Hope Bancorp: Over 5% Dividend Yield, But Earnings Face Margin Pressure

Summary

- Hope Bancorp, Inc. margin decline will likely undermine loan growth, leading to an earnings decline.

- Despite the earnings outlook, the dividend payout is unlikely to dip. Hope Bancorp is offering a very high dividend yield of 5.8%.

- The December 2023 target price suggests quite a high upside from the current market price.

kool99

Earnings of Hope Bancorp, Inc. (NASDAQ:HOPE) will most probably dip this year because of pressure on the margin from expensive borrowing. Subdued loan growth will likely counter the effect of margin pressure. Overall, I'm expecting the company to report earnings of $1.30 per share for 2023, down 28% year-over-year. The year-end target price for Hope Bancorp, Inc. suggests a high upside from the current market price. Further, Hope Bancorp is offering an attractive dividend yield. Therefore, I'm maintaining a buy rating on Hope Bancorp.

Expecting the Liquidity to Hurt the Margin Through the Middle of Q3

Hope Bancorp significantly raised its cash balance by borrowing from the FHLB (Federal Home Loan Bank System) and FRB (Federal Reserve Board) during the first quarter. Although this decreased the riskiness in the wake of the bank failures earlier in 2023, this measure also took its toll on the margin. The reason is that borrowings are costly while cash carries a very low yield. As there have been no new deposit runs on banks or bank failures, I think Hope Bancorp will slowly reverse its cash position by paying down its borrowings. I'm expecting this unfeasible position to have hurt the margin in the second quarter of 2023. Further, I'm expecting this position to squeeze the margin in part of the third quarter of this year before the entire position is reversed.

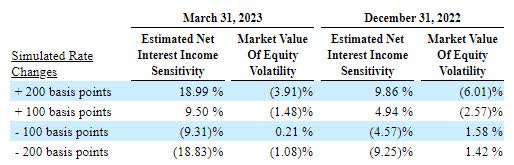

Excluding the effect of the liquidity, the margin will benefit in the upcoming quarters due to the ongoing up-rate cycle and the top line's positive correlation with interest rates. The results of the management's rate sensitivity analysis given in the 10-Q filing show that a 200 basis points hike in interest rates could increase the net interest income by a massive 18.99% over twelve months.

1Q 2023 10-Q Filing

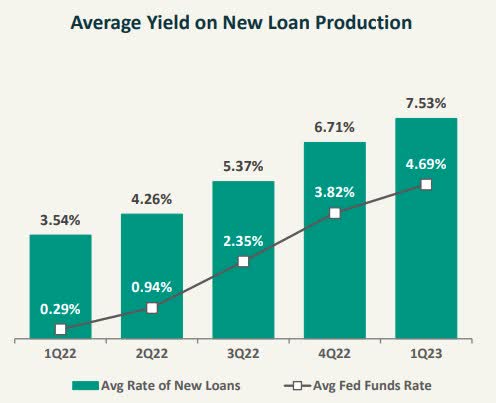

Further, new loan production will raise the margin as the rate on new loans has recently been much higher than the average portfolio yield, according to details given in the latest presentation. My outlook on new loan production is discussed in greater detail below.

1Q 2023 Presentation

Considering these factors, I'm expecting the margin to have decreased by 10 basis points in the second quarter of 2023 before rising by 15 basis points in the second half of the year.

Loan Trend Has Most Probably Bottomed Out

Hope Bancorp's loan portfolio size continued to slip in the first quarter of the year, as the portfolio dipped by 2.2%. The management had mentioned in Q3 2022's conference call that it had become selective in originating loans. Therefore, I had expected a slowdown. However, a decline is worse than my previous expectation.

