Ciena: Supply Chain Improving Faster Than Expected Makes It A Buy

Summary

- Ciena delivered strong financial performance following the normalization of supply chain conditions.

- I believe the company could clock a revenue surprise in FY2023 thanks to a decent backlog and the ability to work it out faster on improved customer lead times.

- The demand for Ciena’s networking offerings could remain robust due to the secular growth in the network bandwidth, data traffic, and rapid adoption of cloud computing.

- I believe that the valuation downturn of CIEN stock is unreasonable, and the company could face up to a 15% upside gain.

Sundry Photography

It took the improvement of supply chain conditions for Ciena Corporation (NYSE:CIEN) to exhibit strong growth in the key coherent optical solutions segment, which was the hardest hit in the past fiscal year. The fact that the prints came out much better than expected plays into the hands of the company and it seems unreasonable for me that CIEN stock is still in the red zone year to date. I believe that it is a good time to take a long position here in order to benefit from the potential 15% upside gap. Ciena is sitting on a decent order book, which could be executed faster than expected due to the improved customer lead times, allowing the company to potentially deliver a revenue growth surprise. Despite the current tilt of the product mix to optical lines causing gross margin weakness, this could be more than offset beyond the current fiscal period, since the new deployments tend to accumulate a backlog for higher capacity modes. In the meantime, Ciena is not backing down on technology innovations, which could allow it to capitalize on the growing demand for cloud computing as well as the expansion of networks at the edge. This delineates the need for faster connectivity and could increase the demand for Ciena's switches, routers, and converged packet optical offerings.

Outlook

The beginning of the year was marked with a rapid development of new technologies, especially in the area of artificial intelligence, against which the matter of internet connectivity and data transfer speed could become one of the key priorities for network service providers. Cloud migration and edge computing, IoT, digital transformation, VR/AR align here as well and require a face-lift of existing data center infrastructure. Concerning the latter, we saw a significant growth of 13.7% in data center systems investments last year. And despite the cloud infrastructure being expected to exhibit a moderate growth in the near-term horizon below the overall IT sector, I believe that the ever-growing demand for cloud services could support a mid-single-digit growth in capital expenditures for data center infrastructure. As a result, a favorable demand profile is delineated for communication solutions and network equipment.

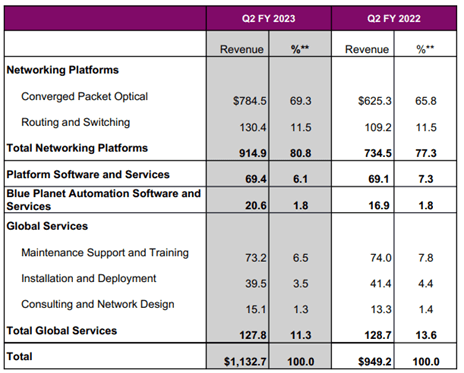

Financial results for Q2 2023 (company presentation)

With the supply chain situation improving for the third quarter in a row, Ciena demonstrated solid dynamics in the top and bottom lines. Total revenue in the second quarter of 2023 amounted to $1.13 billion, up by 19.3% YoY following increased shipments and strong momentum in the converged packet optical portfolio. The latter posted a 25.5% YoY growth due to the new customers win and another record shipment quarter in Q2 for WaveLogic 5 Extreme shipments. The new wins for broadband network gateway underpinned the routing and switching portfolio, which contributed prominently with 19% YoY growth in sales.

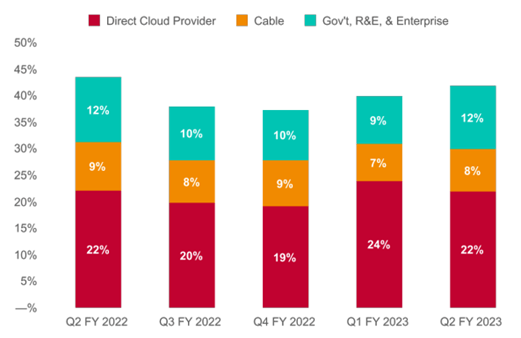

Revenue from non-telco customers (company presentation)

Breaking down the revenue dynamic by customer segments, we can notice the strong performance of cloud providers. In particular, direct cloud provider sales registered 20% YoY growth and accounted for above 20% share in the revenue mix. In line with the above-mentioned trends for cloud development, the growth within this critical customer segment could be expected to grow further.

