Global Asset Allocation Viewpoints, Q3 2023 - Time Is Running Out

Summary

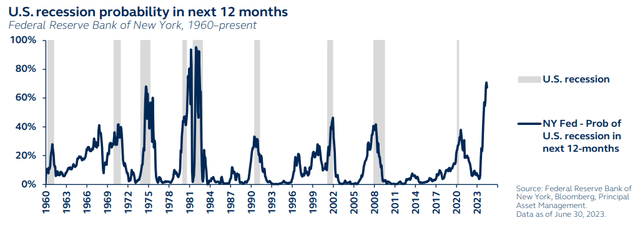

- Despite resilient U.S. growth, the foundations have been laid for a short and shallow recession later this year.

- Notably, as a U.S. recession will likely be short and shallow, any equity pullback will likely be short and shallow. The following recovery will likely be reasonably swift, requiring a nimble and active response from investors.

- While U.S. growth has remained robust, the European economy fell into recession at the end of 2022, and China’s post-reopening economic recovery has lost significant momentum. The outlook for the rest of the year is relatively downbeat.

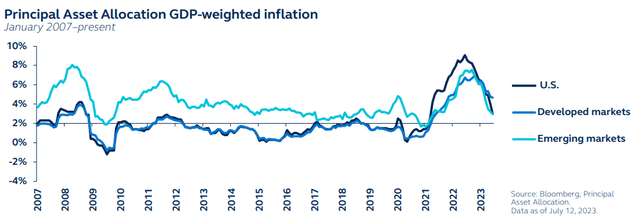

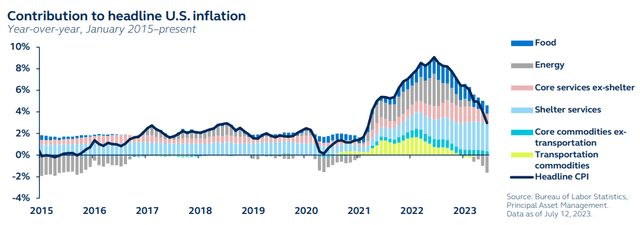

- Headline inflation is falling rapidly, but core inflation is proving to be a worry in developed markets. Slower economic growth will be required to reach global central bank inflation targets. By contrast, emerging market inflation has fallen below developed market inflation.

William_Potter

Key themes for 3Q 2023

- Europe is weakening, China is disappointing, and the U.S. is approaching recession. While manufacturing has struggled, global growth has been supported by the services sector. Despite resilient U.S. growth, the foundations have been laid for a short and shallow recession later this year.

- Inflation is decelerating, but at a slow pace, and will end the year meaningfully above target. Headline inflation is falling rapidly, but core inflation is proving to be a worry in developed markets (DM). Slower economic growth will be required to reach global central bank inflation targets. By contrast, emerging market (EM) inflation has fallen below DM inflation.

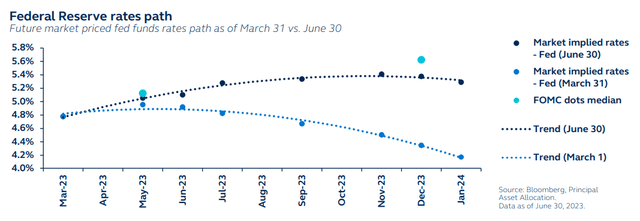

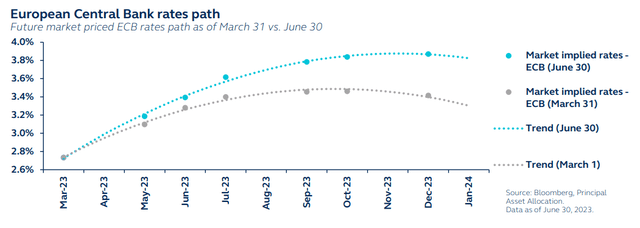

- Most central banks are not done with monetary tightening; rate cuts off the agenda in DM. Stubborn core inflation has led to a repricing of central bank rate hikes, with further hikes to come in most DM economies, including the Federal Reserve (Fed). Inflation caution also implies that rate cuts will not start in 2023.

- Equities will come under pressure as earnings weaken and further rate hikes test valuations. Notably, as a U.S. recession will likely be short and shallow, any equity pullback will likely be short and shallow. The following recovery will likely be reasonably swift, requiring a nimble and active response from investors.

- High-quality fixed-income offers stability and income in this unfolding economic backdrop. While higher-quality bonds will likely outperform and provide important diversification benefits, the mild recovery implies high yield (HY) defaults may not spike significantly, and elevated HY yields could provide a decent cushion as spreads widen.

- Alternatives provide important diversification against traditional equities and fixed-income. Inflation is decelerating but remains sticky and elevated, so inflation mitigation via infrastructure remains crucial for investors. By contrast, the slowing growth outlook will further depress commodities and natural resources.

Investment themes

Consensus without conviction

There is currently minimal dispersion in the macroeconomic view amongst investors. A U.S. growth slowdown, an approaching end to Fed tightening, and disinflation are the three almost universally shared expectations connecting most views. Yet, the continued resilience of the labor market, stickiness of inflation, and gravity-defying gains of artificial intelligence (AI)-related stocks have muddied the picture and injected significant uncertainty into the outlook. As a result, investors have limited conviction about near-term market trends and are waiting for clarity about where the economy, rates, and markets will go before taking active positions. Against an uncertain and confusing macro backdrop, investors would be best served by having a well-diversified broad toolkit among strategies, products, and industries.

Short, shallow U.S. recession

The extent of Fed tightening will likely drive the U.S. into recession. However, this recession - starting in 4Q 2023 - will likely be of shorter duration and shallower magnitude than the historical average. Not only are consumers benefitting from the cushion of excess savings, but labor supply is so tight that a cooling of labor demand may not necessarily lead to significant job losses. Furthermore, the health of household and business balance sheets implies that much of the interest rate sensitivity of the economy has diminished. A short, shallow recession implies that the period ahead will be nothing like the Global Financial Crisis, where asset values were fundamentally impacted for a prolonged time. Instead, a rapid resumption of positive market returns is likely after a correction in valuations to more reasonable levels. Investors should be ready to increase risk asset exposure as the economy approaches its trough.

