OCI Offers A 6.8% Dividend Yield, Transitions To Clean Energy

Summary

- OCI has benefited tremendously from tailwinds in 2021 and 2022, but 2023 will be worse due to lower nitrogen product prices.

- The company remained firmly free cash flow positive in the first quarter and will likely keep the damage limited this year.

- The base dividend should be fully covered. I'm not counting on the variable dividend portion as there are plenty of growth investments to fund.

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

Fahroni/iStock via Getty Images

Introduction

It has been more than a year since my most recent article on OCI (OTC:OCINF) was published. I was very happy with the share price performance as my projections were confirmed by the company. The net debt evaporated fast and OCI paid very handsome dividends to its shareholders. But as the urea price rapidly decreased in the past few quarters, 2023 won’t be as good as 2022. That came as a surprise to OCI as in Q1 2022, the company was still expecting the tailwinds to continue into 2024. That didn’t happen and the current share price is in the mid-20 EUR range, down from a high of 44 EUR per share, less than three quarters ago. As the pendulum usually swings pretty hard in both ways, I wanted to have a look to see when I should perhaps re-establish a position.

Yahoo Finance

OCI has its primary listing on Euronext Amsterdam where it’s trading with OCI as its ticker symbol. As the average daily volume on the Amsterdam listing exceeds half a million shares (the volumes are pretty consistent), it's by far the most liquid venue to trade in the company’s shares (and options). There are currently about 210M shares outstanding, resulting in a current market cap of 5.3B EUR.

As expected Q1 2023 was substantially weaker, and 2023 could be a year of "damage control"

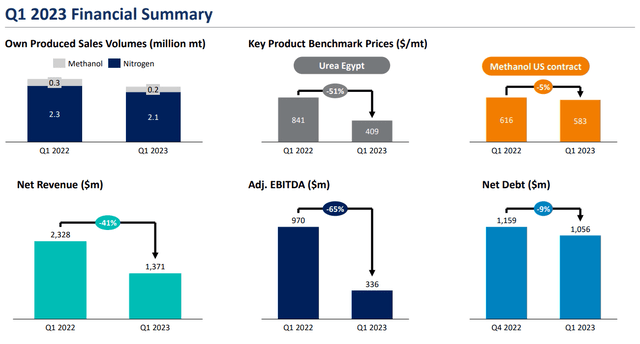

While OCI was still optimistic just over a year ago, reality has set in pretty fast. In the final quarter of 2022, the total adjusted EBITDA was about 35% lower than in the final quarter of 2021 and as the commodity prices continued to get weaker, the revenue in Q1 2023 collapsed by 41% and the adjusted EBITDA fell by about 65% on a YoY basis.

OCI Investor Relations

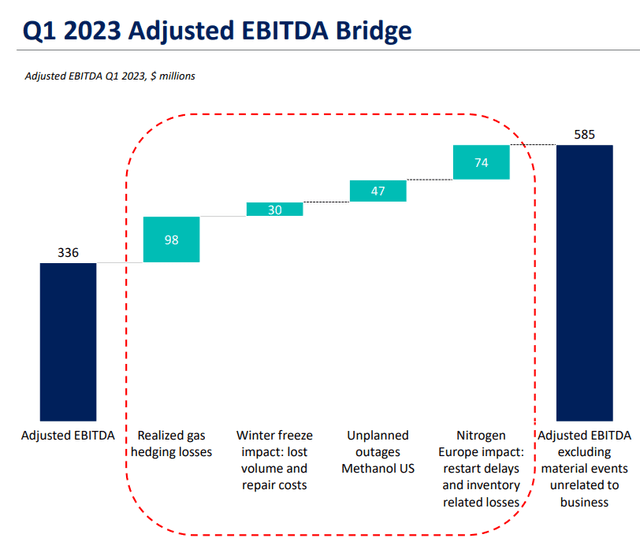

And although the $336M already is a result on an adjusted basis, OCI provided some more details where it basically "adjusted" the adjusted EBITDA for material events which were essentially unrelated to OCI as a company. As you can see below, there were about $98M in losses related to the natural gas price while another $74M impact was caused by the restart delays in Europe.

OCI Investor Relations

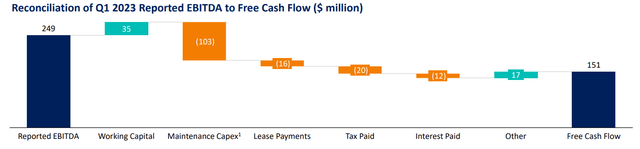

So adjusted for these exogenous events, the adjusted EBITDA was approximately $585M which isn’t too bad at all. The image below also shows OCI clearly remained free cash flow positive. The sustaining capex is relatively low and that for sure has proven to be a blessing for OCI. As you can see below, the free cash flow was approximately $151M, and after deducting the contribution from changes in the working capital position, the underlying free cash flow result was approximately $116M. That’s approximately 0.50 EUR per share at the current exchange rate, so that’s not too bad at all.