Going forward, the industry demand drivers look optimistic against the backdrop of cloud adoption, the rollout of 5G infrastructure, and network automation, and customers can't trim the network capex in order to address these trends. Indeed, the company hasn't experienced much of capital investment cut from customers. However, the continued macro uncertainty is challenging enterprises' IT budgets and resulted in a pushout of orders by customers during the quarter, mainly by hyperscalers. Hence, the backlog amount came down by $600 million to approximately $3.5 billion. The reasoning behind this, apart from the customer budget constraints, could be the faster-than-anticipated improvement in the supply chain, which gives Ciena the ability to deliver significantly more shipments. In particular, the lead times improved prominently, which leads to the environment where order flow levels with the supply capabilities forming somewhat balance and predictability from a customer's point of view.

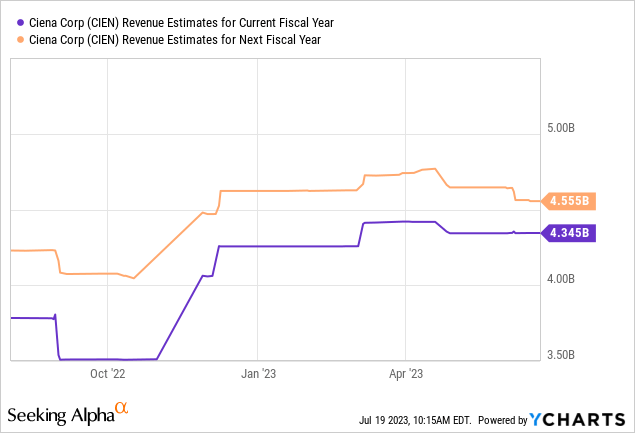

Although the company is sitting on a decent backlog, it fell short of the TTM revenue of $4 billion. Following the strong order inflow last year, the book-to-bill ratio could be calculated now below 1, which could be an indication that Ciena is receiving lower orders that it can fulfill, especially given the rapidly improving supply chain environment. This could be the point where CIEN stock lost 17% since the beginning of the year. The company does anticipate orders to underperform revenue for the second half of the year, but the point is that the demand for bandwidth remains intact. The management extended their target revenue range, the bottom one actually, from 20-22% to 18-22%. Now, given the positive surprise of the supply chain situation, I find the following market expectations to be missing something.

The current year's revenue estimate stood at $4.3 billion, and it seems to me that the number is not incorporating the fact that Ciena now has the ability to deliver more shipments due to improved lead times. As a result, I expect Ciena to have more impressive revenue growth or at least at the upper point of the range, as it could work out more of that backlog into sales. Concerning next year's estimate of $4.6 billion, I will point out first that Ciena maintains its technological leadership in networking, with the announced new generation of Wavelogic 6 network devices that support data rates up to 1.6 terabit becoming available in the first half of 2024. The solution would be the first and only on the market, and from my point of view it is clearly unsustainable with the recent next year's revenue cut.

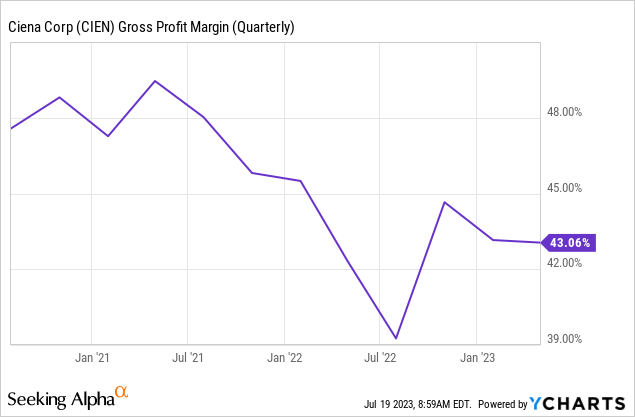

Another look at supply chain conditions could be obtained from gross margin dynamics, which was hit last year by 400bps. This year, the impact is about to come down to 200bps, showing how much the conditions are improving. Against this backdrop, Ciena achieved a 43.1% gross margin, which is up by 80bps compared to the base period.