Lower returns, elevated volatility

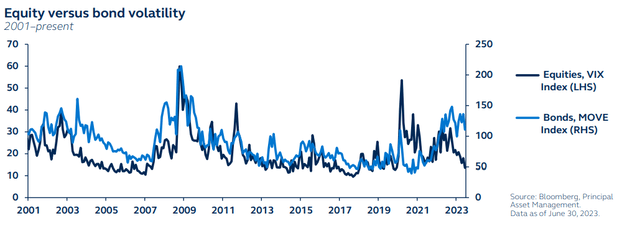

The reversal in ultra-loose global central bank policy has led to an almost unrecognizable global investment landscape. Unlike the golden era of the past decade, where low inflation and low interest rates were suppressing volatility and lifting asset prices, the higher interest rate environment is now uncovering market strains and raising volatility. Investor behavior will need to adjust: expectations for long-term returns need to be lowered, and expectations for volatility need to be raised. Portfolios will need to reallocate risk to take advantage of market inefficiencies and minimize exposure to macro-driven threats.

Consider the potential risks

Financial instability: The drastic rise in rates risks further severe liquidity disruption. Markets have navigated the rate increases and the regional banking crisis without too much disruption, but there is no guarantee that the remainder of 2023 will be as straightforward.

Market melt-up: The AI craze has likely moved too far, too fast. But, without any clear catalyst, mega-cap stocks may continue to rise uninterrupted, pulling up the whole market with them. In this melt-up scenario, valuations would become even more top-heavy, creating a market extremely vulnerable to a significant correction.

Resurgent inflation: If a meaningful decline in core inflation does not materialize, or if inflation starts to rise again, the Fed and other central banks may need to resume aggressive policy tightening. Not only would that deliver additional headwinds to growth, but also add to financial instability risk.

Global economy: Shades of grey

In the face of multiple and significant headwinds, global economic growth has proved resilient. Yet, this is more than a one-size-fits-all picture. While services activity is buoyant, global manufacturing activity is struggling. Regionally, there is some divergence. While U.S. growth has remained robust, the European economy fell into recession at the end of 2022, and China’s post-reopening economic recovery has lost significant momentum. The outlook for the rest of the year is relatively downbeat. Europe’s growth is set to slow, with recovery likely to be limited by tight European Central Bank (ECB) monetary policy. In China, in the absence of significant and proactive policy stimulus, activity will likely remain somewhat depressed. In the U.S., recession risk remains heightened, with concerns centering around profit margin compression and tightening credit conditions. Indeed, while the continued resilience of consumers and the labor market suggest that a U.S. recession is not imminent, leading indicators almost uniformly signal slowing economic growth as the full effects of significant and aggressive Fed tightening are finally felt.

With the three-largest economies facing varying levels of slowdown, the global growth outlook has deteriorated.

Recession: Stop me if you’ve heard this one before...

Despite significant monetary tightening, incoming U.S. economic activity data is nowhere near recessionary. Yet, this doesn’t mean that interest rate hikes aren’t working. Policy works with lags, and the full impact of previous hikes is only now starting to unfold. Several factors will stop supporting the U.S. economy over the coming months and are expected to combine to tip the U.S. into mild recession by year-end:

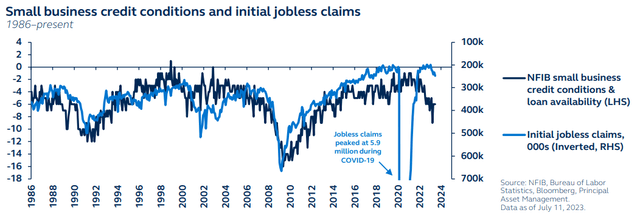

- Labor demand has been robust, but a softening trend is tentatively beginning to emerge, with monthly non-farm payrolls falling to their lowest level since COVID. Average hours worked have been drifting lower, jobless claims are on the rise. These are leading indicators of job losses.

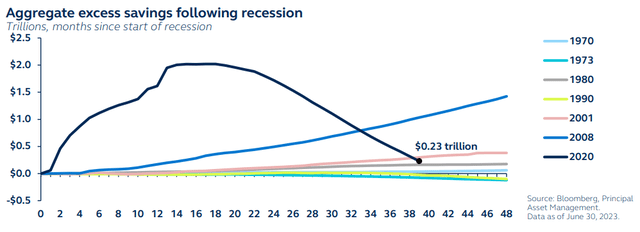

- Consumer activity has been strongly supported by the historically large excess savings cushion. However, savings are gradually being eroded by exuberant spending, inflation, mortgage costs, and time. At the current pace of drawdown, excess savings will be exhausted by 4Q 2023, removing a major support structure for the U.S. economy.

- The recent banking crisis will likely further deteriorate the economic picture. Tightening credit conditions usually act as an accelerant to the unwind in both consumer spending and the labor market.

Deterioration in both consumer spending and labor market activity will likely precipitate the arrival of one of the most-anticipated recessions in history.

Global disinflation dispersion

Global headline inflation continues to moderate, helped along by falling energy prices. However, developed market core inflation remains very elevated:

- U.S. core inflation has fallen only slightly, and monthly core inflation is essentially unchanged from late-2022.

- Euro area core inflation has only just peaked, and price pressures remain very broad across the economy.

- UK core inflation is still yet to peak.

- Japan’s inflation is broadening, reaching healthier levels.

DM inflation is likely to remain notably higher than global central bank targets. Core commodities inflation in the U.S. is expected to fall further, given the ongoing weakness in goods demand, and shelter inflation should begin to abate slowly. The concern lies in the very slow deceleration of core services ex-housing. If the labor market remains extremely tight, inflation in this critical segment will remain too high for the Fed’s comfort, and the disinflation trend will be incomplete.

