Fed Looms As Earnings Begin

Summary

- U.S. equity markets extended their "disinflation rally" this week after European inflation data mirrored encouraging trends observed domestically, while economic data and earnings results were consistent with a "soft landing" trajectory.

- Posting its highest weekly close since April 2022, the S&P 500 advanced 0.6% on the week while the Dow Jones Industrial Average extended its winning streak to 10 straight sessions.

- Office REITs continued their rebound this week following a pair of decent earnings reports showing hints at a stabilization in office leasing activity. Cell Tower REITs were slammed as concerns over toxic lead cable amplified headwinds from reduced carriers network spending.

- Residential real estate earnings season started on a high note with Equity LifeStyle raising its full-year guidance driven by buoyant rent growth and reduced expenses. Homebuilder D.R. Horton also reported a surge in order growth amid historically low existing home inventory levels.

- Hoya Capital Income Builder members get exclusive access to our real-world portfolio. See all our investments here »

Chansak Joe

Real Estate Weekly Outlook

U.S. equity markets extended a "disinflation rally" this week after European and Asian inflation data echoed recent encouraging trends observed stateside, while economic data and corporate earnings results were generally consistent with a "soft landing" trajectory. With the Federal Reserve in its "quiet period" ahead of its FOMC meeting this coming week, investors parsed a decent start to corporate earnings season and cooler-than-expected inflation data in the U.K. and China, while traders took positions ahead of the expected final hike of the Fed's historically-aggressive tightening cycle, postulating whether the Fed will double-down on its hawkish stance or declare victory via a policy pivot.