OCI Investor Relations

It's just too bad the natural gas hedges are having an important impact on the EBITDA and cash flow result. In the first quarter of 2023, OCI had hedged its natural gas at higher prices than the $4.30 per MMbtu it has uses to hedge its nat gas consumption for the next few years. This means that nat gas hedge losses should be lower going forward due to the combination of a lower hedge price and a higher market price. Additionally, management referred to the high-cost inventories of nitrogen products produced in Europe in Q4 which were subsequently sold in the much softer first quarter of this year. Additionally, unplanned outages in Texas didn’t do the company any favors. Additionally, the full-year sustaining capex is budgeted at $300M which means the $103M spent in Q1 indicates the year was front-loaded and the average sustaining capex on a quarterly basis should be just around $75M. This alone would already have boosted the Q1 free cash flow per share by 10-11 eurocents per share.

So while OCI is slowly working its way through the new normal, the company has done well by rapidly improving its balance sheet. As of the end of Q1 the net debt was just $1.06B which means the net debt to EBITDA ratio will be just around 0.6-0.7 this year. OCI also obtained an investment grade rating and issued $600M in 10 year unsecured notes at a 6.70% coupon.

OCI continues to invest in new assets

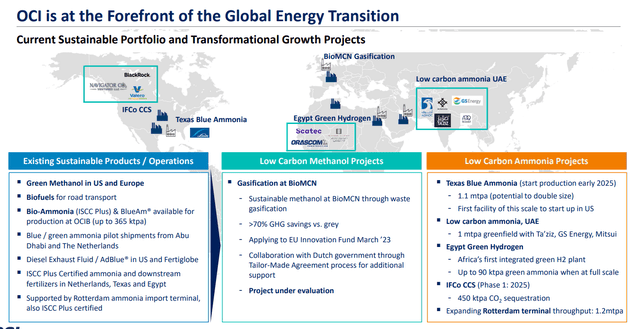

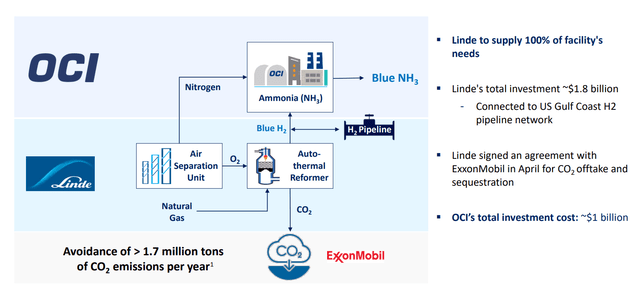

OCI plans to spend a few hundred million dollars per year on its growth initiatives and most of the attention is going towards clean energy. Methanol will likely become increasingly popular as marine fuel and OCI is definitely banking on that, but the biggest project that’s currently being developed is the Texas Blue Ammonia plant. The plant is adjacent to OCI’s Beaumont facility and the 50% owned Natgasoline methanol producer.

OCI Investor Relations

At the new Blue Ammonia plant, OCI upgrade blue hydrogen to produce blue ammonia and over 95% of the carbon emissions will be captured and sequestered (resulting in about 1.7 million tonnes of CO2 being sequestered). OCI expects an IRR of 15-20% throughout the cycle.

OCI Investor Relations

Investment thesis

My only exposure to OCI right now is a written put option which is expiring today (Friday the 21st). As the strike price is 21.50 EUR, that option will expire out of the money, and I think my best approach here is to keep an eye out for additional opportunities to write put options that are out of the money. Thanks to the volatile share price the option premiums are quite decent. A Put option with a strike price of 21 EUR (17% below the current share price) has an option premium of 1.00 EUR (the midpoint between bid and ask). So either the share price is trading above the 21 EUR level in which case I can just keep the option premium. And if OCI is trading below 21 EUR per share, my average purchase cost is approximately 20 EUR.

One important element to keep in mind is the potential dividend payable in the second half of the year. OCI pays a base dividend of $400M per year (approximately 1.70 EUR per share at the current exchange rate) and a variable dividend based on the free cash flow results of the company. Given the still robust free cash flow in Q1, the $400M annual base dividend should be fully covered but I don’t think we should count on the variable dividend as I’d prefer OCI to use the excess cash flow to fund its growth initiatives. If the dividend would indeed remain limited to just the base dividend, the dividend yield would be approximately 6.8% based on the current share price and exchange rate. That’s a fair compensation for waiting for the core business to gain momentum again.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have written an out of the money put option and will likely continue to write put options on OCI.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.