Tesla: Excellent Q2 Results, Remains A Top Pick

Summary

- Tesla, Inc. reported better-than-expected revenue and profitability Wednesday, yet the stock dropped by about 4% after hours.

- Many market participants "sold the news," which could lead to a long-term buying opportunity in Tesla's stock.

- Tesla's recent price drops enabled it to increase sales, consolidating market share and solidifying its dominant, leading position in the EV segment.

- However, price cuts aren't forever, and Tesla's sales could increase more than expected, leading to higher-than-anticipated profitability in the coming years.

- Due to its considerable growth potential and substantial profitability prospects, Tesla remains a top, high-quality stock to buy and hold for the next five years and longer.

- This idea was discussed in more depth with members of my private investing community, The Financial Prophet. Learn More »

jetcityimage

Tesla, Inc. (NASDAQ:TSLA) reported better-than-expected earnings on Wednesday, delivering nearly $25 billion in revenues (47% YoY surge). Moreover, Tesla beat consensus EPS projections by about 10%, with EPS and revenues materializing toward the higher end of the estimate range. Nevertheless, despite the better-than-anticipated earnings results, Tesla's stock dropped by about 4% after hours and may continue moving lower in the coming days.

Some market participants "sold the news" in Tesla, which should lead to a long-term buying opportunity in its stock. Tesla's recent price cuts enabled it to increase sales, consolidate market share, and solidify its dominant, market-leading position in the ultra-competitive EV space. Furthermore, price cuts will only last for a while, and Tesla's sales could increase more than expected as we advance.

Additionally, despite introducing lower prices, Tesla posted a healthy gross margin, and its profitability could increase more than anticipated as the transitory slowdown phase concludes and the economy returns to growth. Tesla has enormous growth and profitability potential, and its stock price should move considerably higher in the coming years, making it a top buy-and-hold candidate long term.

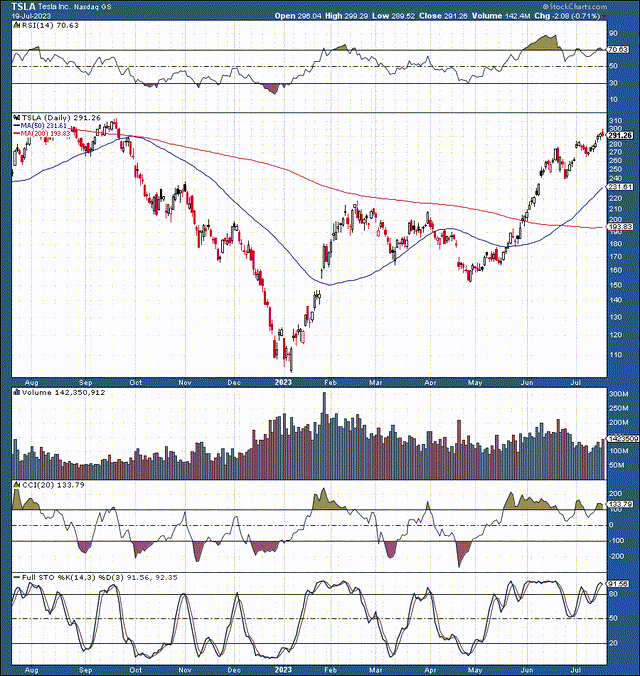

Technically, We Could See A Pullback

Technically, we could see a pullback, and that's a good thing. Tesla's stock has been red hot since hitting a bottom around $100 early this year. Tesla's stock has tripled in about a six-month time frame. Also, shares got massively overbought in mid-June, as the RSI skyrocketed to 90. Therefore, we could see a pullback to about the $250-200 range, creating an excellent long-term buying opportunity if it occurs.

Despite the overextended (near-term) technical conditions, Tesla's technical image remains bullish long-term. The 50-day MA recently crossed above the 200-day MA, signaling improving long-term momentum for Tesla's stock. In addition, technical indicators like the CCI, full stochastic, and others imply that Tesla's stock has substantially more upside potential.

