Starwood Property Trust: No Longer A Steal (Rating Downgrade)

Summary

- I decided to sell my investment in Starwood Property Trust due to a strong stock price performance and an overbought chart picture.

- Despite the commercial real estate investment trust's strong dividend and diversified portfolio, STWD stock has become expensive, and the office market is facing risks.

- Passive income investors may want to take profits now and wait for a potential pullback to restart a position at a more compelling valuation.

Andrii Yalanskyi/iStock via Getty Images

A strong stock price performance since May and an overbought chart picture have led me to close out my investment in Starwood Property Trust Inc. (NYSE:STWD).

Though there are plenty of things to appreciate about the commercial real estate investment trust, such as a strong dividend, low earnings volatility and a diversified portfolio, the trust is now overbought and the stock has become expensive.

Furthermore, the office market is not in great shape and there are risks associated with plummeting office valuation as well as demand for new mortgage originations. If the CRE market situation deteriorates, I think there might be an opportunity to buy into Starwood Property Trust at a much more compelling valuation in the future. Now, I am updating my position to sell.

Changing Investor Sentiment, Lowering STWD To Sell

In the last couple of articles that I have written about Starwood Property Trust, I have often referred to the trust's diversified portfolio, strong originations and good dividend coverage as very good reasons to own STWD for a passive income portfolio. The dividend alone, however, should not be the only reason investors should buy or sell a dividend investment; the total return also matters.

With the trust's stock price going from about $16 in May to $21 in July (+32%), I think it makes sense to capitalize on surging investor sentiment and lock in profits.

The reason why I have sold my position in Starwood Property Trust this week is that I think the market is now overly bullish and ignores risks in the office real estate market. With the stock also trading at a high premium to book value, it was an easy decision for me to sell.

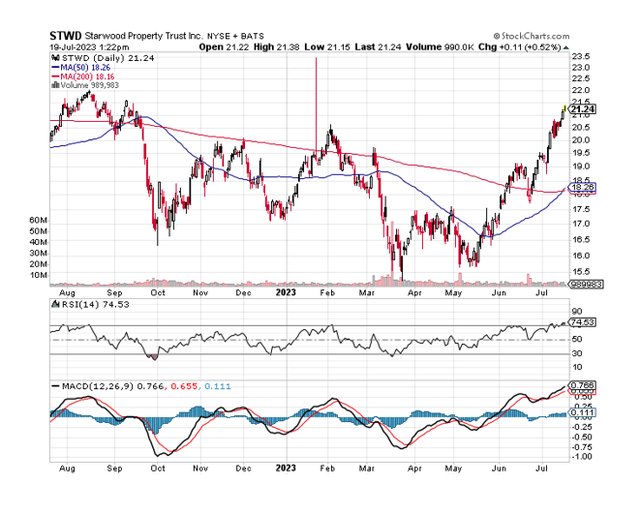

In the last two months, the stock of Starwood Property Trust has been repriced due to rising investor optimism, reducing concerns about a financial crisis, and increased risk appetite. Starwood Property Trust, unfortunately, is now substantially overbought based on the Relative Strength Indicator. Even though I don't primarily base my investment recommendations on technical chart situations, I think that the use of the Relative Strength Index can help passive income investors spot exuberance.

Relative Strength Index (Stockcharts.com)

Market May Ignore Office Real Estate Problems

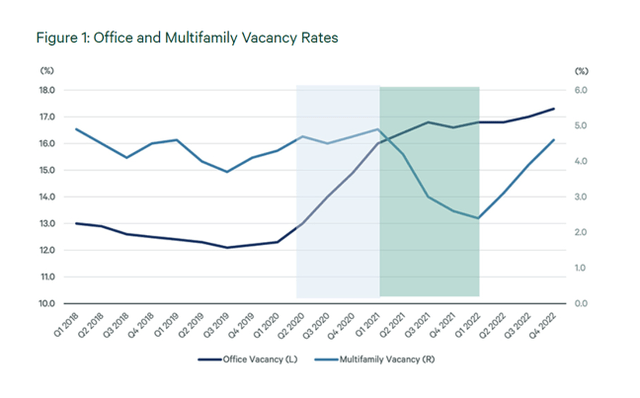

The office real estate market is not in great shape, in part because office leases tend to have shorter lease lengths than residential real estate which causes releasing risks for landlords. Office vacancies have been sharply on the rise since the pandemic and there are so far no signs that the pressure is coming off the market in the near term.

