Value ETF (NYSEARCA:AVES) is an actively managed ETF launched on 09/28/2021. The fund has a portfolio of about 1420 stocks, a dividend yield of 4.49% and an expense ratio of 0.36%. Distributions are paid semiannually.

As described in the prospectus by Avantis Investors, the fund places:

"an enhanced emphasis on securities of companies with smaller market capitalizations and securities of companies with higher profitability and value characteristics."

Value is mainly defined by the fund managers as adjusted book/price ratio, and profitability as adjusted cash from operations to book ratio. Other fundamental metrics may be considered, as well as past performance, industry classification, liquidity, float, tax, and governance. The strategy definition offers a lot of flexibility. On the downside, it is impossible to duplicate or back-test because it lacks the transparency of an index-based ETF. The portfolio turnover rate was 8% in the most recent fiscal year, which is quite low for an actively managed fund.

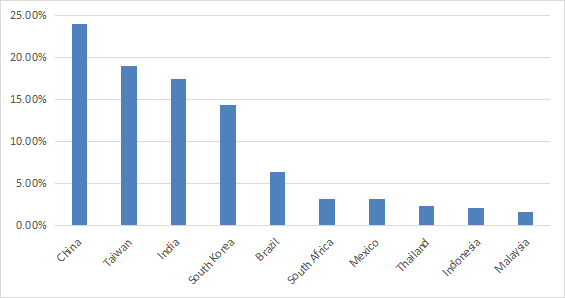

Despite the prospectus pointing to smaller capitalizations, the fund is mostly invested in large and mega cap companies (about 63% of asset value according to Fidelity). China is by far the heaviest country (24%), followed by Taiwan (19%), India (17.4%) and South Korea (14.4%). Other countries are below 7%. Asian countries together weigh over 80%. Exposure to geopolitical and regulatory risks related to China is very high: the aggregate weight of China and Taiwan is 43%. The next chart lists the top 10 countries, representing 93.7% of assets.

AVES country allocation (chart: author; data: Fidelity.)

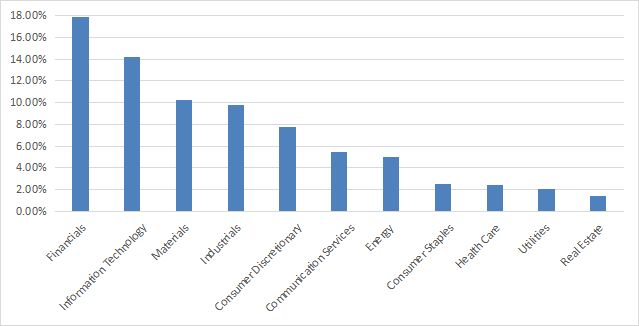

The heaviest sector is financials (17.9%), followed by technology (14.2%), materials (10.2%) and industrials (9.8%). Other sectors are below 8%. The fund is well diversified across sectors, although defensive stocks are underweight (consumer staples, healthcare, utilities).

AVES sector breakdown ( chart: author; data: Fidelity)

As reported in the next table, AVES is much cheaper than the EM benchmark iShares MSCI Emerging Markets ETF (EEM) regarding the usual valuation ratios.

AVES | EEM | |

Price / Earnings TTM | 7.86 | 11.97 |

Price / Book | 0.98 | 1.58 |

Price / Sales | 0.61 | 1.27 |

Price / Cash Flow | 4.15 | 7.84 |

(data source: Fidelity)

The top 10 holdings, listed below, represent about 9% of asset value. The heaviest holding weighs 1.2%, so risks related to individual companies are low.

Name | ISIN | WEIGHT | COUNTRY |

POSCO HOLDINGS INC | US6934831099 | 1.22% | SOUTH KOREA |

SK HYNIX INC | KR7000660001 | 1.06% | SOUTH KOREA |

LARSEN + TOUBRO LTD | INE018A01030 | 1.00% | INDIA |

NETEASE INC | US64110W1027 | 0.95% | CHINA |

HYUNDAI MOTOR CO | KR7005380001 | 0.94% | SOUTH KOREA |

ITAU UNIBANCO | US4655621062 | 0.89% | BRAZIL |

KIA CORP | KR7000270009 | 0.83% | SOUTH KOREA |

VIPSHOP HOLDINGS LTD | US92763W1036 | 0.82% | CHINA |

KB FINANCIAL GROUP INC | US48241A1051 | 0.76% | SOUTH KOREA |

SHENZHOU INTERNATIONAL GROUP | KYG8087W1015 | 0.70% | CHINA |

Past performance compared to competitors

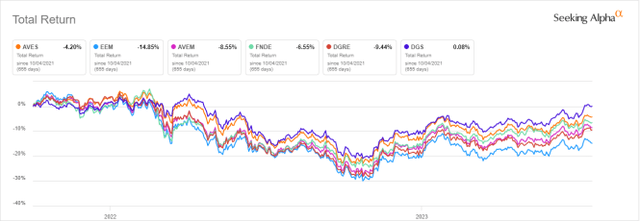

The next chart compares total returns since inception of AVES and five emerging markets funds:

- iShares MSCI Emerging Markets ETF (EEM),

- Avantis Emerging Markets Equity ETF (AVEM),

- Schwab Fundamental Emerging Markets Large Co. Index ETF (FNDE),

- WisdomTree Emerging Markets Quality Dividend Growth Fund (DGRE),

- WisdomTree Emerging Markets SmallCap Dividend Fund (DGS).

AVES vs. Emerging Market ETFs, total return since inception (Seeking Alpha)

AVES is the second-best performer in the list behind the small-cap fund DGS. Excluding dividends, AVES and DGS are almost tied (see next chart).

AVES vs. Emerging Market ETFs, share price return since inception (Seeking Alpha)

Takeaway

Avantis Emerging Markets Value ETF is an actively managed ETF invested in about 1400 companies listed in emerging markets. The strategy combines value and profitability, which may filter out a lot of value traps. It is well diversified across holdings and sectors, but defensive stocks are underweight.

Like most emerging markets funds, AVES has a high exposure to geopolitical and regulatory risks related to China. Some emerging markets funds like iShares MSCI Emerging Markets ex China ETF (EMXC) and WisdomTree Emerging Markets Quality Dividend Growth Fund (DGRE) exclude Chinese stocks. However, they still have about 20% of assets in Taiwan. Avantis® Emerging Markets Value ETF is one of the best-performing emerging markets ETFs since inception, but price history is a bit short to assess the strategy.

Quantitative Risk & Value (QRV) features data-driven strategies in stocks and closed-end funds outperforming their benchmarks since inception. Get started with a two-week free trial now.

This article was written by

Step up your investing experience: try Quantitative Risk & Value for free now (limited offer).

I am an individual investor and an IT professional, not a finance professional. My writings are data analysis and opinions, not investment advice. They may contain inaccurate information, despite all the effort I put in them. Readers are responsible for all consequences of using information included in my work, and are encouraged to do their own research from various sources.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.