The Tesla Advantage

Before we get into the recent earnings, I want to discuss the "Tesla advantage." While Tesla may have numerous competitive advantages, it recently illustrated a remarkable ability to lower prices on its vehicles. This strategy led to improved sales, significant revenue growth, and increased market share during the downturn. Due to Tesla's exceptionally high profitability, the automaker temporarily decreased prices on its Model 3 and Model Y vehicles to less than $40,000 in some regions.

Implementing this strategy enabled Tesla to sell a record number of vehicles last quarter, and the constructive sales trend should persist as we advance. The ability to lower prices in a challenging time is an enormous advantage for Tesla, as most of its pure EV counterparts like Lucid (LCID), Rivian (RIVN), NIO Inc. (NIO), and others are unprofitable, and some haven't illustrated the ability to mass produce cars yet.

Therefore, these newer companies cannot afford to have a price war with Tesla, and lower prices may be detrimental to their business. Thus, Tesla continues increasing sales while the more minor players continue showing limited success in this challenging time.

Furthermore, traditional automakers with compelling EV lineups typically have much lower margins than Tesla. Therefore, dropping prices to better compete with Tesla could result in margin erosion and substantial damage to the traditional automakers' bottom lines.

Thus, we see the Tesla advantage, as it successfully decreases car prices while remaining highly profitable due to its significant revenue growth and high-margin manufacturing ability. Moreover, Tesla can raise prices in the future without damaging demand as the transitory slowdown passes and the global economy returns to growth in the coming years.

Recent Earnings - Better Than Expected

Tesla recently reported non-GAAP EPS of 91 cents (in line with my 90-cent - $1 estimate range). Also, Tesla reported revenues of $24.93 billion, about $200 million above the consensus estimate and roughly a 47% YoY gain. This revenue result was lower than my Q2 estimate, primarily due to fewer regulatory credit revenues and a lower-than-anticipated ASP for Tesla vehicles.

- While we saw the ASP for the Model 3/Y around $47-48K in recent years/quarters, Tesla's price cuts could have brought the ASP down to about $43,500 in Q2.

- Q2 - 424,569 Model 3/Y vehicles (not subject to lease accounting) times $43,500 ASP could have resulted in around $18.5B in sales.

- Additionally, Tesla's Model S/X segment ASP may be around $110K instead of the $120K ASP used in my recent Q2 estimates.

- 17,687 Model S/X vehicles (adjusted for lease accounting) at an ASP of about $110,000 could have provided around $1.9B in revenues in the second quarter.

- This updated data brings us to Tesla's Q2 automotive sales figure of about $20.4 billion.

- Also, Tesla only utilized $282 million in regulatory credits. This number is on the lower end of the spectrum, and we could see more ($1-1.2B) in regulatory credit revenues in the year's second half.

- We could also see the ASP for Model 3/Y vehicles move higher, to around $47,000, and $115K for the Model S/X segment in the second half.

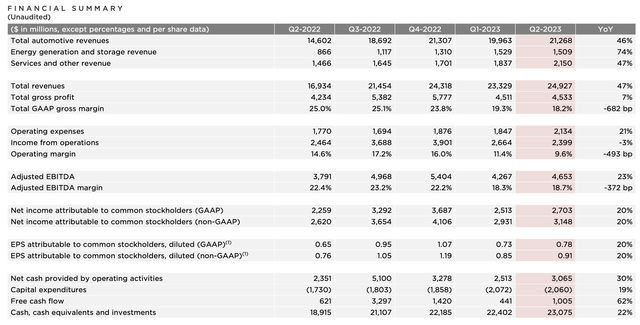

Tesla: Q2 Financial Summary

Financial summary (static.seekingalpha.com )

We see exceptional growth, 47% YoY revenues (with the price cuts). Tesla's deliveries increased by 83% YoY last quarter (Model 3/Y production increased by 90%), while automotive sales climbed by 46%. Therefore, automotive revenues should increase considerably as ASPs stabilize and proceed higher as the transitory slowdown phase ends soon.

Also, Tesla's energy generation and storage business revenue has skyrocketed recently, surging by 74% YoY to more than $1.5B last quarter. We could continue seeing significant growth in Tesla's EG&S segment in future quarters, and the business segments should become increasingly profitable as we move on.