By contrast, China’s consumer prices are barely increasing, and emerging market inflation actually fell below developed market inflation in April.

DM central banks have made less progress towards disinflation than they had hoped. Inflation is likely to remain sticky and will still sit above global central bank targets at year-end.

Central bank tightening: Not the end of the road just yet

During early 2Q, broad market consensus converged around the idea that global monetary loosening would start before year-end, with this expectation lifting risky assets. However, it has become clear that rate hikes are yet to have the desired impact on inflation, requiring further tightening.

The Fed’s latest dot pot shows that most committee members expect at least two more hikes this year. By contrast, with modest recession on the horizon, our long-held Fed forecast sees just one more increase, bringing policy rates to a peak of 5.25-5.50%.

Both the ECB and the Bank of England (BoE) have inflation challenges. For the ECB, this implies hikes may persist into Autumn. For the BoE, policy rates will likely rise another 100 basis points and may exceed 6%, raising the risk of recession.

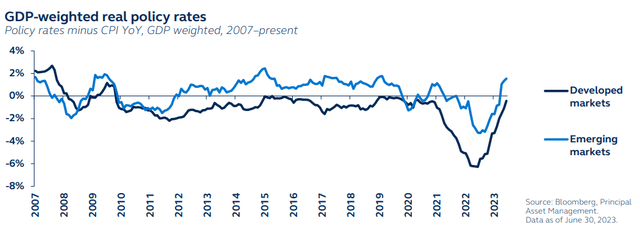

Central banks will need to keep an eye on financial stability. The U.S. regional banking crisis is past the acute phase, but additional tightening may threaten renewed stress. Inflation persistence also means that rate cuts are off the agenda for all major developed market central banks this year. By contrast, central banks in emerging markets, which began hiking rates in 2021, well before their DM counterparts, are either cutting rates or will soon start.

Inflation persistence means that markets need to raise their developed market rate expectations and also price out any rate cuts this year.

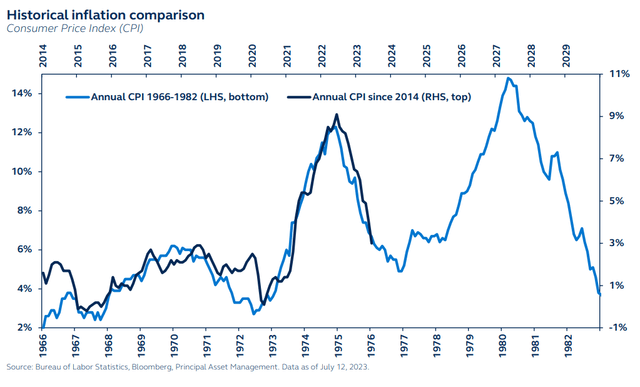

Lessons from the '70s: No space for rate cuts in 2023

While it’s reasonable to assume the Fed might provide relief if the economy falls into recession later this year, a modest contraction in activity and limited rise in job losses would not justify rate cuts. History clearly warns against cutting rates before inflation price stability has been achieved.

The striking similarities between U.S. inflation developments today and those of the early 1970s could be instructive for the path forward. During the inflation spike of that period, the Fed also responded with steep interest rate hikes. After some time, the Fed was anxious to ease monetary policy, cutting interest rates before inflation had fallen back to levels consistent with price stability. The result was a resurgence in price pressures.

The experience of the 1970s has taught central bankers to take inflation risks seriously. Lowering interest rates before the Fed is confident that inflation is on a sustainable path back to 2% would threaten to undo all its hard work to date, ultimately requiring more aggressive hikes next year.

Indeed, the only scenario that would justify early rate cuts is a desperately struggling economy accompanied by a sharp increase in job losses or a financial crisis - neither a particularly favorable backdrop for investors.

The risks associated with premature rate cuts are significant. The Fed would need to see a desperately struggling economy or a financial crisis to justify rate cuts this year.

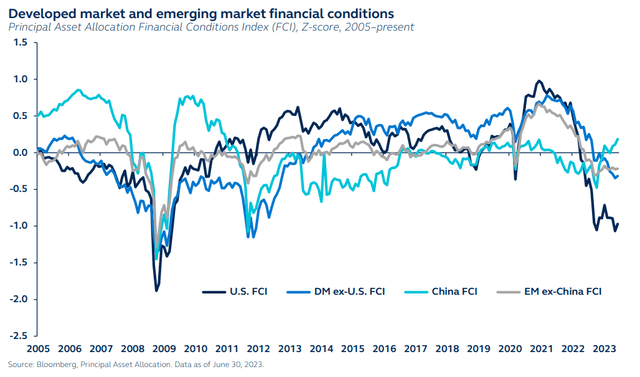

Financial conditions are overdue a reversal

Financial conditions describe how policy influences the economy through the intermediation of a wide range of market rates, risk premia, and spreads, as well as the exchange rate.

Despite continued rate hikes and the threat of recession, global financial conditions loosened in 2Q as investors became increasingly optimistic about several factors, including an imminent end to global central bank hikes, rate cuts later this year, and a potential U.S. soft landing.

However, optimistic growth expectations need to be questioned now that risks have swung towards higher terminal policy rates. As a result, market sentiment is beginning to look vulnerable, with DM financial conditions likely to tighten in the second half of 2023.

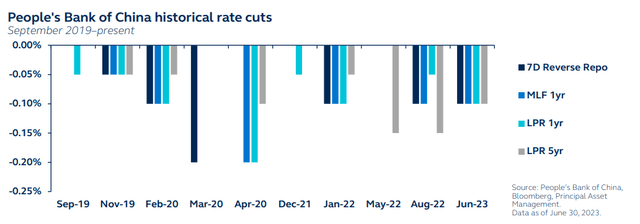

The emerging market financial conditions picture may look more constructive. Falling central bank rates in many EM economies should cushion them from the broad deterioration in global growth and market sentiment. For China, however, policy rate cuts may not be enough to offset the weakness in growth, suggesting China’s risk assets may continue to struggle.

