Infinera Corporation: Solid Business And Solid Outlook

Summary

- Infinera Corporation's share price has fluctuated significantly in recent months, peaking at $7.8 in the last 52 weeks, but the company's strong earnings outlook makes it a potential buy.

- The company, which operates in the communications equipment industry, has invested heavily in R&D and is establishing strong partnerships, including with KAMO Power for the deployment of the Infinera XTM series.

- Despite facing challenges such as supply chain constraints and potential macroeconomic slowdowns, Infinera's valuation and strong steps towards growing its market share make it a solid investment opportunity.

Laurence Dutton/E+ via Getty Images

Investment Summary

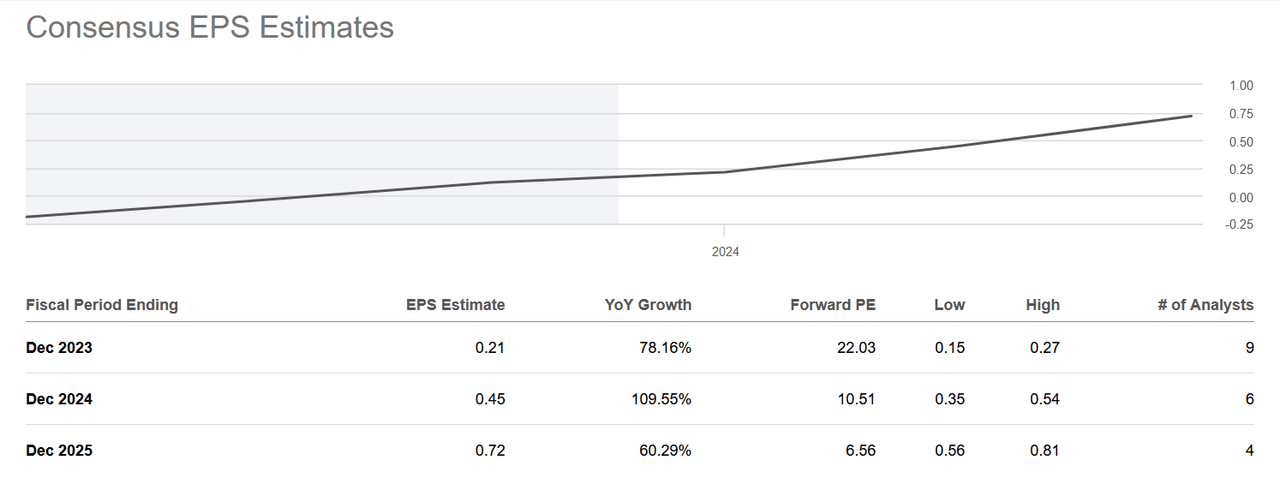

Infinera Corporation (NASDAQ:INFN) has been on a real rollercoaster the last few months in terms of its share price. Peaking at $7.8 in the last 52 weeks, the share price has plunged from that and the question arises whether it's a buy now or not. The FWD p/e sits at 21 with the earnings outlook remaining very positive as the Q1 report beat on expectations as well.

Infinera operates as a company in the communications equipment industry. Here it provides customers with optical transport networking equipment. The vertical integration that INFN has imparted into its business is showing potential and in the long term should support more sturdy margins. Given the strong growth tailwinds aiding INFN, I think paying a 21x earnings premium is not that bad. I am rating INFN a buy at these price points.

Strong And Lasting Market Demand

The market for optical transports remains very strong and INFN will be a key player in this space it seems as they are investing heavily into it. In 2022 INFN spent over $300 million in R&D expenses, nearly 20% of the total revenues. This dependency on ensuring they have the most cutting-edge technology will of course make them out as the clear quality pick for customers. But it can weigh on margins for the company in the short term. But the vertical integration that INFN is engaging in could also help offset some of this in my view.

Growth Drivers (Earnings Presentation)

As for the optical transport market, it's expected to grow quite quickly at a CAGR of 8.4% between 2018 and 2028. The growth drivers here are coming from 4 different key reasons. The massive bandwidth capacity growth that is necessary for our planet is a major reason, but as coherent optical engines are becoming increasingly popular, it helps funnel growth to INFN as well.

