Bristol-Myers Squibb Is A Buy At Current Support (Technical Analysis)

Summary

- Bristol-Myers Squibb Company (BMY) is a promising investment opportunity due to its strong presence in oncology and immunology, and its robust pipeline of compounds in development.

- The stock price of BMY demonstrates a strong bullish trend, suggesting a promising buying opportunity.

- The appearance of a key reversal candle within the ascending channel further reinforces the bullish prospects for BMY.

Solskin

This detailed article offers a positive investment viewpoint on Bristol-Myers Squibb Company (NYSE:BMY), a distinguished pharmaceutical enterprise with a lasting legacy and remarkable portfolio. BMY has a firm footing in the ever-expanding fields of oncology and immunology, coupled with numerous compounds currently in development, underscoring its dedication to innovation and sustained growth. This article presents the technical evaluation of BMY's stock price, with the aim of forecasting its future trajectory to identify potential investment opportunities. Notably, the stock price demonstrates a robust bullish trend and seems to rebound from a critical support region, displaying vigorous price activity. This potent price action points towards a promising buying opportunity in the market.

A Bullish Investment Perspective

BMY is a leading pharmaceutical company with a longstanding history and an impressive portfolio, exhibiting an undeniable potential for investors with a bullish perspective. The chart below paints a vivid picture of BMY's long-term profitability, as it provides a detailed examination of the company's quarterly revenue and net income. The revenue for the first quarter experienced a slight dip, descending to $11.34 billion, yet, there was an upswing in net income to $2.262. This uptick in net income, despite a slight dip in revenue, positions BMY as a strong potential investment candidate. BMY has a strong presence in the high-demand sectors of oncology and immunology, bolstered by an impressive portfolio. Its ongoing commitment to innovation and steady growth is further exemplified by the more than 50 compounds currently in development and the myriad of ongoing clinical trials. This positions BMY as a shining exemplar of progress in the pharmaceutical industry.

With the unfortunate reality of an aging global population, the demand for lifesaving medicines is predicted to rise in the coming years. The company's products, both existing and under development, could help fill this growing need. Moreover, BMY has demonstrated an impressive ability to navigate the challenging landscape of patent expiration, ensuring the continual growth of its portfolio. What makes BMY particularly compelling is its progress in developing a drug for non-small cell lung cancer, a leading cause of cancer-related deaths in the U.S. The company's drug candidate, repotrectinib, recently accepted for priority review by the FDA, has shown encouraging results in phase 1/2 clinical trials, significantly reducing tumor sizes in a majority of patients. The success of this drug can contribute to a meaningful increase in annual sales and profitability.

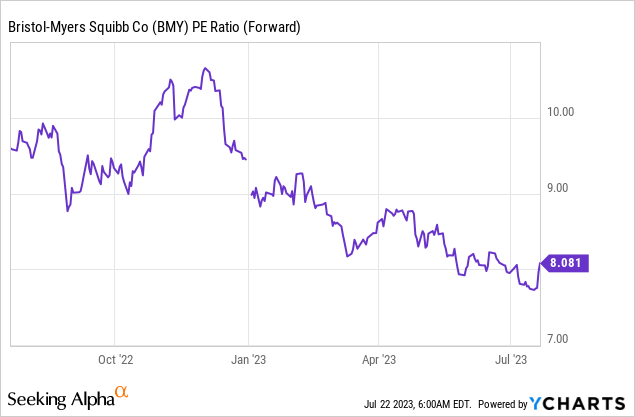

Currently, BMY's stock may be underappreciated, having dipped more than 10% in 2023. However, its forward price-to-earnings ratio of 8.081, well below the drug pharmaceutical industry average of 14.04, combined with a robust pipeline that can withstand patent expirations of key drugs like Eliquis and Opdivo, offers an enticing opportunity for value investors. Thus, the overall picture suggests a bullish future for BMY, highlighting the company as a worthwhile consideration for prospective investors.

Interpreting the Recent Bounce in Bristol-Myers

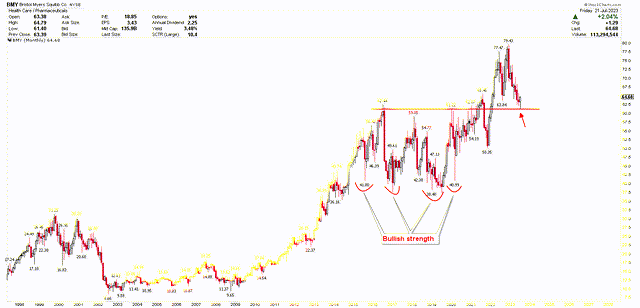

The BMY's robust long-term outlook is reflected in the solid bullish price structure evident in the yearly chart below. Over the past four decades, BMY has enjoyed an impressive uptrend, indicating robust investor confidence and market potential. The most considerable correction in the company's history occurred between 1999 and 2002 when the stock price fell from a high of $31.25 to a low of $8.66. This decline was influenced by the dot-com bubble's burst, which led to a broad economic recession. However, it is important to note that the company's overall bullish structure remained unscathed, reflecting its resilience in challenging economic climates.