Now that risks have swung towards higher terminal rates, market sentiment is beginning to look vulnerable and financial conditions are overdue a tightening trend.

Equities

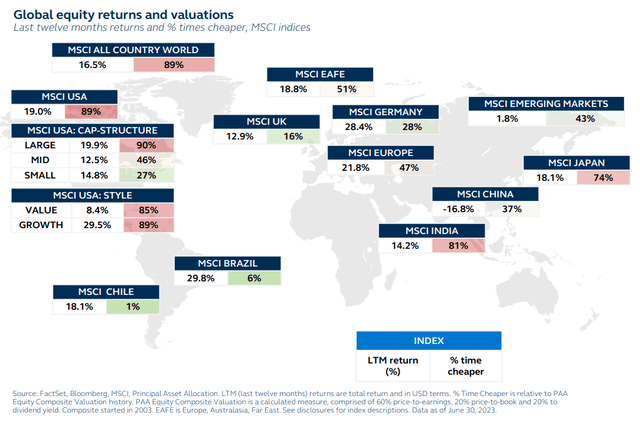

Global equity valuations are becoming more stretched

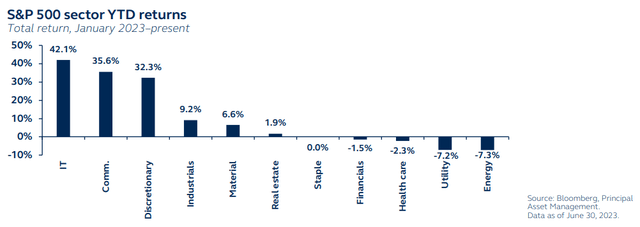

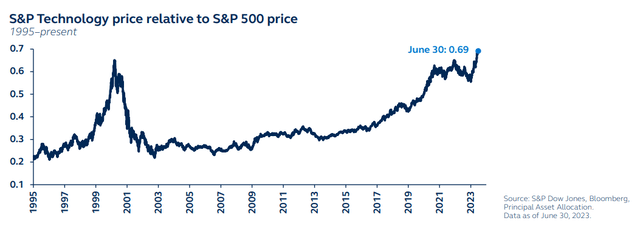

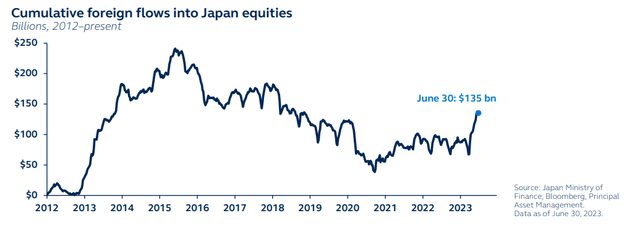

Global equities delivered a strong performance in 2Q, helped by earnings resilience and a spectacular tech rally. While fading hopes of China’s recovery have erased all their equity gains since January, the rest of emerging markets held up well. European equities lost steam as 2Q progressed, in line with China’s growth weakness. Japanese equities rallied on the back of reflation momentum and currency tailwinds. U.S. indices performed well but had a narrow market breadth, driven almost entirely by companies associated with AI excitement.

As a result, global valuations became more stretched. U.S. large-cap and growth remained the most expensive markets, while valuations in most other regions remained around or below their historical medians. Europe has become cheaper, while Japan has become more expensive, with valuations well above their historical median.

EM valuations are slightly cheaper than the historical median, but regional divergence remains significant. India’s valuations are stretched and have been cheaper 81% of the time. By contrast, and despite a strong rally in 2Q, Latin America still looks attractive, with Brazil having been cheaper only 6% of the time.

After 2Q’s rally, global equity valuations have become more stretched. The U.S. remains the most expensive market, while Latin America has rarely been cheaper.

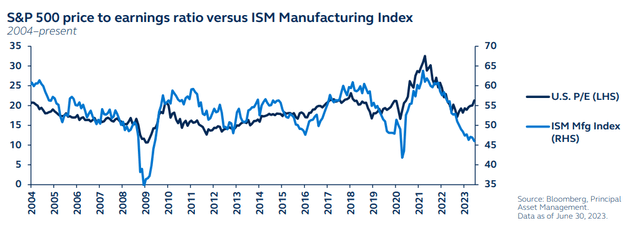

U.S. equities defy rate hikes and recession concerns

The S&P 500 entered a new bull market during 2Q, shrugging off concerns of recession and restrictive monetary policy. This has re-rated equities to higher valuation multiples, appearing stretched and unreflective of the potential earnings risks ahead.

With the foundations of an economic slowdown gradually falling into place and further Fed tightening still to come, earnings headwinds are likely to intensify. Cost cutting has preserved margins so far, but as inflation slows nominal growth, revenues are also placed at risk. Stretched valuations imply that U.S. equities are particularly vulnerable to earnings disappointment.

Yet, with recession likely to be short and shallow, any market pullback will also likely be short and shallow. Defaults should not spike significantly, while earnings decline should neither be deep nor sustained. As a result, a return to September 2022 lows for the S&P 500 is unlikely, and the window will be small for increasing exposure to U.S. equities at attractive valuations.

Investors should remain nimble and ready to deploy available cash towards U.S. equities as the economy and earnings approach their troughs.

While U.S. equities are vulnerable to earnings disappointment, the short and shallow nature of recession implies any pullback will be equally short and shallow.

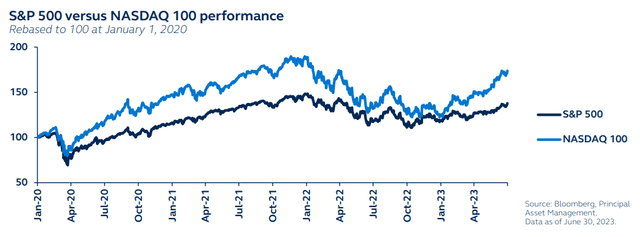

Bad breadth and narrow market leadership

While the S&P 500 has been on an impressive run, the rally has been driven by the explosive performance of only a handful of mega-cap stocks across the technology, consumer discretionary, and communications sectors - and all by companies firmly associated with AI excitement.

