Logitech: A Bullish Reversal Continues, Share Buybacks And Strong Secular Growth

Summary

- 18% of S&P 500 companies have reported Q2 results, with 75% beating bottom-line estimates and 61% exceeding sales expectations.

- Logitech is set to report Q1 2024 numbers, with a buy rating due to its expected growth and attractive valuation.

- Despite the unexpected departure of CEO Bracken Darrell, LOGI recovered quickly, with its stock remaining largely unchanged after a 15% drop in mid-June.

- Ahead of earnings Monday night and with a new share buyback plan in place on this free cash flow-positive name, I highlight key price levels to watch.

Araya Doheny

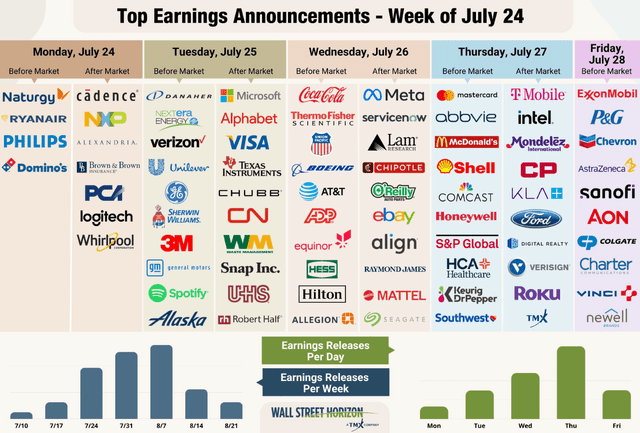

18% of S&P 500 companies have reported Q2 results. So far, a solid 75% of them have beaten bottom-line estimates, according to FactSet. The sales positive surprise percentage is 61%, less impressive and weaker than was seen in Q1. This week takes it up a notch, with many key sectors being in the spotlight after many Financials and some Consumer Discretionary names were the focus earlier this month.

I have a buy rating on Logitech (NASDAQ:LOGI) which is confirmed to issue Q1 2024 numbers Monday after the bell.

Earnings Season Heats Up This Week, Starting Monday Afternoon

According to Bank of America Global Research, LOGI is a design company specializing mainly in PC peripherals such as mice, keyboards, and headsets. It began by creating products for use around the PC platform but today it is a multi-brand, multi-category company selling products for consuming, sharing and creating digital content such as computing, gaming, video, and music either on a computer, mobile or in the cloud.

The Switzerland-based $10 billion market cap Technology Hardware, Storage, and Peripherals industry company within the Information Technology sector trades at a high 28.5 trailing 12-month GAAP price-to-earnings ratio and pays a near-market 1.9% dividend yield. Ahead of earnings on Monday evening, the stock features a moderate 33% implied volatility percentage.

The big news last month was the unexpected departure of CEO Bracken Darrell. Guy Gecht, previously a member of the non-executive board, will assume the role of interim CEO. Mr. Gecht is an ex-CEO and founder with more than 19 years of CEO experience. Reports say he does not plan to shift corporate strategy. The stock plunged on June 14 when that news hit the tape, as the former CEO was esteemed on Wall Street. But LOGI recovered quickly to fill the gap-down in price action. LOGI is basically unchanged now after dropping more than 15% in mid-June.

Before that, Logitech reported a solid top and bottom line back in early May. Q4 GAAP EPS verified at $0.26, a two-cent beat, while revenue was lower by 22% on a year-on-year basis, topping estimates by $38.5 million. The management team also reiterated its FY 2024 outlook. Its strong mid-term growth outlook along with a solid track record of execution acumen and high ROIC are positive aspects. What's more, exposure to secular growth spots, such as social media and gaming, fosters a rather easy growth trajectory.

Key risks include a softer consumer spending environment that could materialize in the second half or early next year as well as weaker gross margins, always key for tech hardware companies.

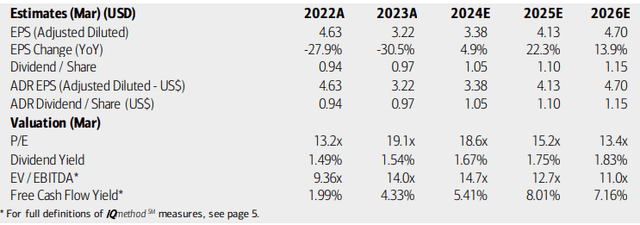

On valuation, analysts at BofA see earnings recovering modestly this year (its FY 2024) before rising at a faster pace in 2025. Dividends, meanwhile, are expected to rise at a steadier clip through 2026. Over the coming quarters, we should see the forward operating P/E ratio decline as EPS rises, of course, much will depend on what the stock price does. But with a current non-GAAP earnings multiple above 21, the valuation is pricey at first blush. With a near-market EV/EBITDA ratio and solid free cash flow, however, the firm is profitable at a reasonable cost.

