Photronics: This Top-Rated Stock Is Still Attractive

Summary

- Photronics is a $1.6-billion market cap company that manufactures and sells photomask products and services worldwide.

- During Q2 FY2023, Photronics achieved record revenue and profit, experiencing growth in demand for its products in both of its business segments.

- The potential for PLAB stock's further multiple expansion appears to be quite comfortable.

- I see a fair price for PLAB ~25.2% above current levels, which is good enough to rate the stock a "Buy".

- Looking for a helping hand in the market? Members of Beyond the Wall Investing get exclusive ideas and guidance to navigate any climate. Learn More »

SweetBunFactory

The Company

Photronics, Inc. (NASDAQ:PLAB) is a $1.6-billion market cap company that manufactures and sells photomask products and services worldwide. Their photomasks are used in the production of integrated circuits and flat panel displays, enabling the transfer of circuit patterns onto various electronic components. Photronics supplies its products to semiconductor manufacturers, flat panel display manufacturers, designers, foundries, and other high-performance electronics manufacturers. As of FY2022, the company's largest customers include United Microelectronics Corp. (UMC) and Samsung Electronics Co. Ltd. (OTCPK:SSNLF), which together accounted for ~32% of Photronics' total revenue.

The company's revenue is divided into 2 segments:

- Integrated Circuit (IC) accounts for the majority of Photronics' revenue [73.5%], and it includes sales of photomasks to IC manufacturers for use in the production of logic, memory, and specialty chips

- Flat-Panel Display (FPD) accounts for the remaining smaller portion of consolidated revenue, and it includes sales of photomasks to FPD manufacturers for use in the production of TVs, monitors, and other displays

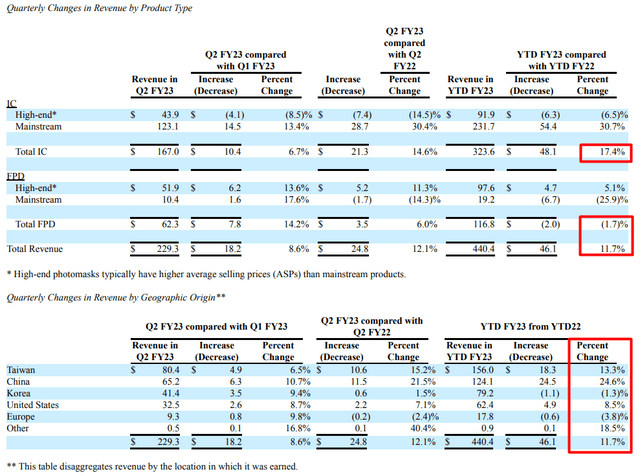

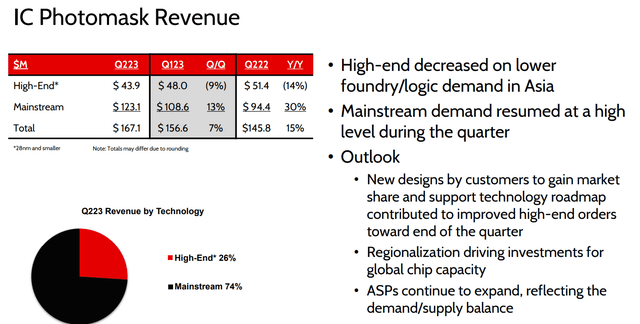

During Q2 FY2023, Photronics achieved record revenue and profit, experiencing growth in demand for their products in both the IC and FPD segments, with revenue growth in almost all geographic regions:

The company's position as one of the largest merchant photomask suppliers allowed them to have broad exposure to global markets, reducing dependence on any specific sector or region, the CEO noted during the most recent earnings call.

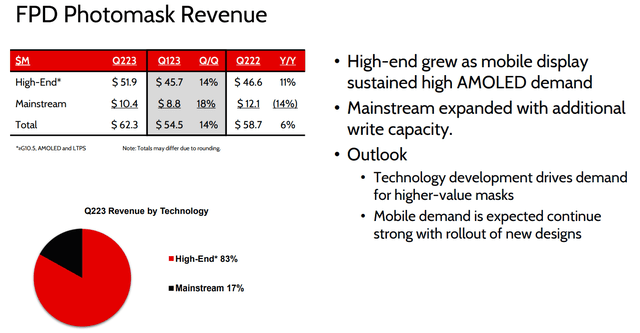

Photronics reported strong demand in the mainstream IC sector, especially in the 40 to 55-nanometer range, although they observed some softness in the high-end sector, which is expected to fully recover in the 1-2 quarters. In the FPD sector, there was significant growth in demand for AMOLED displays, while LCD demand stabilized and showed sequential growth.