- Until mid-June, the five best-performing stocks in the S&P 500 had contributed 60% to returns this year (compared to an average positive contribution of 35% over the past decade).

- The market-weighted S&P 500 is outperforming the equal-weighted S&P 500 by 11% - the largest year-to-date outperformance since records began in 1990.

- Even more astounding, the outperformance of the S&P 500 Technology sector over the broader index is now higher than during the dot-com era.

Such narrow market concentration is a potential concern for investors. Against a backdrop of further monetary tightening and economic slowdown, a broadening of the rally looks challenging. From here, if the few stocks driving the rally fail to deliver on elevated earnings expectations, the broad market will likely be exposed to a pullback.

The narrowness of the U.S. rally means that diversification via non-U.S. equities, which have lower tech concentration and are less correlated to the AI excitement, may be warranted.

Looking at EM equities through a non-China lens

Investors had hoped China’s post-COVID economy would resemble the post-reopening strength of the U.S. and Europe. However, the Chinese economy hit a wall in 2Q as recovery momentum lost significant steam. Aggregate financing activity in China also disappointed after an initial surge.

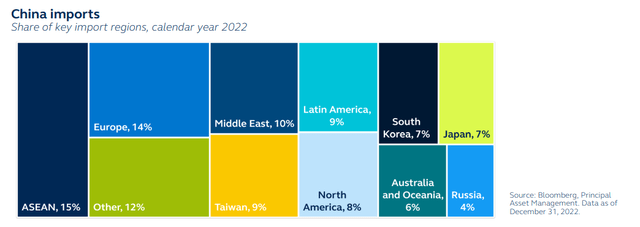

With economic weakness widely recognized by policymakers, stimulative measures are likely to follow. The central bank has already reduced several policy rates, yet the magnitude of the moves has fallen short of market expectations. Modest stimulus may be sufficient to help ensure China hits its 5% GDP growth target for 2023, but more would be needed to trigger meaningful positive spillover effects to the rest of EM and other major trading partners.

Nonetheless, there are some clear positives within EM Asia and Latin America beyond China. Emerging markets ex-China economies have generally proved stronger than DM economies, inflation is normalizing faster, and several EM central banks are primed to start cutting rates in the near future. In Latin America, for example, fundamentals are improving just as valuations are running below their historical averages - an attractive investment combination.

China’s disappointing recovery means policymakers could roll out stimulus, but it may not be big enough to benefit wider EM. However, there are positives within EM ex-China.

Europe’s and (especially) Japan’s reversal in fortunes

The euro area and Japan have enjoyed a reversal in fortunes this year, attracting significant inflows following years of investor disinterest. Yet, while the outlook for Japanese equities in 2H 2023 looks bright, Europe’s outlook is less promising.

Positive expectations for China’s reopening had previously lifted European equities, but China’s recovery has lost momentum and is potentially becoming a drag for Europe. European inflation, too, remains a significant problem, and the ECB’s hawkish response will weigh on European growth. However, the ECB’s relative hawkishness is bolstering the euro, adding to returns for USD-based investors, and justifying a neutral portfolio weighting.

Japan’s economy is experiencing a revival, with inflation and wage growth returning to healthier levels. Following its central bank peers, the Bank of Japan is widely expected to shift away from ultra-easy monetary policy in response to higher inflation. Potential strengthening in the Japanese yen will likely attract global investor attention, adding to returns for USD-based investors. Japan also provides an attractive opportunity for diversification, given that its economic cycle appears desynchronized from other DMs

Japan is enjoying an economic revival. Healthier inflation prospects will likely trigger BoJ tightening, bolstering the yen and adding to returns for USD-based investors.

Fixed-income

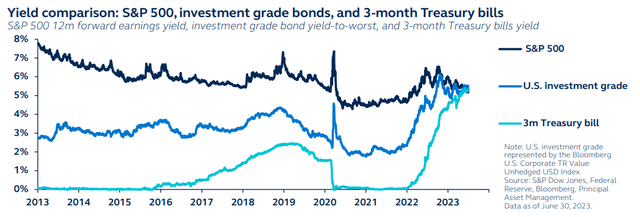

Fixed-income: Interest rate risk is favorable to equity risk

2Q began at the height of regional bank failures, which had bolstered safe-havens such as Treasurys and investment-grade bonds, and depressed riskier fixed-income sectors. As concerns about the banking sector faded and economic data showed resilience, future Fed rate cuts were pushed out to 2024 - driving an underperformance in more stable assets relative to high-yield credit and even equities.

While this performance seems justified by current economic resilience, it conflicts with forward-looking indicators suggestive of future economic deterioration. As the lagged effects of central bank tightening begin to take their toll on credit conditions and the economy slows, recent buoyancy in equities and riskier credit sectors is likely to unwind, with higher defaults, downgrades, and widening credit spreads.

In a slower-growth environment, fixed-income looks preferential to equities. Unlike bonds, equities don’t sufficiently account for recession risk, as evidenced by the subdued level of equity volatility relative to the elevated level of bond volatility. In fact, the earnings yield on stocks is now less than safer U.S. Treasurys and high-grade corporate bonds. Locking in more stable income streams and adding diversification via bonds will be prudent as an economic slowdown unfolds.

Investors are getting higher compensation for taking interest rate risk than equity risk. With the economy set to slow, there’s strong rationale for locking-in more stable fixed-income streams.

