Taiwan Semiconductor: AI Speed Bump

Summary

- TSMC reported a mixed Q2'23 earnings report due to cutting full-year estimates.

- The Taiwanese foundry company still predicted booming AI demand while the headlines focused too much on delays at the Arizona fab.

- The stock is cheap at 14x more normalized '24 EPS targets considering a forecast for a return to 20% growth.

- Looking for more investing ideas like this one? Get them exclusively at Out Fox The Street. Learn More »

Bilanol/iStock via Getty Images

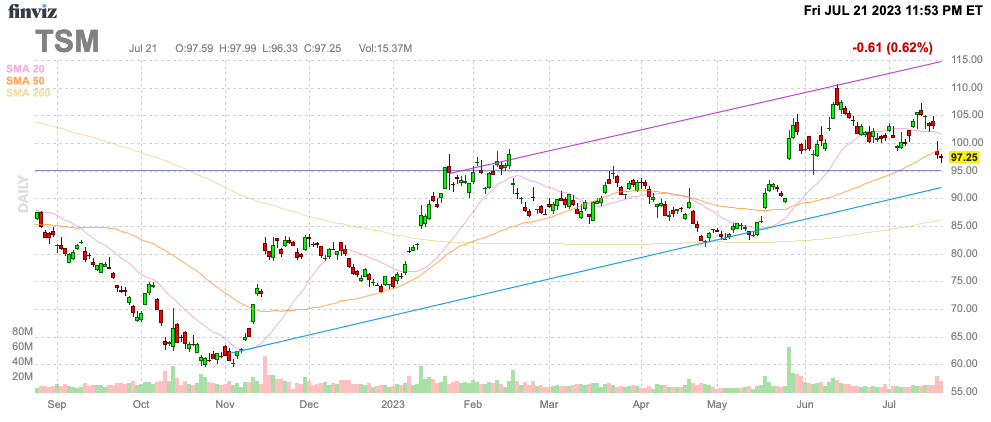

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) reported disappointing Q2’23 earnings to kick off the earnings season for the semiconductor sector on the wrong note. The foundry leader faces a tough Q3 due to ongoing inventory overhangs, but the current weak results are just a speed bump towards a big AI future. My investment thesis is ultra Bullish on the chip foundry giant trading at a discount after the recent dip.

Source: Finviz

Tough Q2

TSMC reported a tough Q2'23 with revenues falling a sharp 13.7% from last year. The foundry company did beat analyst targets with revenues $300 million above estimates. TSMC still reported a solid profit with an EPS of $1.14 with gross margins of 54.1%, though down 500 basis points from last Q2.

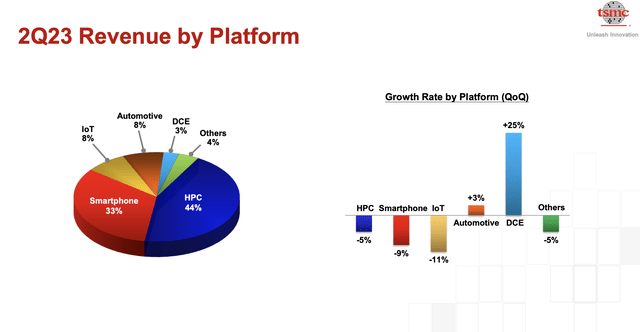

The market probably doesn't appreciate enough that the Taiwan chip company still obtains 33% of revenue from smartphones and only 53% of revenues are sold to advanced technologies associated with 5-nanometer and 7-nanometer. TSMC forecasts a big ramp up in 3-nanometer chips in Q4.

Source: TSMC Q2'23 presentation

The Chinese smartphone market has been brutal since the start of Covid and the Q2 results and Q3 guidance appears heavily impacted by a consumer group unwilling to aggressively spend on new technology after such lengthy shutdowns. The updated guidance has 2023 revenues falling 10%, below prior guidance.

The key here is that TSMC still sees a strong future in AI chips from the likes of Nvidia (NVDA), but the HPC category is only slightly larger than smartphones heavily impacted by weak Chinese demand. The market regularly overestimates the amount of advanced chips produced by TSMC for the likes of Nvidia, Apple (AAPL) and Advanced Micro Devices (AMD).

