Why A Lower Yield May Be A Better Long-Term Investment

Summary

- The inverted yield curve means longer-term bonds yield less than shorter-term bonds.

- The inverted yield curve and overall higher rates are a figment of the COVID pandemic and the response to it.

- Reinvestment risk on short-term bonds is substantial today. You may be kicking yourself for not going longer-term on your bond maturities.

- Looking for option income ideas that focus on capital preservation? I offer this and much more at my exclusive investing ideas service, Yield Hunting: Alt Inc Opps. Learn More »

Andres Victorero

One of the questions I continue to receive goes something like this:

"Why would I buy a corporate bond with a 5.5% interest rate when I can buy a T-bill with a 5.05% yield?"

Or something like:

"Why should I buy a 10-year treasury bond at 3.85% when I can buy a six-month treasury at 5.0%?"

The question boils down to a simple question as an answer (something you're not supposed to do, but I'm doing anyway):

"Would you rather get 3.85% for 10 years or 5% for six months or maybe one year and then 2.5% thereafter?"

The answer is all about reinvestment risk, which we've been discussing more and more, as this is the largest risk facing lower-risk investors today. A portfolio built on high-quality, low-credit-risk investments is more interest-rate sensitive than credit risk sensitive (bankruptcy risk).

Reinvestment risk is the risk that you purchase a short-term investment and then, when it matures, you go looking for something that yields about the same and "uh oh" cannot find it.

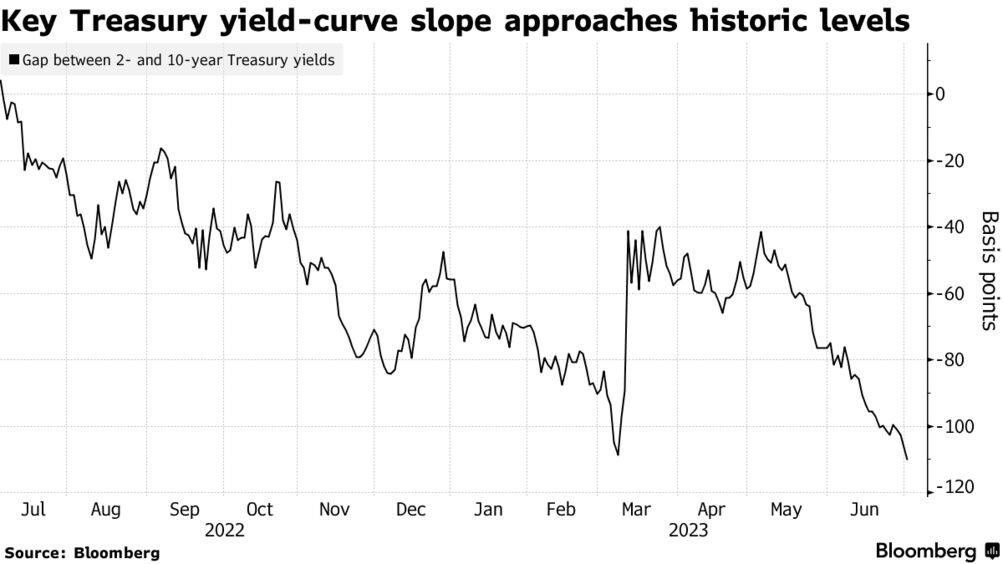

The current yield curve is heavily inverted - near historic levels.

bloomberg

All this means is that shorter-term bonds yield more than longer-term ones. This is not normal, as modern portfolio theory states that the more risk and the more time your investment has, the more return.

The inverted yield curve as a recession indicator makes sense, since banks will not lend as aggressively in this type of environment. Banks borrow short term (paying depositors) and lend long term (mostly long-term mortgages). If their borrowing costs (deposit rates) get too high relative to long-term rates, they will not lend.

If they don't lend, credit will not be created and the economy will grind to a halt or even contract (recession).

This is the environment we find ourselves in today.

Today's Investing Regime Is Unique In History

The foresight we have into interest rates is some of the clearest in history. What we mean by that is, it is a quirk of recent events that we have these "higher" interest rates?

For most of the last 15 years, interest rates have been at or near zero. That was in response to the global Financial Crisis and massive demographic headwinds that caused a deflationary environment. For most of that 15-year period, inflation averaged just 1.7% per year, below the Fed's target.

Then, COVID struck.

COVID really was the first worldwide pandemic since the Spanish Flu more than 100 years before. The economy ground to a halt as businesses were forced to close their doors to prevent the spread of the virus.

Almost overnight, 12 million people lost their jobs.

The Federal Reserve and the US government, having not really dealt with this previously, decided to go big in their response. The stimulus they created to is estimated to be as large as $7 trillion (one-third of GDP!).

To put that into perspective, the same entities created a stimulus of approximately $1.7 trillion. They definitely went big.

No one could blame them, as they had no idea what the pandemic would bring. A recession is a deflationary event, by definition, and with inflation already low, they needed to stimulate the economy to prevent depression and more people from losing their jobs.