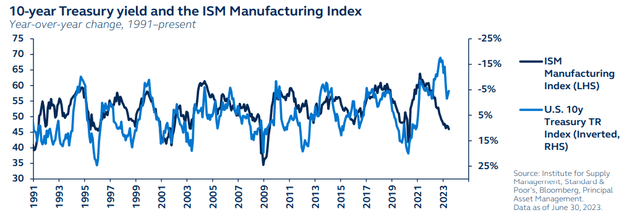

U.S. Treasurys: Playing an important role in portfolios

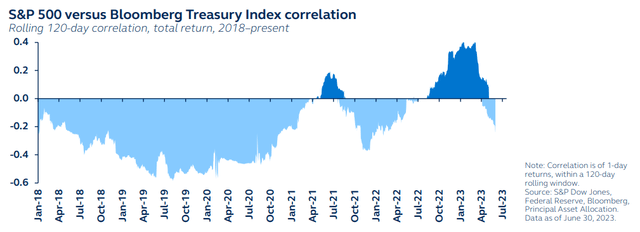

With central bank policy rates at their highest in over a decade, the value provided by sovereign bonds, particularly U.S. Treasurys, has seldom been greater. Investors are getting much higher compensation for taking interest rate risk than in previous years.

As the stock-bond correlation has turned negative, U.S. Treasurys are providing important diversification benefits and risk mitigation. While equities are likely to face earnings headwinds from a slowing U.S. economy, bond yields should come under downward pressure as expectations for future interest rates are reduced, thereby providing capital appreciation to bondholders. As such, bonds can act as a hedge against volatility and equity drawdowns.

The recent resolution to the debt ceiling discussion has raised concerns about potential upside interest risk. After hitting the debt limit in January, the U.S. Treasury ran down its cash balance to keep making payments, and now must issue around $1 trillion in debt to replenish it. As issuance is expected to be primarily short-term bills rather than notes or bonds, overall demand, especially from money market funds, should be sufficient to absorb it with little risk to long-dated maturities.

As the economy slows, U.S. Treasurys will likely provide important security and diversification benefits, as well as capital appreciation.

Navigate credit headwinds with high-quality assets

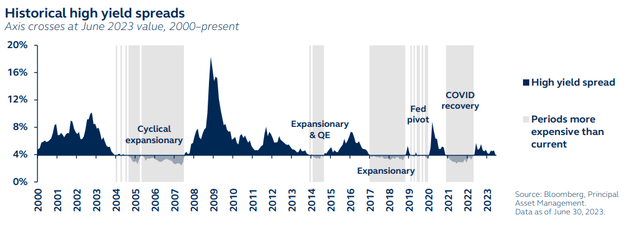

High-quality bonds underperformed low-quality bonds in 2Q as fears around the regional banking crisis and debt ceiling impasse eased. With soft-landing hopes increasing, investors are becoming more optimistic about high-yield relative to investment-grade (IG). While investment-grade spreads have been more expensive 41% of the time since December 2000, high-yield spreads have only been more expensive 33%. Higher-risk credit markets don’t appear to be pricing in potential financial stress or economic downturns, and investors should be wary.

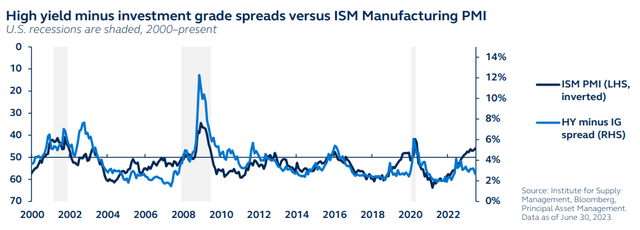

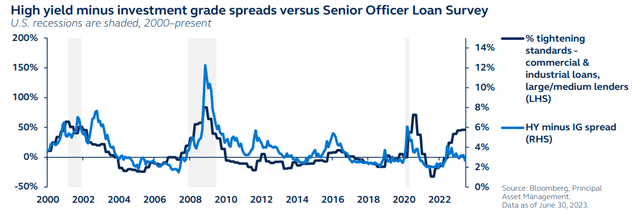

Historically, high-quality credit assets tend to outperform during economic downturns, and during recessions, the credit spreads between U.S. high-yield and investment-grade bonds tend to widen the most. While the upcoming recession will likely be mild, falling PMI activity indicators and tightening lending standards are already pointing towards wider spreads.

In addition to the spread impact, high-quality bonds also benefit from longer duration. During economic downturns, falling Treasury yields typically result in greater price gains for investment-grade credit due to IG's higher duration versus high-yield bonds.

Higher-quality fixed-income assets should outperform in economic downturns, benefitting from tighter spreads and longer duration.

High yield: Robust amidst economic weakness

High yield bonds were a bright spot in fixed-income in 2Q. Spreads have tightened significantly since their peak in March and are now pricing in a soft landing for the U.S. economy. Historically, periods where the asset class experienced tighter spreads than it is currently were characterized by economic expansions or a dovish Fed.

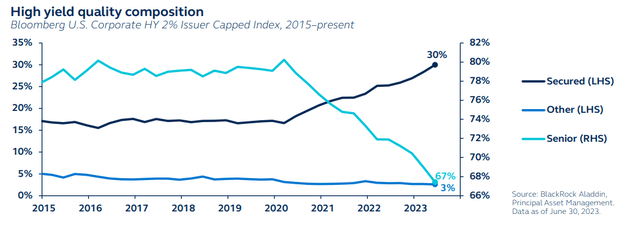

Nonetheless, with total yields an attractive 8.5% at the end of 2Q, high-yield investors would have a decent cushion if spreads were to unwind during the coming economic downturn. Overall, the asset class is better-positioned now compared to previous economic downcycles:

- The recession is expected to be mild, implying that the default spike could be lower.

- The credit quality of the high-yield index today is well above its historical average.

- Near-term refinancing pressure is low. The maturity wall remains low in 2023 and will likely only build in 2024-2025.

If U.S. Treasury yields fall substantially during recession, the shorter-duration profile of high yield would put the asset class at a disadvantage relative to high-quality bonds. However, the current attractive carry is clearly valuable to income-seeking investors.

