Outset Medical: Expansive TAM, Yet Profitability Remains Distant

Summary

- Outset Medical Inc's share price has risen by over 11% over the past year, but the company lacks a positive bottom line, making it a risky investment.

- The company, which develops hemodialysis systems for dialysis, recently reported revenues of $33.5 million, a 9.5% increase YoY, and gross margins of 19.2%.

- Despite its cutting-edge technology and large total addressable market, the company's negative net margins and speculative nature make it a hold rather than a buy for the moment.

Extreme Media

Investment Outline

Outset Medical Inc (NASDAQ:OM) has had a quite decent last 12 months for the share price as it's up nearly 12%. But there is still a lack of fundamentals in the business, like a missing positive bottom line. This investment would come with a lot more added risk, risk that I am not sure is worth paying for right now. The first positive EPS seems to be far out and that makes me more willing to invest elsewhere right now.

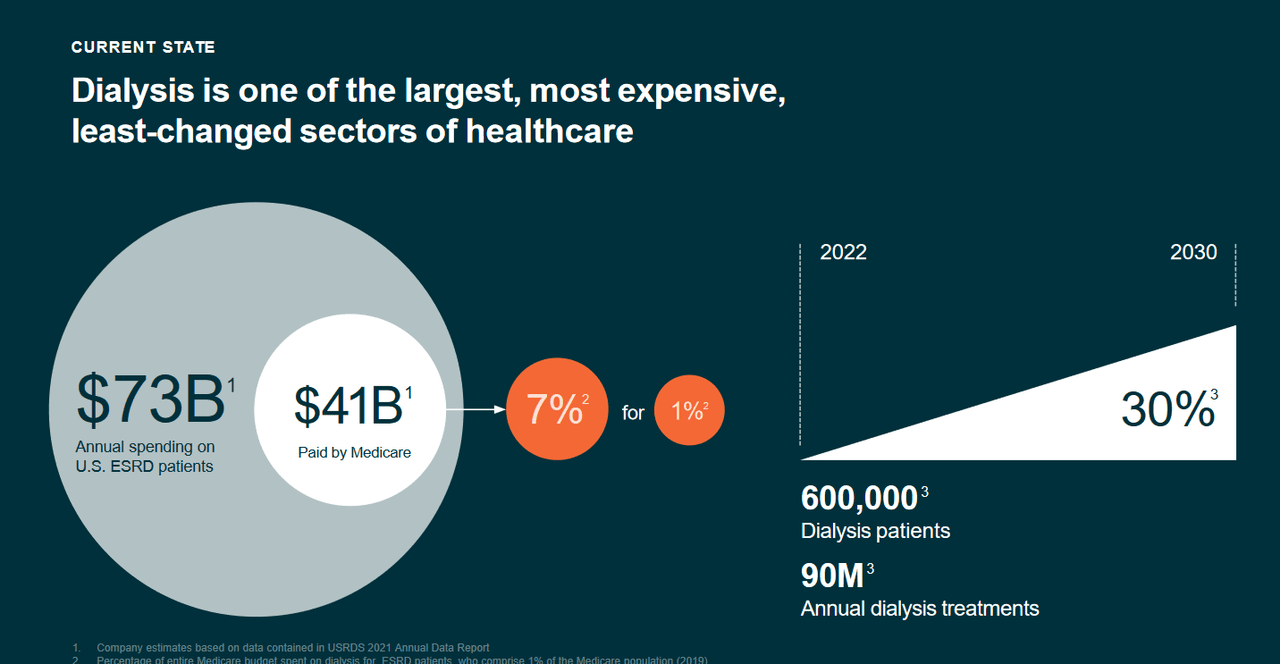

The company focuses on developing hemodialysis systems for dialysis. As for the market that OM operates in it seems to have a solid outlook showcasing a 6.1% CAGR until 2030. In the previous report, OM managed to outpace this with revenues growing 9.5% YoY, reaching $33.5 million. This isn't fast enough to justify or support a buy case here though. It seems you would be losing out on potential gains as other profitable companies could provide higher returns. However, I still think OM is an exciting company and the long-term is positive, therefore I will have them as a hold.

Recent Developments

OM showcased between April 11-15 the potential of their technology and that seemed to have caused a slight jump in the market share price between those days, since then it's up slightly as well. But during that conference and presentation, the company CEO shared some comments,

"Our latest studies demonstrate how Outset is working to bring innovation to the dialysis industry by overcoming the bias that chronic kidney disease (CKD) patients need perfect conditions to treat at home".

