Hostess Brands: Good Growth Prospects But Valuation Is Not Attractive Enough

Summary

- Hostess Brands' revenue growth is expected to benefit from volume recovery, increased advertising and promotional activities, and new product innovations.

- The resilient nature of the snacking category should help the company offset macro headwinds.

- However, the company's growth prospects are already reflected in the stock price at the current premium valuation, leading to a neutral rating on the stock.

Tim Boyle

Investment Thesis

Hostess Brands' (NASDAQ:TWNK) revenue growth should benefit from sequential volume recovery due to easing comparisons in the back half of 2023. Moreover, never-ending snacking behavior should help the category stay resilient even during a tougher macroeconomic environment. Further, revenue should also benefit from increasing investments in advertising and promotional activities and new product innovations.

On the margin front, the company should also see good growth in the coming years as it benefits from normalized investment levels, productivity gains, and a more favorable cost environment. Overall, I am optimistic about the company's growth prospects. However, these prospects are already reflected in the stock price at the current levels as the company is trading at a premium compared to its historical valuation multiple. I would prefer to wait on the sidelines for a better entry point. Therefore, I have a neutral rating on the stock.

Revenue Analysis and Outlook

In my previous article, I discussed Hostess Brands' ability to keep on delivering revenue growth despite the normalization of demand for its products post-pandemic, with the help of reinvesting in growth through new innovations and advertising. However, I preferred to stay on the sidelines due to its slight premium valuation. Since then, the company has reported earnings for the first quarter of 2023 and the stock price has remained flattish.

In the first quarter of 2023, the revenue growth continued. However, the company is experiencing a normalization of demand for sweet-baked products after solid demand during the last couple of years. In addition, the company also lapped high volume growth in the previous year's first quarter, where TWNK benefited from its ability to supply the increased demand compared to the peers in the same category.

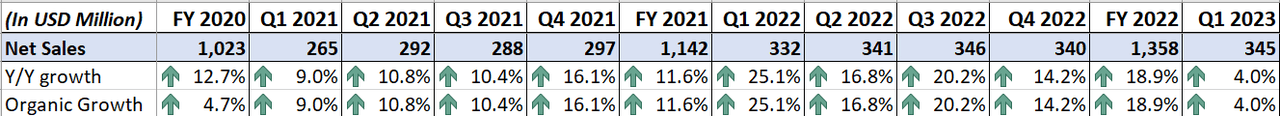

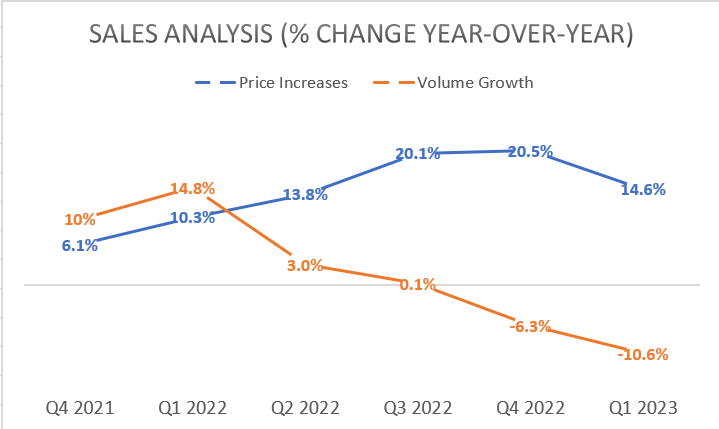

This resulted in tough comps and lead to a volume decline in the first quarter of 2023. The company was able to post revenue growth despite volume decline as carryover price increases from 2022 more than offset the volume headwind. This resulted in a 4% YoY growth in revenue to $345 million, reflecting a 14.6 percentage point benefit from price increases and a 10.6 percentage point volume decline.

TWNK's Historical Revenue (Company Data, GS Analytics Research)

Looking forward, I believe the company should be able to sustain its revenue growth despite the demand normalization. Revenue growth should benefit from volume recovery, secular demand trends for healthy snacking, reinvestments in advertising and new product innovations, and additional capacity.

In the first half of 2022, the company was able to supply the increased demand, due to its efficient supply chain network as opposed to its peers, who faced supply challenges from the pandemic. This created tough comparisons for the first quarter of 2023. However, TWNK also began to increase its prices aggressively halfway through FY2022, which impacted volume growth in the second half of the year, as price-sensitive consumers were taken aback. Moreover, in the latter half, the company also began to experience a general normalization of demand coming out of the high-growth pandemic years, leading to lower volume generation and easing comparisons.

TWNK's Historical Revenue Analysis (Company Data, GS Analytics Research)

Looking at the quarters ahead, the company has completed the required pricing increases to offset inflationary pressure and does not plan to take any additional price increases in the near term. As a result, I expect volume to start recovering sequentially in the second half of 2023 as the impact of price increases reduces and the volume comps begin to ease. This should help support revenue growth as we progress through the year.

While the broader macros are slowing, I believe the sweet-baked goods category should be able to sustain its growth with support from never-ending snacking preferences and growing demand for healthy snacking options. Snacking is an eating behavior that people find hard to avoid. This behavior when combined with sweet indulgence becomes even more addictive. This has resulted in the growth of the sweet-baked snacking good category for decades and is what the hostess brands have benefited from. The company, in order to maximize the benefit of consumers' sweet-tooth addictions, focuses on different eating occasions to offer consumers a wide variety of snacking options as per their cravings throughout the day. These snacking occasions are Morning Sweet Start, Lunchbox, Afternoon Reward, Immediate Consumption, and Afternoon Sharing. This helped the company grow demand for its sweet-baked goods. I expect demand should remain resilient even during recessionary times as snacking is one such luxury that people find affordable and rewarding, making them happy. So, at least in the near term, the company's revenue prospects look good.

