Digimarc: Weak Bottom Line And High Risk

Summary

- Digimarc Corporation performance has been underwhelming in the last five years, with a negative 3% return, despite an all-time return of 208%.

- Financial performance is weak across growth, profitability, and cash flow generation, with high R&D expenses and volatility in revenue growth.

- Despite owning an extensive patent portfolio in digital watermarking, risk remains high. I give Digimarc Corporation stock a neutral rating.

monkeybusinessimages/iStock via Getty Images

Digimarc Corporation (NASDAQ:DMRC) is a technology company that specializes in developing and licensing digital watermarking and identification solutions.

Founded in 1995, the company went public in 2008. Though all-time return stands at ~208%, performance has been underwhelming in the last five years. The 5-year return is negative 3%, though performance seems to have improved YTD, with the stock gaining ~57%.

I rate DMRC neutral. My target price model suggests that at ~$29 per share today, the price level is unattractive to initiate a buy position. Furthermore, I believe that risk remains high. In particular, I would be cautious about the product digitization space, which seems to present limited but growing opportunities.

Risk

Overall, Digimarc Corporation exposes investors to a relatively high-risk level in my view. I remain uncertain about the mission criticality of DMRC’s products from the perspective of its customers. While product digitization seems to represent a large TAM (total addressable market) on paper, the space also seems to be quite emerging and unproven.

As such, I may anticipate sales execution issues related to low market awareness today, where many of DMRC's potential customers may not be fully aware of the benefits of digital watermarking and cloud-based product data.

Another key part of the problem would be the implementation of DMRC's solution, which requires deep integration into the existing workflows of its potential customers. For instance, implementing a digital twin technology to help with plastic recycling solutions for a CPG retail customer would require DMRC to integrate its solutions into the customer's packaging manufacturing process.

Suffice it to say, I think that the lackluster financial performance as of Q1 alone has further underlined such anticipated challenges.

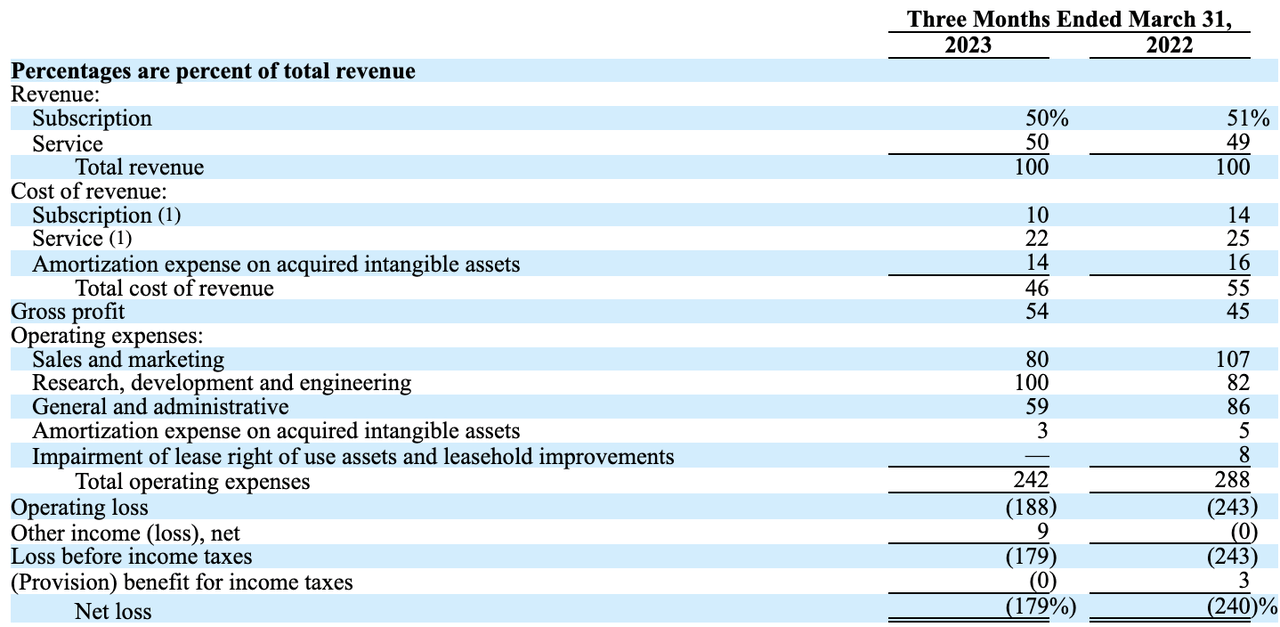

In Q1, growth continued to be expensive for DMRC. Looking at its significantly high R&D expenses, it appears as if DMRC has been iterating on its product developments heavily, suggesting that it has yet to be in a position where it can scale based on a solid product-market fit. Likewise, though sales & marketing expenses as % of revenue improved to 80% in Q1, the figure is still exceedingly high. As such, it also somehow highlights the emerging nature of the space, where lengthy market education and tailored sales processes may have been required to demonstrate the value of the offering.