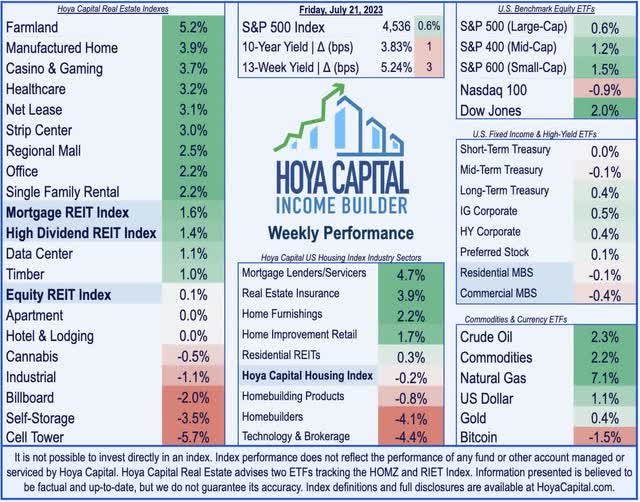

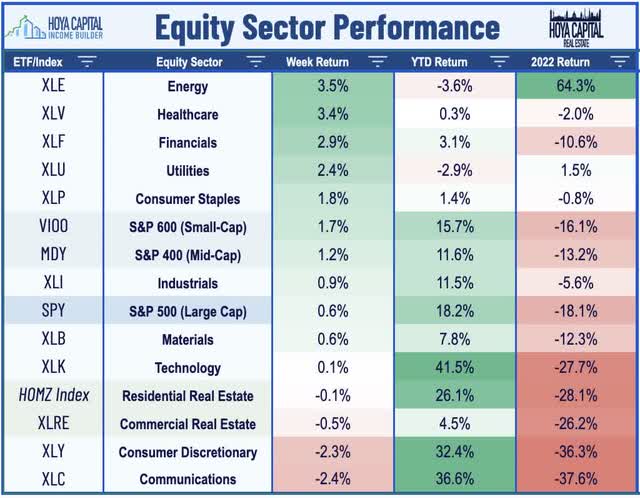

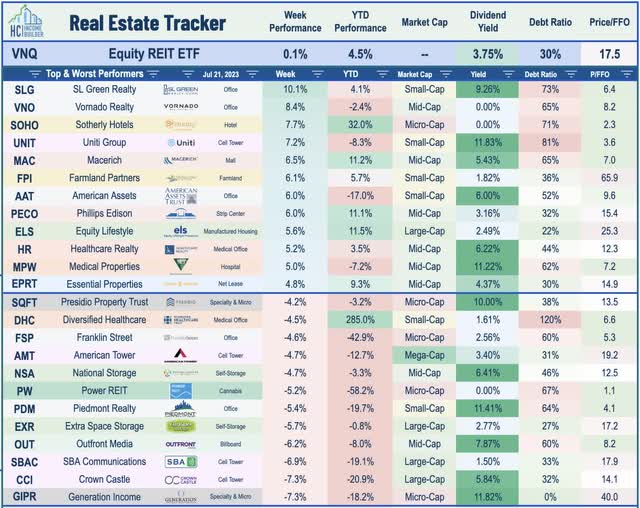

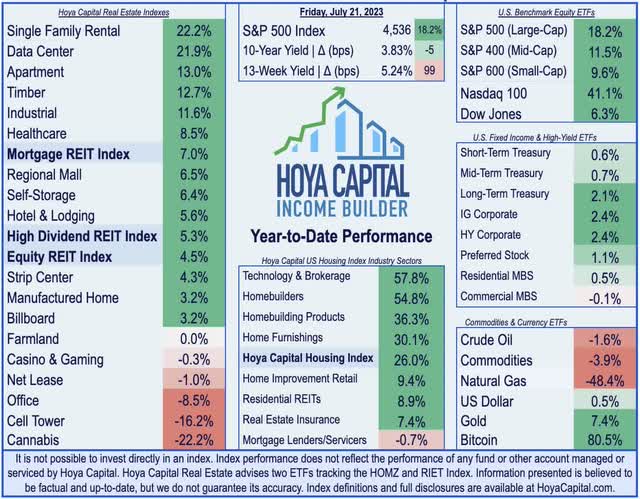

Posting its highest weekly close since April 2022, the S&P 500 advanced 0.6% on the week while the Dow extended its winning streak to 10-straight sessions. The other major equity benchmarks - the Mid-Cap 400 and Small-Cap 600 posted gains of around 1.5%, but tech-related weakness dragged the Nasdaq 100 lower by nearly 1% on the week. Real estate equities were mixed this week as industry-specific headwinds on large-cap communications and logistics-focused REITs offset a solid start to REIT earnings season across the residential and office sectors. The Equity REIT Index advanced 0.1% on the week, with 13-of-18 property sectors in positive territory, while the Mortgage REIT Index gained 1.6%. The red-hot homebuilding sector slumped, however, as mildly disappointing housing market data offset a strong report and guidance boost from DR Horton - the nation's largest builder.

After dipping nearly a quarter-percentage point last week, the 10-Year Treasury Yield finished higher by 1 basis point this week to close at 3.83%, while the policy-sensitive 2-Year Yield climbed 11 basis points to 4.86%. The US Dollar Index rebounded from its lowest levels in over a year after the closely-watched U.K. CPI report showed that British consumer inflation slowed to a 7.9% year-over-year rate - the slowest increase in over a year and well below consensus estimates. Crude Oil futures advanced 2% despite another soft slate of data from China, which reported that its economy grew 6.3% in the second quarter - well below estimates of 7.0% - as the expected post-lockdown bounce has quickly fizzled out. Eight of the eleven GICS equity sectors finished higher on the week, led on the upside by Financials (XLF) stocks on the heels of a solid slate of bank earnings results driven by higher interest rates and still-low delinquency rates. Communications (XLC) and Consumer Discretionary (XLY) stocks lagged on downbeat results from streaming giant Netflix (NFLX) and electric car maker Tesla (TSLA).

