BDC Weekly Review: Investors Don't Get The NAV Return

Summary

- We take a look at the action in business development companies through the second week of July and highlight some of the key themes we are watching.

- BDCs had another strong week, extending the year-to-date rally to double-digit figures.

- BDC investors often forget that they are not entitled to a given company's total NAV returns and need to take the valuation into account.

- We recently reduced our allocation to the BDC sector in light of a strong run-up in valuation.

- I do much more than just articles at Systematic Income: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Darren415

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company ("BDC") sector from both the bottom-up - highlighting individual news and events - as well as the top-down - providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of July.

Market Action

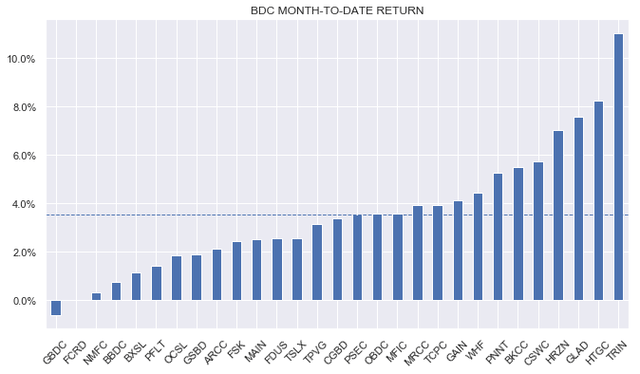

BDCs had a big week with a 2% total return, extending their recent rally. Month-to-date the sector is up nearly 4%, with venture-debt focused lenders like TRIN, HTGC and HRZN in the lead.

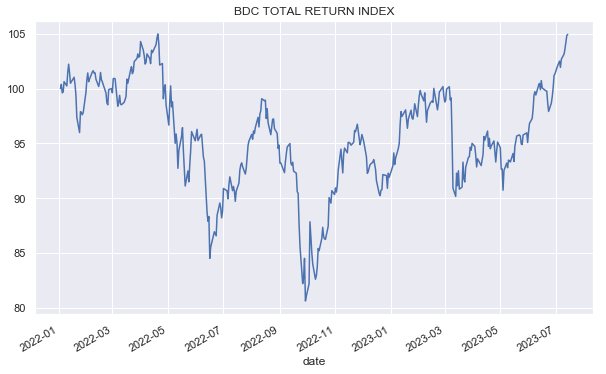

The sector is up by double-digit figures this year and is now at its highest point since the start of 2022 in total return terms.

Systematic Income

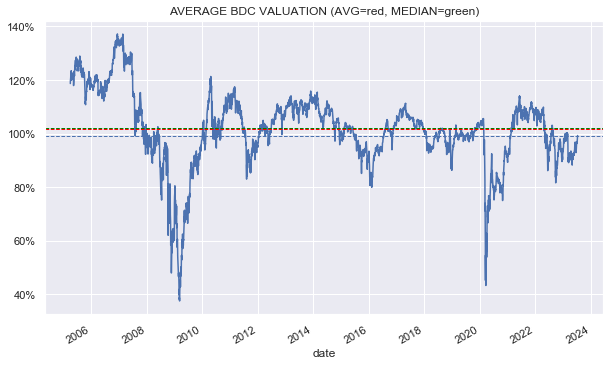

The valuation of the sector is now right around 100%, just shy of its long-term average.

Systematic Income

Market Themes

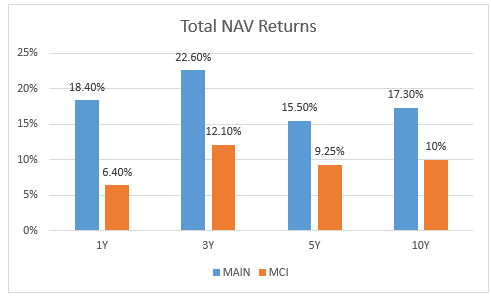

We recently discussed a closed-end fund, Barings Corporate Investors (MCI) in one of our CEF weeklies. MCI is a kind of BDC-lite as much of its portfolio is in private credit. One commenter said - why not buy a real BDC like MAIN and get double the return. In this section, we take a look at the mechanics of BDC returns in the context of their valuation.

First, the double return figure is questionable. In order to get anywhere close to a double total NAV return, we have to use a 1Y period, which is the only period where MAIN has double or stronger returns than MCI. Over a more sensible longer-term period like 5 years, MAIN has a 15.5% return while MCI has a 9.25% return. So yes, MAIN has done a lot better in total NAV terms.

Systematic Income

But here is the important bit - investors don't buy BDCs (or CEFs for that matter) at the NAV. They buy them at the market price which, in the case of MAIN, is 50% above the NAV and in the case of MCI 6% below the NAV.

Let's assume that MAIN absolutely kills it again over the next 5 years just as it did over the last 5 with a 15.5% total NAV return while MCI delivers the same respectable 9.25% total NAV return. What we really need to do is to calculate the total NAV return adjusted by the valuation, which we can by just dividing the return by the valuation.

The intuition here is simple: $1 spent by a MAIN investor only entitles them to 67 cents of the NAV, meaning that invested dollar wouldn't earn a 15.5% return but 67% of that return or 10.3% over the next 5 years if the total NAV return is 15.5%

If we do the same exercise with MCI, we get 9.9%. In other words, the two are not far from each other from a return on invested capital perspective assuming unchanged valuations.

Investors who prefer MAIN over MCI at current levels implicitly either think that performance of MAIN will improve significantly relative to the sector, or its valuation will outperform relative to the sector. All certainly possible, but from where we sit, MAIN is priced for perfection.

Market Commentary

We are starting to get an early preview of BDC Q2 results. Saratoga (SAR) always reports early as it has a different calendar period. The NAV fell 3% primarily due to unrealized depreciation. Despite the drop during the quarter, the NAV has held up well since the start of 2022 with an increase of about 5%.

Net income increased by 10%. Portfolio quality looks to be doing well, with no assets expected to result in a loss of principal according to the company and 3.5% of assets in the Underperforming bucket. There was one non-accrual at 0.9% of the portfolio on fair-value. Overall a good result which bodes well for the sector.

Stance and Takeaways

With the recent run-up in BDCs, we just trimmed our allocation to the sector in favor of more resilient securities. While the recent set of benign inflation readings suggest the Fed could be done very soon, it doesn't mean it is ready to take rates down. In the meantime, a lot of the tightening to date is yet to make itself felt while the recent rise in loan defaults is clear that many borrowers are struggling with servicing the debt. While BDC yields remain attractive, the valuation on offer leaves too little margin of safety in our view. We expect to see lower valuations across the sector in the coming months, which would offer more attractive entry points.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.