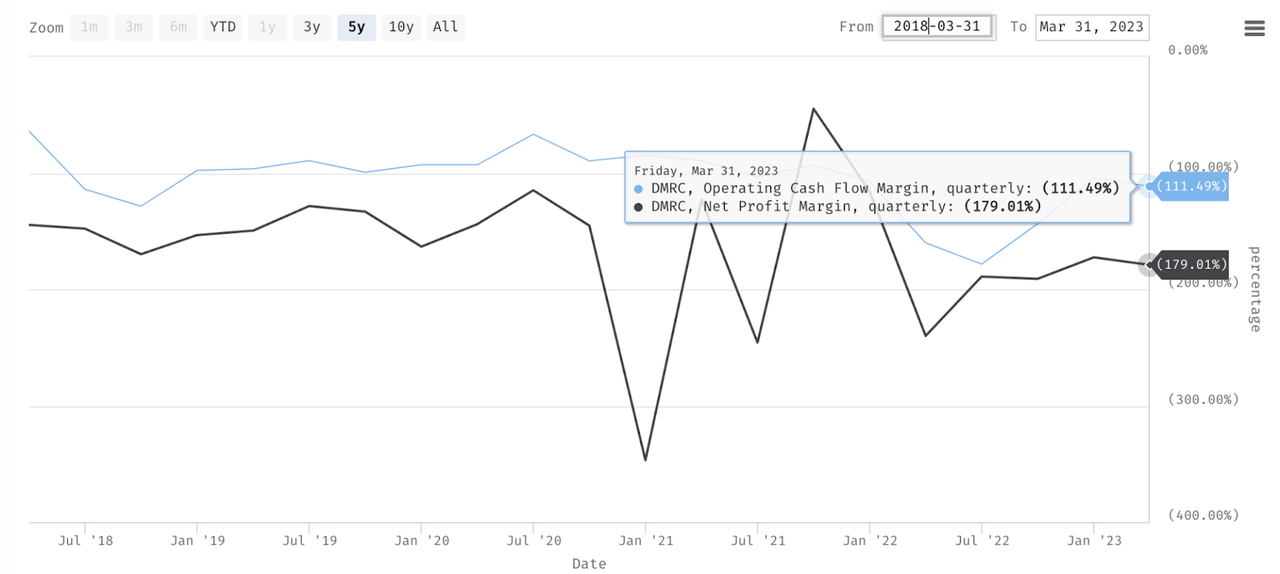

In general, though, DMRC’s fundamentals have been weak across growth, profitability, and cash flow generation. Revenue growth has been volatile. DMRC posted double-digit revenue growth in the last two years, but growth has declined to ~5.8% in Q1.

Operating cash flow / OCF and net profitability have also been far away from breakeven, with minimal signs of improvements. Moreover, DMRC has actually seen margin contractions since the past 5 years.