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

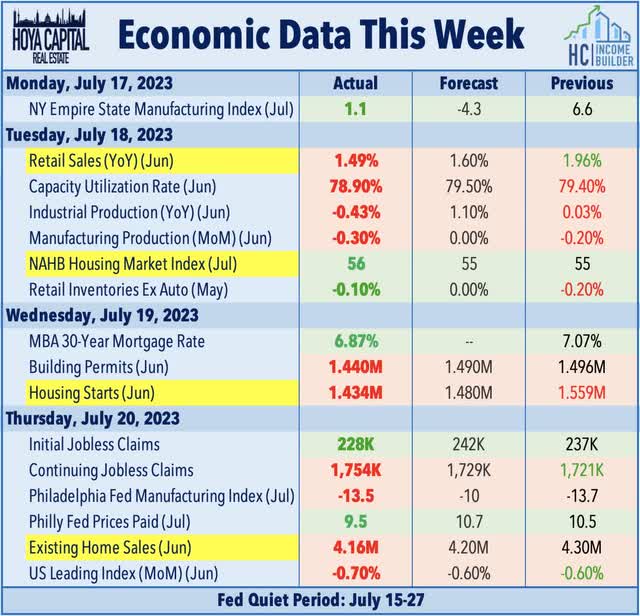

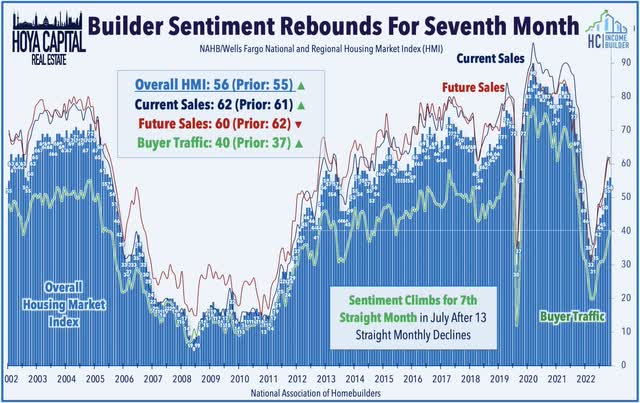

Consistent with the countercyclical performance trends it exhibited early in the pandemic, the previously-sluggish U.S. housing sector has again emerged as a bright spot in recent months. Data this week showed that NAHB Homebuilder Sentiment - a leading indicator of housing market activity - rose for a seventh-straight month in July, which follows a stretch of thirteen straight monthly declines. Rising to 56 on the headline index with gains in the current sales and buyer traffic sub-indexes, builders attributed improving sentiment to low inventory levels and a stabilization in mortgage rates. Measures of current sales rose to the highest level since the summer while the gauge of prospective buyer traffic also edged up to a 13-month high. Existing Home Sales data this week showed that sales of previously-owned homes declined slightly in June from the prior month, but historically low inventory levels were the primary culprit behind the weakness. Despite headwinds on demand resulting from elevated mortgage rates, potential homebuyers are facing an increasingly competitive market, with properties selling in an average of 18 days in June - down from the historical average of 35-45 days - while over three-quarters of homes were on the market for less than a month.

Retail sales data this week provided mixed signals on the state of the U.S. consumer, showing that spending rose at a weaker-than-expected pace in June, but the "miss" was largely driven by reduced spending at gasoline stations. The value of retail purchases rose 0.2% after an upwardly revised 0.5% increase in May, which was below consensus estimates of 0.5%. Excluding autos and gasoline, however, retail sales increased 0.3%, which was above estimates of a 0.1% gain. Strength from online retailers offset a relatively soft month from brick-and-mortar retailers with seven out of 12 brick-and-mortar categories reporting lower sales last month. Total retail sales are now higher by 1.5% from last year. As these figures aren’t adjusted for inflation, "real" retail spending is lower by roughly 2% from last year after adjustment using the headline CPI Index.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

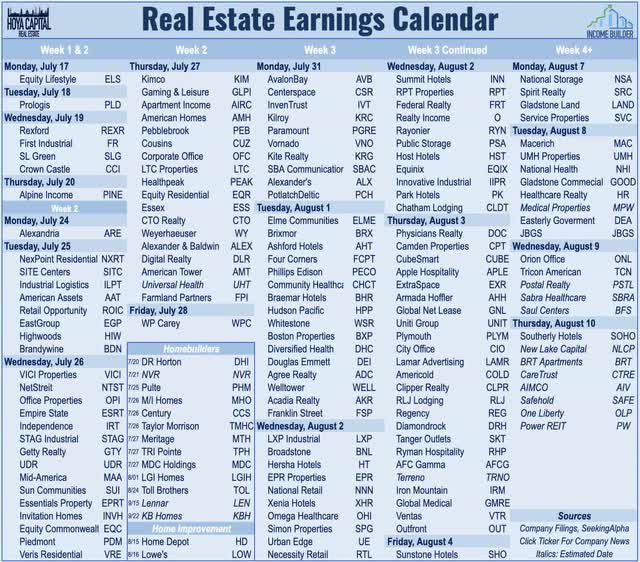

Real estate earnings season kicked into gear this week with a mixed slate results from the initial half-dozen REITs. As discussed in our REIT Earnings Preview, we'll hear results from 175 equity REITs, 40 mortgage REITs, and dozens of housing industry companies over the next month. Real estate equities - the sector with perhaps the most to gain from a moderation in inflation and normalization in Fed monetary policy - entered earnings season with wind in their sails. Expenses and margins will be a key focus amid broader disinflationary impacts on revenues. A reversal from last quarter where an impressive "beat rate" was driven by surprisingly buoyant rent growth, upside guidance revisions to Net Operating Income ("NOI") are more likely to be driven by lower expense expectations. Access to capital is a major focus amid expectations that capitulation from debt-burdened private portfolios will create consolidation opportunities for well-capitalized REITs.

