Taiwan Semiconductor: Imploding Demand From Key Customers - $150B Gen-AI To The Rescue

Summary

- Unsurprisingly, TSM reports impacted top and bottom lines in FQ2'23, thanks to the pulled-forward growth from the hyper-pandemic period and ongoing inventory correction.

- This cadence may suggest that the foundry's key customers, such as AAPL, AMD, and INTC, are experiencing implosions of demand.

- The only bright spot may be NVDA, attributed to its astounding forward guidance from the robust Generative AI demand, temporarily absorbing TSM's excess capacity through its high-end GPUs.

- While we believe that the foundry may successfully execute in Arizona, its bottom line may also be impacted due to the tremendous gap in costs and work culture.

- While TSM is a Buy with a long-term PT of $147, investors must also keep abreast of the developing Chips War, despite the Generative AI's TAM of $150B by 2028.

malerapaso/iStock via Getty Images

The Drastic Normalization Cadence Is Here, With TSM Naturally Impacted

We previously covered Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in April 2023, suggesting that the likely recession might be more a pressing matter than geopolitical risks. This was due to the potential impact on its top and bottom line, worsened by the tougher YoY comparison.

The global demand for electronics might also be moderated as corporate capital expenditures were tightened, with discretionary spending impacted from the elevated interest rate environment.

True enough, TSM recently reports a drastic decline in its FQ2'23 revenues to NT$480.84B (-5.4% QoQ/ -10% YoY) and GAAP EPADR to NT$7.01 (-12.1% QoQ/ -23.3% YoY), likely suggesting a sustained deceleration cadence ahead.

This is compared to the foundry's FY2022 YoY growth of +42.6 %/ +70.4% and FY2019 YoY growth of +3.7%/ -2.5%, respectively.

TSM's gross margins have also been impacted to 54.1% (-2.2 points QoQ/ -5 YoY) in the latest quarter, due to the foundry's sharp decline in capacity utilization, compared to the FY2022 levels of 59.6% (+8 points YoY), though still improved from FY2019 levels of 46.4% (-2.1 points YoY).

As a result, it is unsurprising that TSM's operating margins have moderated to 42% (-3.5 points QoQ/ -7.1 YoY), thanks to the accelerating expenses to NT$58.24B (+5.3% QoQ/ +9.1% YoY) in FQ2'23.

This is compared to FY2022 operating margins of 49.6% (+7.6 points YoY), though still improved compared to FY2019 levels of 35.2% (-2.4 points YoY).

This cadence may suggest that TSM's key customers, such as Apple (AAPL), Advanced Micro Devices (AMD), and Intel (INTC), are experiencing implosions of demand.

For example, Foxconn (OTCPK:FXCOF) reported impacted FQ2'23 revenues of NT$1.30T (-10.9% QoQ/ -13.7% YoY), with Computing Products down QoQ though Smart Consumer Electronics remain up QoQ.

This may signal AAPL's lower Mac/ iPad sales, with iPhone sales remaining stable, similar to the March 2023 quarter, explaining why the market analysts only expect the Cupertino giant to report FQ3'23 revenues of $81.78B (-13.7% QoQ/ -1.4% YoY) and EPS of $1.19 (-21.7% QoQ/ inline YoY).

The same is expected with AMD and INTC due to the ongoing PC/ CPU headwinds, with their next quarter estimates drastically down YoY and mostly inline QoQ.

The only bright spot may be NVIDIA (NVDA), attributed to the latter's astounding forward guidance from the robust generative AI demand, temporarily absorbing TSM's excess capacity through its high-end GPUs, similarly highlighted in the foundry's FQ2'23 earnings call:

While the quantification of the total addressable opportunity is still ongoing, generative AI and large language model only reinforce the already strong conviction we have in the structural mega trend to drive TSMC's long-term growth... when the cloud services having the generative AI service revenue, I think they will increase the CapEx, that should be consistent with the long-term AI processor demand. (Seeking Alpha)

While the implosion of semi demand may be attributed to the peak recessionary fears, one may also argue that this is an expected normalization cadence after the explosive/ pulled-forward demand during the hyper-pandemic heights.

Perhaps this is why TSM already guides a rather optimistic FQ3'23 revenues of NT$526.68B at the midpoint (+9.5% QoQ/ -14.1% YoY), gross margins of 52.5% (-1.6 points QoQ/ -7.9 YoY), and operating margins of 39% (-3 points QoQ/ -11.6 YoY).

