ANSYS: Heady Valuation

Summary

- Despite industry tailwinds, ANSYS' near-term outlook is uncertain as demand appears to be softening.

- AI is becoming an important part of simulation toolkits and ANSYS' large footprint and long history position it for success in this area.

- The simulation market is relatively small and only offers modest growth. ANSYS will need to take market share and expand the market to justify its valuation.

RoMiEg/iStock via Getty Images

ANSYS (NASDAQ:ANSS) is a leading provider of simulation software which is widely used in product design and engineering workflows. This is a growth market where the barriers to entry are increasing as customer demands become more complex. Market growth is only modest though, and ANSYS already has a dominant position. The company will have to continue gaining market share and expanding use cases to justify its high valuation, which is a difficult ask.

Market

ANSYS provides engineering simulation software, which is part of the broader computer-aided engineering industry. Simulation is used to analyze and optimize product designs through the use of virtual prototypes. This market is driven by the demand for faster and more efficient product development cycles, increased product performance, reduced costs, and improved safety.

Increased product complexity is creating a need for software that can model a range of physical phenomena, including structural mechanics, fluid dynamics, heat transfer and electromagnetics, with the focus shifting from component level analysis to the system.

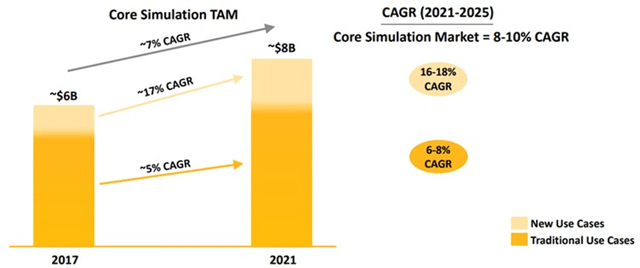

Figure 1: Simulation TAM (source: Ansys)

Over the next 10 years ANSYS expects new use cases to drive market growth, even as growth within traditional use cases declines. Despite this, the market is still only expected to grow at something like an 8% annual rate. The question for ANSYS could be whether AI can meaningfully accelerate market growth.

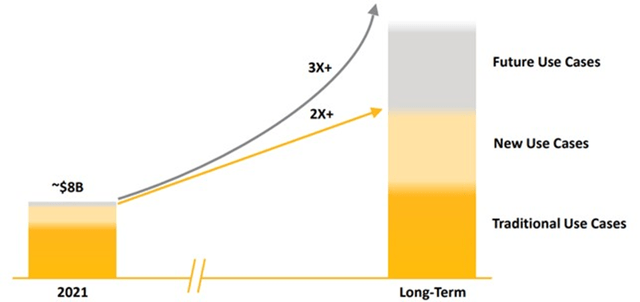

Figure 2: Long Term Simulation TAM (source: Ansys)

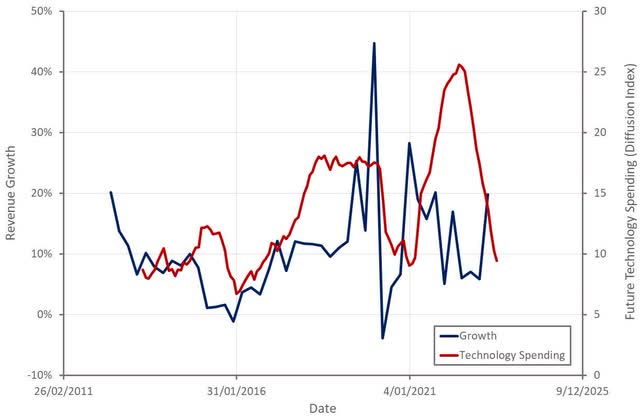

While there are long-term industry tailwinds, the near term remains cloudy. The pandemic caused an industry wide acceleration, the effects of which are yet to be fully digested. In addition, end market demand is generally moderating, with an ongoing elevated risk of recession. Uncertain demand prospects coupled with high interest rates are causing companies to shun investments, and there is little sign of immediate relief in this area. While ANSYS is currently upbeat about its growth prospects, it would be prudent to expect continued growth deceleration throughout 2023 and possibly 2024.

Figure 3: Future Technology Spending Diffusion Index and ANSYS Growth (source: Created by author using data from ANSYS and The Federal Reserve)

ANSYS

ANSYS is a leader in advanced numerical simulation methods that accurately predict the behavior of engineered products. It offers a comprehensive suite of simulation tools that encompass a variety of physical phenomena. ANSYS' multi-physics solution also enables customers to perform increasingly complex analyses, from the component through to the system level. The company's tools cover the entire simulation workflow, including pre-processing, simulation solvers, post-processing, and optimization.