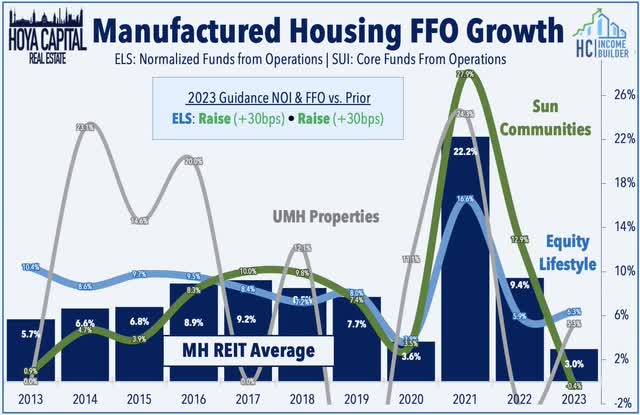

Manufactured Housing: Residential REIT earnings season started on a high note with Equity LifeStyle (ELS) rallying over 5% on the week after being added to the S&P 400 Index and reporting solid results in which it raised its full-year FFO and NOI guidance, "driven by continued strength in annual revenue and reduced expenses throughout our portfolio." ELS increased its full-year 2023 FFO growth outlook to 6.3% - up from 6.0% last quarter - which would be an acceleration from the 5.9% growth in 2022. ELS also raised its full-year NOI guidance driven by lower expense projections driven primarily by lower utilities rates. ELS maintained its outlook for full-year revenue growth in its core manufactured housing with a midpoint at 6.8%, but revised lower its revenue outlook in its RV & marina segment by about a percentage-point to 4.6% on continued softness in its transient RV segment - an area that has been impacted by a post-COVID normalization and by "unfavorable weather patterns" including delayed openings at several of its Northern resorts.

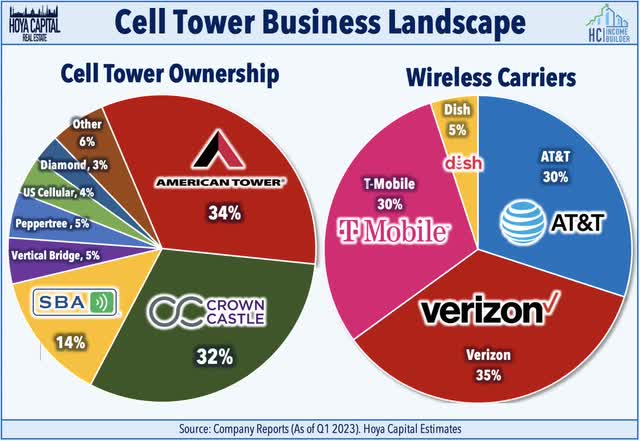

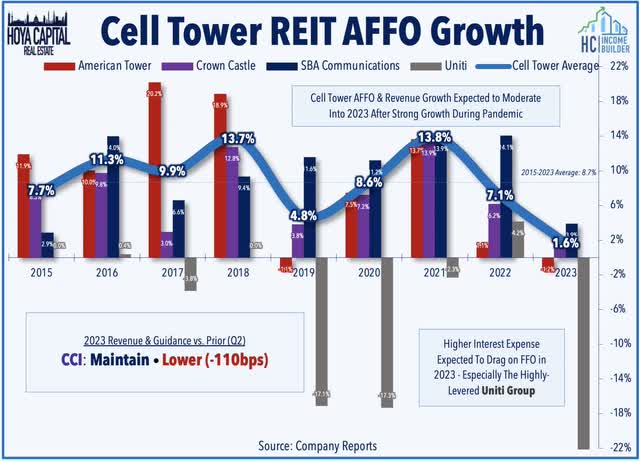

Cell Tower: The perennially-outperforming cell tower REIT sector has uncharacteristically stumbled over the past year - and took another leg lower this week on the heels of a Wall Street Journal report that named AT&T (T) and Verizon (VZ) among several telecom companies that abandoned underground toxic lead-sheathed copper landline cables - most of which were installed before the 1960s - which are possibly causing environmental damage that could require costly remediation. While the cell tower REITs have limited direct exposure to issues related to the 50-100 year-old cables, these potential problems come as wireless carriers were already expected to spend about 10-20% less in 2023 compared to last year on network upgrades following an initial surge in spending related to 5G network deployment. Shares of AT&T are lower by 21% on the year - trading near their lowest level in thirty years - while Verizon has dipped nearly 16% on the year. Following the Journal investigation, a Wall Street analyst estimated it could cost $59 billion to remove all of the lead cables nationwide.

On that note, Crown Castle (CCI) dipped 7% on the week after reporting soft second-quarter results and lowered its full-year adjusted FFO outlook citing a "significant" slowdown in carrier network spending. CCI now expects its full-year FFO to rise 1.9% this year - a 110 basis point decrease from its prior outlook of 3.0% growth - but maintained its guidance ranges for revenues, adjusted EBITDA, and same-store property revenues. Industry-level commentary was surprisingly downbeat, with CCI noting that "the initial surge in tower activity [related to the 5G rollout] has ended," which led to a decline in tower activity (equipment upgrades and modifications) of more than 50% in the second-quarter. On the impacts of the recent WSJ reporting on potential remediation costs for AT&T and Verizon of old abandoned lead-containing network cables, CCI commented that it has "not seen any behavior change from our carrier customers... but obviously, they’re very healthy and have a long history of being able to navigate through various cycles."