The AI ramp is real, but the rest of the business is providing a speed bump in the near term per CEO C. C. Wei on the Q2'23 earnings call:

Moving into third quarter 2023. While we have recently observed an increase in AI-related demand, it is not enough to offset the overall cyclicality of our business. We expect our business in the third quarter to be supported by the strong ramp of our 3-nanometer technologies, partially offset by customers continued inventory adjustment.

The company suggested the AI processor revenues only accounts for ~6% of TSMC's total revenue, though the foundry company is targeting 50% CAGR over the next 5 years. Even with this massive growth through 2027, the AI processor revenue will only reach low teens percent of revenue.

Ramp Back Up

The key to the future is that TSMC didn't step away from forecasting substantial revenue growth over the next few years. The foundry company maintains a prior forecast for up to 15% to 20% growth through 22026 and a return to 53% gross margins.

The market headlines focused on the company pushing back the opening of the Arizona fabs due to a lot of employee quality issues, but TSMC still forecasts strong long term growth. The opening of the first fab in the U.S. won't deter the long term growth potential, as no other competitor is going to take market share during any delay.

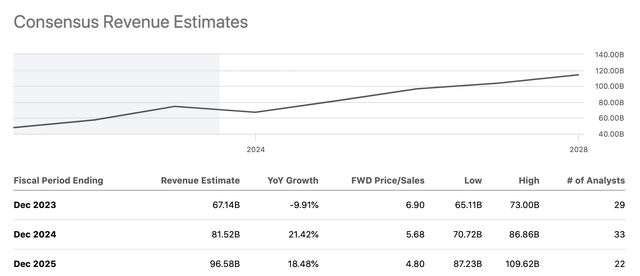

TSMC cut revenue forecasts for the year to a 10% dip, but the numbers will rebound in 2024 and into 2025. The current consensus revenue estimates have 2025 reaching $96.6 to top the previous peak in 2022, but the targets aren't going to reach the 20% CAGR clip without a rebound in the 25% range.

Remember, even with TSMC cutting capex spending forecasts for the year to the lower of the prior range of $32 to $36 billion, the Taiwanese company is still spending more than Intel (INTC) by a wide margin. The lower spending on capex this year will reduce depreciation expenses in future years helping profits rebound faster.

After a 10% revenue dip this year, the current consensus analyst estimates don't appear to support the prior forecast for 15% to 20% growth over the period. TSMC would now need to grow at 25% clips in order to make up the loss revenue this year by over $7 billion on the 10% forecasted dip.

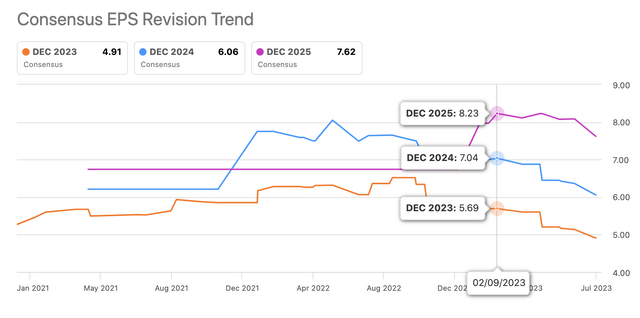

The recent dip in demand doesn't support a cut from the expectations for 2024 and 2025. In fact, the booming AI demand fully supports a scenario where the prior EPS targets are hit, as smartphone and PC demand should ultimately rebound and provide a tailwind by next year.

On the dip below $100, the stock trades below 14x more normalized 2024 EPS targets of $7+ from back in February. Don't forget, these EPS targets were from back in February prior to Nvidia signaling the booming demand for AI chips due to the success of generative AI and LLMs. In fact, Nvidia didn't shocked the market until late May with the surprising 50% guide up for the July quarter. If anything, the booming AI demand should support TSMC reporting 2024/25 numbers topping the estimates from earlier this year. Any of the weak demand in 2023 should only be temporary.

Takeaway

The key investor takeaway is that the markets are overreacting to some lingering weakness in China and smartphone markets. These issues will pass and the AI boom will boost TSMC profits above the peak 2022 levels and likely to levels topping prior estimates when 2023 started.

Investors should use this weakness to load up on the leading foundry stock.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.