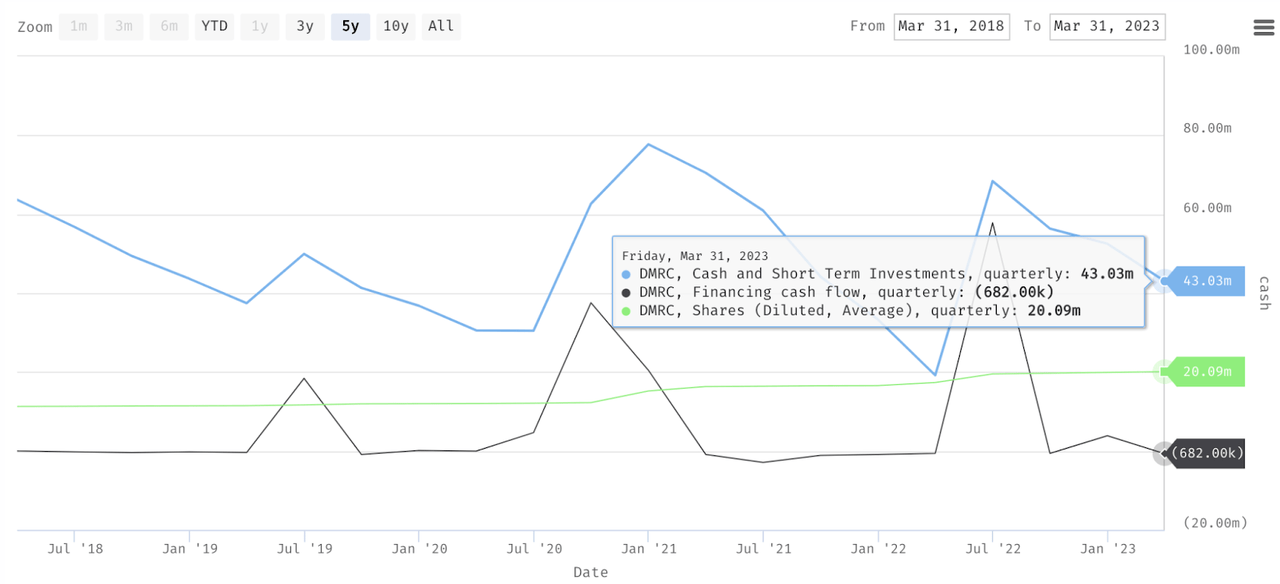

DMRC has also been relying on shares issuance to generate liquidity due to the negative OCFs, with the total number of shares almost doubling over the same period, effectively diluting the shareholders. As of today, DMRC’s business doesn’t look sustainable. Based on the cash-burn pattern, it seems that DMRC may potentially need another financing sometime late this year.

Catalyst

Aside from the management’s focus on operational efficiencies that may lift margins, I think that near-term catalyst remains minimal. Though I don't fully have a good grasp on the future of the product digitization space, there seems to be a genuine opportunity for DMRC to win in the space given the lack of competition. To a large extent, it would likely be due to the DMRC's possession of various technology patents:

we believe we have one of the world’s most extensive patent portfolios in digital watermarking and related fields, with approximately 950 U.S. and foreign patents granted and applications pending as of December 31, 2022. The patents in our portfolio each have a life of approximately 20 years from the patent’s effective filing date.

Source: DMRC's 10-K.

Nonetheless, it still depends on how well DMRC can grow its business with better economies of scale. I feel that DMRC may be on the right track to do so by working with established VAR / Value Added Resellers to expand its sales channel. As I have highlighted earlier in the risk section, implementation of its technology would probably remain one of the most expensive, hence most risky activities. Partnering with VAR would alleviate some of these risks.