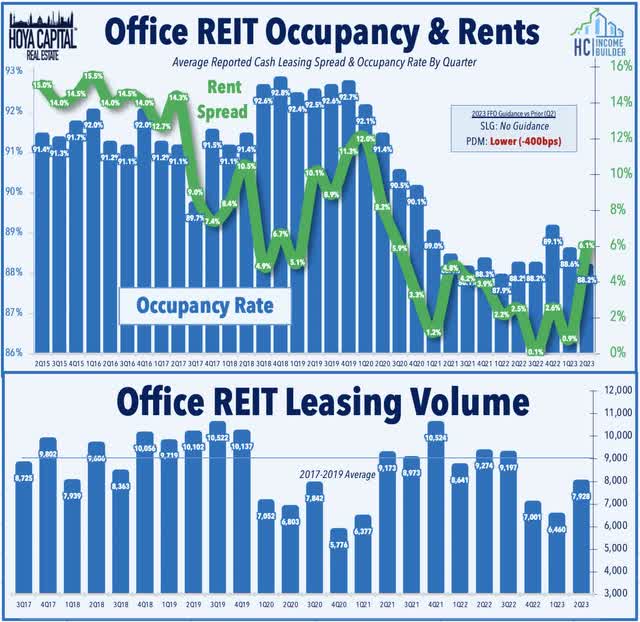

Office: Extending a nearly 25% rally from the lows in April, office REITs continued their rebound this week following a pair of decent earnings reports showing hints at a stabilization in office leasing activity, consistent with reporting last week from brokerage firm JLL, which noted that office leasing activity rebounded 7.7% in Q2 compared to Q1. NYC-focused SL Green (SLG) rallied more than 10% after reporting improving leasing demand in the midtown Manhattan submarket and from financial services tenants. Leasing activity totaled 411k square feet - down from 505k SF last quarter - and about 25% below its pre-pandemic average, but SLG reported a healthy pipeline of 1.1 million square feet that are in negotiations. Piedmont (PDM) dipped 5% on the week as a decent quarter of property-level metrics was offset by an announced refinancing of $400M in debt that was slated to mature next year at a sharply higher interest rate - an unsecured five-year note at a 9.25% rate compared to its maturing 4.45% note - which prompted a downward revision to its full-year FFO outlook. Property-level metrics were quite solid, however, highlighted by total leasing volume of 581k SF - which was 8% above its four-quarter average - and an impressive 14.3% cash roll-up on these leases.

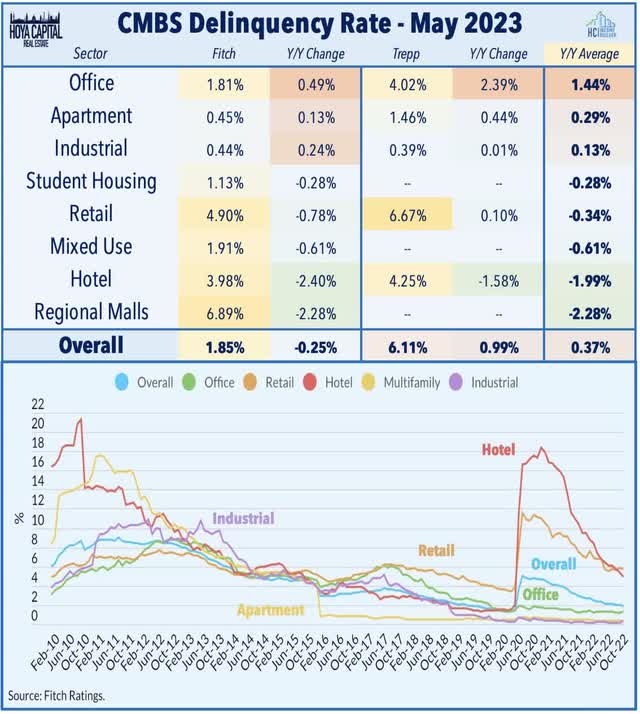

Sticking in the office sector, Bloomberg reported this week that Starwood Capital defaulted on a $212.5M mortgage on a 29-story Atlanta office building, one of a half-dozen loan defaults in recent months from highly-leveraged private equity portfolios. The mortgage loan was originated at a loan-to-value of nearly 80% in 2018 - more than double the comparable leverage profile of the average office REIT. Despite the relative outperformance of Sunbelt over to coastal office markets, the company was unable to find a buyer to pay more than the total debt balance, consistent with recent estimates which peg the average decline for office assets at between 20-40%, depending on the region and sub-market. Compounding issues from the increased debt service cost and a dwindling equity interest, the building's occupancy rate dipped from around 85% to just above 60% this year after its largest tenant vacated at the end of 2022. Trepp reported last month that delinquency rates on CMBS office loans jumped 128 basis points to 4.2% in May, which was the highest since 2018.