Additionally, we could be looking at around rock bottom margins for Tesla here. Tesla has lowered prices aggressively, resulting in lower margins in recent quarters. Due to the significant price drops, Tesla's gross margin shrunk to 18.2% last quarter, substantially lower than the 25% gross margin we saw in the same quarter one year ago.

As the recovery progresses, we should see Tesla's gross margin climb back above 20%, potentially stabilizing in the 23-25% range in future years. The increased profitability should contribute substantially to the bottom line, boosting Tesla's net income and EPS more than anticipated in the coming years. Also, it's worth mentioning that Tesla's net income margin was around 10.8% in Q2, substantially higher than traditional automakers.

Net Income Margins in the Industry

- Ford (F): 1.75% (typically 0-5%)

- Toyota (TM): 6.6% (usually 5-10%)

- General Motors (GM): 5% (typically 4-7%)

- Honda (HMC): 4% (typically 3-5%)

- Tesla: 10.8% (usually 13-15%).

A year ago, Tesla posted a net income margin of about 14%. Still, due to the challenging economic atmosphere and the subsequent price decreases, Tesla's Net income margin came in close to 11% last quarter. On the other hand, many traditional automakers are barely making a profit in this environment, and even the highly profitable Toyota corporation's profitability margin is substantially lower than Tesla's. We should see Tesla's income margin improve substantially as prices and the economy recover, likely moving up toward 15% or higher in future years.

Tesla's Stock Could Go Much Higher Long Term

| The year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $112 | $150 | $200 | $260 | $333 | $423 | $533 | $665 |

| Revenue growth | 37% | 34% | 33% | 30% | 28% | 27% | 26% | 25% |

| EPS | $4.25 | $8 | $11 | $15 | $20 | $26 | $33 | $40 |

| EPS growth | 4% | 88% | 38% | 36% | 33% | 30% | 28% | 24% |

| Forward P/E | 34 | 33 | 34 | 33 | 32 | 30 | 27 | 25 |

| Stock price | $270 | $333 | $510 | $660 | $832 | $990 | $1080 | $1200 |

Source: The Financial Prophet.

Risks to Tesla Exist

Despite my bullish outlook, Tesla faces several risks. Tesla could encounter demand issues as its vehicles continue reaching higher degrees of penetration in the market. Furthermore, Tesla's competition continues to increase as more pure EVs come to market, including many from traditional automakers.

Due to these and other risks, Tesla's revenues may expand slower than anticipated, and its profitability may be lower than my projections indicate in future years. Tesla's growth may slow more than expected, and the multiple on the stock could contract, causing its share price to appreciate slower or decline in a worst-case scenario as we advance. Investors should carefully examine these and other risks before investing in Tesla's shares.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet's All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don't Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!

This article was written by

Hi, I'm Victor! It all goes back to looking at stock quotes in the old Wall St. Journal when I was a kid. What do these numbers mean, I thought? Fortunately, my uncle was a successful commodities trader on the NYMEX, and I got him to teach me how to invest. I bought my first actual stock in a company when I was 20, and the rest, as they say, is history. Over the years, some of my top investments include Apple, Tesla, Amazon, Netflix, Facebook, Google, Microsoft, Nike, JPMorgan, Bitcoin, and others.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, LCID, NIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)

0.68, 0.95, 0.65, 0.95, 1.07, 0.73, 0.78

There's no growth. So Victor thinks 0.78 is great because it "beat estimates"?

Beating estimates doesn't mean much when the estimates say your earnings are decreasing and your P/E is 90. All this quarter showed was that you can move more units if you sacrifice margins. Anyone surprised? But once price cuts become ineffective you have to reduce production. That's where we are at now. Elon says Q3 production will be reduced because of "factory upgrades". Anyone believe that? If you do then you probably also bought his "Don't worry about margins because FSD will make falling margins look silly" nonsense. After 7 years he's still flogging his FSD lies and even repeated the "car will be worth 5x" crap.

And, licensing partial FSD before factories are selling full output, in my opinion, will cannibalize Tesl car sales and attract buyers to the other car brand.