ANSYS' software is used in a broad range of industries, including high-tech, aerospace and defense, automotive, energy, industrial equipment, materials and chemicals, consumer products, healthcare and construction.

Product offerings include:

- Structures - structural analysis product suite

- Electronics - electronic magnetic field simulation software for electronic and electromechanical products

- Fluids - modelling of fluid flow and related physical phenomena

- Semiconductors - power analysis and optimization software

- Digital Mission Engineering - systems analysis for aerospace, defense and intelligence applications

- Optics and VR - optics simulation

- 3D Design - design tools that enable simulation across the product design process

- Materials - materials information management

- Embedded Software - embedded software simulation, code production and automated certification.

- Photonics - photonic design and simulation tools

- Safety Analysis - safety and cybersecurity threat analysis

- Autonomous Vehicle Simulation - allows the testing of drive designs on a virtual vehicle in a real-world environment

- Digital Twin - virtual prototypes of real-world systems

ANSYS' business is built on a number of technology pillars, which include:

- High-performance computing

- Cloud computing

- AI and machine learning

Given the compute intensity of many simulations, high performance compute capacity is an important part of ANSYS' solutions. ANSYS' products enable access to high performance compute capacity to run simulations, on-prem or in the cloud. Cloud-based simulation tools provide access to elastic compute resources which enable fast run times and lower total cost of ownership.

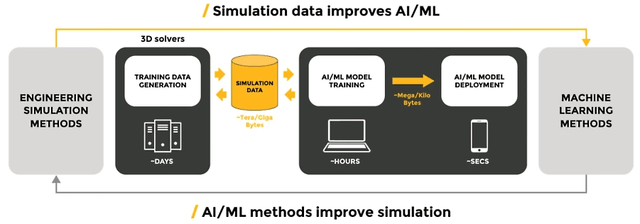

AI can be used in simulation to make running models faster and easier. Simulation can also be used to create synthetic data to train AI models. ANSYS is able to leverage a database built over the course of 50 years to train models, giving it a strong competitive position.

Figure 4: AI in Simulation (source: Ansys)

Simulation and AI are likely to become more intertwined over time, with AI forming an integral part of simulation workflows. For example, AI can be used to generate a large number of design options and rapidly evaluate which options are best. This would bring simulation earlier into the design process and potentially expand ANSYS' addressable market, as there are far more employees working in design than simulation.

While market growth is only expected to be modest, ANSYS believes it can drive growth through:

- Product growth - Simulation software is evolving to address more complex problems and is being adopted in more industries.

- User growth - ANSYS is trying to broaden its user base through education and making its software easier to use.

- Computation growth - Larger and more complex simulations require the use of more licenses.

ANSYS has also been driving growth through acquisitions that build on the capabilities of its software. Recent acquisitions include:

- Motor Design's MotorCAD - Multiphysics workflow for electric machine design

- OnScale's cloud native web-based user interface enables device independent access to simulation.

- C&R Technologies Thermal Desktop - thermal system design and optimization

- Rocky - discrete element method technology

- DYNAmore - finite element solver and optimization software for non-linear mechanical problems

Competition

While ANSYS is a dominant player in the market, there are several competitors that offer similar software and services:

- Siemens (OTCPK:SIEGY) - Siemens offers Simcenter simulation and test solutions. This software covers a broad range of physical phenomena as well as system modelling.

- Dassault Systèmes (OTCPK:DASTY) - SIMULIA is a portfolio of simulation software that covers a wide range of disciplines, such as structural analysis, fluid dynamics, electromagnetics, and multi-physics simulations. CST Studio Suite specializes in electromagnetic simulation software for various applications, including antennas, RF components, and high-frequency systems.

- Altair (ALTR) - Altair is a leading provider of engineering simulation software and services. Its portfolio includes tools for simulation, high-performance computing and data analytics. Altair appears to have a greater focus on AI and integrating simulation into the design process.

- MSC Software - MSC Software was one of the pioneers in the field of simulation software and offers a range of solutions. MSC Software is now owned by the Swedish company Hexagon and has a relatively small market presence compared to ANSYS.

- Autodesk (ADSK) - Autodesk offers a range of software for use across the product lifecycle, including design, engineering, simulation and manufacturing. This software enables end-to-end digital transformation and can provide real time and immersive experiences. Solutions are targeted at industry verticals and are grouped under AEC, Media & Entertainment and Manufacturing.

- PTC (PTC) - PTC provides solutions that help customers design, engineer, manufacture, and service products. PTC's portfolio includes CAD, CAE and PLM software. Creo Simulation Live is integrated into PTC's Creo CAD software and allows engineers to analyze and optimize designs during the design process.