High-yield is well-positioned given the mild recession outlook, its better credit quality, and low near-term maturity pressure. Despite rich valuations, carry is very attractive.

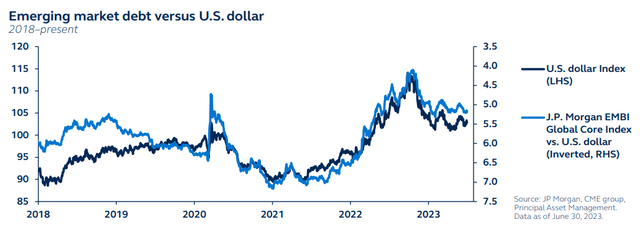

EM debt: Improved outlook but with lingering risks

Given its cyclical nature, emerging market debt (EMD) typically performs poorly in economic downturns and financial crises. However, there are a few positive catalysts for EMD in today’s macro environment.

A mild U.S. recession outlook and desynchronized economic cycles suggest EMD may escape the downturn relatively unscathed. Economic strength and resilience in other parts of the world should help support risk sentiment and prevent a significant correction in cyclical assets.

Many emerging market central banks were ahead of their developed market peers in hiking rates, successfully reining in inflation sooner. This position has allowed them to shift to a more dovish stance, with many considering rate cuts from very high levels. Such a policy change would likely provide attractive yields and enhanced returns on local currency bonds. In fact, GDP-weighted real policy rates for emerging markets are above zero, while developed markets' rates remain in negative territory. In a steadier/weaker USD environment, EM currencies should begin to regain ground.

Of course, despite the relative attractiveness, EMD is not risk-free. A deep liquidity crisis or deeper recession in the U.S. could significantly impact EMD.

Emerging market debt could escape mostly unscathed in a mild U.S. recession. Faster inflation normalization in EM is allowing their central banks to start shifting to rate cuts.

Alternatives

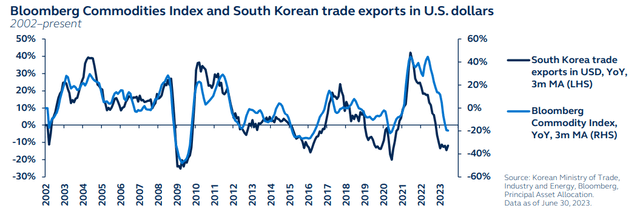

Commodities: Short-term pain but long-term gain

Except for agriculture, which has been benefiting from the hot summer outlook in the Northern Hemisphere, broad commodities have struggled this year. The prospect of a global economic slowdown will likely weigh further on commodity performance over the coming quarters.

With China’s reopening losing significant momentum and policy stimulus underwhelming expectations, boosted commodity demand from Asia seems unlikely. In the U.S., despite a seemingly resilient economy, the foundations for a meaningful slowdown later this year are in place. So, while segments of the global economy look stronger, they will not be able to offset the reduced commodity demand from the world’s two largest economies.

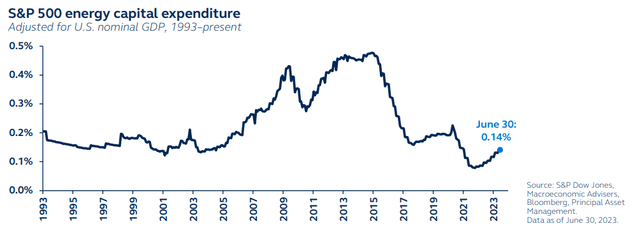

The short-term outlook for natural resources has also declined. The equity beta component embedded in natural resources may result in further downside if the weakening economic backdrop weighs on the broader equity market. The long-term outlook, however, remains more constructive. Limited capital expenditure in fossil fuels capacity in recent years implies that commodities will likely remain in a long-term state of structural supply deficits that will support commodity prices.

The short-term commodity outlook is fairly weak as China growth concerns add to U.S. growth fears. By contrast, long-term trends are clearer and more constructive.

Infrastructure’s crucial defensive role in portfolios

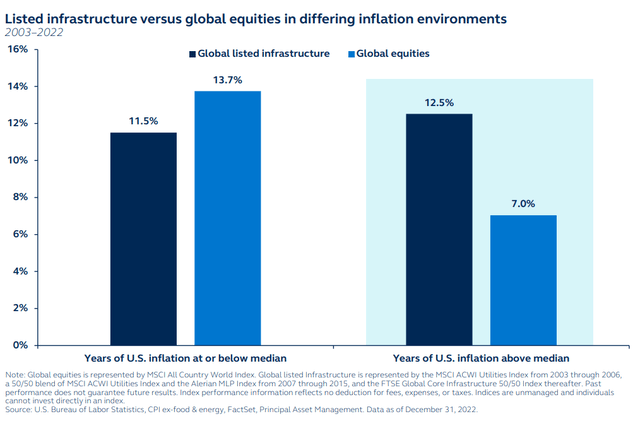

A continued constructive view of listed infrastructure conveys its diversification benefits in this macro environment and its fundamental strengths and defensive characteristics.

Listed infrastructure is one of the few asset classes that can potentially outperform in a slowing-growth, sticky inflation environment. Indeed, listed infrastructure has historically delivered meaningfully higher returns than global equities during periods of elevated inflation. For investors, although inflation has decelerated fairly rapidly from its peak, the next phase of bringing inflation down toward 2% is likely to be more challenging.

While infrastructure may not outperform if the U.S. economy achieves a soft landing and inflation declines quickly, its equity beta means infrastructure should not significantly underperform global equities.

From a portfolio perspective, infrastructure investments can offer more stability, typically having predictable cash flows associated with the long-lived assets. They also provide exposure to the global theme of decarbonization, which presents a multi-decade tailwind for utilities and renewable infrastructure companies.

Infrastructure continues to offer important inflation mitigation and a more stable income stream.