PLAB's IR materials PLAB's IR materials

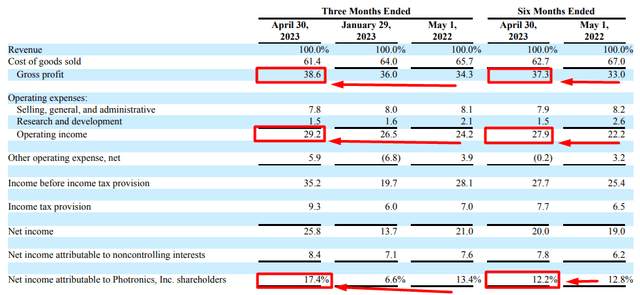

The firm's growth and operating margins benefited from strategic pricing and effective cost management, which can be seen from the vertical analysis of PLAB's income statement:

They earned $0.65 per share on a GAAP basis and $0.54 per share on a non-GAAP basis, excluding gains from foreign exchange. Photronics emphasized that photomask demand is driven by new designs and capacity expansion, and they have invested in technology and advanced process know-how to support their customers' needs.

From what I gathered from third-party market research reports, the total photomask market is expected to grow at a CAGR of 3.21% over the next few years, reaching $5.99 by FY 2029. That does not sound like the strongest growth numbers, but it's important to note that it's the IC and FSD categories - the main things for PLAB - that will be the main drivers. That's because the automotive, healthcare, and telecom industries are all eager to get high-resolution advanced photomasks. PLAB has consistently spent 8-15% of its revenue on capital expenditures in recent years, focusing mainly on the high end of the mainstream business for integrated circuits [ICs]. Now, the company is planning to replace end-of-life tools with more efficient and updated ones to ensure technological advances and capacity expansions. In this regard, I have a feeling that the company will be ready to master the growing demand for photomasks - the whole market seems tempting despite its modest CAGR.

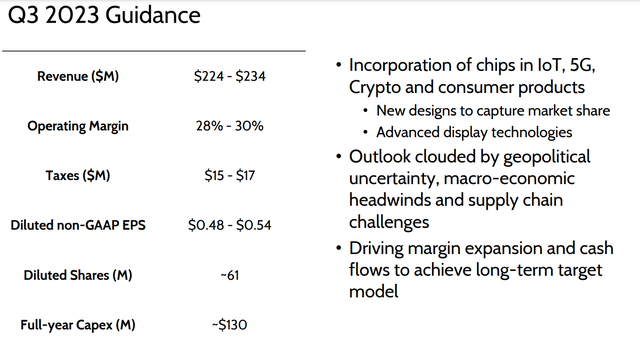

In its supplementary IR presentation for Q2, Photronics provided guidance for Q3 FY2023 [expected to be released on 8/23/2023], targeting revenue in the range of $224-234 million [$229M in the middle] for the quarter. The management team anticipates continued strong demand in the photomask sector and estimates non-GAAP earnings per share to be in the range of $0.48 to $0.54 [$0.51 in the mid-range].

This guidance is almost in-line with what Wall Street awaits:

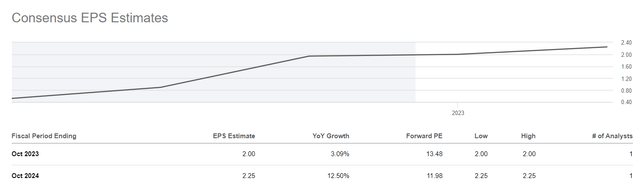

Moving from quarterly to annual estimates, we see that one analyst is forecasting PLAB's FY2024 EPS to rise to $2.25, representing 12.5% year-over-year growth and giving the stock a P/E of ~12x:

Is this much or little for PLAB? Let's now turn to my valuation analysis to figure it out.

Valuation

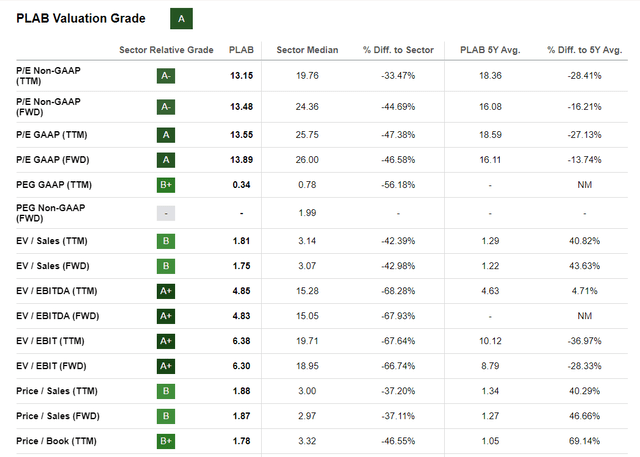

Seeking Alpha's Quant system rates PLAB stock a strong "A" on its valuation metrics:

Seeking Alpha, PLAB's Valuation

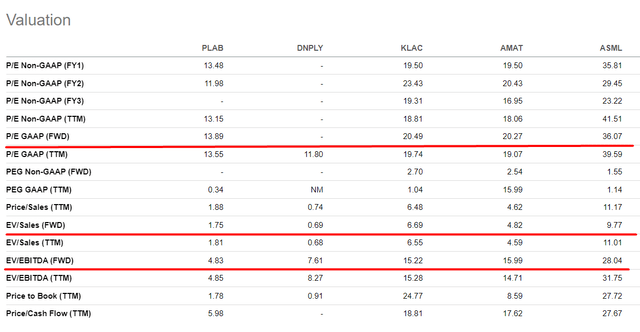

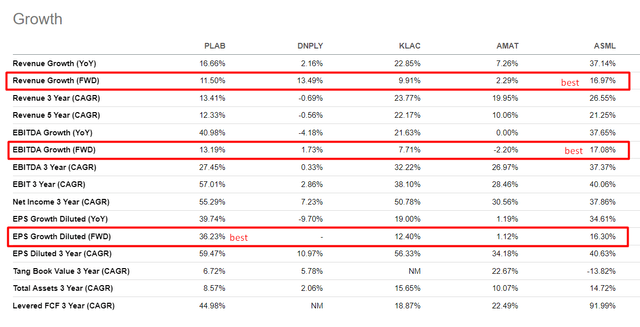

If we compare PLAB to large U.S.-traded peers - and there are not many of them, and they are much larger - we'll find that PLAB is valued somewhat cheaper than the rest:

At the same time, using my key growth metrics (forward revenue, EBITDA, and EPS), we see that PLAB as a whole is much better than the group average, but lags behind the larger ASML Holding N.V. (ASML) in terms of revenue growth and EBITDA:

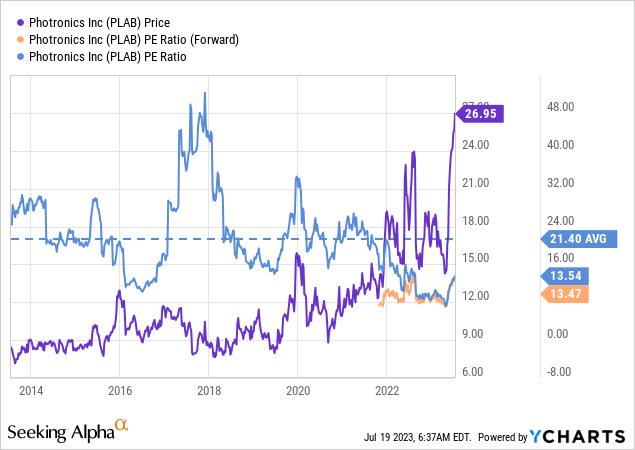

Looking at the historical development of PLAB stock's P/E ratio one can't fail to note that the multiple is at a very low level despite the stock's rise of 60% YTD:

This is happening against the background of the widening of margins that I mentioned in my analysis of PLAB's financial statements above. The potential for the stock's further multiple expansion appears to be quite comfortable - assuming PLAB achieves a conservative forwarding P/E of 15x, then the stock should be worth $33.75 at a consensus EPS of $2.25. From this, I calculate an undervaluation of ~25.2% to the last closing price.

The Bottom Line

One notable risk to consider when investing in Photronics is its significant dependence on China. The company's largest customer, United Microelectronics, is based in China, and Photronics operates a manufacturing facility in the country. In the most recent quarter, approximately 51% of the company's shipments were reliant on the Chinese market. Factors such as export controls, trade disputes, or other political developments could impact the company's operations, supply chain, and revenue stream.

Nor can we ignore the fact that the global economy is slowing and a recession is likely ahead, which could hit the cyclical semiconductor industry hard.

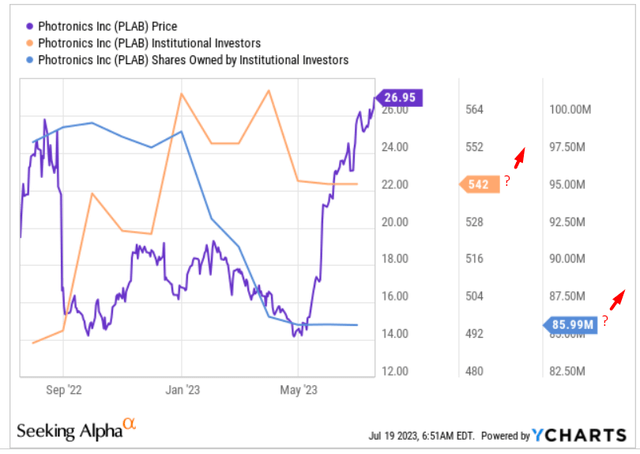

Despite the risks, however, I believe PLAB has every chance of feeling the influx of new institutional investors, while the valuation gap I identified today has not closed.

I see a fair price for PLAB ~25.2% above current levels, which is good enough to rate the stock a "Buy".

Thank you for reading!

Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

This article was written by

The chief investment analyst in a small family office registered in Singapore, responsible for developing investment ideas in equities, setting parameters for investment portfolio allocation, and analyzing potential venture capital investments.

A generalist in nature, common sense investing approach. BS in Finance. The thesis description can be found in this article.

During the heyday of the IPO market, I developed an AI model [in the R statistical language] that returned an alpha of around 24% over the IPO market's return in 2021. Currently, I focus on medium-term investment ideas based on cycle analysis and fundamental analysis of individual companies and industries.

Get a free 7-day trial +25% off for up to 12 months on TrendSpider with the coupon code: DS25

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

The macro risks you have called out apply to a range of stocks (eg: reliance on China etc).

As I have a 3 yr horizon for this stock, I expect it to be at least 3X to 5 X in the next 24 -36 months.