Again, hard to blame them as what we were facing was a big unknown.

Well, the economy recovered rather quickly and jobs began to return fast later that year. But the money (the $7T) was already committed.

With the economy recovering and an extra $7T out there circulating, inflation was finally created - something the Fed had been attempting to do for more than a decade.

Inflation heated up for most of 2021 and the first half of 2022, reaching its apex in June 2022 at +9.1%. Since then, the Fed has raised interest rates and drained liquidity from the system by quantitative tightening (reducing the balance sheet).

However, this is not something that they can flip a switch and reverse. It's more like turning the Titanic. It's a slow process, and it is delayed in its response. In other words, monetary policy has an approximate 12-month transmission mechanism (it takes 12 months before the action taken starts being felt).

Since June 2022, inflation has been coming down, but we are still above the Fed's target of +2.0%.

On July 12, it was reported that headline inflation fell to 2.98% and Core to +4.8%. The Fed is making progress, but still has work to be done.

It's likely that the hiking of interest rates is largely done (maybe one or, at most, two more). The Fed knows about the delay in the transmission mechanism, so they know that hikes today won't be felt for some time. They don't want to overdo the tightening.

That means we are likely to see rates top out here, hold for a few months or so, and then the Fed is likely to start cutting.

As I noted, this is a fluke of history due to the COVID virus and our response to it. The clarity we have for rates over the next one to two years is much clearer than normal.

Rates Are Likely To Fall

Given that backdrop, we know that rates are likely to come down in the next year or so. It really doesn't matter when, as we know that we are well above the neutral rate (~2.5%).

If you know nothing else about bonds, you probably know that bond prices and interest rates are inversely related. That means, if/when rates drop, bond prices will rise.

baird

Buying a short-term bond here means you neither get to take advantage of that price increase when rates fall, nor can you lock in these higher yields for years to come.

The longer the time to maturity, the more sensitive the bond's price is to changes in interest rates. This is called duration in the investment world.

This is due to the pull towards par a bond's price does as it approaches maturity. Since a bond has a terminal value ("par") at maturity, the price will converge with par as it approaches that date.

Lock In These Yields!

If you have this kind of clarity into the direction of rates over the next year or two, and the likelihood is that rates will be lower rather than higher from here, you want to go longer-term maturities to exploit that probability.

Locking in a yield of 6%-plus for the next five years, 10 years, or even longer means you are generating bond returns that are greater than 3x of what was achieved over the last five years.

You don't want to be kicking yourself a year or two or three from now when rates are back down to 2% or 3% and your income has been cut in half (or more!).

Individual bonds are the best way to capture these yields and lock them in, since bond funds are subject to daily or quarterly cash flows. Those cash flows coming into a bond fund are invested at the then, current rates. If rates fall, the new cash is invested at lower yields, diluting your higher yielding bonds and reducing your income.

Individual bonds are not subject to that same risk.

By going longer term, even if it means your yield is lower, you're reducing your overall risk (most of the time this is not the case as going longer-term typically means you are exposed to greater interest rate risk).

This is a weird time when you want more interest rate risk, simply because of the quirk in history and the higher than normal probability of the ability to forecast interest rate direction.

Concluding Thoughts

We think short-term bonds have a role in the portfolio but that investors should be, for the first time in many years, focusing on extending out duration and average maturity. By doing so, you'll be locking in these higher yields for many years to come.

The investment strategy should be to invest in individual bonds foremost, with high-quality BBB- or better, and a focus on longer-maturities (10–20 years is the sweet spot, but you can certainly have some bonds that are longer) and avoiding bonds with first calls dates within the next 5 years (preferably longer).

We will continue to push these bonds on our service whenever we see them.

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income from bonds. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. We also help members build individual bond portfolios to complement CEFs.

If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.

This article was written by

- YH Core Income Portfolio: yield ~8%

- YH Flexible Income Portfolio: yield 7.53%

- YH Taxable Core Portfolio: yield 5.24% (some tax free)

- YH Financial Advisor Model

Plus: Muni CEF Shopping List.

Our team includes:

1) Alpha Gen Capital - I am a former financial advisor and investor. Not someone from another career doing this on the side. My analysis is meant to provide safe and actionable insight without the fluff or risky ideas of most other letters. My goal is to provide a relatively safer income stream with CEFs and mutual funds. We also help investors learn about investing and how to properly construct a portfolio.

2) George Spritzer - Another career financial guru who runs a registered investment advisor with a specialization in closed-end funds for individuals. George uses the following investment strategies:1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc.3) Landlord Investor- spent his career as a management consultant for public sector clients at a multinational consulting firm in the DC area. He has transitioned to a new career as a full time landlord. His investment portfolio is comprised of two parts -- broad-based index funds and income plays such as preferred stock, CEFs, and REITs. He also owns individual/baby bonds which he buys on margin to boost total return. Landlord is our 'individual preferred stock' expert analyst.

www.YieldHunting.com

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.