Market Opportunity (Earnings Presentation)

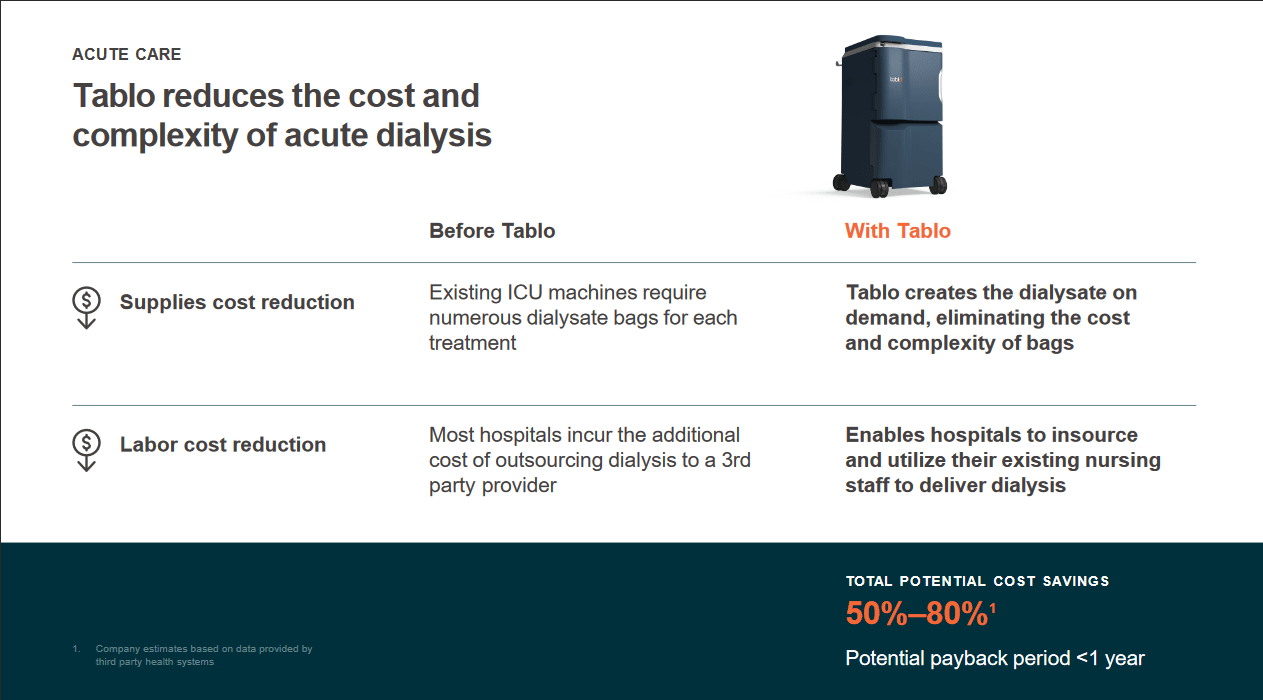

The market that OM serves is a very complex one and the priority of OM lies with reducing the cost and complexity for patients in need of dialysis. The recent presentation shows why OM offers investors solid exposure to this market as they focus primarily on this. But as we are far from profitability yet, there might be some volatility and difficult years still to go. At least until we see the potential of growing revenues and earnings operating as a medical technology company.

Besides the conference, OM also announced earnings not that long ago. On March 31, 2023, OM reported revenues of $33.5 million, a 9.5% increase YoY. But this wasn't perhaps what investors were looking at mostly, instead, the margins were in the spotlight and OM didn't disappoint. The gross margins reached 19.2%, up from 14.5% a year prior.

In the quarter, OM also added 30 new hospital sites as part of their Outsets land and commercial strategy expansions. This was the largest quarterly growth for the company ever since 2021. We aren't that far off until the Q2 report is released either. On August 2, 2023, OM is releasing it and what will be in the spotlight once again I think is the margins. If we continue to see QoQ growth from OM then I find it likely we might have the share price continuing to go up. What we need to see is strong improvements toward profitability to better be able to evaluate the potential value of the business. For the moment it's still quite speculative I think.

Margins

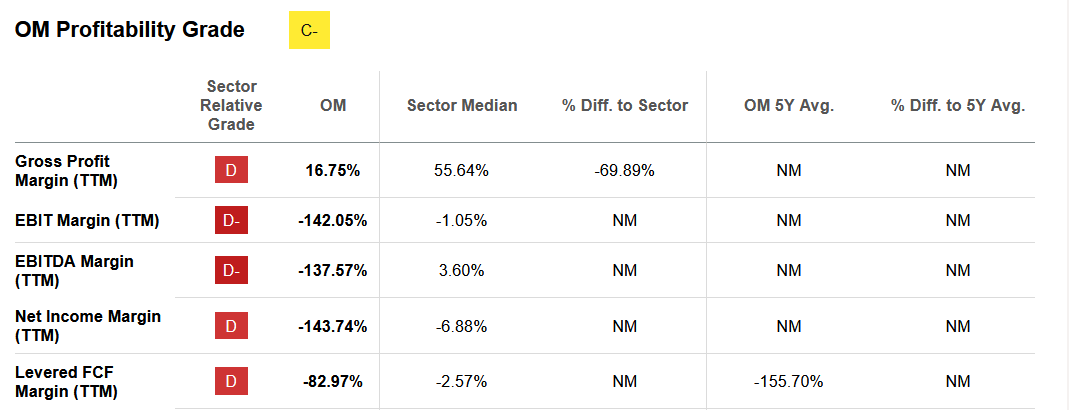

Margin Profile (Seeking Alpha)

The margins for OM are a very tough part to view. Based on the image above here I think most investors would turn right around when OM has negative net margins of 143%. But it seems that margins are supposed to rapidly expand based on expectations. In 2024 the EPS prediction sits at $(2.37). With the revenue estimation and around 50 million outstanding shares, we would land at a negative net margin of around 40%. That would be a significant improvement and one that if beat could yield a higher share price. It is still not good enough to make for a buy case though I think is important to mention. In the long term, the FCF margin will also be a crucial part to oversee.