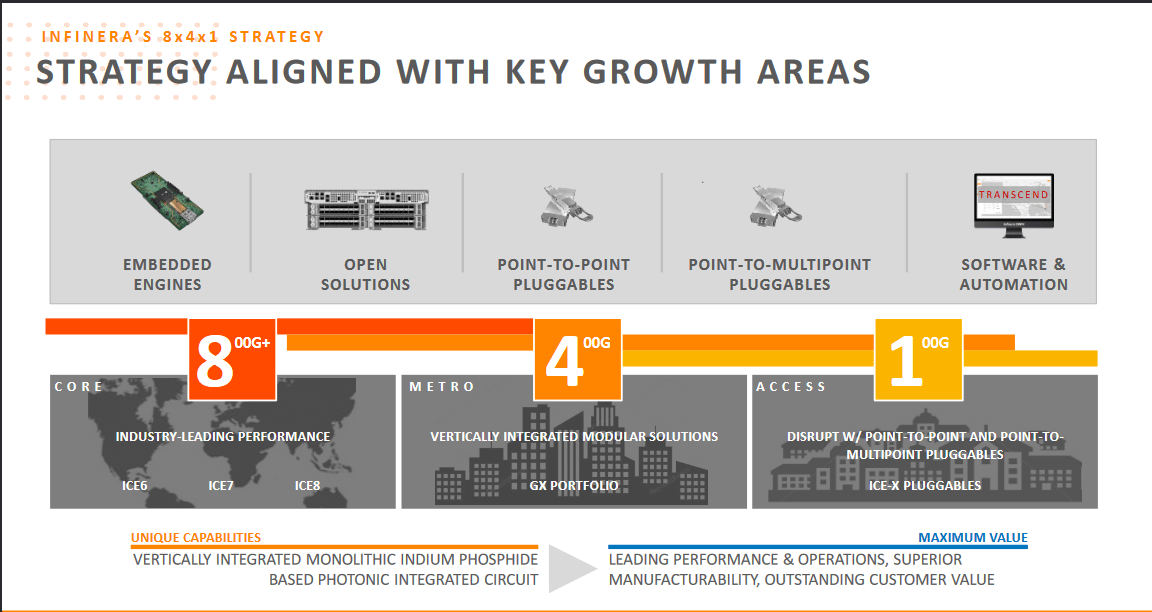

Key Markets (Earnings Presentation)

INFN has made good progress though in positioning itself favorably to capture this broad demand. Infinera is also establishing strong partnerships with key long-term customers. In recent news, it was revealed that KAMO Power is deploying the Infinera XTM series on its 2,700 route-mile rural networks to help serve 17 member cooperatives. The area in which is being deployed is both Oklahoma and southwest Missouri. This scalable 100G transport service is proving why it can be a significant supplier of these products for the industry.

Quarterly Result

The previous report from INFN showed them able to grow efficiently and face demand successfully. The revenues may have seen a decline QoQ but grew YoY by around 15%. This displays momentum and seeing it continue into Q2 could add fuel to the share price in my opinion.

Despite the revenue dropping from Q4 2022, the gross margins expanded nicely to 37.5% and sit above its 5-year average of 34.7%. With time, I think we will continue seeing steady improvements here and if demand persists a gross margin above the sector's average of 48% seems very plausible.

