Phillip Morris' Tobacco Prospects Are Smoking Indeed

Summary

- Consumer demand for tobacco products remains robust, despite the sustained hike in Average Selling Prices, contributing to PM's expanding shipment volumes and gross margins.

- The management also intensified its investments in the IQOS ILUMA, easily expanding the smoke-free segment's top line and global market share.

- However, this cadence has triggered a decline in its operating margins and FCF generation, potentially moderating its next dividend hike in FQ3'23.

- Then again, we remain confident about PM's execution, due to the accelerating growth in the global IQOS users, with the US launch likely occurring by 2024/ 2025.

porpeller/iStock via Getty Images

PM Continues To Execute A Robust Tobacco Investment Thesis

We previously covered Philip Morris (NYSE:PM) in May 2023, discussing its potential entry to the US smoke-free market by 2024, thanks to the reassigned IQOS rights from Altria (MO) and supposed domestic production line.

We believed that the tobacco company might still experience a significant tailwind in the smoke-free category, further accelerating its "ambition to become a majority smoke-free business" by 2025, easily countering the decline in the global cigarette consumption.

For now, PM has delivered an exemplary FQ2'23 performance on July 20th, with revenues of $8.96B (+12.3% QoQ/ +14.9% YoY) and adj EPS of $1.60 (+15.9% QoQ/ +8.1% YoY).

Most importantly, it appears that consumer demand remains robust, despite the sustained hike in Average Selling Prices, due to the tobacco company's expanding cigarette shipment volume of 157.01B (+9.2% QoQ/ inline YoY), HTU volume of 31.42B (+14.7% QoQ/ +26.5% YoY), and Oral Products volume of 197.4M (+13.9% QoQ/ +13.8% YoY) in the latest quarter.

This has naturally contributed to PM's exemplary FQ2'23 gross margins of 64% (+1.7 points QoQ/ -2.4 YoY), easily countering the rising inflationary pressures on materials and energy costs.

Then again, the tobacco company's operating expenses have also drastically accelerated to $3.17B (+46.7% QoQ/ +49.5% YoY), likely attributed to the IQOS ILUMA/ ZYN global ramp-up and Swedish Match acquisition, among others. This naturally triggers headwinds to its adj operating margins to 39.4% (+2.1 points QoQ/ -1.8 YoY) in the latest quarter.

Combined with its growing long-term debts of $41.4B (+2.5% QoQ/ +85.9% YoY) and the Fed's sustained rate hikes thus far, PM faces further profitability headwind, since its annualized interest expenses have also expanded to $1.18B (+1.3% QoQ/ +135.7% YoY) in FQ2'23.

While the management has attempted to manage the interest rate risks, ~82% of its debts are unfortunately exposed to the rising variable rates of approximately 4% in FQ1'23 (+0.41 points QoQ/ +0.74 YoY). Therefore, depending on when the Fed pivots, we may see the tobacco company's EPS impacted in the intermediate term.

Then again, PM investors need not be concerned about the safety of its dividends, since the management has maintained its FY2023 Free Cash Flow guidance of $9.2B at the midpoint (-5.3% YoY), based on its annualized dividend cash flow of $7.88B in the latest quarter (inline QoQ/ +1.3% YoY).

Then again, due to the Swedish Match acquisition, the tobacco company has iterated a lack of share repurchases in 2023. Combined with the guidance of FY2023 adj EPS of $6.17 at the midpoint (+3.1% YoY), there is a good chance that its next dividend hike in FQ3'23 may be minimal.

It appears that the PM management may prefer to preserve cash on its balance sheet and focus on deleveraging, while incrementally investing on ILUMA and the US/ Wellness & Healthcare businesses.

For now, we are highly encouraged by this strategy, since the tobacco company already reported 27.2M of global IQOS users by June 30, 2023 (+5.4% QoQ/ +43.1% YoY), with adoption and market share particularly accelerating in Japan and the EU.

PM maintains its smoke-free US ambitions as well, with the US FDA PMTA and MRTPA submissions to be completed by Q4'23, suggesting that marketing authorization may be received by 2024 and launch by 2025, if everything goes well. This builds upon its long-term plans of introducing inhalable recreational/ medical use cannabinoids, through the Wellness & Healthcare business.

While the tobacco company does not break down its operating income according to Total Combustible Tobacco and Smoke-free segments, the latter's top-line has been expanding to $3.1B (+35.3% YoY) in the latest quarter, suggesting its high growth cadence, compared to the former's at $5.79B (+6% YoY).

Therefore, we remain confident about PM's prospects in the long-term, with its well-diversified smoke-free strategies likely providing further tailwind to its top/ bottom lines and market share growth, as global demand for conventional cigarettes declines.

So, Is PM Stock A Buy, Sell, or Hold?

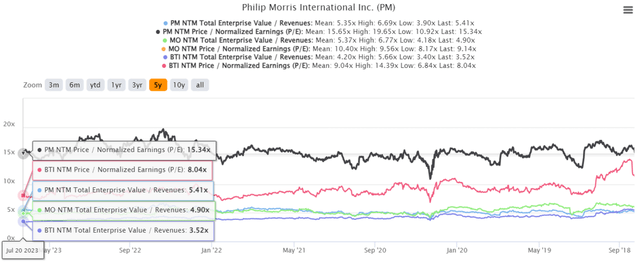

PM 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

For now, PM's valuations remain stable over the past few years, at NTM EV/ Revenues of 5.41x and NTM P/E of 15.34x, compared to its 1Y mean of 5.60x/ 16.38x and pre-pandemic mean of 5.07x/ 15.22x.

Most importantly, the stock maintains its premium valuations compared to its tobacco peers, such as MO and British American Tobacco (BTI), attributed to the success of its smoke-free offerings. This is on top of the former's accelerated top and bottom line expansion at a CAGR of +8.5%/ +8.2% through FY2025, compared to its peers' +1.3%/ +4.2% and +2.5%/ 5.3%, respectively.

Based on PM's NTM P/E valuations and the market analysts' FY2025 adj EPS projection of $7.57, I am looking at a long-term price target of $116.12, suggesting a more than decent upside potential of +18.2% from current levels.

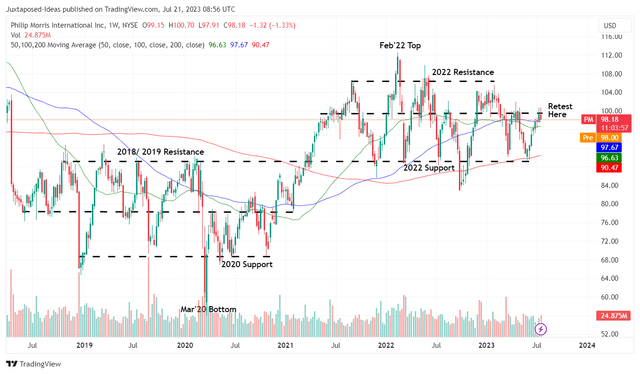

PM 5Y Stock Price

Trading View

Depending on how the PM stock performs over the next few days, bottom fishing investors may consider waiting for another retracement to its previous 2022 support levels of $90 for an improved margin of safety.

Those levels may also unlock an expanded forward dividend yield of 5.14%, though still lower than MO's 8.29% and BTI's 8.29%. Then again, based on its exemplary FQ2'23 performance and raised FY2023 guidance, we doubt the stock may do so in the near term.

Therefore, interested investors may still add PM here, due to the relatively attractive risk reward ratio.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.