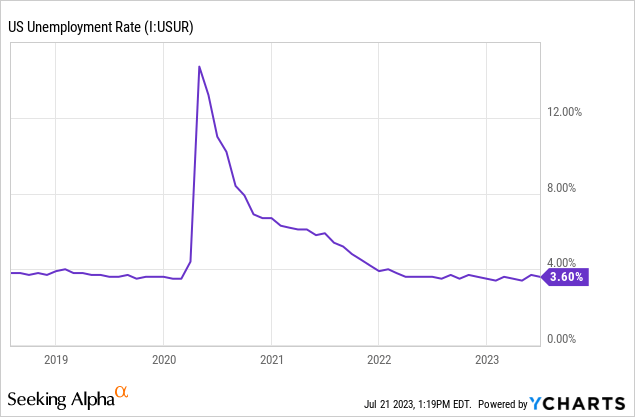

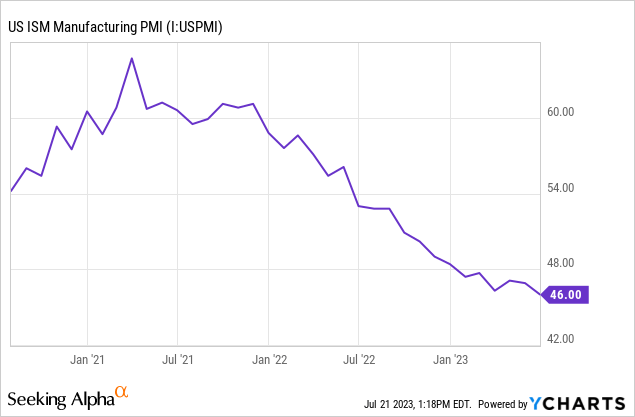

The management expects the growth to improve from the first quarter's level. As mentioned in the presentation, the management expects loan growth to be in the low-single-digit range for the full year. Given the economic condition, I believe the management's growth target is not difficult to achieve. Hope Bancorp is a nationwide lender with a focus on businesses owned by Korean Americans. Therefore, national economic metrics like the Purchasing Managers' Index and unemployment rate are good gauges of business sentiment and consequently Hope Bancorp's product demand. The unemployment rate currently gives a positive outlook, while the PMI index provides a negative outlook for loan growth.

Considering the overall demand outlook, I'm expecting the loan portfolio to grow by 3.0% in 2023. I'm expecting deposit growth to be slighter better than loan growth, in line with the recent trend. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net Loans | 12,006 | 12,182 | 13,356 | 13,812 | 15,241 | 15,697 |

| Growth of Net Loans | 9.0% | 1.5% | 9.6% | 3.4% | 10.3% | 3.0% |

| Other Earning Assets | 2,316 | 1,868 | 2,486 | 2,853 | 2,629 | 4,533 |

| Deposits | 12,156 | 12,527 | 14,334 | 15,040 | 15,739 | 16,674 |

| Borrowings and Sub-Debt | 1,118 | 927 | 559 | 622 | 1,275 | 2,634 |

| Common Equity | 1,903 | 2,036 | 2,054 | 2,093 | 2,019 | 2,126 |

| Book Value Per Share ($) | 14.5 | 16.0 | 16.6 | 17.0 | 16.8 | 17.7 |

| Tangible BVPS ($) | 10.8 | 12.3 | 12.7 | 13.2 | 12.9 | 13.8 |

| Source: SEC Filings, Author's Estimates (In USD million unless otherwise specified.) | ||||||

Earnings to Dip Due to Margin Pressure, Higher Expenses

The earnings of Hope Bancorp will most probably decline this year because of pressure on the margin. Further, operating expenses will be higher this year due to inflation. However, the staffing rationalization steps taken in the first quarter will constrain the growth of operating expenses. Overall, I'm expecting Hope Bancorp to report earnings of $1.30 per share for 2023, down 28% year-over-year.