Logitech: Earnings, Valuation, Free Cash Flow Forecasts

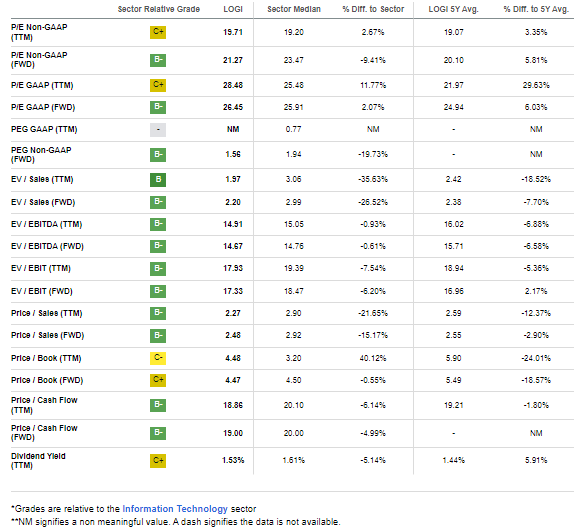

Digging deeper into the valuation picture, we see some favorable metrics. In this case, I would like to consider the normalized forward PEG ratio. If we assume $3.50 of next-12-month EPS (an 18.1 P/E) and a 15% growth rate, then normalized forward PEG is just 1.21, which is attractive in my view. What's more, LOGI's forward price-to-sales ratio is a more than 15% discount to the sector median.

LOGI: Generally Attractive Valuation Multiples

Seeking Alpha

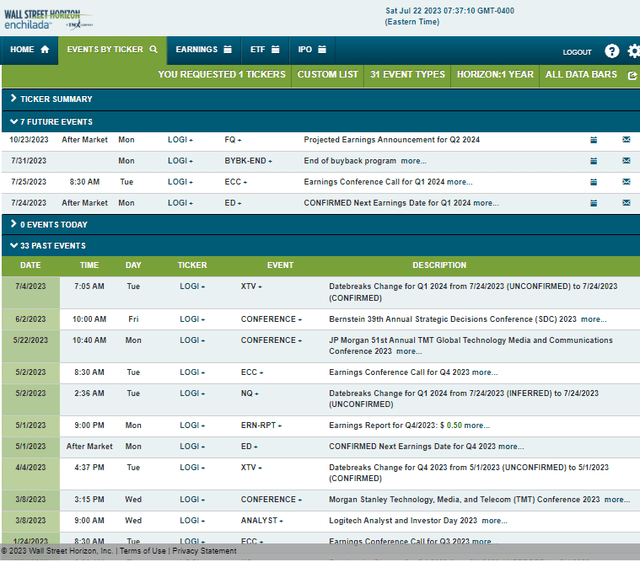

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q1 2024 earnings date of Monday, July 24 AMC with a conference call immediately after the numbers hit the tape. You can listen live here. Also, be on watch for possible updates to LOGI's share repurchase plan, which was just updated to include a $1 billion authorization.

Corporate Event Risk Calendar

The Technical Take

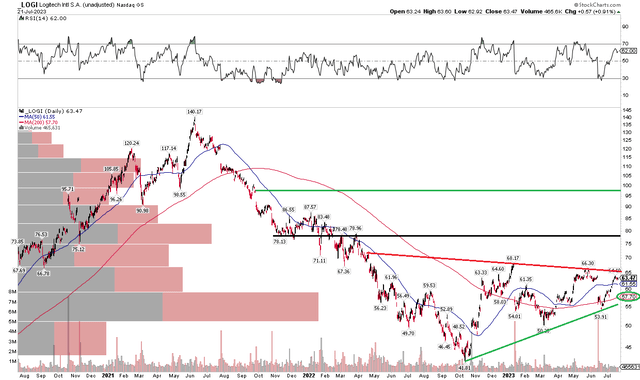

LOGI has improved momentum from a year ago. Notice in the chart below that shares have put in a pair of higher lows after notching a bottom just above $40 back in October last year. The stock hit a high above $140 more than two years ago but plunged 70% to its bear market low. With a 50% recovery to today's price, I see signs that a bearish to bullish reversal is indeed underway.

I would like to see LOGI climb above a downtrend resistance line, currently at $65. A rally through this resistance would lead to a bullish measured move price objective to near $100 based on the size of the current consolidation, added on top of the hypothetical breakout point. More immediate selling pressure could come about around the $78 area. But with a freshly rising long-term 200-day moving average, the bulls appear to be in control.

Overall, there are bullish signs, though I would like to see a breakout above the mid-$60s.

LOGI: Watching for an Upside Breakout Above the Mid-$60s

The Bottom Line

I have a buy rating on LOGI. I see it attractive on valuation considering the expected growth later in its fiscal year and through 2025 while the chart suggests a bullish reversal pattern is ongoing.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.