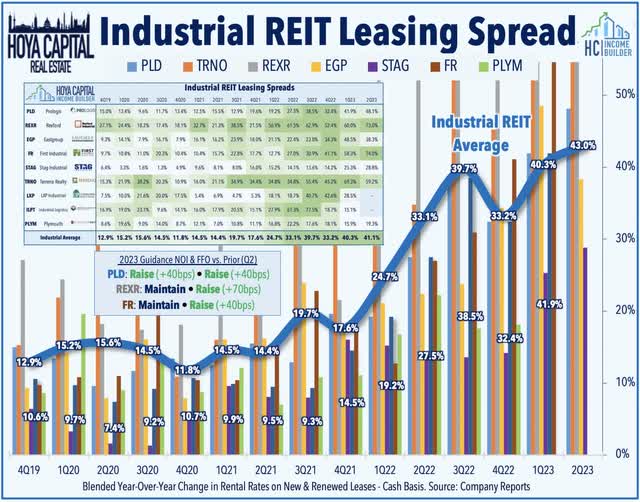

Industrial: Tenant-related issues also pressured logistics-focused REITs this week - taking away the spotlight from a solid slate of earnings results - as the fifth-largest trucking carrier in the country - Yellow (YELL) is teetering on the edge of bankruptcy amid a post-pandemic plunge in shipping rates and crippling industry-wide labor union disputes. Prologis (PLD) declined 2% on the week despite reporting another "beat and raise" quarter, lifting its full-year FFO and NOI outlook by another 40 basis points driven by a record-high cash rent spread of 48.1% in Q2 - up from the 41.9% reported in Q1. PLD's earnings call commentary, however, indicated some early signs of softness in the ultra-tight industrial real estate markets. First Industrial dipped 4% this week as investors looked beyond a boost to its full-year FFO outlook and record-high rent spreads of 74%, focusing on a modest downward revision to its full-year occupancy guidance. Southern California-focused Rexford gained 1% after its results pushed back on concerns over SoCal softness. REXR achieved record-high rent spreads of 73% in Q2 and now expects full-year FFO growth of 9.4% - up 70 basis points from its prior outlook.

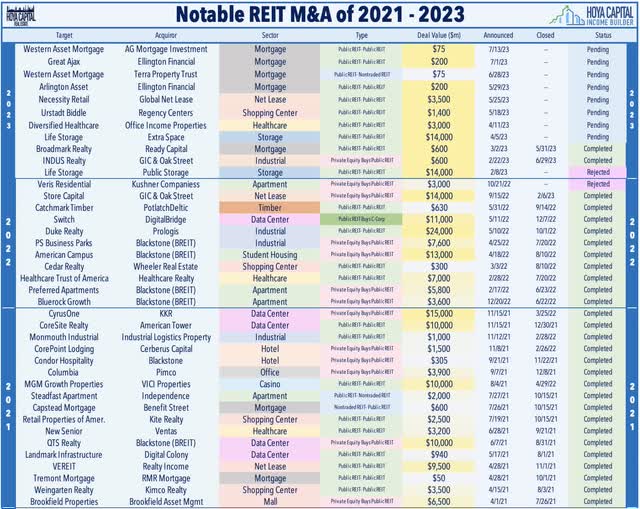

There were several developments on pending REIT M&A deals over the past week. Extra Space (EXR) completed its acquisition of Life Storage (LSI), forming the largest storage operator in the country based on property count. Separately, activist firm Flat Footed reiterated its opposition to the proposed merger between Diversified Healthcare's (DHC) and Office Properties Income (OPI) - a pair of externally-managed REITs advised by RMR Group. The firm proposed a meeting with leadership to "discuss superior alternatives to the value-destructive deal" and noted that other major shareholders including D.E. Shaw and H/2 Capital Partners have announced their opposition to the deal "because it does not serve shareholders’ best interests." Elsewhere, Global Net Lease (GNL) and Necessity Retail (RTL) announced that the U.S. SEC has declared effective its Form S-4 filing, which it commented "is another important step towards completing the merger and internalization of GNL and RTL." The GNL/RTL deal has faced similar activist opposition, including a push this week from Orange Capital Ventures, which issued a statement outlining its "serious concerns" about what it believes are "blatantly coercive tactics" regarding the proposed merger.