The company is scheduled to announce its second-quarter results pre-market on July 24, 2023. I'm expecting it to report earnings of $0.32 per share, almost unchanged from the first quarter's results. The following table shows my annual income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net interest income | 488 | 467 | 467 | 513 | 578 | 559 |

| Provision for loan losses | 15 | 7 | 95 | (12) | 10 | 26 |

| Non-interest income | 60 | 50 | 53 | 44 | 51 | 44 |

| Non-interest expense | 278 | 283 | 284 | 293 | 324 | 367 |

| Net income - Common Sh. | 190 | 171 | 112 | 205 | 218 | 157 |

| EPS - Diluted ($) | 1.44 | 1.35 | 0.90 | 1.66 | 1.81 | 1.30 |

| Source: SEC Filings, Author's Estimates(In USD million unless otherwise specified). | ||||||

The Risk Level Appears Somewhat Low

Uninsured deposits were around 38% of total deposits while the available borrowing capacity, cash and cash equivalents, and unpledged investment securities covered around 50% of total deposits at the end of March 2023, according to details given in the presentation. Therefore, the uninsured deposits do not present much of a threat to the going concern status of the company. However, in case of a deposit run on the bank, the uninsured deposits present a threat to the margin, and consequently the earnings of the company because in such an event cheaper deposits will get replaced by more costly borrowings.

Apart from the uninsured deposits, the risks are subdued. Hope Bancorp's loan book is well-diversified geographically. Further, unrealized losses on the Available-for-Sale securities portfolio amounted to $201.1 million, which is around a manageable 10% of the total equity balance. As a result, I believe Hope Bancorp's total risk level is low to moderate.

Attractive Dividend Yield and Price Upside Call for a Buy Rating

Hope Bancorp is offering a dividend yield of 5.8% at the current quarterly dividend rate of $0.14 per share. The earnings and dividend estimates suggest a payout ratio of 43% for 2023, which is in line with the five-year average of 41%. Therefore, I'm not expecting any change in the dividend level. As it is, Hope Bancorp does not change its dividend level often.

I'm using the historical price-to-tangible book ("P/TB") and price-to-earnings ("P/E") multiples to value Hope Bancorp. The stock has traded at an average P/TB ratio of 0.92 in the past, as shown below.

| FY19 | FY20 | FY21 | FY22 | Average | ||

| T. Book Value per Share ($) | 12.3 | 12.7 | 13.2 | 12.9 | ||

| Average Market Price ($) | 11.7 | 8.5 | 13.1 | 14.0 | ||

| Historical P/TB | 0.95x | 0.67x | 0.99x | 1.09x | 0.92x | |

| Source: Company Financials, Yahoo Finance, Author's Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $13.8 gives a target price of $12.7 for the end of 2023. This price target implies a 32.3% upside from the July 20 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.72x | 0.82x | 0.92x | 1.02x | 1.12x |

| TBVPS - Dec 2023 ($) | 13.8 | 13.8 | 13.8 | 13.8 | 13.8 |

| Target Price ($) | 10.0 | 11.4 | 12.7 | 14.1 | 15.5 |

| Market Price ($) | 9.6 | 9.6 | 9.6 | 9.6 | 9.6 |

| Upside/(Downside) | 3.7% | 18.0% | 32.3% | 46.7% | 61.0% |

| Source: Author's Estimates |

The stock has traded at an average P/E ratio of around 8.4x in the past, as shown below.

| FY19 | FY20 | FY21 | FY22 | Average | ||

| Earnings per Share ($) | 1.35 | 0.90 | 1.66 | 1.81 | ||

| Average Market Price ($) | 11.7 | 8.5 | 13.1 | 14.0 | ||

| Historical P/E | 8.7x | 9.4x | 7.9x | 7.7x | 8.4x | |

| Source: Company Financials, Yahoo Finance, Author's Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $1.30 gives a target price of $11.0 for the end of 2023. This price target implies a 14.0% upside from the July 20 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 6.4x | 7.4x | 8.4x | 9.4x | 10.4x |

| EPS 2023 ($) | 1.30 | 1.30 | 1.30 | 1.30 | 1.30 |

| Target Price ($) | 8.4 | 9.7 | 11.0 | 12.3 | 13.6 |

| Market Price ($) | 9.6 | 9.6 | 9.6 | 9.6 | 9.6 |

| Upside/(Downside) | (13.0)% | 0.5% | 14.0% | 27.6% | 41.1% |

| Source: Author's Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $11.9, which implies a 23.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 29.0%. Hence, I'm maintaining a buy rating on Hope Bancorp.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.