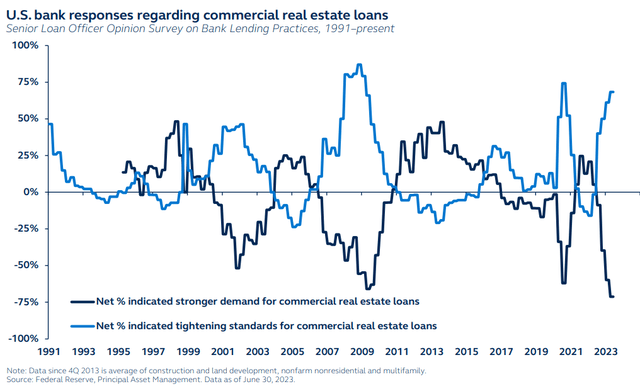

REITs are vulnerable to recent banking sector strains

REITs continue to be challenged, with office REITs, in particular, still struggling in the face of sluggish return-to-office trends and the tightening credit environment.

Recent events in the U.S. regional banking sector have broadly resulted in tighter lending standards, wider credit spreads, and lower credit availability for real estate. Scarce and expensive debt is set to continue pressuring transaction volumes, likely driving a further pullback from commercial real estate - and therefore REITs - in the coming months.

However, REITs are likely approaching the bottom of their cycle. Traditional office space accounts for only 3% of the overall U.S. REIT market. At the same time, other nontraditional sectors, such as single-family rental, self-storage, and wireless towers, enjoy structural demand drivers and provide earnings resiliency. After some further adjustments, REIT valuations will likely start to look attractive again.

Furthermore, as economic growth weakens and bond yields fall, REITs would typically perform well as a traditionally defensive, low-volatility, rate-sensitive sector. As such, once valuations have reset, deteriorating economic fundamentals may signal a more positive story for REITs.

REITs are due for a further pullback. Yet, once valuations have reset, deteriorating economic fundamentals may signal a more positive story for REITs.

Investment implications

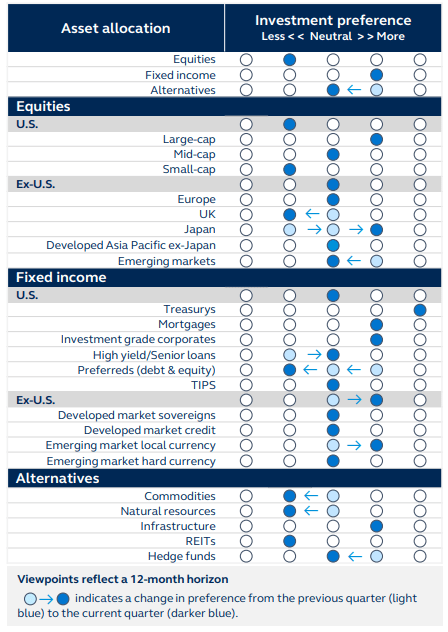

Diversified asset allocation: Underweight equities, overweight bonds and neutral alternatives.

Equities

In recognition of the economic risks, our equities positioning remains at underweight. We prefer other markets over the U.S. Still, the shallow nature of the expected U.S. recession means that a significant and sustained pullback is unlikely, and investors should look for the opportunity to increase exposure once there has been some correction in current valuations. Within the U.S., large-cap equities should continue to benefit from both cyclical and secular fundamental tailwinds, although there is a risk of some pullback if elevated earnings expectations for tech firms prove overly optimistic. Within developed markets ex-U.S., we increase our exposure to Japan due to the economic revival and likely shift in central bank policy. Within emerging markets, China’s recovery has proved disappointing, but there are substantial opportunities in other regions.

Fixed-income

Our fixed-income positioning remains at overweight, with bonds likely providing more stability during the coming economic slowdown. Within the U.S., we keep our overweight exposure to U.S. Treasurys, mortgages, and investment-grade, recognizing that these fixed-income assets' longer-duration, high-quality profile should outperform as the economy slows. We move high-yield to neutral, acknowledging that while spreads will likely widen as the economy slows, elevated yields may provide a decent cushion if spreads unwind. In addition, high-yield credit quality is well above its historical average. Local currency emerging market debt moves to overweight as high-real yields, central bank rate cuts, and likely further dollar weakness should combine to enhance returns.

Alternatives

Alternatives shift to neutral as, although they provide important diversification benefits, the outlook for specific segments has deteriorated. We shift our commodities and natural resources positions to underweight, concerned by the coming global growth slowdown and likely equity market downturn. REITs remain at underweight, given continued pressures on the real estate sector, particularly from the office space. We shift hedge funds to neutral as volatility remains very subdued. By contrast, we maintain our overweight to infrastructure, encouraged by its inflation protection characteristics, stability of cash flows, and exposure to the structural decarbonization trend.

Alternatives asset class include commodities, natural resources, infrastructure, REITs, and hedge funds. Allocations across the investment outlook can be proportionately adjusted so magnitudes across categories do not have to net to neutral. Data as of June 30, 2023.

| Equities Reduce risk appetite and focus on U.S. large-cap and quality factor. | Position toward certainty • Exposure to quality within equities can potentially offer risk mitigation during pullbacks. • Attractive international valuations suggest opportunities outside the U.S. • U.S. large-cap offers stronger geographical revenue exposure and more attractive valuations. | How to implement • Large-cap U.S. strategies • Quality-biased active managers • Well-diversified and active international managers | |

| Fixed-income Increase exposure to high-quality credit. | High-quality, core fixed-income • Core fixed-income to hide out in as recession risk rises. • Recommend increasing duration bias across the asset class. | How to implement • IG credit heavy core fixed-income for stability • Agency MBS strategies | |

| Alternatives Pursue less correlated real asset exposures. | Real assets • Real return-focused strategies gain attractiveness when nominal growth slows. • Infrastructure offers more stable cash flows with potentially attractive yield. • Real assets can help mitigate inflation risk. | How to implement • Diversified real asset strategies (infrastructure, natural resources) • Private real estate markets | |

This article was written by