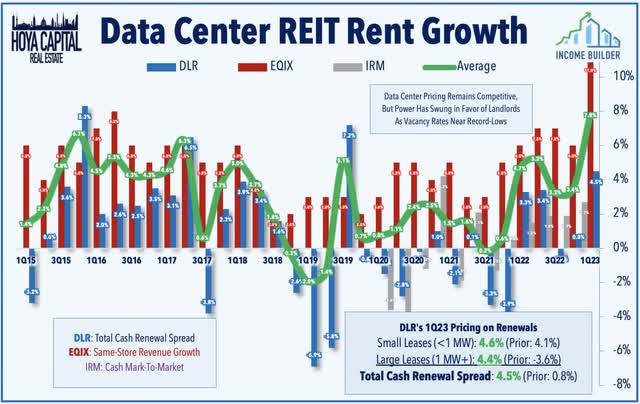

Data Center: Sticking with the M&A theme, Digital Realty (DLR) gained 1% on the week after it announced that it sold a 65% interest in two data centers to GI Partners for $743M. DLR will maintain a 35% interest in the joint venture while continuing to manage the day-to-day operations of the assets and granted GI Partners an option to purchase an interest in a third facility on the same data center campus. DLR initially acquired the facilities in 2017 through its merger with former REIT DuPont Fabros. The two data centers contributed to the joint venture contain roughly 67 MW of capacity and are 90% occupied in aggregate. The release notes that based on annualized in-place cash net operating income, the transaction values the two facilities at roughly 6.5% cap rate. Among the top-performing property sectors this year, the Data Center REIT rebound has been fueled by reports of "booming" demand for artificial intelligence ("AI") focused data center chips and signs of improved data center rent growth, which ironically comes as these REITs become a trendy "short call" based on a thesis of weak pricing power.

Mortgage REIT Week In Review

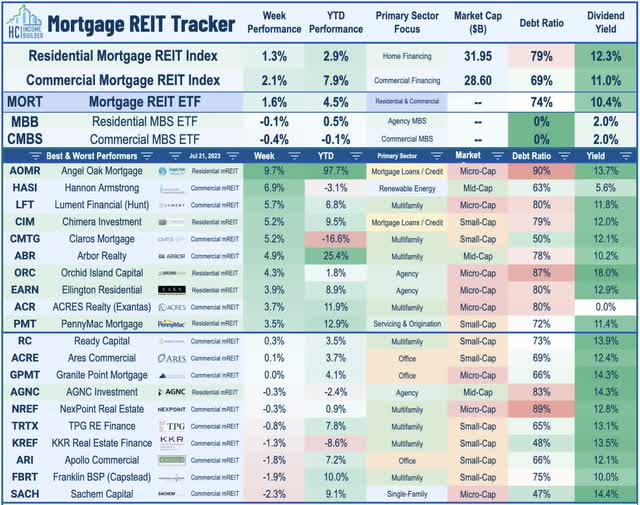

Mortgage REITs posted broad-based gains for the week, with the iShares Mortgage REIT ETF (REM) advancing another 1.6% to extend its rally since early May to over 20%. Rithm Capital (RITM) gained nearly 3% on the week after it announced that it acquired a $1.4B portfolio of prime unsecured consumer loans from Goldman Sachs (GS) that were originated through Goldman's Marcus consumer finance business. The portfolio of short-duration fixed-rate consumer loans will represent about 4% of its total loan book. Elsewhere, Western Asset Mortgage (WMC) gained another 1.5% on the week after it announced that it would begin talks with AG Mortgage (MITT), which last week proposed to acquire WMC in a stock-and-cash deal at an implied price of $9.88 per share. The bid came several weeks after WMC announced a deal to merge with non-traded REIT Terra Property Trust. WMC noted that MITT's proposal is "reasonably expected" to result in a superior proposal to the previous Terra proposal and "intends to engage in discussions in accordance with the terms of the merger agreement with TPT."

Mortgage REIT earnings season kicks-off in the week ahead with results from nearly a dozen mREITs including AGNC Investment (AGNC) on Monday, Annaly Capital (NLY) and Blackstone Mortgage (BXMT) on Wednesday, PennyMac Mortgage (PMT) on Thursday, and Ladder Capital (LADR) on Friday. In our REIT Earnings Preview, we noted that the RMBS and CMBS benchmarks were about flat in Q2 as a decline in spreads was offset by a modest increase in benchmark rates. For residential mREITs, book values and dividend commentary will be the major focus. For commercial mREITs, we're more closely focused on loan performance and changes in Current Expected Credit Loss ("CECL") allowance - particularly for mREITs with significant office exposure. We note that despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends, but there remains a handful of mREITs with payout ratios above 100% of EPS.

