Fevertree Drinks: Even Upgraded Margin Guidance Won't Justify Current Valuations

Summary

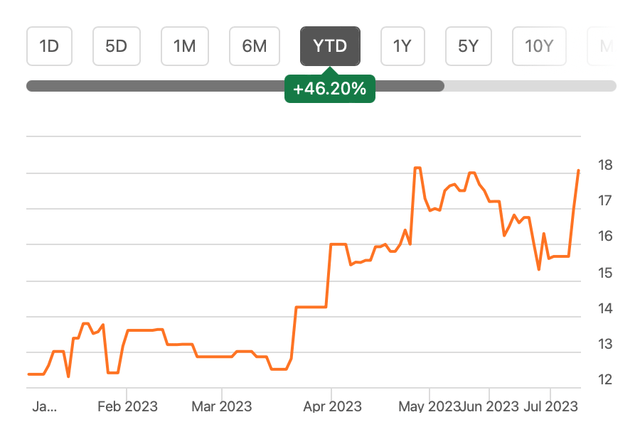

- London-based mixer drinks manufacturer Fevertree Drinks has seen a 46% increase in its stock price year-to-date, with a 15% increase in the last couple of weeks alone.

- With no clear impetus from the company, I believe the stock's rise can be attributed to an improved inflation environment, with the company expecting to drive margin improvements.

- However, it seems currently considered overvalued, with doubts over whether growth can meet expectations given slowdowns in its key markets, leading to a recommendation to hold the stock.

Ilya S. Savenok

Since I last wrote about the London-based mixer drinks manufacturer and brand Fevertree Drinks (OTCPK:FQVTF) in January this year, it has seen an impressive 46% increase year-to-date [YTD]. 15% of this increase has come in the past couple of weeks alone, which calls for a closer look at it.

Investment Thesis: Then and Now

I was tempted to give it a Buy rating the last time, and in hindsight, should probably have done so. But that's only because the overall macro picture has improved since. It might not have. Indeed, it looked risky at the time, with consumer price inflation in its biggest market, the UK, still in double digits. And there were recession predictions for not just the UK, but also its other big market, the US. Added to that, its market multiples were high compared to the consumer staples sector at the time.

But as it happens, the macros are not looking entirely as gloomy now, which has been a positive for the stock. Around two months after writing the article, it started its upward climb after the company made optimistic revenue projections with the release of the annual results in March. In the last 10 days of the month, the stock rose by 28%.

This time around, however, there do not seem to be company updates to justify why the stock is rising, except for an improving macro context. Specifically, inflation has seen a significant improvement, especially cost pressures for producers. This can impact margins positively, which dropped a fair bit in 2022. At the same time, it's hard to overlook that growth in its key markets is still exceptionally slow, and in the meantime, its market multiples have doubled since I last checked. As a result, the balance is once again tilted towards a Hold rating.

Elevated market multiples

First, let's talk about the multiples. Its trailing twelve months' [TTM] reported price-to-earnings (P/E) ratio is at a huge 65.7x. Let me put it in context. This is double where it was in January. The consumer staples sector isn't trading low either, for sure, with a P/E of 23.2x, but it's nowhere close to the stock.

It can be argued that while alcohol and related drinks can be resilient even in slowdowns, it is likely to be impacted by a slowdown as far as the hospitality business weakens further. To that extent, it actually has a consumer discretionary component to it too. Even then, the S&P 500's consumer discretionary index has a P/E of 33.8x, which is far lower than that for the stock.

It can also be said, that FQVTF has a tendency to be highly valued by investors as such. The median P/E for its main listing on London Stock Exchange's AIM has been at 62.5x over the past ten years. But it's trading higher than even these levels.

If it were to decline to its average median P/E, that would be around a 5% fall from the current level. But if it were to fall all the way to the consumer discretionary sector's level of P/E, the price would actually halve. In the past, its P/E has dropped to even lower levels of around 18x, so it's not as far-fetched as it might sound right now.

Growth not guaranteed

This is even more so, since it's not entirely certain if the company can meet its current sales guidance at GBP 390-405 million, which represents a 15.5% YoY increase at the midpoint from the last financial year (FY22), which is actually an improvement over the 11% increase seen last year.

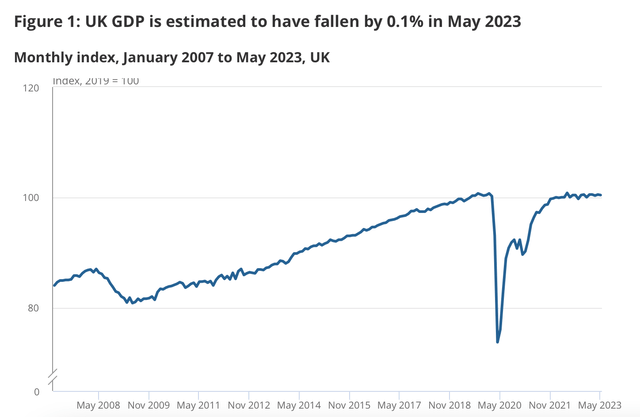

The UK economy might have performed better than the near-certain recession projections until earlier this year, but it is still firmly in slowdown mode. For the past year, the economy's GDP has barely moved (see chart below). Significantly, the food and beverage services segment actually declined by 1.1% as per the latest report. Moreover, the company's UK sales saw a decline of 2% already in 2022.