In the longer term, while there are some concerns regarding the sweet-baked goods category and their impact on health for some people, TWNK plans to offset it through Voortman Brand. The company acquired the Voortman brand in 2020. The brand offers zero-sugar cookies and wafers to consumers who look to balance out their snacking cravings with healthier options. This should support the overall demand for the company's products as the healthy snacking category is gaining a lot of traction post-pandemic.

Further, the company is also focused on reinvesting in growth through advertising and new product innovations. According to management, currently, the company has more than 90% brand awareness, but top-of-the-mind brand awareness is only 40%. As snacking is something that goes on in people's minds throughout the day, TWNK needs good advertising and marketing initiatives to increase top-of-the-mind awareness. For this purpose, the company has been keeping its growth rate of Advertising and Promotions (A&P) spending above the revenue growth rate and A&P investments have increased by double digits over the last three years, with a 20% increase in 2022. The company plans to keep increasing A&P investments to boost sales growth through increasing top-of-the-mind awareness.

Additionally, new product innovations are also a major growth driver of any package goods company as new products help companies meet changing consumer preferences and also help influence the overall demand. As mentioned in my previous article, the company launched Bouncers last fall, which is a reimagined version of its core products under the Twinkies, Ding Dong, and Donettes brands. The innovation is gaining traction from consumers in the initial trial phases and helping lift sales. Late in March, the company also launched Kazbars. The company has transformed its iconic moist cake into a multi-textured layered snack bar filled with layers of sweet flavors like caramel, chocolate, and candy crunch. The company has created an indulgent bar form of its popular baked cakes through Kazbars. According to management, Kazbars' first few weeks of retail takeaway and consumer feedback have been positive. TWNK also has a good record of growing top-line through new products as it has a good vitality rate (the vitality rate measures the percentage of revenue contribution from new products launched over the last three years) of 15%-17% over the last couple of years, which is in-line with the company's targeted range. The company also has a good pipeline of new innovations lined up in the coming quarters. This should continue to boost retail takeaway and help the top-line growth.

Lastly, the company has also been investing in an additional bakery in Arkadelphia, this will provide 20% incremental capacity to its Donuts and Cake platforms. The new bakery will become operational in the fourth quarter of the current fiscal year. This should also help the company increase its distribution of sweet-baked products and help increase the top line in the coming years. Hence, I remain optimistic that TWNK should be able to sustain its revenue growth in the coming years.

Margin Analysis and Outlook

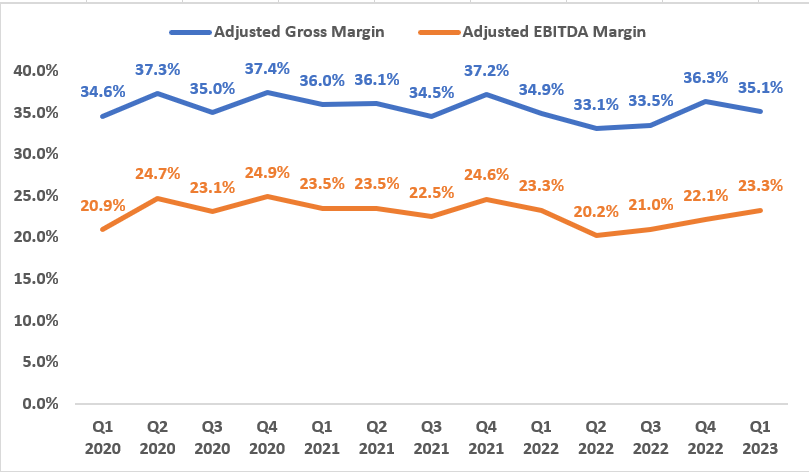

In the first quarter of fiscal 2023, Hostess Brands' adjusted gross margins continued to face inflationary raw material costs. However, the company was able to offset it through price increases. This resulted in an adjusted gross margin increase of 20 bps YoY to 35.1%. However, the adjusted EBITDA margin remained flattish YoY at 23.3% due to increased advertising and promotion spending, and investments in distribution.

TWNK's Historical Adjusted Gross Margin and Adjusted EBITDA Margin (Company Data, GS Analytics Research)

Looking forward, the adjusted gross margin is expected to remain flat YoY for the full year 2023 as the benefit from price increases is expected to be offset by ~$5 million in start-up costs associated with its new distribution center in Arkadelphia. However, management expects the adjusted EBITDA margin to increase YoY for the full year 2023 as operating expenses are anticipated to remain flat in 2023 as compared to 2022.

Beyond 2023, I expect margins to continue expanding as higher investment costs associated with the distribution center abate. Moreover, inflation is expected to moderate sequentially. The company incurred ~13.7% inflation in the first quarter of 2023 and has guided high single-digit inflation for the full year 2023. This implies inflation should moderate moving forward and result in a favorable cost environment in the coming year, helping margin growth. Additionally, the company also expects to gain productivity benefits from its new bakery in Arkadelphia. The new bakery is supported by the automation of several processes. This should reduce the dependence on labor and also increase overall efficiency, and help the company gain productivity in the coming years. So, I remain optimistic about the medium to long-term margin growth prospects of the company.

Valuation and Conclusion

Hostess Brands is currently trading at 22.33x the FY2023 consensus EPS estimate of $1.11, which is a premium compared to its historical 5-year average forward P/E of 20.96x. I believe the company has good growth prospects in the future and should continue to benefit from its growth strategy. Margins should also increase with a more favorable cost environment in the coming years. However, at these premium valuations, the company's growth prospects are already getting priced in. So, I would prefer a better entry point and have a neutral rating as of now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.