However, it was another consecutive quarter of margin deterioration due to the unfavorable product mix, specifically the heavy mix of new line systems. Still, I expect Ciena to keep its gross margin in the 42-44% range in the upcoming third fiscal quarter. This would be a prominent improvement compared to last year, when the company experienced component shortages, necessary for the production of higher-margin modems. What gives a bright point to the margin is that optical line systems deployment, which has low data transfer rates, tends to be followed by a cycle of higher orders for modems in order to expand capacity. As a result, this could facilitate accumulation of the backlog, most of which, however, could arrive in the coming years. Moreover, the new coherent modem, WaveLogic 6, seems to be coming at the perfect timing to benefit from future orders.

Valuation Takeaways

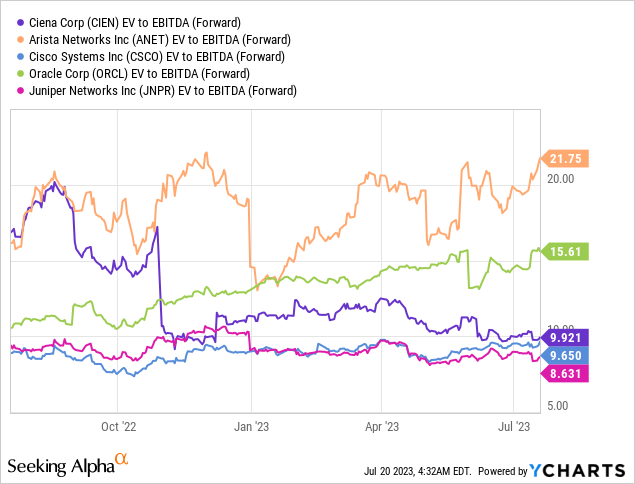

Considering the valuation, CIEN stock is trading at a significantly lower EV/Sales multiple when compared to Arista Networks (ANET), Cisco Systems (CSCO), Oracle Corp. (ORCL), and Juniper Networks (JNPR). However, the company commands a lower profitability profile as well, so let's look directly at the EV/EBITDA comparison.

Ciena is currently trading at a forward EBITDA multiple of 9.9x, which represents a 21.5% discount to the selection's 12.6x median. I would bet for 43% gross margin and EBITDA of $608 million in FY2023. This should yield an enterprise value of $7.7 billion and a $48.7 equity price per share, implying a 15.7% upside.

It's also worth noting the valuation dynamic of CIEN stock, which marked a significant downturn since the back half of 2022, as the supply chain challenges that brought higher costs have restrained the company from delivering on healthy end-market orders. Ciena has a number of advantages though, which favorably distinguishes it from other operators. The company offers a wide range of networking solutions, with a growing customer base on a regular basis. The quality of products and services is at a high level, where software and platforms from Ciena have high efficiency, applicable to various fields. The company places a significant portion of its revenue into R&D, which has led to the development of advanced technology and products that offer superior performance, scalability, and flexibility when compared to its competitors. The following trend shows that Ciena is not cutting back on innovations even in challenging market conditions, which is a key point for technology leadership.

To sum up, I believe that Ciena is an attractive Buy with a prominent upside gap for a number of reasons. The supply chain is improving at a faster-than-expected pace, which could be evidenced from customer lead times and a lower expected impact on gross margin. I wouldn't be surprised to see Ciena exceed the revenue mark for FY2023, as the company could now fulfill more of its order book. By the way, the situation with backlog is looking sound as the company is about to receive follow-up orders as a result of the heavy deployment of new optical line systems. In addition, the new coherent modems are hitting the market next year. This could boost the gross margin up to 45% as the market environment indicates that the volumes of deliveries of those higher-margin offerings and the lead times are normalizing. Last but not least, the industry profile is quite supportive of the robust demand of Ciena's optical, routing & switching offerings due to the secular growth of networking and optical communications in prospective areas like cloud computing, IoT, data centers, AI, and 5G networks.

Risk Factors

The main challenges for the company remain logistical and supply issues due to the uncertainty in the macro environment. This could drive costs upwards, reduce the availability of equipment and components, especially for the higher-margin modems, and increase customer lead times.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.