Academy Sports and Outdoors: Staying Positive On Management's Ability To Execute Its Strategy

Summary

- ASO 1Q23 performance was disappointing, with adjusted EPS and revenue below consensus estimates, leading to lowered FY23 projections.

- I maintain a buy rating for ASO, expecting the company to adapt to changing consumer preferences and provide more value to customers.

- Stock price movement is likely to track how successful is management in executing initiatives.

AndreyPopov

Investment action

I recommended a buy rating for Academy Sports and Outdoors (NASDAQ:ASO) when I wrote about it the last time, and as I expected, the analyst day has reinforced my optimistic outlook on the company. Based on my current outlook and analysis of ASO, I reiterate a buy rating. I expect management to convince the market that they can execute on their announced strategy during the analyst day. I believe evidence of such success will be seen in 2H as management navigates the business to meet today’s consumers’ demands.

Qualitative review

The first quarter was a terrible performance. 1Q adjusted EPS came in at $1.30, below the $1.66 expected by consensus. The $1.38 billion in revenue missed estimates for $1.44 billion, and the -7.3% SSS missed consensus estimates for -3.6%. Lastly, the adjusted operating margin of 9.9% was also lower than the expected 12.4%. As a result, management lowered FY23 revenue and earnings projections.

My faith in management's ability to execute has been slightly shaken by this dismal quarter; they appear to have mispositioned the business from the get-go. Managers cited sluggishness in sales of high-priced seasonal categories like patio furniture and water sports as a primary cause of the revenue shortfall. Weakness in sales of other high-priced, long-replacement-cycle items like kayaks and treadmills also contributed significantly. Although apparel and footwear did better and gained some unit share in outdoor, I thought it was obvious not to pursue sales of large ticket items in light of the current inflationary climate, which has reduced consumers' discretionary spending budget.

Despite the dismal performance in 1Q, I am giving the company another quarter to see how the management deals with the preferences of their customers. As the trend toward cheaper goods continues, I anticipate that management will emphasize providing "value" to customers. This can take many shapes, including promotions, markdowns, and private label sales. The issue is that while ASO has succeeded in categories where the higher price points are justified by innovation, they have failed miserably in categories where this is not the case. Therefore, if management fail to show results of them meeting today's consumer demand, I will become more skeptical of how well ASO will cope with the current climate while also implementing the new strategy it announced.

What I think is good for the stock is that growth in the second half of the year will look much better in the headlines. In particular, the second half of the year would have more favorable sequential comparisons, less punishing weather, the introduction of new brands to potentially pique consumers' interest, potentially successful strategies tailored to the current market, and a more robust capacity to target consumers digitally, all of which should drive an increase in sequential sales. How the stock would performance would likely track how management is successful in executing these initiatives.

Quantitative analysis and Valuation

ASO is generating positive earnings; hence, I am using a forward PE multiple to compare the business against peers. ASO is trading at 7.4x forward earnings today, which is in line with the average multiple that peers’ are trading at (Dick’s Sporting Goods and Hibbett).

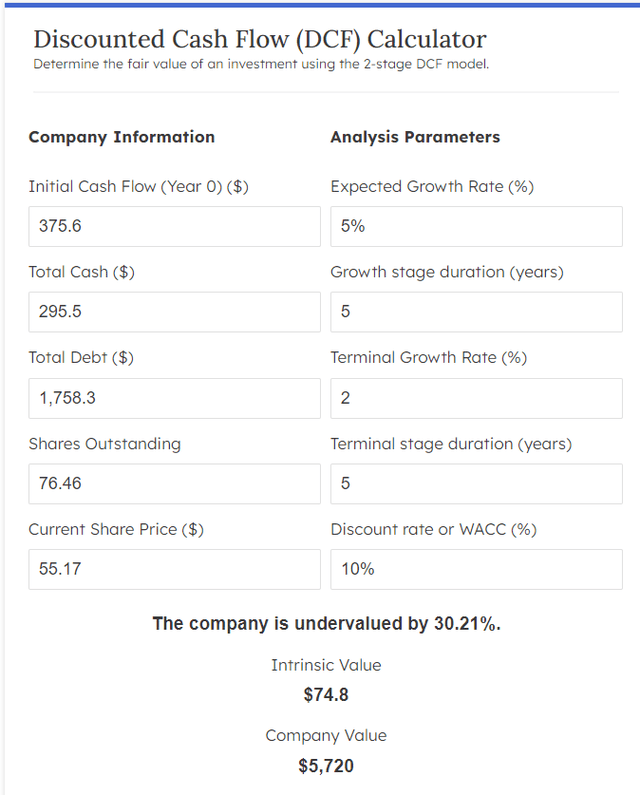

I believe ASO's new strategy will enable the business to grow FCF in the mid-single digits for the foreseeable future (the growth years), followed by a deceleration to 2% (inflation rate) as it matures in its terminal years. I believe growth will not exceed GDP growth by a huge magnitude given the nature of the business (it is not a high growth business). My simple DCF model suggests that ASO's intrinsic value is $74.80 per share, with an upside of 30%.

Risk and final thoughts

If Nike sees ASO as just another generic retail partner, they may decide to cut off product distributions to ASO altogether. If Nike products were no longer available, it could hurt ASO's financial results and stock price because of a drop in customers and market share. Also, ASO's omnichannel capabilities are inferior to those of competitors. There is a risk of ASO losing customers and market share despite its best efforts to enhance its digital presence and omnichannel capabilities.

Despite the challenging performance in the first quarter, my confidence in management ability to execute its strategy remains cautiously optimistic. While the disappointing quarter raised concerns about mispositioning and reliance on high-priced seasonal categories, I believe the company deserves another quarter to adapt to changing consumer preferences and emphasize providing "value" to customers. The success of ASO's new strategy will likely determine its growth trajectory and stock performance.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.