Given the nature of the market it is probably reasonable to expect competition to decline over time due to the burden of R&D investment. It is difficult for vendors to provide cutting edge simulation capabilities across a broad range of physical phenomena, and this is compounded by a growing demand for system level analysis where a variety of phenomena interact. The future of the market is also likely to be driven by AI and high-performance computing. Larger incumbents are likely to be leaders in AI due to their access to data and greater resources.

Financial Analysis

Total revenue grew by 19% YoY in the first quarter and ACV increased by 16% YoY in the same period. Growth was broad based in the first quarter, with revenue growing by double-digits in every geographic region. High-tech and semiconductor, aerospace and defense, and automotive and ground transportation sectors were strong contributors.

ANSYS has stated that its pipeline of business improved in the first quarter and continues to show momentum. Full year ACV growth is expected to be 11.5-14.9%. Revenue growth is expected to be 8.2-12%. Longer-term, ANSYS is targeting 12% ACV growth rate through to 2025. This growth includes an expectation of a 1-2% annual contribution from M&A.

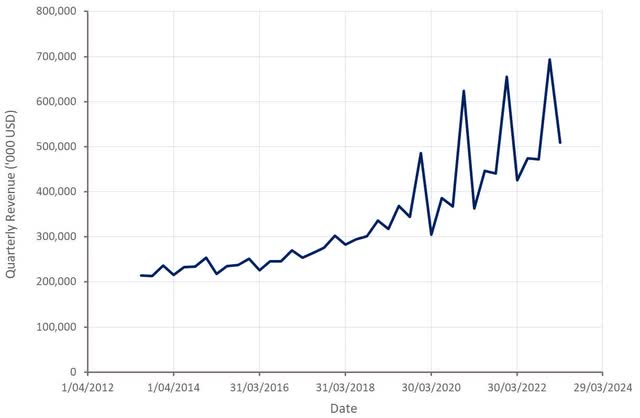

Figure 5: ANSYS Revenue (source: Created by author using data from Ansys)

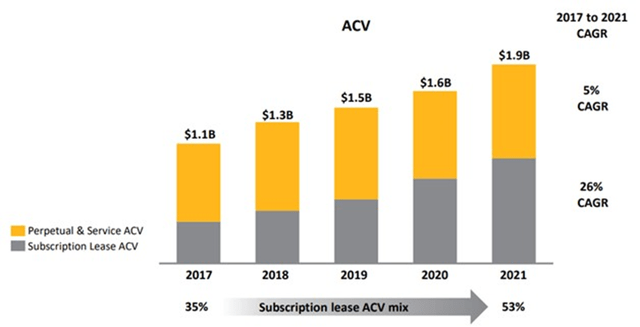

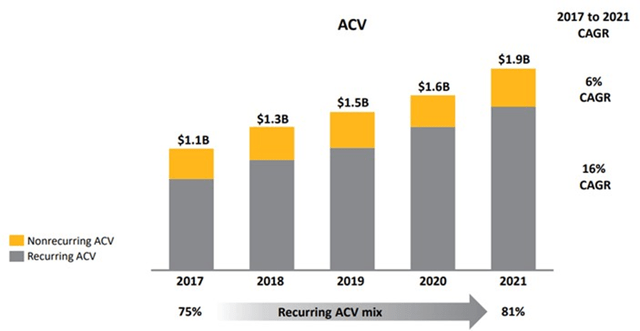

ANSYS is still in the process of moving from upfront sales to a recurring revenue business model, which is currently a headwind to revenue and operating margins. This transition is maturing though, with the majority of ACV now attributable to subscriptions and recurring in nature.

Figure 6: ANSYS Subscription Lease ACV Mix (source: Ansys) Figure 7: ANSYS Recurring ACV Mix (source: Ansys)

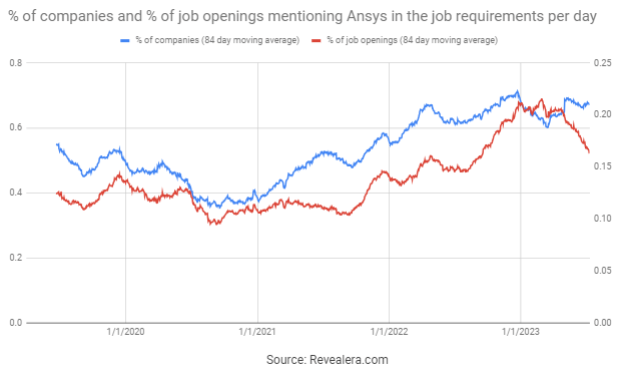

While ANSYS' first quarter results were strong and management has provided optimistic commentary, demand appears to be softening. Companies continue to pullback on investments and the number of job openings mentioning ANSYS in the job requirements has declined sharply in recent months. This not surprising though given the surge in job openings in 2022.