Assuming that the foundry is able to maintain its market leading profit margins, we suppose a top-line normalization is still acceptable, since no company is able to sustain the high growth cadence mostly attributed to the global supply chain imbalance during the one-off pandemic.

However, assuming that FQ4'23 develops as per FQ3'23 guidance, we may see TSM record underwhelming FY2023 revenues of NT$2.04T (-9.7% YoY) with its EPADR also declining to approximately NT$29 (-26% YoY), due to the lower capacity utilization and rising inflationary pressures.

Combined with the delayed Arizona production to 2025, "due to the insufficient amount of skilled workers required for equipment installation," it is unsurprising that the stock has fallen as it has in one day.

Then again, TSM investors should have anticipated this issue, as similarly highlighted by Morris Chang, Founder of TSM in April 2022, and Wendell Huang, VP & CFO of TSM in the FQ4'22 earnings call, due to the tremendous gap in construction/labor/material costs and work culture between the US and Taiwan.

While we believe that the foundry may successfully execute in Arizona, its bottom line may also be impacted, with the company's earnings from the Arizona plant potentially reduced by half compared to the Taiwan plants. Only time may tell.

So, Is TSM Stock A Buy, Sell, or Hold?

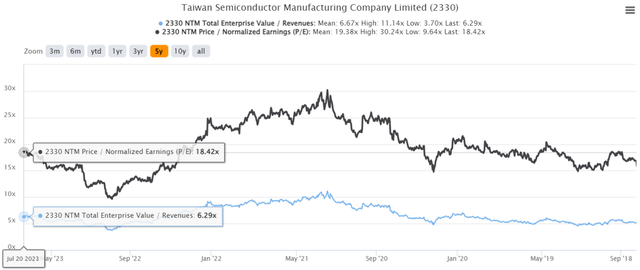

TSM 5Y EV/Revenue and P/E Valuations

For now, TSM's valuations have already normalized to NTM EV/ Revenues of 6.29x and NTM P/E of 18.42x, nearing its pre-pandemic levels of 5.70x/ 18.67x and down from its hyper-pandemic heights of 11.14x/ 30.24x, respectively.

Thanks to the tech rally and optimism surrounding generative AI, we believe the foundry may be able to sustain these stable valuations. Based on the market analysts' FY2025 EPS projection of $8.03, we are also looking at a long-term price target of $147.91, suggesting an excellent upside potential of +51.1% from current levels.

TSM 5Y Stock Price

Depending on how the market reacts to TSM's mixed FQ2'23 earning call, we believe there may be more volatility over the next few days. Therefore, bottom fishing investors may consider waiting for another retest at the $85s for an improved margin of safety.

On the one hand, we believe its moat remains unchallenged, despite INTC's best intentions, Tower Semi's expertise, and the boost from the IRA. On the other hand, TSM's uncertain margins and engineer talents in the Arizona factory remain true headwinds to its long-term prospects, worsened by the Chinese geopolitical discount.

Given its mixed prospects, it is uncertain if the TSM stock may reach its full potential, depending on how big a boost generative AI provides on its top and bottom lines in the intermediate term.

However, it is for this reason we continue to rate the TSM stock as a Buy here, due to the highly attractive risk reward ratio. Keen investors may also note the long runway for Generative AI, which currently only comprised ~6% of the foundry's revenues, based on its recent earnings call.

With the management projecting a tremendously bullish CAGR of up to +50%, we are looking at an expanding Generative AI TAM of up to $150B by 2028, with TSM commanding nearly ~25% of those revenues. These numbers are similar to the CEO of AMD's guidance in a recent interview as well, further highlighting the early innings to the AI rally.

Naturally, there is one caveat to this investment thesis, since the Chips War between the US and China is still ongoing, with no resolution in sight. Investors must also size their portfolios accordingly, as to how Warren Buffett has, to avoid any capital losses arising from these developing geopolitical events.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMD, INTC, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

Trying to pull in orders from Taiwan semi / other Manufacturers and Assemblers

My understanding Taiwan semiconductor has flex fab lines. So they can convert from one customer to another if there's a slowdown.

If this is true a very positive benefit for Nvidia.

Nvidia's Q2 will be reported in three weeks could be a blowout.