Office And Multifamily Vacancy Rates (CBRE)

Office valuations have plummeted and delinquencies for office CMBS are on the rise which are concerns for the office market at large, but also for CRE focused REITs like Starwood Property Trust whose originations partly depend on demand for new mortgage loans that are backed by office real estate. In short, deteriorating fundamentals in the office real estate market directly translate to lower loan demand for Starwood Property Trust.

The National Bureau of Economic Research published a paper titled Work From Home and the Office Real Estate Apocalypse suggests that New York real estate alone could have 44% valuation downside over the long run as multiple headwinds (lower re-lease rates, higher vacancies, higher interest rates makes) make it harder for landlords to turn a profit on their office real estate holdings.

Small Margin Of Safety In The Dividend Pay-Out Ratio

Starwood Property Trust does have office exposure, though the REIT remains diversified across a number of real estate sectors. Starwood Property Trust's total loan exposure to offices at the end of the first quarter was 13% (not counting medical office buildings accounted for separately as part of STWD's owned real estate portfolio).

Investors appear to me to be very exuberant right now which might imply that concerns over headwinds in the office real estate market may not be recognized as such.

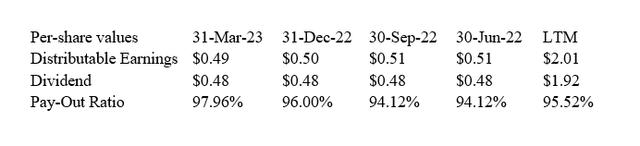

A specific point of concern for me is that softening demand for new mortgage loans might affect Starwood Property Trust's pay-out ratio, which, as of 1Q-23, was 96%. Though I don't expect STWD to run into any immediate dividend coverage issues, the commercial mortgage REIT does not have a very large margin of safety relating to its dividend.

I am reproducing my dividend pay-out metrics table below, for your convenience.

Dividend (Author Created Table Using Company Supplements)

Starwood Property Trust: No Longer A Steal

The main reason why I'm changing my recommendation on Starwood Property Trust is that I think investors have become too bullish on the trust despite concerning trends in the office real estate market.

The U.S.'s bank crisis in March has also sparked fears about commercial real estate exposure and an FT article explained that banks rushed, starting in 1Q-23, to sell commercial real estate assets (loans) for fear of deteriorating fundamentals in the sector. JPMorgan and Wells Fargo warned of losses in the market for offices.

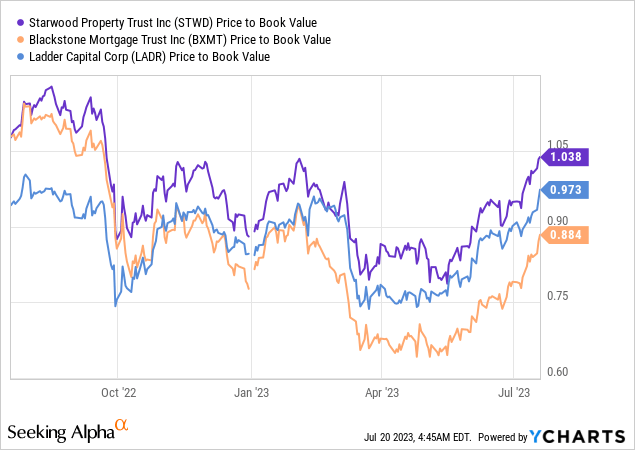

Despite these headwinds, STWD has surged 32% since May and now trades at a small premium (3%) to book value whereas in May it traded at a substantial discount.

Other CRE trusts, like Blackstone Mortgage Trust Inc. (BXMT) and Ladder Capital Corp. (LADR) have seen their book value discounts shrink substantially though none trades at a premium like STWD.

Why Starwood Property Trust Could Either See A Higher Or Lower Valuation

In the medium term, I would expect that Starwood Property Trust's valuation moves in line with the broader trends in the commercial real estate market.

An increase in loan defaults, refinancing issues for borrowers and rising vacancies are all reasons to suspect that market conditions in the U.S. commercial real estate market will remain challenging in the short term.

On the contrary, the emergence of recovery trends in the commercial real estate market as well a recovering origination business, particularly in the office sub-sector, would justify a revisit of the investment thesis.

My Conclusion

I took advantage of the strong increase in the price for Starwood Property Trust and closed out my position entirely. Though I still find lots of things to like about the commercial REIT, such as a diversified business and multiple revenue streams, there is a time to sell and this time is now, in my opinion.

STWD's yield has dropped from more than 11% in May to 9% today and the stock is marketed at a premium to book value. The stock is also overbought, reflecting investor exuberance.

Weighing the pros and cons of an investment in Starwood Property Trust I come to the conclusion that passive income investors may want to take profits here and wait for a pullback to restart a position, potentially at a much more compelling valuation.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.