BMY Yearly Chart (stockcharts.com)

BMY experienced its second most significant price correction between 2016 and 2019, plummeting from a high of $62.44 to a low of $37.47. Despite this drop, the bullish trend rebounded with the 2019 candle signaling a key reversal, setting off a new rally in the market. This resurgence of BMY was followed by a period of increased market volatility after 2019, which catapulted the company's share price to an all-time high of $79.43 by 2022. The current price correction back to the level of $62.44, the breakout point, should attract new investors and spur further growth, affirming the stock's healthy long-term outlook.

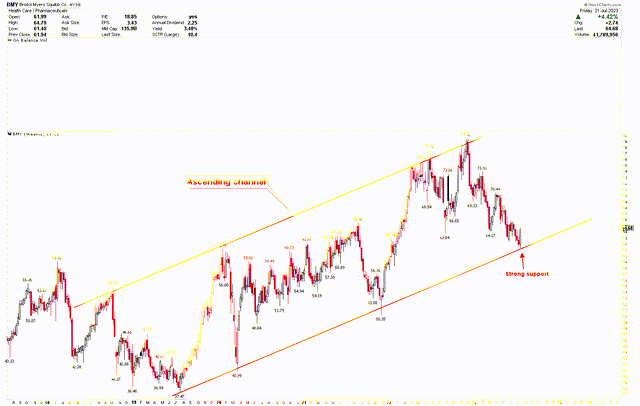

The bullish momentum becomes even more evident in the monthly chart below. BMY's share price was consolidating within a $40 to $60 range, with the price swiftly rebounding each time it neared the lower $40 mark. This pattern changed course in 2022 when the company's shares broke the consolidation phase, closing above the red line and leading to an all-time high. Currently, the price is stabilizing following a correction back to the breakout level. A bounce from this support region has the potential to create a bullish hammer on the monthly chart, particularly if the closing price for July 2023 exceeds $65, thereby reinforcing a solid buy signal.

BMY Monthly Chart (stockcharts.com)

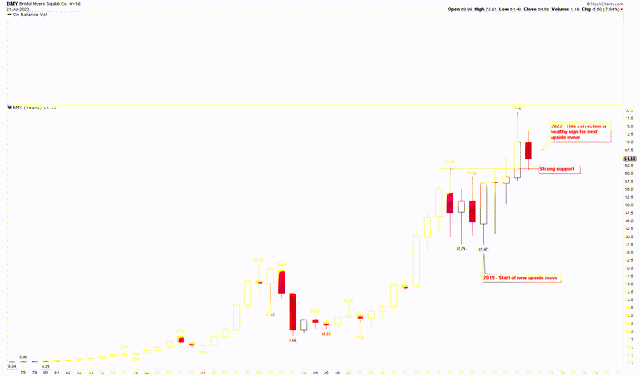

In addition, the weekly chart provides another valuable perspective by showing an ascending channel. BMY's share price is bouncing back from a low of $61.40, marking a robust key reversal candle at this strong support region. This key reversal candle at this significant support region signals the likelihood of the price strengthening over the coming weeks. Astute investors can leverage this key reversal candle and the bullish price action to take up positions. The risk associated with investing at this point is low, given the price is viewed as a bargain following the recent correction from the all-time highs. This serves to underline the appeal of BMY's stock to potential investors. The company's ability to recover from corrections and its steady growth trajectory speaks to its robust market position and future potential.

BMY Weekly Chart (stockcharts.com)

Market Risks

BMY’s operations reside predominantly in the oncology and immunology sectors, areas of medicine that are notably competitive and fast-paced in terms of research and development. The company's ability to maintain its strong foothold in these markets is dependent on its capacity to continue producing innovative and effective treatments. Any failures or delays in developing and bringing new products to market could impact revenue and growth projections, posing a risk for investors.

The company is also heavily reliant on the success of its extensive pipeline of compounds under development and clinical trials. While this demonstrates the company's commitment to growth and innovation, it also leaves it susceptible to any unsuccessful clinical trial results or regulatory disapprovals, which could result in substantial financial losses and a subsequent drop in stock value.

From a technical standpoint, BMY's stock price is showcasing a robust recovery from the potent support zone of $62. If the price were to drop below this threshold, it would suggest an increased likelihood of further downward movement in the market.

Bottom Line

In conclusion, BMY represents a significant and enticing prospect for value investors, offering a compelling combination of growth potential, resilience, and commitment to innovation. Despite recent setbacks in revenue and stock value, the firm's resilient nature and continual investment in new products signal its potential for a strong recovery. Furthermore, the company's ongoing research into new medical solutions, such as the promising drug repotrectinib, adds to its allure as an investment prospect. The technical analysis aligns with the fundamental outlook, with the price forming a solid base at a strong support region. The appearance of a weekly key reversal within the rising channel suggests the probability of additional price growth in the upcoming period. Additionally, a price closing above $65 in July 2023 will give rise to a bullish key reversal on a monthly basis. Hence, investors can consider enhancing their stakes at the present levels to benefit from a potential future rally in BMY.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)

*Intrinsic Value Calculator by Benjamin Graham

www.investingcalculator.org/...Inputs can be found here: finviz.com/...ycharts.com/...Current "normal" earnings: $3.43

Growth rate (EPS growth next 5 yrs): 3.49%

Corporate Aaa bond: 4.62%

Margin of safety: Subjective; Buffett likes about 25%

Current stock price: $64.68

Finally, click on "calculate" button