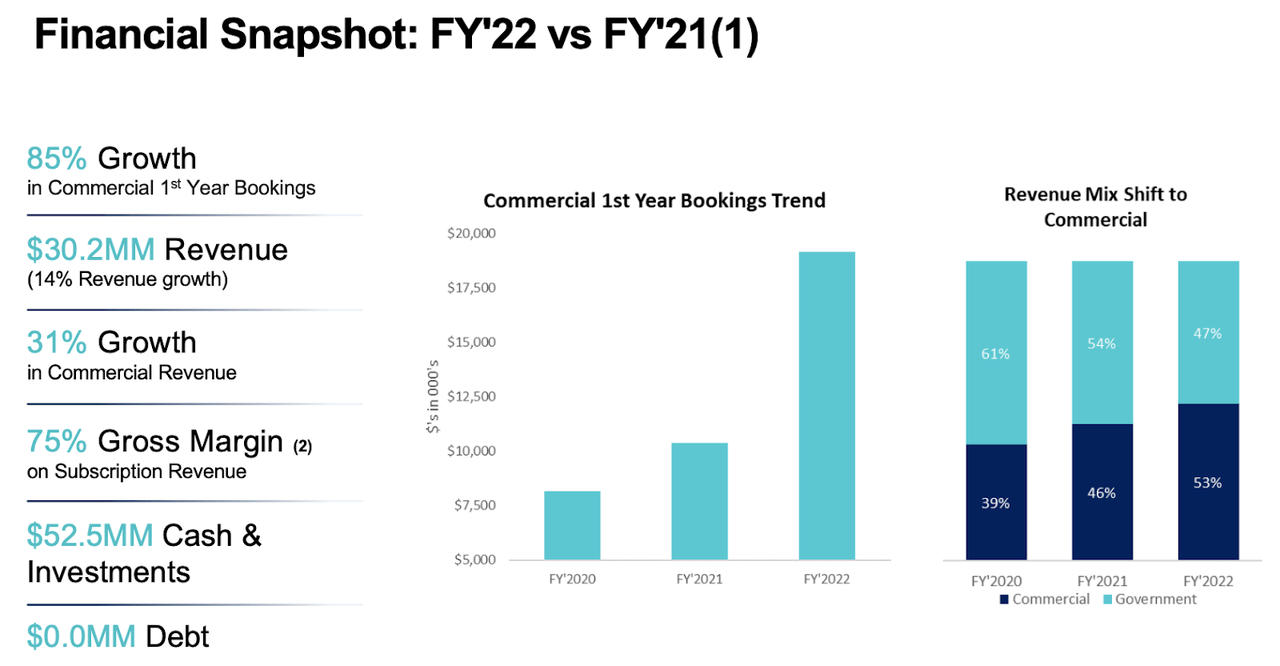

I also think that as commercial revenue continues to increase and dominates the revenue mix further, DMRC may benefit from better growth visibility, which should generally reward the stock with higher valuation premium.

Valuation / Pricing

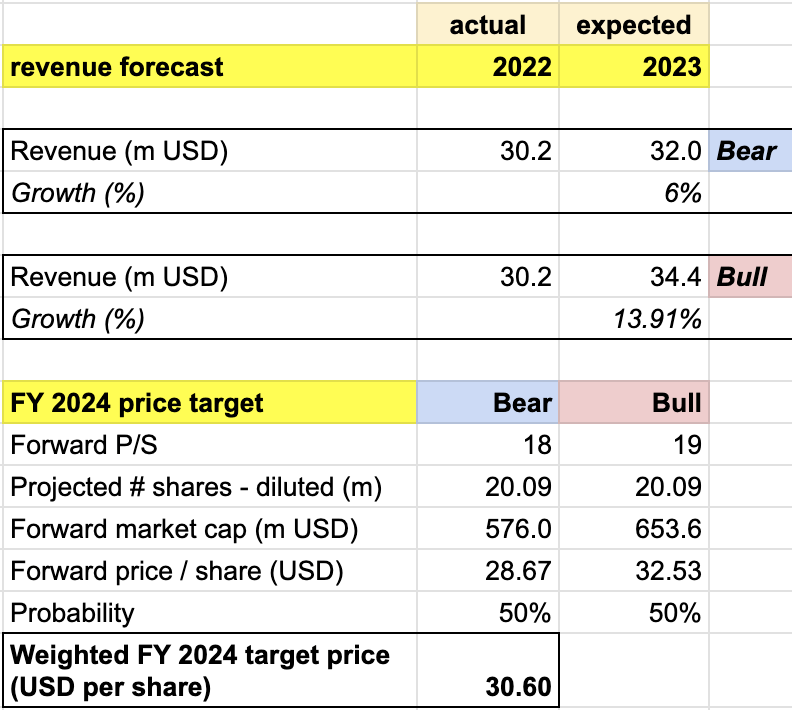

My target price for DMRC is driven by the following assumptions for the bull vs. bear scenarios of the FY 2023 target price model:

Bull scenario (50% probability) assumptions - DMRC to deliver revenue of ~$34.4 million, a ~14% YoY growth, at the highest end of the market estimates. I assume a P/S of ~19x, the level where it is trading today.

Bear scenario (50% probability) assumptions - DMRC to deliver revenue of ~$32 million, a 6% YoY growth, below the lowest end of the market estimates. I would assume that the P/S declines to 18x, a level seen a few months back.

author's own analysis

Consolidating all the information above into my model, I arrived at an FY 2023 weighted target price of ~$30.6 per share. Since DMRC is trading between ~$28 - $29 the stock appears to offer a very little upside. At this price level, I maintain a neutral stance on the stock.

Conclusion

I give Digimarc Corporation a neutral rating as the current share price of ~$29 is unappealing for a buy position. More importantly, I continue to be concerned about the high level of risk, particularly in the product digitization space, which offers limited, though growing opportunities. Despite the management's efforts to improve operational efficiencies, growth has been costly for DMRC, and there appear to be minimal near-term catalysts for significant changes.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.