2023 Performance Recap & 2022 Review

Through the first half plus three weeks of 2023, the Equity REIT Index is now higher by 4.5% on a price return basis for the year (+8.9% on a total return basis), while the Mortgage REIT Index is higher by 7.0% (+13.0% on a total return basis). This compares with the 18.2% gain on the S&P 500 and the 11.5% advance for the S&P Mid-Cap 400. Within the real estate sector, 12-of-18 property sectors are in positive territory on the year, led by Single-Family Rental, Data Center, Apartment, Timber, and Industrial REITs, while Office and Cell Tower REITs have lagged on the downside. At 3.83%, the 10-Year Treasury Yield has declined by 5 basis points since the start of the year - up sharply from its 2023 intra-day lows of 3.26% - but still below its late-2022 closing highs of 4.30%. The US bond market has stabilized following its worst year in history as the Bloomberg US Aggregate Bond Index has gained 2.3% this year. Crude Oil - perhaps the most important inflation input - is lower by 2% on the year and roughly 30% below its 2022 peak.

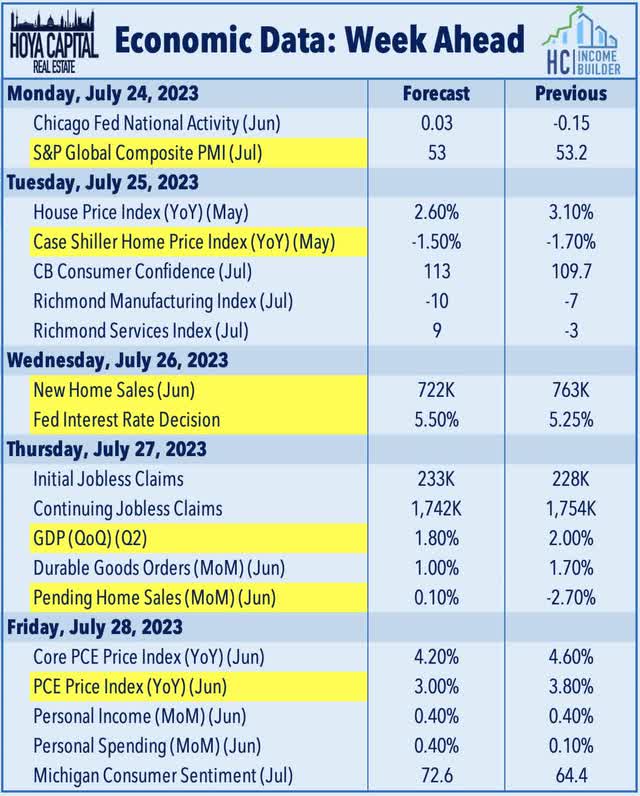

Economic Calendar In The Week Ahead

Inflation, housing markets, and central banks are in the spotlight in a jam-packed slate of economic data in the week ahead. The Fed's two-day policy meeting concludes with its Interest Rate Decision on Wednesday. Swaps market now imply a 99% probability that the Fed will hike interest rates by another 25 basis points in July to a 5.50% upper bound, which investors expect will conclude the Fed's most aggressive rate hiking cycle in history. Before the Fed meeting, we'll see home price data via the Case Shiller and FHFA along with the New Home Sales report for June, which surged to its strongest pace in over a year in the prior month. We'll see some more housing data on Thursday with Pending Home Sales data, which is expected to increase for the sixth month out of the past eight, following a stretch of thirteen straight monthly declines. Also on Thursday, we'll get our first look at second-quarter Gross Domestic Product which is expected to show that the U.S. economy grew at a 1.8% annualized rate. Over the past five quarters, real GDP growth has averaged below 1%. Perhaps the most important report of the week comes on Friday with the PCE Price Index - the Fed's preferred gauge of inflation - in which the headline PCE is expected to show a similarly sharp deceleration to the cusp of a "2-handle" as seen in the CPI last week. In the same report, we'll also be looking at Personal Income and Personal Spending data for May, a key read on the state of the U.S. consumer.

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read The Full Report on Hoya Capital Income Builder

Income Builder is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

This article was written by

Real Estate • High Yield • Dividend Growth

Visit www.HoyaCapital.com for more information and important disclosures. Hoya Capital Research is an affiliate of Hoya Capital Real Estate ("Hoya Capital"), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut.

Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns.

Collaborating with ETF Monkey, Retired Investor, Gen Alpha, Alex Mansour, The Sunday Investor, and Philip Eric Jones for Marketplace service - Hoya Capital Income Builder.Hoya Capital Real Estate ("Hoya Capital") is a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations is an affiliate that provides non-advisory services including research and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital has no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIET, HOMZ, ALL HOLDINGS IN THE INCOME BUILDER REIT FOCUSED INCOME & DIVIDEND GROWTH PORTFOLIOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry. This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing. The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized. Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes. Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receive compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.