Ares Commercial: High Dividends Don't Lie And The Worst Is Likely Over

Summary

- Ares Commercial Real Estate stock has seen a remarkable recovery since its post-FQ1 earnings low in May, with a price-performance return of nearly 50%.

- Despite challenges with its four- and five-rated loans and a significant percentage of its portfolio in the embattled office segment, ACRE has bottomed out.

- ACRE has sufficient liquidity to make accretive investments and expects to maintain its current level of regular and supplemental quarterly cash dividends for the remainder of the year.

- Investors who braved the significant pessimism to pick ACRE lows in May likely observed its bottoming process and have been duly rewarded.

- With macroeconomic conditions expected to improve further, I assessed that the worst is likely over.

- Looking for a helping hand in the market? Members of Ultimate Growth Investing get exclusive ideas and guidance to navigate any climate. Learn More »

FangXiaNuo

Ares Commercial Real Estate Corporation (NYSE:ACRE) dip buyers have enjoyed a remarkable recovery after its post-FQ1 earnings low in early May. Accordingly, ACRE formed its lows at the $7.50 level and recently surged through the $11.20 level, delivering a price-performance return of nearly 50% between those levels (not including its attractive dividends). In other words, dip buyers who braved pessimism have significantly outperformed the S&P 500 (SPX) (SPY) since then.

As such, it does call into question whether ACRE has bottomed out decisively for holders to consider adding more positions at the next pullback. Sellers who let go of their shares at ACRE's May lows were justified in feeling aggrieved. After all, ACRE held a relatively significant percentage of its portfolio in the most embattled segment of the commercial property market: office (31%).

Therefore, why did ACRE still manage to bottom out, with buyers returning to support the malaise, despite its ongoing challenges with its four- and five-rated loans? The company indicated it actively manages these issues, "including loan modifications, sales, foreclosures, and other strategies to maximize outcomes and redeploy capital."

Analysts on ACRE's May earnings calls were concerned with its office exposure. However, management also attempted to assure and remind holders that "the degradation of office fundamentals has been well-publicized." In other words, I assessed that the company wants investors to know that the challenges facing Ares Commercial Real Estate Corporation aren't a new development. It has been ongoing, and the media's negative portrayal has likely caught the attention of many investors across the sector.

Therefore, I'm pretty sure price action investors observed the significant pessimism forming a bear trap (false downside breakdown) before returning. The market is forward-looking, and price action investors leverage clues highlighting the market's psychology at potential key turning points to make their move.

Notwithstanding, the concerns over the company's high dividend yield are justified. At the lows in May, ACRE traded at a forward yield of more than 18%, well over its 10Y average of 9.5%. Therefore, I believe it's pretty clear that the market has not ignored the challenges facing Ares Commercial Real Estate's office exposure and priced in a very high possibility of it cutting dividends.

The company maintained sufficient liquidity ($225M of available capital) at the end of Q1 to make accretive investments. In addition, it also stressed that it "expects to maintain its current level of regular and supplemental quarterly cash dividends for the remainder of the year."

As such, it indicates that the company has confidence in holding on to its income investors who invest for its relatively high yields, despite its weakened earnings capability. Accordingly, Wall Street estimates suggest that the company's distributable EPS could fall to $1.20 in FY23, compared to its expected annualized dividend per share of $1.40 (17% above EPS).

However, analysts' estimates also suggest that FY23 is expected to be the bottom, with its distributable EPS expected to recover to $1.34 by FY24. With ACRE still priced at a forward dividend yield of almost 13% despite its remarkable recovery since its May lows, ACRE's valuation remains relatively appealing.

With macroeconomic conditions expected to remain favorable, suggesting a soft landing is increasingly likely, I don't expect the challenges in the office segment to deteriorate further. However, structural headwinds remain and aren't likely to go away in the near term. Therefore ACRE is expected to trade well above its 10Y dividend yield average, suggesting investors should reflect a significant discount to account for these headwinds.

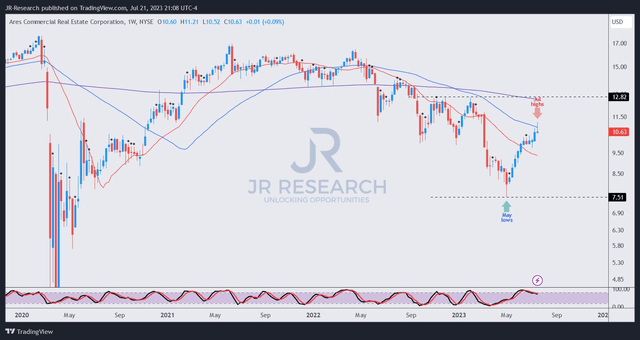

ACRE price chart (weekly) (TradingView)

ACRE recently re-tested its 50-week moving average or MA (blue line), as selling pressure intensified after forming its July highs. Therefore, I believe dip buyers likely leveraged the resistance zone to cut exposure after its remarkable surge.

I assessed that ACRES is unlikely to fall back toward its May lows, indicating that investors who missed the opportunities back then can consider capitalizing on its next significant pullback.

For now, I'll closely watch ACRE to assess where the selloff could take us before I turn more constructive.

Rating: Hold (On the watch for a rating change).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn't? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Wang of JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore (NUS). NUS is also ranked among the top ten universities globally. I currently hold the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.