Figure 8: Job Openings Mentioning ANSYS in the Job Requirements (source: Revealera.com)

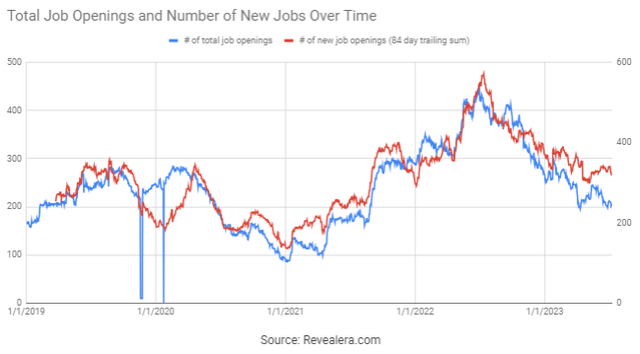

The number of ANSYS job openings also suggests that demand is weak, with ANSYS pulling back on investments in sales capacity in response.

Figure 9: ANSYS Job Openings (source: Revealera.com)

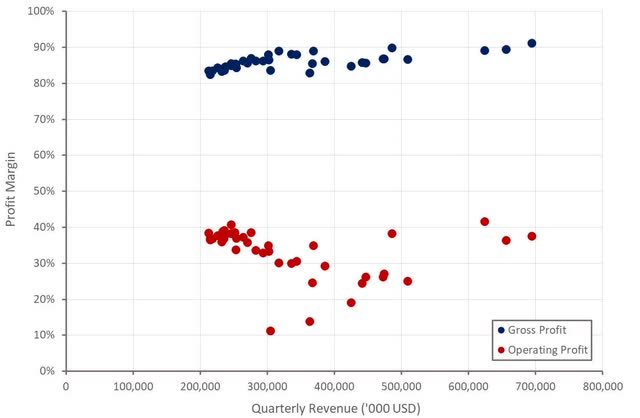

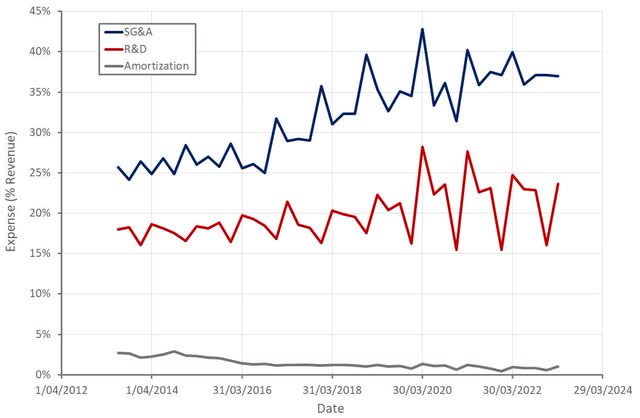

ANSYS' margins have been under pressure due to its business model transition, but the company remains highly efficient. Margins appear to have bottomed and may improve slightly going forward, particularly if ANSYS pulls back on investments in R&D and sales and marketing.

Figure 10: ANSYS Profit Margins (source: Created by author using data from Ansys) Figure 11: ANSYS Operating Expenses (source: Created by author using data from Ansys)

Valuation

ANSYS is a high-quality company that continues to grow and generate strong free cash flows. The company has a solid competitive position, which is only likely to increase as simulation requirements become more complex. At some point quality becomes necessary but insufficient though.

ANSYS' competes in a relatively small market, and already leads that market. While the company will continue to grow, this growth may not be sufficient to generate reasonable returns for investors. ANSYS probably needs a revenue CAGR approaching 15% over the next decade just to perform in line with the market (assuming modest multiple compression), which far exceeds what the company managed over the past decade.

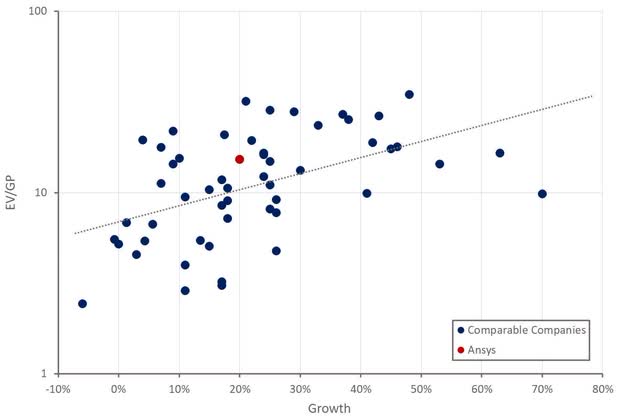

Figure 12: ANSYS Relative Valuation (source: Created by author using data from Seeking Alpha)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.