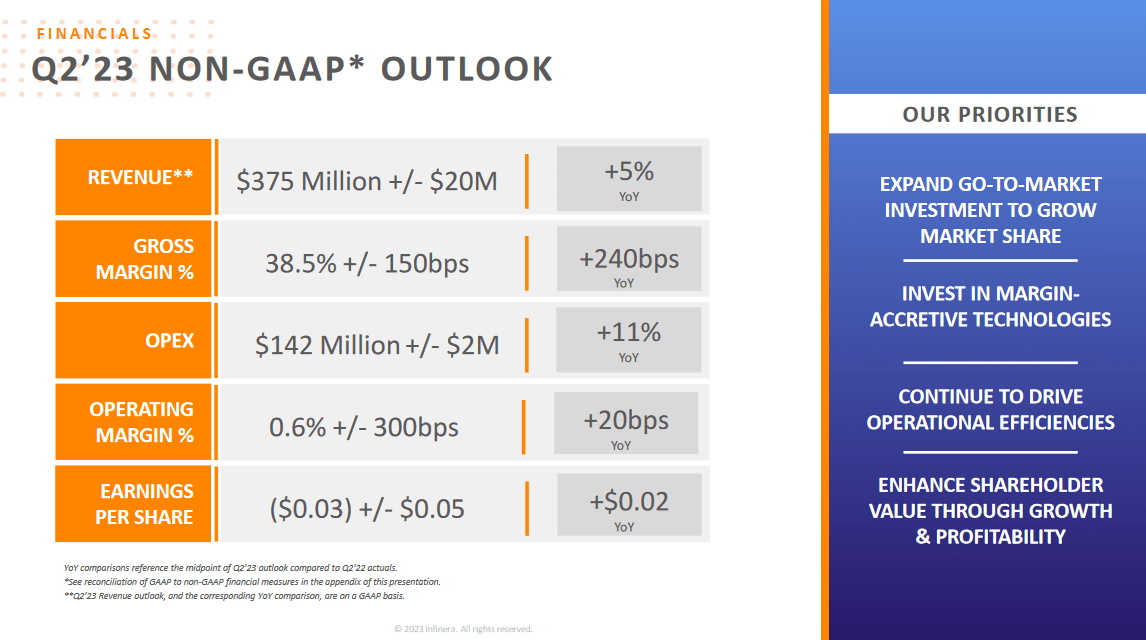

Q2 Outlook (Earnings Presentation)

The outlook for Q2 as provided by the company itself looks quite decent. It displays some of the momentum I mentioned I saw in Q1 that can continue. Gross margins are quite solid already, so I think the biggest point to watch is the growth of revenues instead. Here, INFN needs to make solid improvements to help justify its valuation. It's currently sitting at a p/s 0.63, which is far below the sector's average of 3. A beat on EPS would add fuel to the share price, I think for the short-term at least. Seeing the plunge it made in 2023, finding a footing now is important.

EPS estimates are still very positive and by 2025 INFN is predicted to have an EPS of $0.72. I find them quite unrealistic in all honesty since the R&D expenses remain high (nearly 50% of gross profits) and I don't see the market placing much demand on INFN's ability to scale revenues fast enough and margins to keep up.

Risks

INFN, operating in the telecommunications industry, faces various challenges and risks. Supply chain constraints could affect both revenue and gross margins, potentially straining customer relationships if product delivery lags behind competitors. A macroeconomic slowdown might lead to reduced spending and fewer orders. To mitigate economic downturns, INFN may consider an equity or convertible offering, but this could dilute existing shareholders if priced below market value.

Growth Trends (Earnings Presentation)

Moreover, the success of Infinera's new 400G ZR+ pluggable is crucial for future revenue growth; failure to penetrate this market could significantly impact the company's performance. Infinera needs to navigate these challenges strategically to maintain its competitive position in the industry.

Valuation & Wrap Up

With the share price dropping so harshly in the last few months, it has opened up a very intriguing opportunity to begin an investment in INFN in my opinion. The p/e of just 21 is nearly 10% below the sector. When compared to a similar size company like CommScope Holding Company Inc (COMM), which provides infrastructure solutions for communications, INFN still comes across as the better option. The valuations differ widely, and COMM has a FWD p/e of just 2.6. I still see INFN as the more appealing option given the industry and markets they serve, markets that I want exposure to. But also because the earnings outlook does seem more positive, even though I am skeptical of the 100% EPS growth between 2023 and 2024 that is predicted. Where I see INFN potentially outperforming in terms of earnings comes from the fact customers are quickly burning through inventory levels, as stated in the Q1 earnings call from INFN. The management team stated they are seeing customers begin to gear up for more shipping as machine learning and artificial intelligence is taking over the workplaces.

For investors seeking a solid investment opportunity that is working with the semiconductor industry, then INFN looks very good here. The price has come down significantly and now the margin of safety is in my preferred zone. I am rating INFN a buy here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.