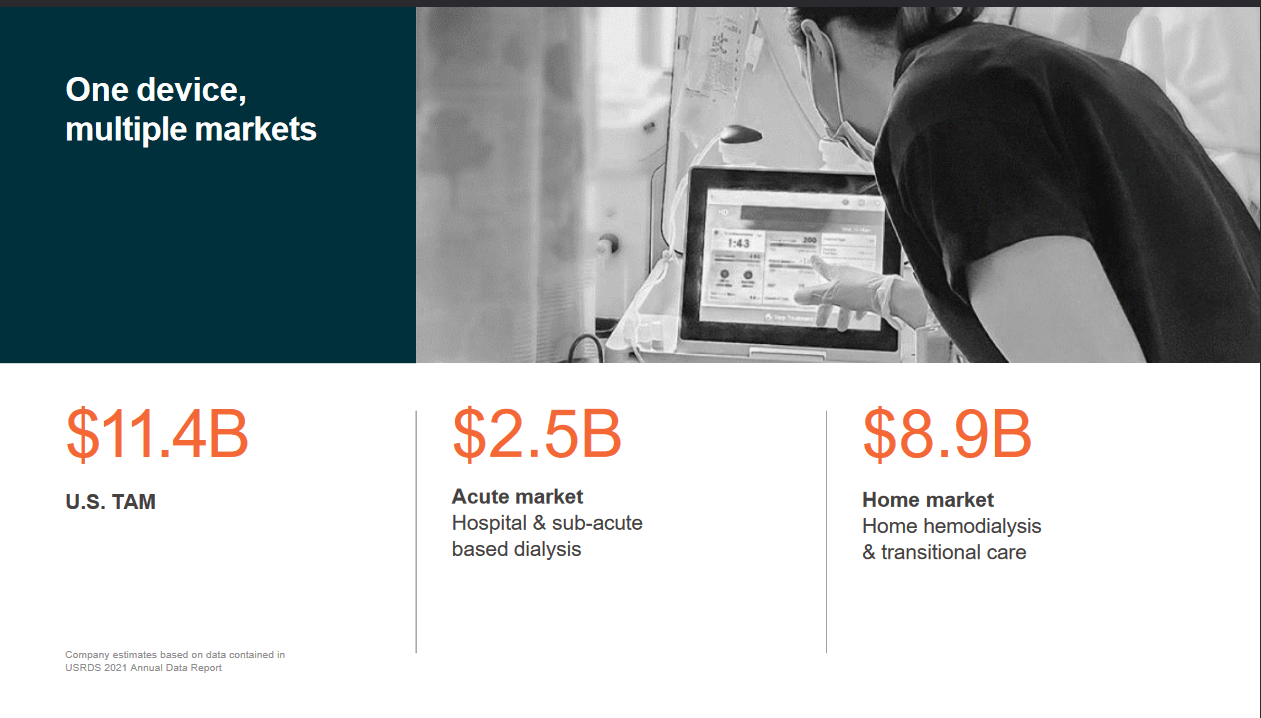

TAM Opportunity (Earnings Presentation)

If OM can beat the sector's average then it will be in a fantastic position to invest aggressively and fuel more growth. Seeing as they have a massive market opportunity of $11.4 billion in just the US OM will in my opinion continue to see strong revenue growth. But eventually, it has to trickle down to strong bottom-line margins.

Risks

Operating in the healthcare sector comes with its challenges, as it involves dealing with high expenses and stringent regulations. Developing new products and treatments requires significant investments in research, clinical trials, and manufacturing processes. These expenses can quickly escalate, especially if a company faces setbacks or delays in its development pipeline.

Company Product (Earnings Presentation)

Besides, OM is currently significantly in the negatives for its margins and I don't see any good argument that we will see a quick change in this. Investors should expect a lot of volatility in the share price. An investment size should be smaller to reflect the speculative aspect of the company.

Investor Takeaway

OM is a very exciting company that is delivering a very necessary solution to the dialysis market, reducing costs and creating more efficient solutions. The company has only been operating since 2003 and in its industry that time is often not enough to grow margins into a strong enough state of profitability. This has resulted in share dilution over the years and the net margins are negative 138% in the last 12 months. This isn't setting OM up as a good investment opportunity right now I think. But the technology is cutting edge and the TAM is massive. Having exposure to this seems beneficial and viewing it as anything other than a long-term investment would be a mistake. But I want a positive net margin before suggesting a buy, as a result, for the moment I view OM as a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.