Source: Office Of National Statistics

It did see double-digit growth in the European and US markets, though, last year. But then again, these economies are seeing their own slowdowns too, so it remains to be seen whether they can come to the rescue. It doesn't help that its latest trading update from May doesn't give any concrete growth figures either.

Margin improvement likely

That said, the company is more optimistic about margins now, saying it "expects to drive margin improvements". This is an improvement over its outlook in March, where it said "whilst the business is facing significant inflationary headwinds… we are focused on mitigating actions through a combination of pricing across regions, cost saving initiatives, and increased local US production." There was no mention of margin improvements at the time.

It's not hard to see its margins improving for me. The UK has seen a come-off in headline inflation to 7.9% year-on-year (YoY) for June 2023, making it the fourth consecutive month that it has either declined or stayed flat. Further, producer price inflation has actually turned negative, coming in at -2.7% YoY during the month. This is the first time they have shown deflation since November 2020, when the pandemic was still raging. At the broadest level, I think this screams potential margin expansion for companies.

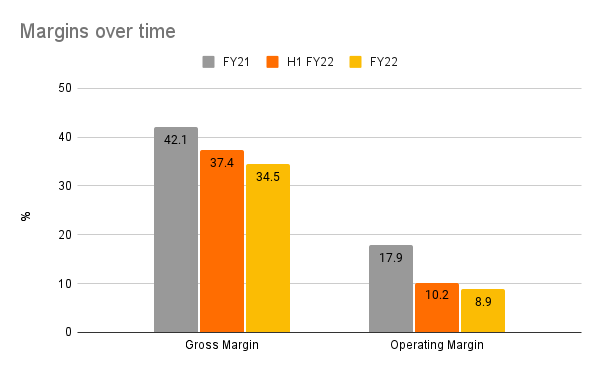

Source: Fevertree Drinks, Seeking Alpha, Author's Estimates

This is particularly good news for Fevertree Drinks, which has witnessed a margin decline in the past year. At a time of high inflation, this trend while expected, was also concerning. In fact, my article on it was titled "Fevertree Drinks: Continued Growth But Margins Decline". At the time, the most updated figures available were for the first half of its financial year 2022 (H1 FY22), which showed a gross margin of 37.4% and an operating margin of 10.2%, an already notable decline from H1 FY21. The full-year numbers showed a further decline in gross margin to 34.5% (FY21: 42.1%) and in operating margin to 8.9% (FY21: 17.9%).

What margin improvements mean for the price

Cut to now, and the talk of margin expansion leads me to believe that its adjusted EBITDA guidance is due for an upward revision when it releases its interim results in September. At present, the guidance is between GBP 36-42 million. Even if revenue were to come in at the lower end of the forecast range of GBP 390 to 405 million, and the adjusted EBITDA was at the top end, the margin would still be 10.7%. This is lower than the 11.6% seen last year. So for margins to expand, either earnings guidance would have to rise or revenue guidance would be downgraded or both.

But what does it mean for the stock's price? For lack of more information, let's assume that the adjusted EBITDA increases to the top end of the guidance range, especially since I have my doubts about revenue growth forecasts. To keep things simple, if net income comes in at 62.7% of this number, as we saw in FY22, its EPS would rise to just under USD 0.29 (FY22: USD 0.26). This yields a forward P/E of 62.7x, which is still a bit higher than its median level.

What next?

The point clearly here is, that no matter how it's sliced, for me there's just no upside visible to the Fevertree Drinks stock right now. Even taking into account a higher profit level than forecast, its market multiples are just too high.

There could have still been a case for even higher multiples if its revenue growth was a given. On the contrary, there's actually a risk to growth, especially as the cyclically sensitive hospitality segment can suffer during a slowdown across its major markets.

For an investor who has bought the stock in the past year, it is a Sell. But I usually make calls with the medium term in mind. There is potential for the otherwise market-leading company to make gains as macroeconomic growth picks up again. Considering that it has seen much higher earnings levels in the past years compared to FY22, it's entirely possible it can go back to growing earnings more, which can justify its market multiples. I retain a Hold rating.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Manika is an investment researcher and writer as well as a macroeconomist, with a focus on converting big-picture trends into actionable investment ideas. She has worked in investment management, stock broking and investment banking. As an entrepreneur, running her own research firm, she received the Goldman Sachs 10,000 Women scholarship for certification in business. She is also a public speaker, having shared her views at multiple international forums and has been quoted in leading international media.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)